In & Out Trend Continuation Forex Scalping Strategy

Scalping is one of the toughest skills to master in trading. To scalp, one must make decisions quickly, be emotionally stable, focused, and learn to feel the market. Simply put it, scalping is not for everybody. Its either you have what it takes to scalp or not.

However, many are still drawn to scalping because of the quick money it yields skilled scalpers. Many pro scalpers could multiply their accounts several times and these attracts new traders to this type of trading.

Personally, I wouldn’t advice newbies to start here though. But if you feel that you may be one of those who are made for scalping, then here are a couple of tips for you.

Follow the trend and buy low, sell high.

You’ve probably heard of these before, right? But to put these two together would be quite difficult. Following trends usually tend to cause traders to chase prices. By doing so, you are not buying low and selling high.

With this strategy we will be using both words of wisdom.

30 Smoothed Moving Average (SMA) Trend Indicator

To follow the trend, we should have a way to identify the trend. For this, we will be using the 30 Smoothed Moving Average (SMA). This allows us to identify the trend based on the location of price in relation to the 30 SMA. If price is above the 30 SMA, then we will judge the trend as bullish. If price is below the 30 SMA, then the trend is bearish.

To identify a trending market, price should never whipsaw the 30 SMA. Having a portion wherein price in any way shape or form touches the 30 SMA should be a warning sign that the trend is not strong enough for a high probability scalping.

Why 30 SMA? Why not 50? Why not 100? When scalping using trend following strategies, we need to be strict in screening out ranging markets. Using moving averages with longer periods would be more forgiving to price spiking up and down. However, price could easily whipsaw the 30 SMA, which would disqualify or warn us against a ranging market.

The Trigger Lines

For our triggers, we will be using the red and blue fast-moving lines of the sMAMA indicator. These two lines are very reactive to price and should hug price near it. Anywhere price goes, these two would follow it.

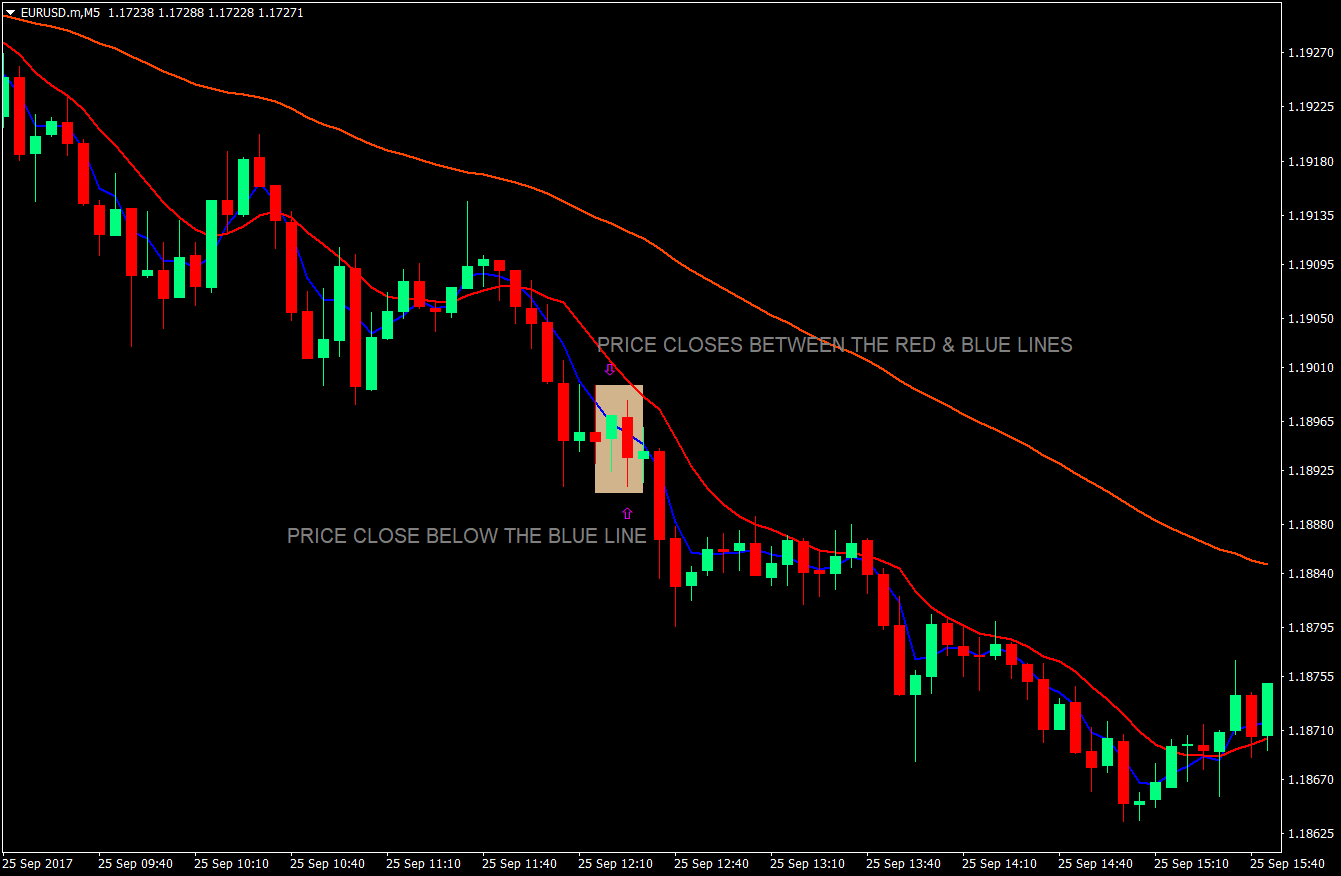

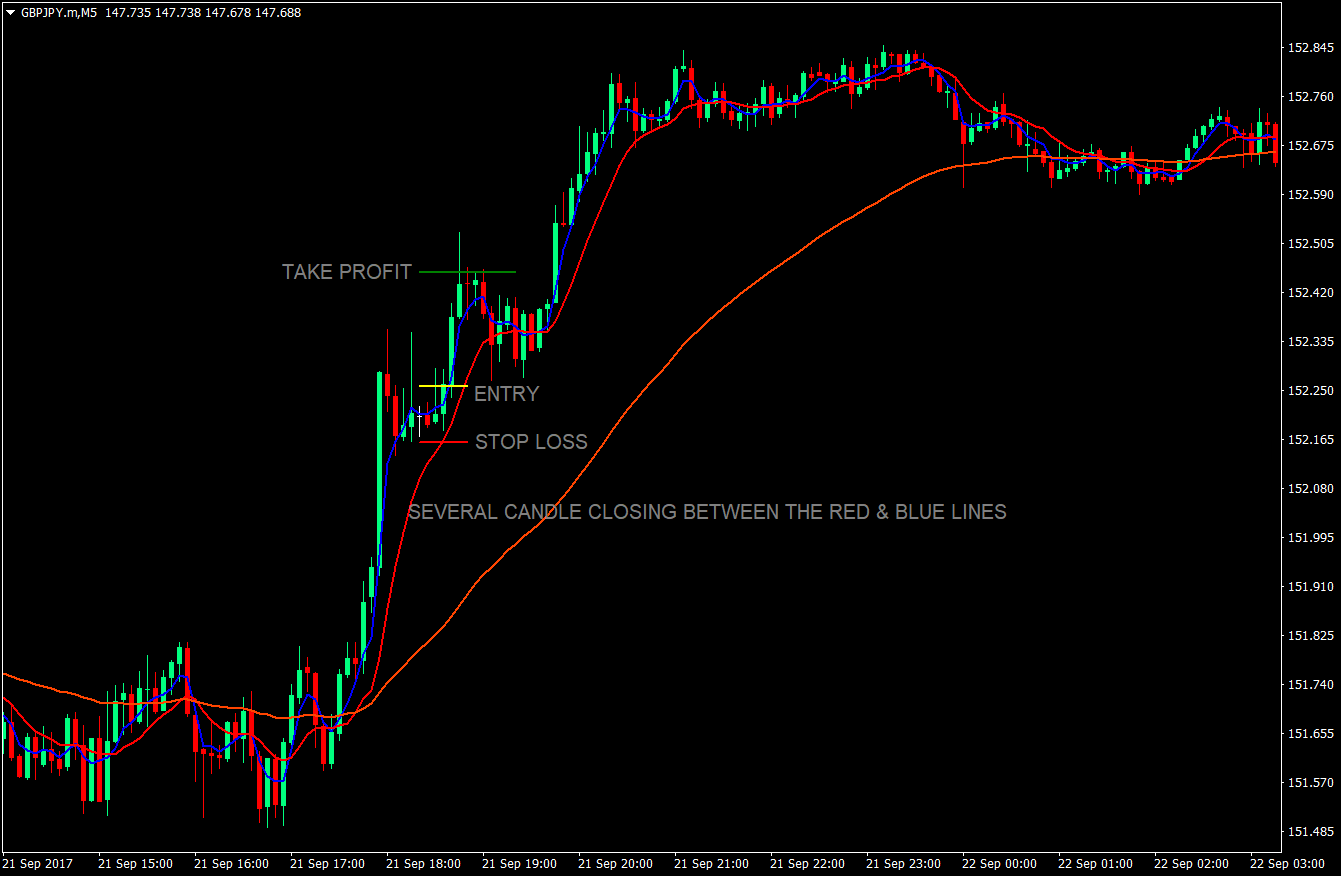

These two lines would allow us to see where price is taking a breather during a rally or a drop. How do we do this? During a rally, price usually goes outside of these two lines. But trending markets have a few instances wherein price would retrace for a while before it continues to rally. As this happens, price tends to close in between the red and blue lines. As soon as price closes back out of the two lines, then it is a signal to enter the market.

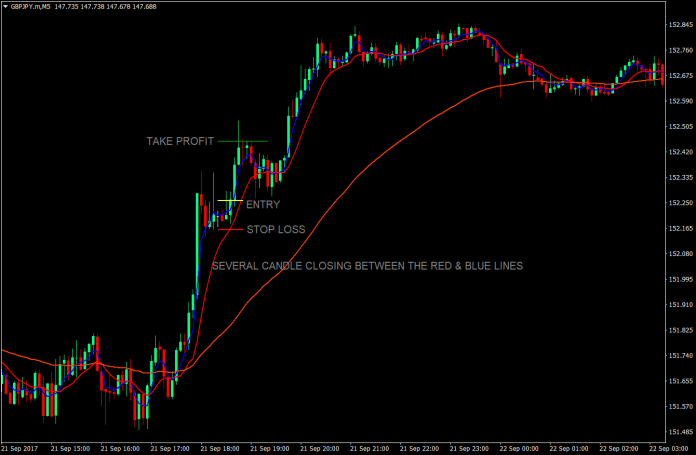

Here is an example of a trending market on the 5-minute chart with several minor retracements. On several retracements, price closed in between the red & blue lines, before continuing the trend.

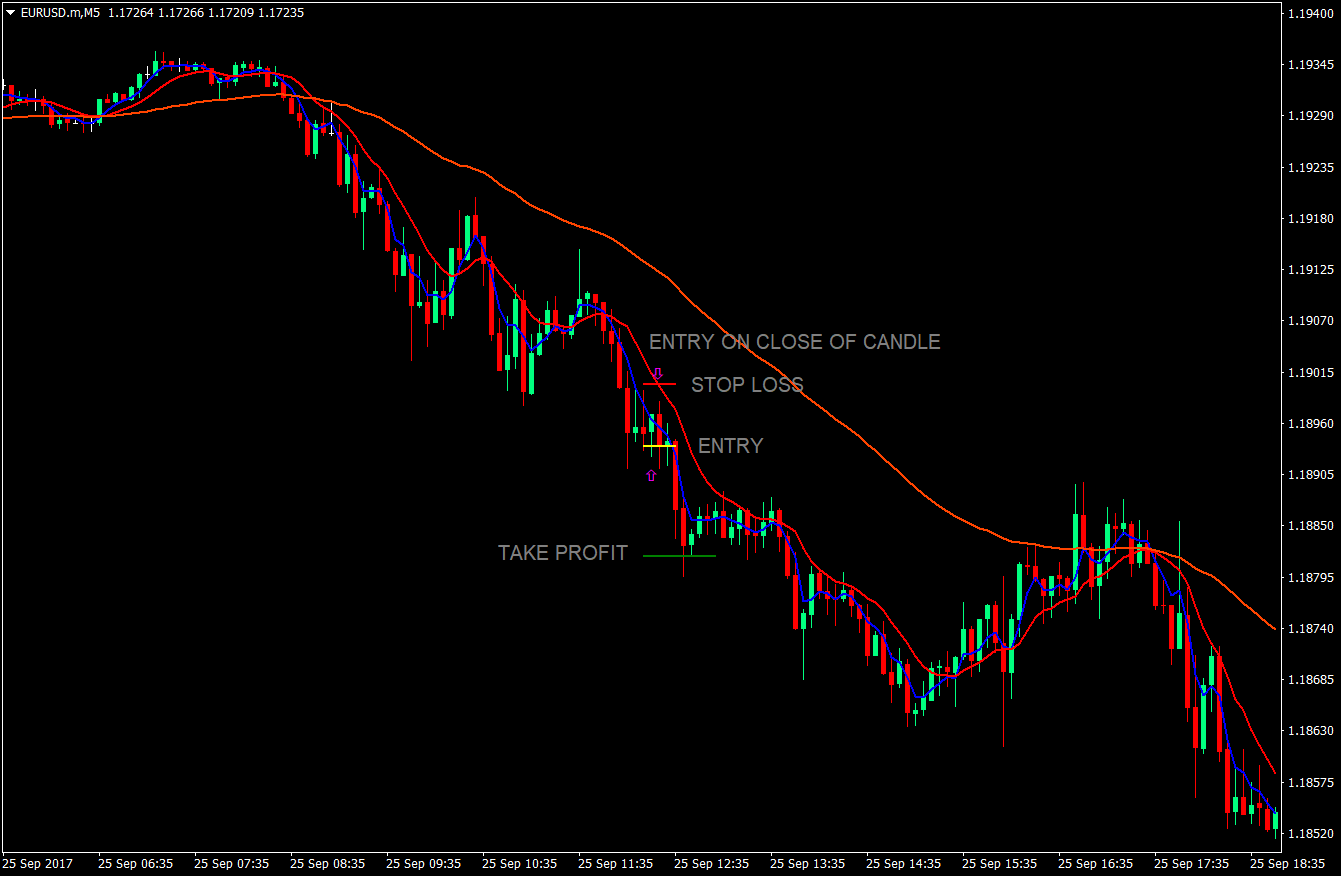

The Sell Setup – Entry, Stop Loss & Take Profit

Entry Rules:

- Price should be well below the 30 SMA without any instance where price touched the 30 SMA. This indicates that the market is clearly trending.

- The blue line should be below the red line.

- Price should close in between the red and blue lines before closing below it on the next candle.

Stop Loss: The stop loss should be placed just a few pips above the red line.

Take Profit: The target take profit should be twice the stop loss risk. This should allow for a 1:2 risk reward ratio.

The Buy Setup – Entry, Stop Loss & Take Profit

Entry Rules:

- Price should be above the 30 SMA without any instance where price touched the 30 SMA. This indicates that the market is clearly trending up.

- The blue line should be above the red line.

- Price should close in between the red and blue lines before closing above it on the next candle.

Stop Loss: The stop loss should be placed just a few pips below the red line.

Take Profit: The target take profit should be twice the stop loss risk.

Conclusion

This strategy is an effective trend continuation strategy. Its strength is in screening out ranging markets, since price would clearly whipsaw the 30 SMA during a ranging market. It is also very simple to follow and is easy to identify. Entries and exits are clearly defined during a trending market.

It is important to take note though that a trending market usually averages around 2 to 4 bounces off these lines. Opportunities presented on the 4th or 5th bounce should be taken with caution since trends don’t usually extend too long.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: