Mechanical Day Trade Forex Trading Strategy

In trading, there are a couple of important things to determine in order to have a high probability trade setup – direction and entry. But although these two are all you’d have to determine, these two is precisely what makes trading difficult. This is because getting just one of these two right won’t cut it. You would have to have both of them right. If not, then you would just be thrown in the whims of chance. Have these two spot-on though and you’ll be in for some big profits. This skill is what great traders have that others don’t.

But how do we get these right? Let’s tackle them one by one.

First, direction. There are two main categories of trading strategies that determine your direction – momentum or mean reversal. Momentum refers to trading with the direction previously held by the market, which to me is synonymous to trend. So, we could also call momentum as trend trading. On the other hand, mean reversal trading refers to trading against the current trend with the belief that price would always come back to its average price, thus it is called mean reversal. Now, between the two, trading with the trend seems to be a lot easier. This is because you won’t be trading against the current market sentiment, and you would trading with lesser obstacles such as supports and resistances. So, in this article we will learn to trade with the trend.

Traders often use either a technical indicator or price action to determine trend direction. I think it is actually good to learn both. But this strategy is aimed towards being mechanical, so we will use a technical indicator to determine the trend, which will be our Parabolic SAR or SAR. This will allow us to quantifiably determine the direction of our trades based on the indicator.

Now, let’s go to the second factor that determines a high probability trade, the entry. Some momentum or trend following trading strategy could cause a trader to buy peaks or sell on the lows. This is because momentum traders are notorious for trying to chase price. This is definitely not the way to go if you’d want to be profitable. But there is a way to trade with the trend without chasing price. This is by waiting for price, waiting for it to retrace to a favorable price level so that we could enter near the start of a fresh price thrust that goes with the trend. To make this as mechanical as possible, we will be using two moving averages to determine our retracement area or our dynamic area of support or resistance. What we will be looking for is for price to enter and close between the two moving averages. This signifies the retracement. Then, we wait for price to close back outside of the two moving averages, which signifies the resumption of the trend.

The Setup: Mechanical Day Trade Strategy

This day trade strategy would be setup on the 5-minute chart. Some traders think of this timeframe as a scalping timeframe, but I see it as a day trade due to the length of time we hold a trade in this time frame.

To determine the trade direction, we would use the SAR. If price is above the SAR, then we should be looking for buy trades. If price is below it, then we are looking to sell.

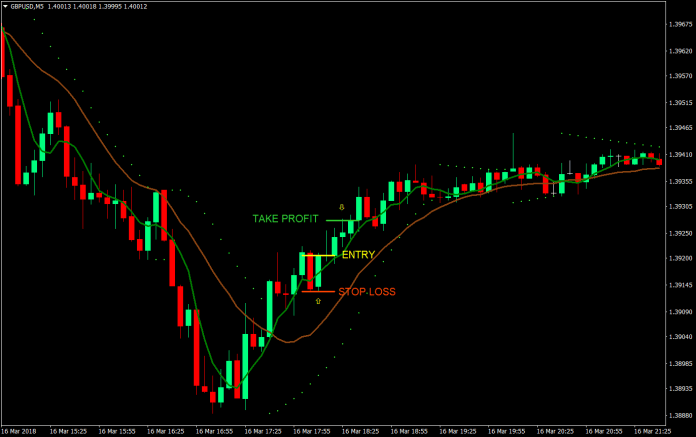

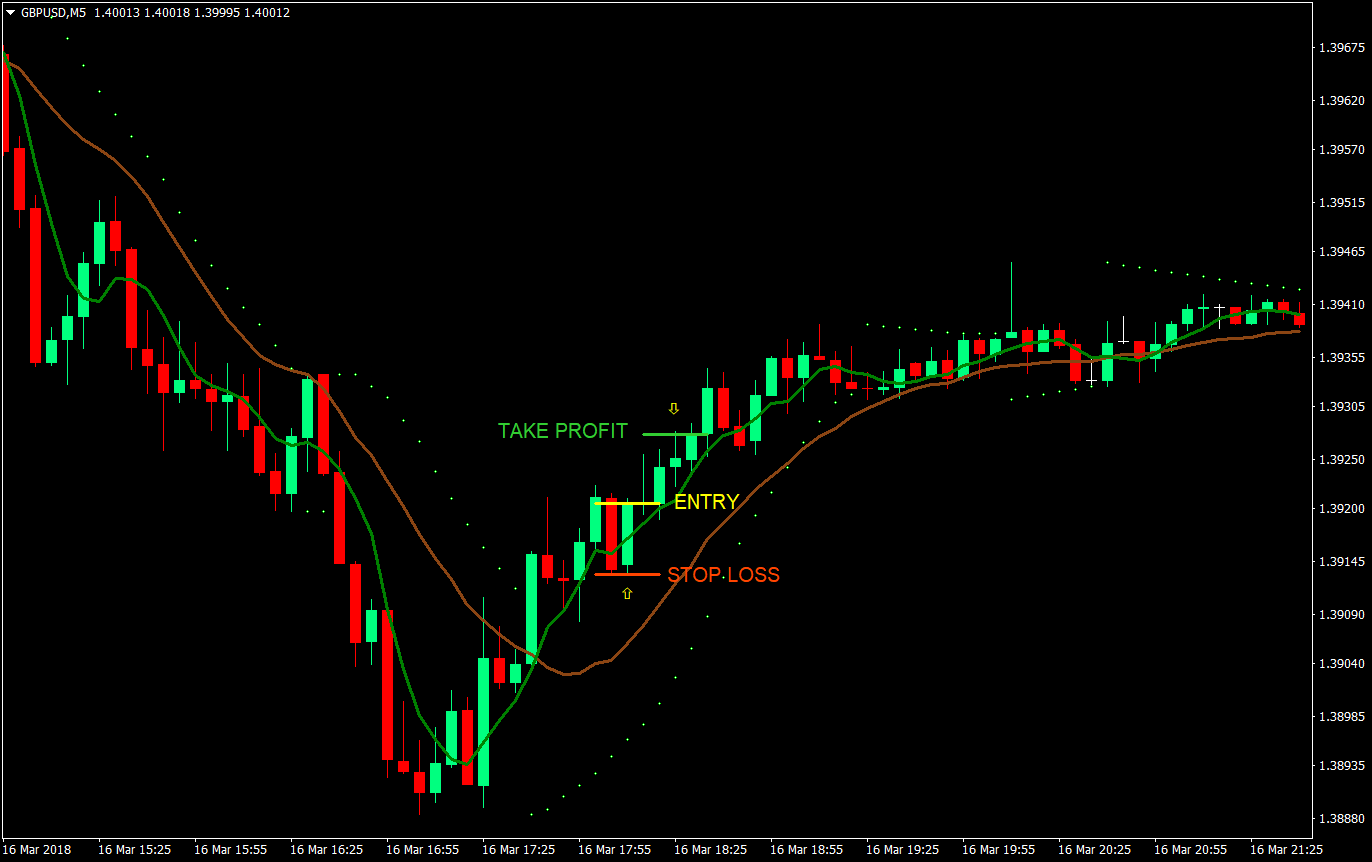

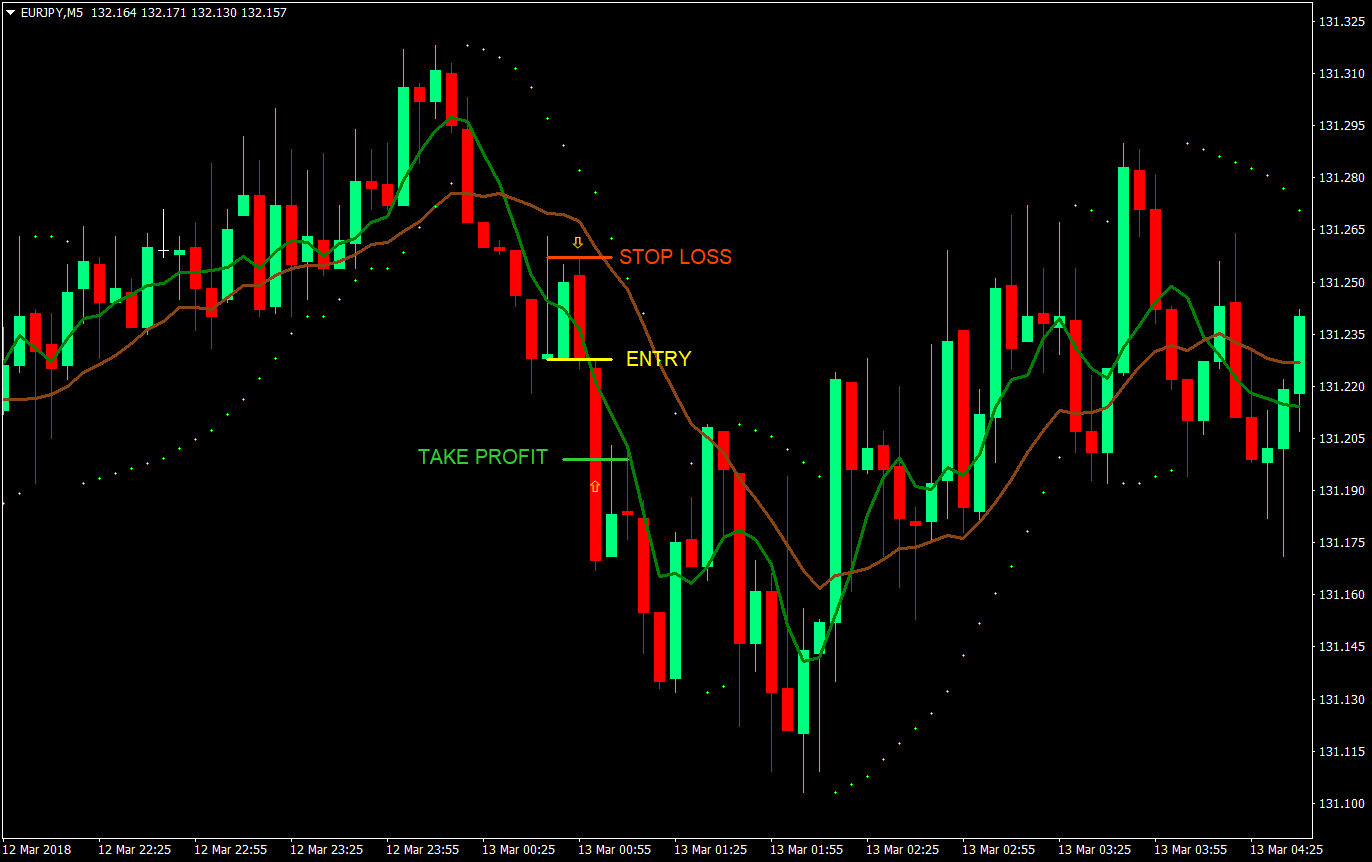

Our two moving averages would be the 5 (green) and 15 (brown) Exponential Moving Average. This will serve as a filter and a dynamic area of support and resistance. On an uptrend, the 5 EMA should be above the 15 EMA, while on a downtrend, the 5 EMA should be below the 15 EMA. Then we look for closes between the two EMAs, then closes back out of it on the direction of the trend.

Buy Entry:

- Price should be above the SAR

- 5 EMA (green) should be above the 15 EMA (brown)

- Wait for price to close between the 5 & 15 EMA

- Then wait for price to close back above the 5 EMA

- Enter a buy market order at the close of the candle

Stop Loss: Set the stop loss at the low of the candle

Take Profit: Set the take profit at 1x the risk on the stop loss

Sell Entry:

- Price should be below the SAR

- 5 EMA (green) should be below the 15 EMA (brown)

- Wait for price to close between the 5 & 15 EMA

- Then wait for price to close back below the 5 EMA

- Enter a sell market order at the close of the candle

Stop Loss: Set the stop loss at the high of the candle

Take Profit: Set the take profit at 1x the risk on the stop loss

This simple mechanical strategy covers the two factors that lead to a high probability trade, the direction determined by the SAR and the entry determined by a retracement and continuation signal on the EMAs. By having these two determined, we get a mechanical trading strategy that yields higher probability trades. There are however several ways to determine trend direction and entry aside from this method.

This strategy has a fixed 1:1 reward-risk ratio. However, this is still in effect a negative reward-risk ratio since we haven’t covered the commission and spread yet. This is an area which you could tweak to your liking. However, this is somehow more of a conservative target so as to yield a higher win-loss ratio.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: