Filtered Crossover Forex Trading Strategy

Although very popular among many traders, many crossover strategies fail to produce the kind of results that traders would want from a strategy. In fact, I know of a beginning trader who burned his account blindly following a popular crossover strategy.

But why is it so popular if it doesn’t work?

It is not that crossover strategies don’t work. It is just that it has a lot of weaknesses making it inappropriate to use in all markets. Weaknesses that should be filtered out to avoid losses.

One weakness is that entries are sometimes a little too late. This is because most entries based on a crossover is an entry on an over-extended state on the short-term. Most candles that cause the crossover has too much momentum, it strays too far from the moving averages. This could mean a shorter room to move on the direction of the trade. It could also cause a mean reversion on the short-term, which could be a minor retracement, or worse cause the market to start to range. There are many instances when after a strong one sided move the market would start to range, the worst scenario for a crossover strategy.

Another weakness related to the prior is that the exits are also a little too late. Crossover strategies aim to catch a big trending move by entering the market near the beginning of the move and exiting when the trend is sure to have ended. This is the main strength of crossover strategies. However, it is also the Achilles’ heel of most crossover strategies, as the exits are sometimes a price point where the trade has gone back to the red. Traders would end up beating themselves thinking if only they had exited the trade a little earlier when it was in profit.

Another weakness is that it has no regard for a longer-term trend. I would consider a crossover strategy as a reversal strategy. It is a reversal strategy because the entry based on the crossover is an assumption that the previous trend has ended, and the opposite trend should start. However, even though it is a reversal strategy, it is still a reversal on the shorter-term trend. Often times, a crossover entry is available but the trade is going against a longer-term trend. Crossover strategies would work better if the trades taken are in the direction of a longer-term trend, as the short-term trend is often at the mercy of the longer-term trend.

With this strategy, we will try to address each of these weaknesses of crossover strategies to give us a crossover strategy with higher probability trades.

The Setup: A Filtered Crossover Strategy

The basics of a crossover strategy is an entry on the crossover of a faster moving average and a slower moving average. Below are the settings of our moving averages.

- Fast Moving Average: 8-period Linear Weighted Moving Average (LWMA) (Gold)

- Slow Moving Average: 10-period Linear Weighted Moving Average (LWMA) with +1 shift ( Magenta)

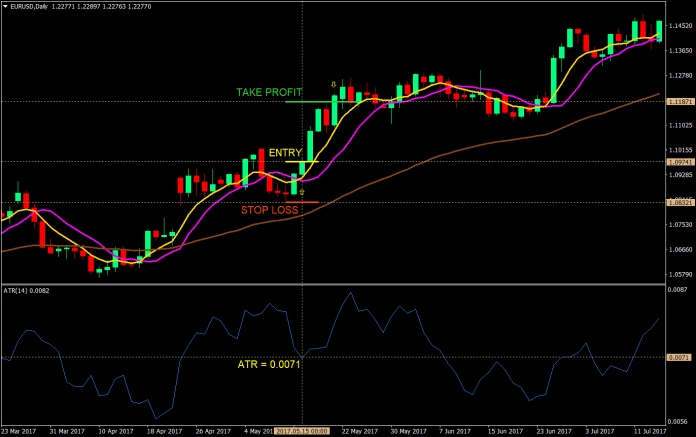

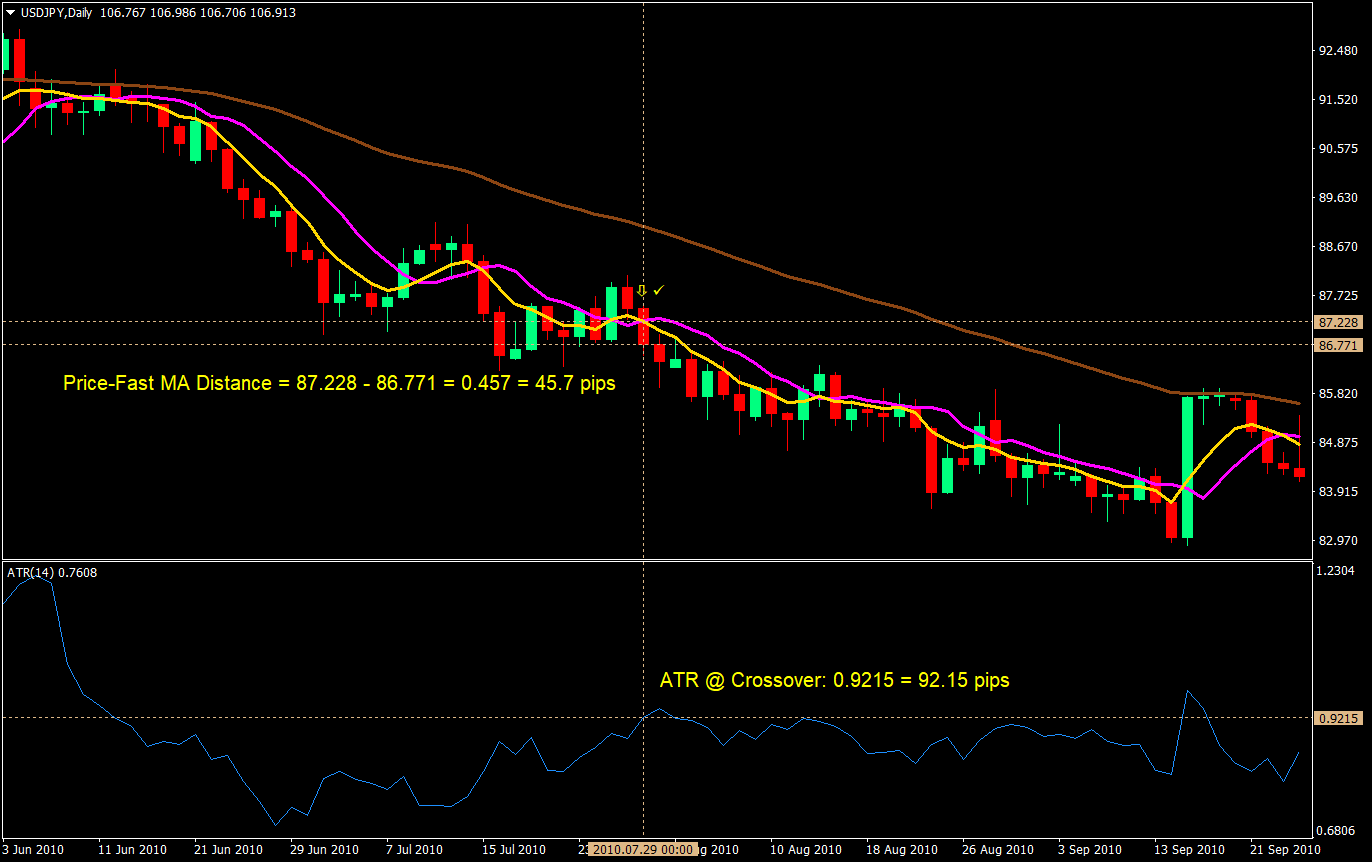

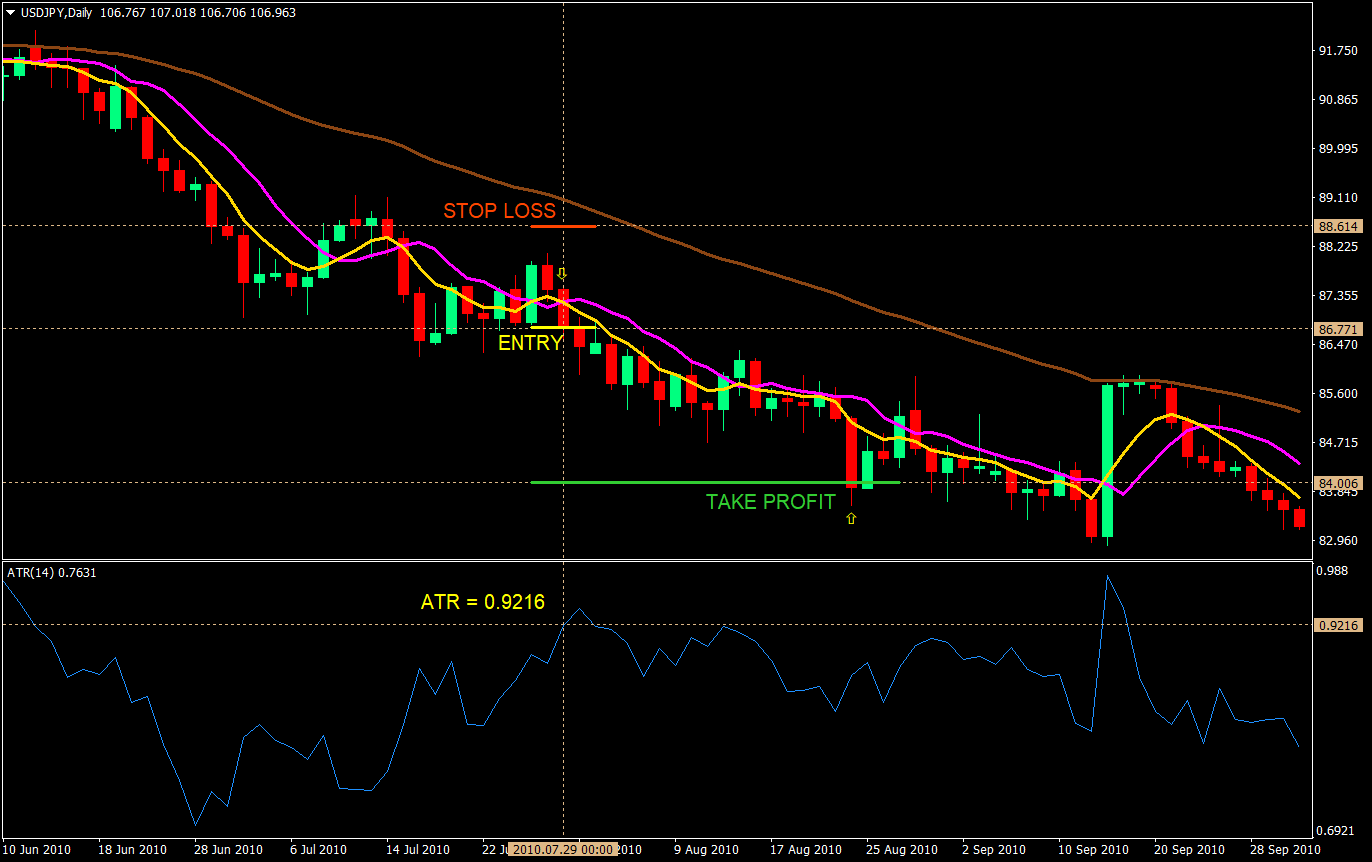

To address the issue of entering on an overextended candle, we will be using a 14-period Average True Range (ATR) indicator and the fast moving average itself. To avoid over-extended entries, we will only take trades when the candle causing the crossover closes on a price that is not farther than 1 times the ATR from the fast moving average. This should allow are trade to have a little more room to go on our direction. Below is an example of this filter.

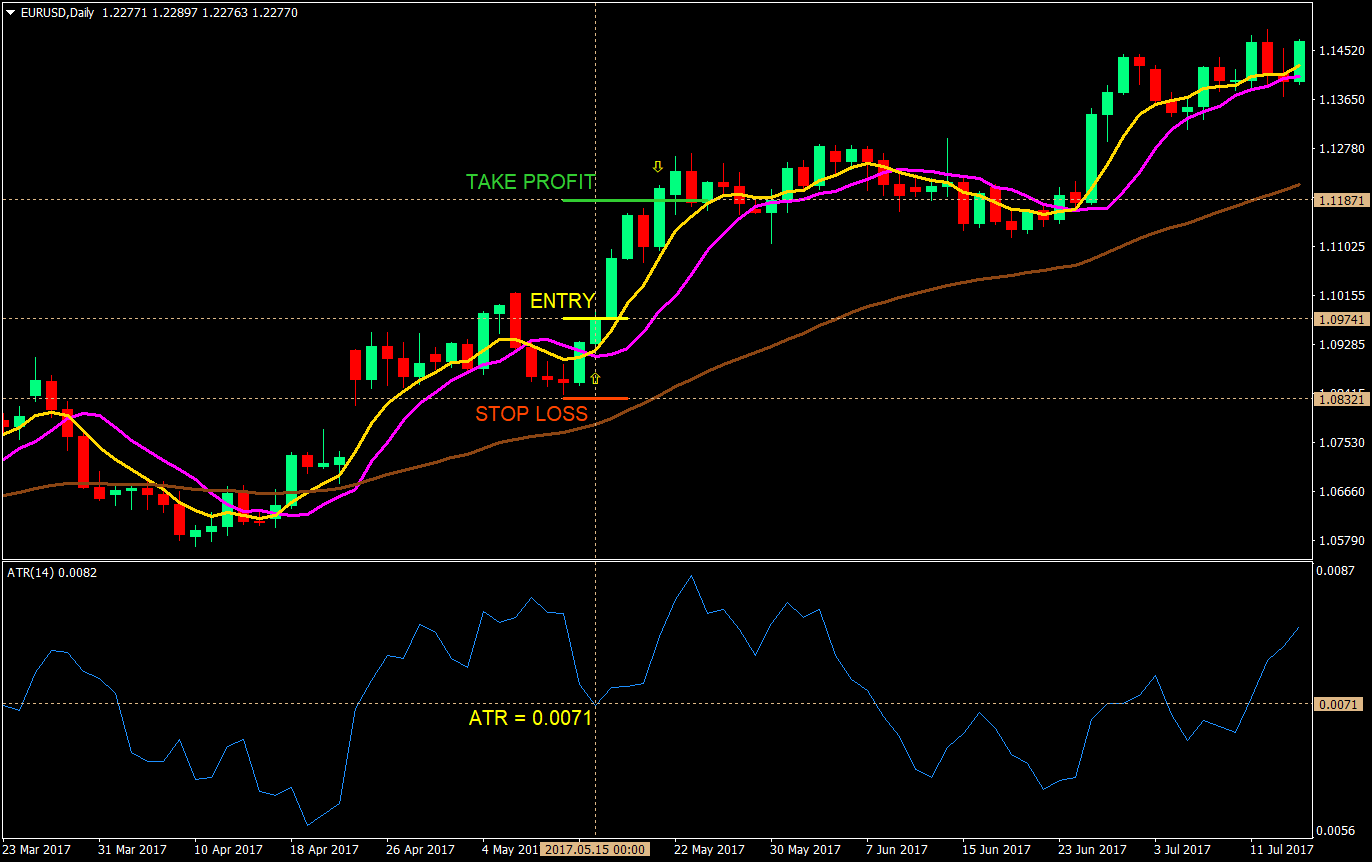

To address the issue of exiting too late, we will be using a take profit target. Yes, this will cap our profits and negate the main strength of crossover strategies, but it will also help us avoid exiting when price has already reversed. It would be better to err on the conservative side to avoid losing money. To do this, we will use also be using the ATR. We will set the take profit at 3x the ATR.

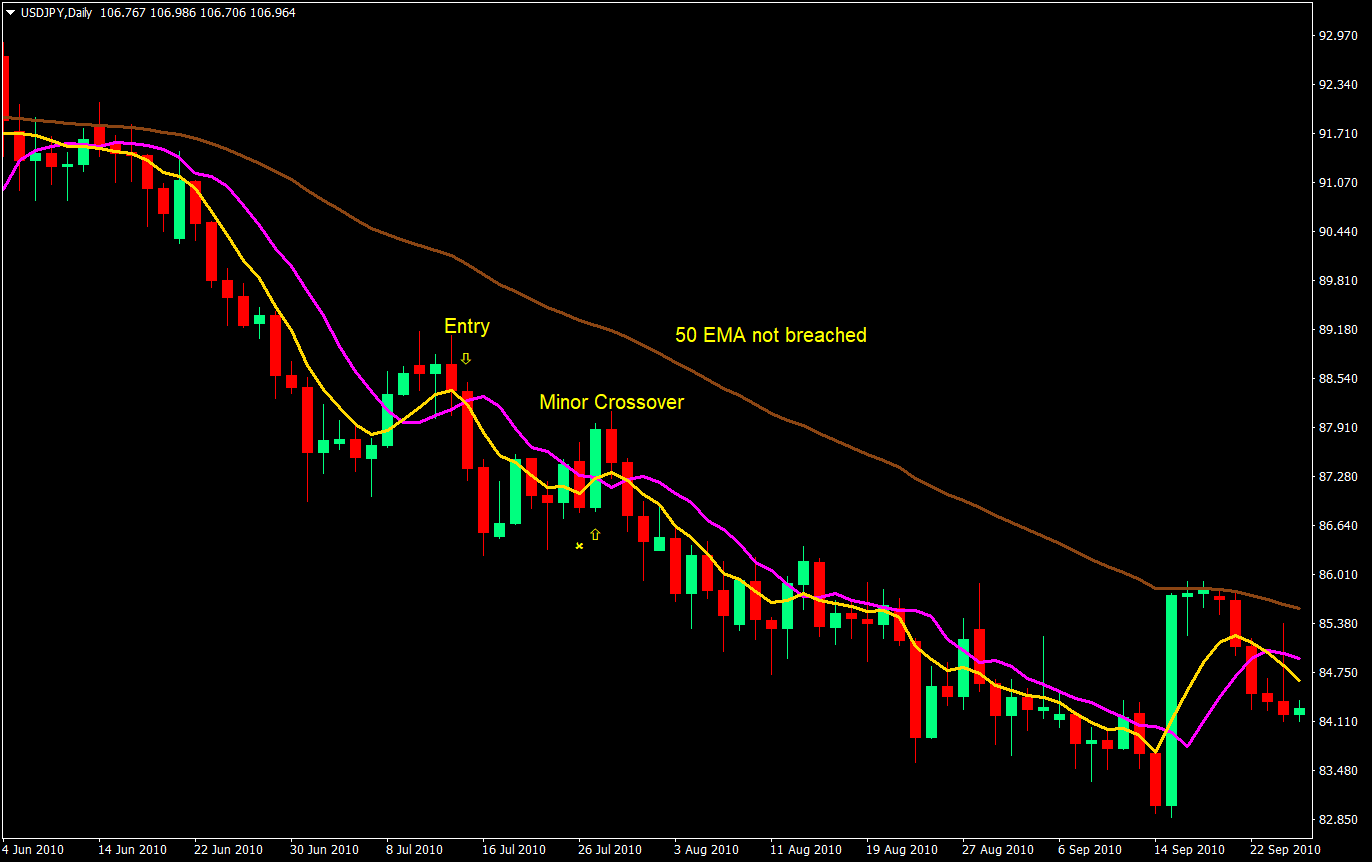

The last weakness that we will be dealing with is the issue of not trading with the longer-term trend. To filter out trades that are not going the direction of the longer-term trend, we will use the 50 Exponential Moving Average (EMA) as our filter. We will only take buy trades if the setup is above the 50 EMA and sell trades only if the setup is below the 50 EMA. By doing this, we not only increase the probability of a successful trade by trading with the trend, we could also avoid premature exits. Sometimes, the moving averages would crossover multiple times before going the direction of our trade, however, this doesn’t mean that the longer-term trend has ended. The crossover strategy trade, if it prematurely crosses over without hitting our target could still be salvaged by holding on the trade, as long as price hasn’t crossed-over the other side of the 50 EMA.

On the chart below, if for example we took the prior crossover because we hadn’t filtered this over-extended entry using the ATR, we would have lost money if we exited on the reverse crossover, only to find that price did go back the direction of our trade and would have profited if we held on. However, we could have had a reason to hold on the trade because the 50 EMA was not yet breached. Thus, still having the probability of having price go our direction, as it did.

Buy Entry:

- Fast MA (gold) crosses above slow MA (magenta)

- Setup is above the 50 EMA (brown)

- Close price is not farther than 1x the ATR from the fast MA (gold)

Stop Loss: Set the stop loss at 2x the ATR from the entry price

Exit: Set the take profit at 3x the ATR from the entry price

Sell Entry:

- Fast MA (gold) crosses below slow MA (magenta)

- Setup is below the 50 EMA (brown)

- Close price is not farther than 1x the ATR from the fast MA (gold)

Stop Loss: Set the stop loss at 2x the ATR from the entry price

Exit: Set the take profit at 3x the ATR from the entry price

Conclusion

This strategy is geared towards addressing the weaknesses of regular crossover strategies. By doing so, we are increasing the probabilities that the trade would be successful. It also tries to avoid the noise of minor reversal crossovers by focusing on the 50 EMA as the main trend indicator, while using the crossover only as an entry. Also, by using the ATR as a filter, we avoid entering on over-extended momentum candles.

By setting the stop loss at 2x the ATR and the take profit at 3x the ATR, we are locking in our reward-risk ratio at 1.5. The only variable left will be the win-loss ratio, which should be higher than most crossovers due to the filters.

The main control of risk tolerance would be the multiple used on the ATR for the stop loss and the take profit. This is the area which could be tweaked to suit the trader’s risk tolerance. However, it is usually after breaching the 2x ATR stop loss when the trend actually reverses, thus the use of these settings.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: