Many traders would agree that trading with the trend is one of the easiest ways to earn from the forex market. Trade direction just seems a lot clearer during trending market conditions. Half the battle is done just by knowing which direction to take. The only question is when to take the trade.

However, even though trend following trading seems easy just by looking at charts, if you’ve been into trading for a while, you would know that trend following strategies are easier said than done. This is because most strategies lack an essential component in trend following trading. Trend following is not just about knowing when the trend is starting and ending. It is also about knowing if the trend is strong enough to sustain its direction for quite some time. Trades taken on weaker trends could allow for some profits for a while, however these trends would easily reverse giving back profits to the market.

The Optimum Channel Cross trading strategy is a trend following strategy which takes into consideration not only the direction of the trend but also the strength of the trend. This way we get to have better chances of getting trades that do trend for quite some time.

Average Directional Movement Index

The Average Directional Movement Index (ADX) is one of the most useful technical indicators that could be used by a trend following trader. This is because it not only provides information of the direction of the trend and its reversal points, it also provides information regarding the strength of the trend. This information is very important because this allows traders to gauge if the market’s trend does have a high probability of continuing longer or not.

The ADX indicator is a momentum indicator which is plotted on a separate window. It is composed of three lines, the +DMI, -DMI and the ADX line.

DMI stands for Directional Movement Index. This component of the indicator is what indicates the direction of the trend. The DMI is composed of two lines, +DMI and -DMI. Whenever the +DMI is above the -DMI, the market is bullish. On the other hand, having the -DMI above the +DMI would mean that the market is considered bearish.

Unlike the DMI lines, the ADX line is non-directional. Instead, it only indicates the strength of the trend. Traditionally, trend strength is only considered to be strong only when the ADX line is above 25. However, this does not usually apply for trend reversals. This is because the ADX line tends to dip during market reversals before rising again. The same applies when the market is coming from a market contraction phase prior to an expansion phase which is typical of a trending market. The ADX line tends to be lower before rising above 25 during the trend. This is because the ADX line is still a lagging indicator. Some would still use it as a trend strength filter, which would prohibit them from taking trades with an ADX below 25. On the other hand, aggressive traders would rather take the trade as the ADX is rising even though it still below 25 knowing that it tends to lag a bit.

Adaptive Moving Average Indicator

The Adaptive Moving Average (AMA) indicator is a custom moving average which is quite different compared to the usual moving average. This is because the AMA takes into consideration the strength of the trend. The sensitivity of the moving average based on the strength of the trend could also be adjusted depending on the parameters used by the trader.

Channel Trading Signals Indicator

The Channel Trading Signals indicator is a custom indicator which draw channels based on the high, low and close of candles. However, this indicator could also be used in a crossover strategy. This is because this indicator closely follows price action movement, making it an excellent leading indicator.

Trading Strategy

This strategy is a trend strength-based crossover strategy. Both the ADX indicator and the i-AMA indicator provide for the trend strength component of the strategy. Aside from trend strength, the strategy also makes use of the crossover signals provided using the two indicators.

The Channel Trading Signals indicator is then paired with the i-AMA indicator to provide a crossover signal that is based on trend strength and a leading indicator.

Indicators:

- i-AMA-Optimum

- channel-trading-signals

- Average Directional Movement Index

- Period: 28

Timeframe: 1-hour, 4-hour and daily charts

Currency Pair: major and minor pairs

Trading Session: Tokyo, London and New York sessions

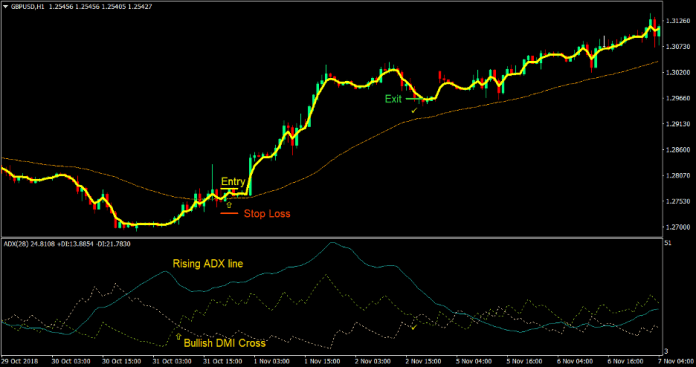

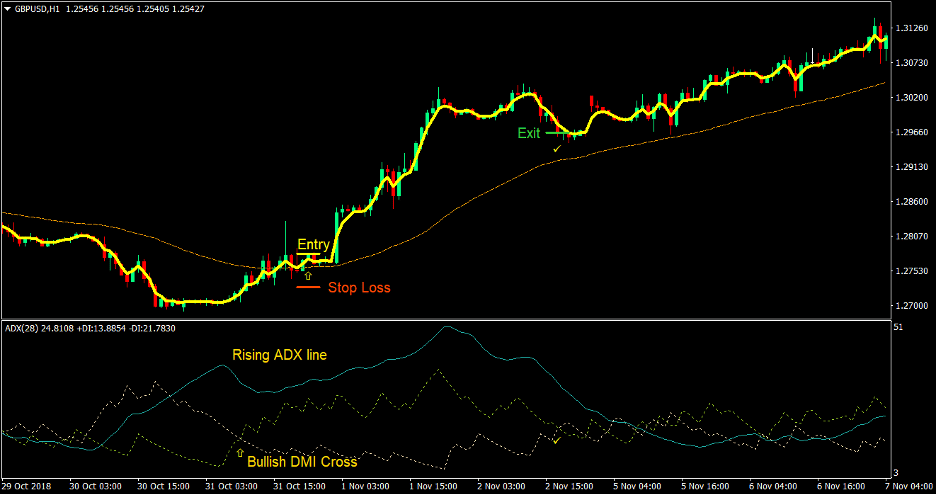

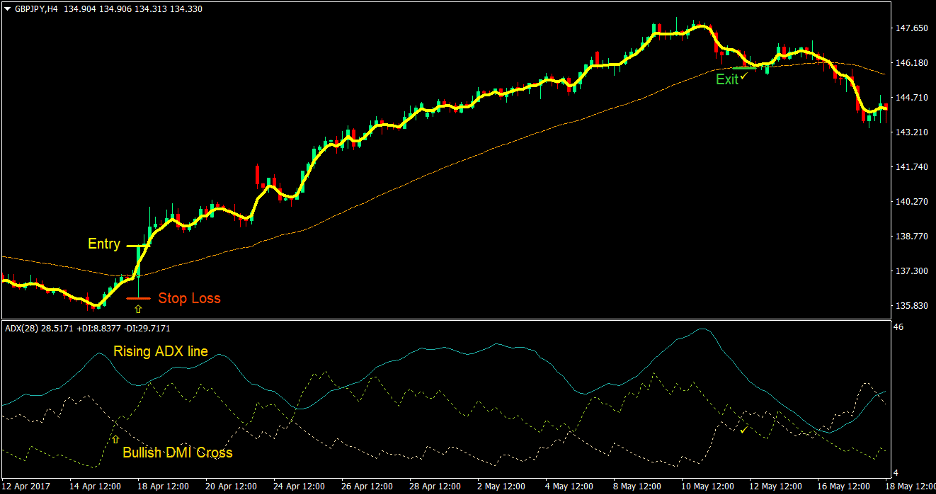

Buy Trade Setup

Entry

- On the ADX indicator window, the +DMI line should cross above the -DMI line indicating a bullish trend reversal

- The ADX line should start rising indicating a strengthening trend

- The Channel Trading Signals line should cross above the i-AMA line indicating a bullish trend reversal

- Enter a buy order on the confluence of the above conditions

Stop Loss

- Set the stop loss at the support level below the entry candle

Exit

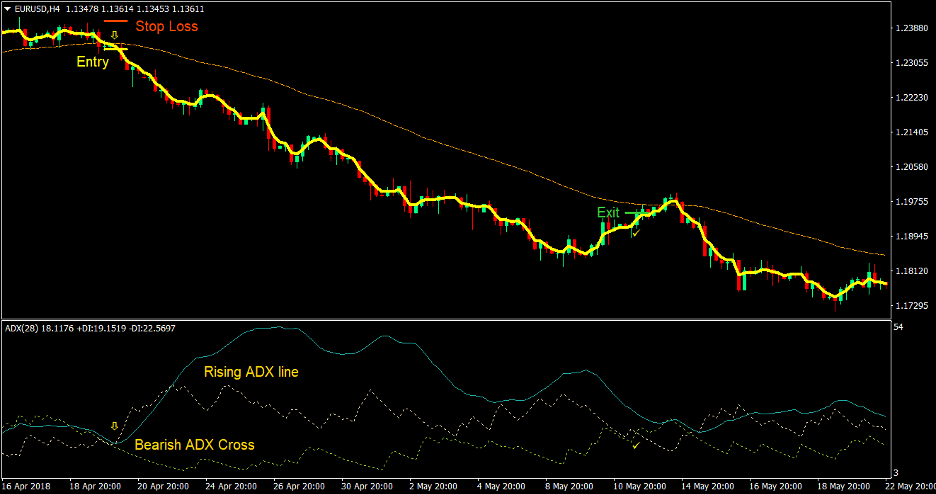

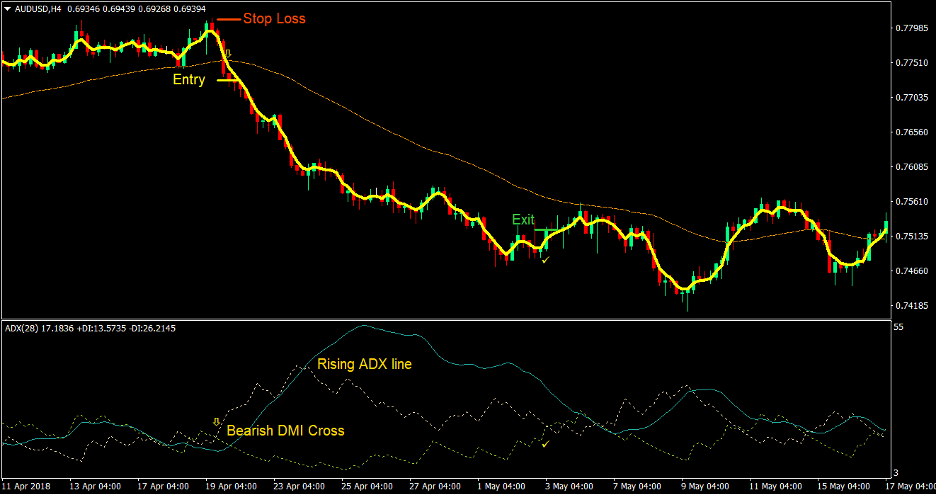

Sell Trade Setup

Entry

- On the ADX indicator window, the +DMI line should cross below the -DMI line indicating a bearish trend reversal

- The ADX line should start rising indicating a strengthening trend

- The Channel Trading Signals line should cross below the i-AMA line indicating a bearish trend reversal

- Enter a sell order on the confluence of the above conditions

Stop Loss

- Set the stop loss at the resistance level above the entry candle

Exit

- Close the trade as soon as the +DMI line crosses above the -DMI line

Conclusion

This trading strategy is a high yield type of strategy. It is typical for this strategy to catch trades that have reward-risk ratio of 2:1 to 5:1. These are the types of trades that cause trading accounts to grow exponentially. It also allows traders to easily recuperate some losses during the drawdown periods which is typical in most trading strategies.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: