Simple Stochastic Day Trade Forex Trading Strategy

Trading could be simple and mechanical. It could be a simple “if – then” logic which could be followed even by robots. This is what others would call algorithmic trading. This is possible. In fact, there are many algorithmic traders who have managed to program bots to trade for them based on their “if – then” logic.

Although the idea of algorithmic trading is good, I don’t think it is optimal. Why? Because it doesn’t take into account context. Even if all the rules of a robust algorithm are ticked, if the context of the trade isn’t taken into consideration, the probability of a successful trade would be lower. Context could mean many things. It could mean fundamental news, market structure, retracements, breakouts, trend, etc.

For example, if you would use an algorithmic strategy that is supposed to be traded on a trending market, but you are trading it on a ranging market, it would surely have lower probabilities. I’m pretty much guilty of this often. Or if you would trade an entry that should be taken on deep retracements, but are taking it on a very shallow retracement, again the probabilities would be lower. Or if you would trade an entry signal that is supposed to indicate a start of a trend, but you are trading it on a news spike that has stalled on the lower timeframe, again another potential losing trade.

Context makes the difference between a mediocre strategy and a great strategy. The thing is though, considering context is more of an art rather than a science. It couldn’t be fitted in an “if – then” rule set. And it definitely takes practice to get used to analyzing context. There are no shortcuts and there are no 100% correct analysis. It all depends on the traders’ willingness to practice trading.

With this strategy presented, you will have a framework to trade algorithmically with a basic “if – then” mindset. However, it would be best if you would combine this with the context of the market when you trade.

The Setup: Simple Stochastic Day Trade Strategy

This strategy is based on the simple overbought and oversold crossover of the stochastic indicator. However, what most traders miss out is taking trend direction into account. In this strategy, we will have a mid-to-long-term trend bias indicator by using the 100 Exponential Moving Average (EMA).

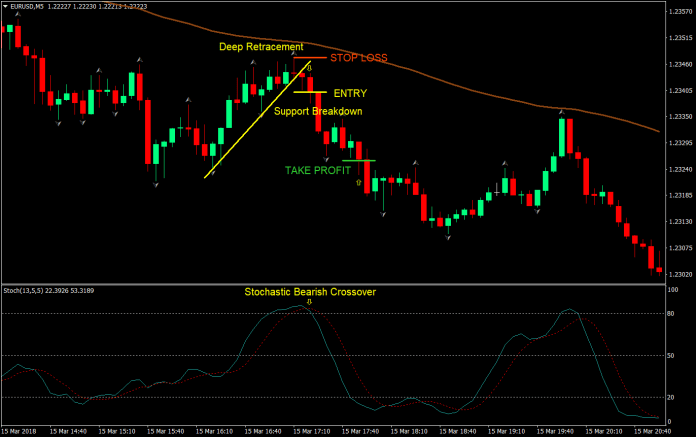

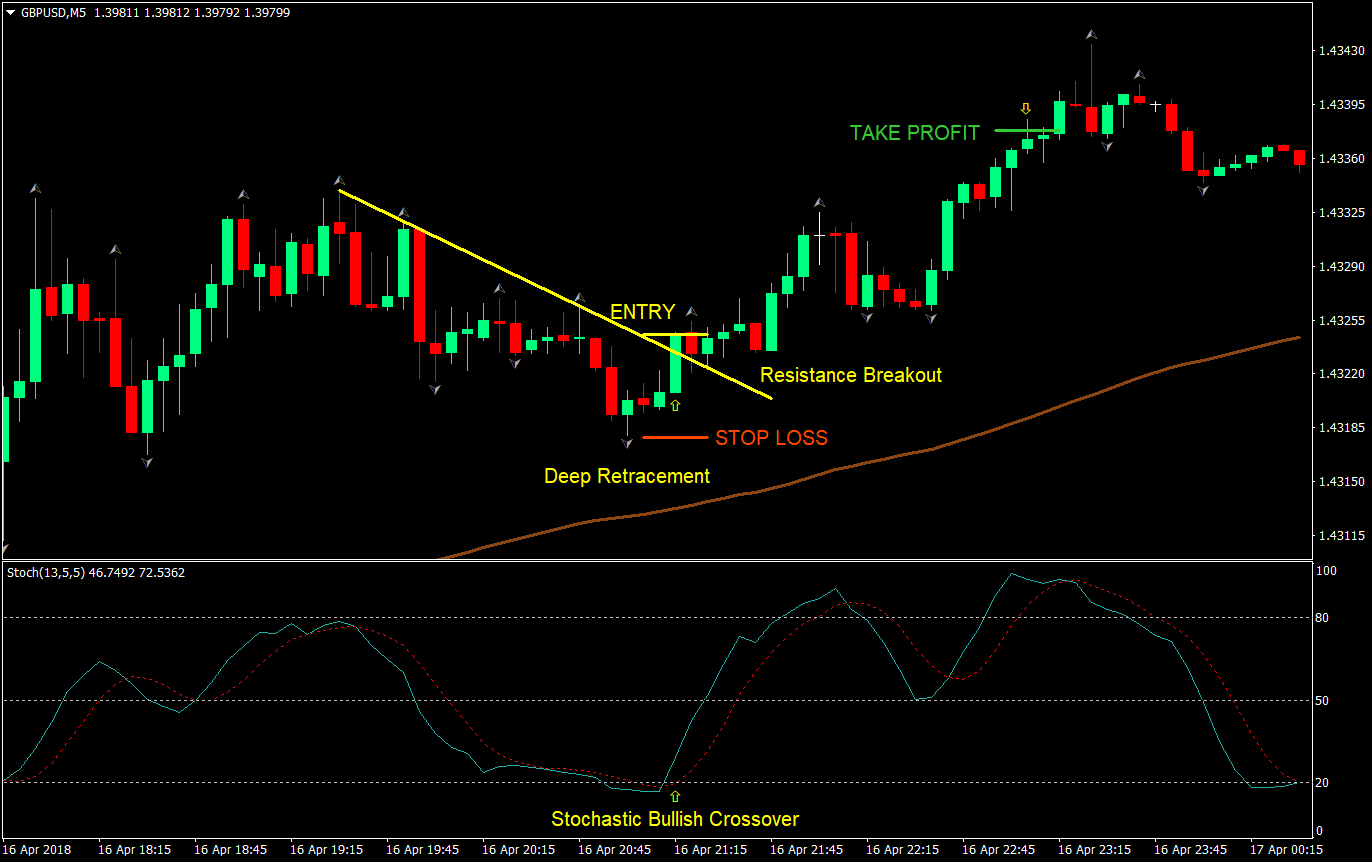

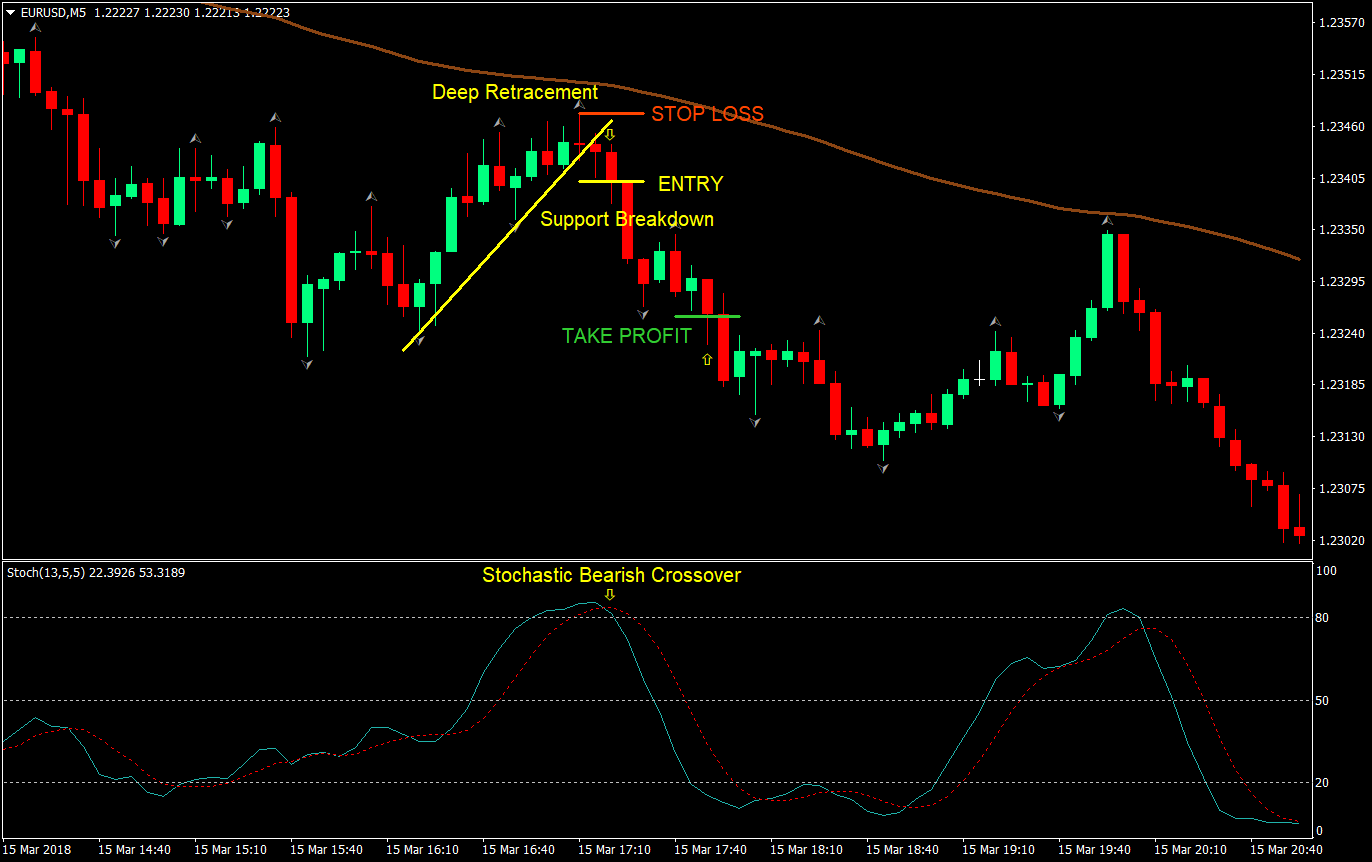

The idea behind this strategy is to take trades on deep retracements near to the 100 EMA but has not breached it. This should be the context of the market condition – a deep retracement. Avoid trading this on a potentially reversing market structure or shallow retracements.

Since this is a deep retracement, you would also often see a support or resistance that should be broken out of. You could add this context as confluence on your trade.

Timeframe: 5-minute chart

Buy Entry:

- Price should be above the 100 EMA (brown) indicating a mid-term uptrend

- Both stochastics should be below 20 indicating an oversold market condition

- Enter a buy market order on the candle close corresponding to the crossover of the fast stochastic above the slow stochastic

Stop Loss: Set the stop loss on the fractal below the entry

Take Profit: Set the take profit at 2x the risk on the stop loss

Sell Entry:

- Price should be below the 100 EMA (brown) indicating a mid-term downtrend

- Both stochastics should be above 80 indicating an overbought market condition

- Enter a sell market order on the candle close corresponding to the crossover of the fast stochastic below the slow stochastic

Stop Loss: Set the stop loss on the fractal above the entry

Take Profit: Set the take profit at 2x the risk on the stop loss

Conclusion

This simple strategy takes a very basic indicator, the Stochastics, which should be near statistical breakeven when traded strictly as a stochastic and improves it further. The improvement is because of the fact that traders would take the stochastics and use it in the context of a steadily trending market. Aside from that, we also add the context of deep retracements and breakouts. By doing this, a basic indicator becomes the focal point of a good strategy. However, the success of this strategy depends on how the trader would analyze the context of the market conditions.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: