How do you get a high probability trading setup? High probability trade setups typically occur when there are multiple indications that price is going a certain direction. This is called confluence.

In trading confluence is when there are several indicators or technical charting analyses that point towards the same direction. It may be a candlestick pattern coinciding with an indicator. It could also be a support or resistance bounce coinciding with an oversold or overbought market condition. It could also be two or more indicators pointing the same direction quite at the same time. Whatever way you approach confluences in technical analysis, as long as the indications are complimentary, it usually results in an increased probability. However, using technical indicators present an advantage due to its objectivity. It allows traders to simply follow rules and filters based on the strategy and decide accordingly.

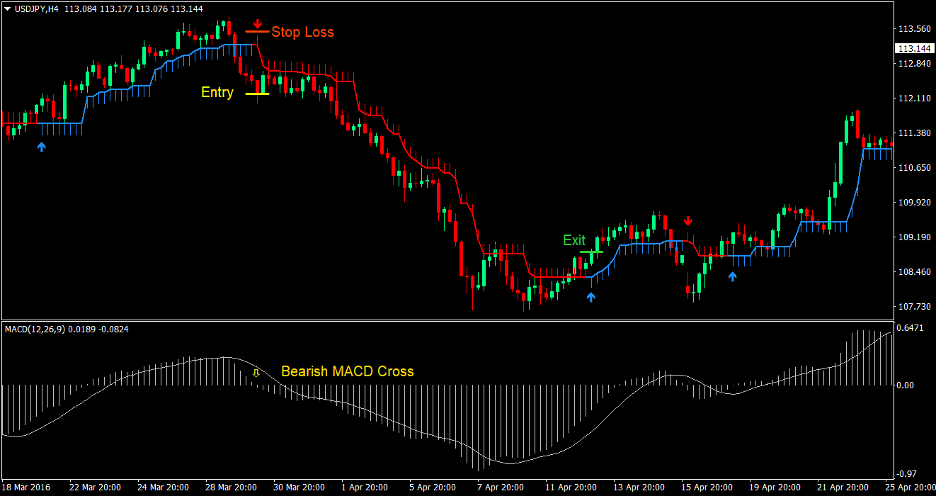

The MACD Half Trend Forex Trading Strategy is one which makes use of two very popular technical indicators. These indicators are complimentary and when both indicators provide signals at the same time, it usually results in a high probability trade setup.

Moving Average Convergence and Divergence

The MACD or Moving Average Convergence and Divergence is pretty much a standard oscillating indicator, which is widely used by technical analysts. You would even hear about it being used in market analysis news on TV.

The MACD is simply an oscillating indicator based on the crossing over of moving averages. It is composed of three moving averages. The first two are usually Exponential Moving Averages (EMA). One is fast while the other is slow. The slower moving average is then subtracted to the faster moving average. The difference is then usually plotted as a histogram bar. Positive bars indicate a bullish market condition while negative bars indicate a bearish market condition. The crossing over from positive to negative is in itself a trend reversal signal. This is because if you would consider it closely, it is actually a crossing over of two moving averages.

Then, we have a signal line. The signal line is usually a Simple Moving Average. The crossing over of the histogram bars and the signal line could then be another entry signal. Signals using this method is usually filtered by whether the signal line and histogram is positive or negative. This is because of the assumption that these two would always be drawn to the midline, which is zero. This method is popular among mean reversal traders.

Half Trend Indicator

The Half Trend Indicator is another custom indicator that has been gaining popularity lately and probably with good reason.

The Half Trend Indicator is a trend following indicator which is printed on the price chart itself. It is composed of lines and bars attached to the line. Whenever it is bullish, the bars are drawn below the line. Whenever the market is bearish, the bars are then drawn above the line. The indicator also changes colors whenever it detects a change in trend.

If you would closely examine the Half Trend Indicator, you would notice how high the probability it has of having a correct reading of the trend. Many of the signals it produces even usually would result in high returns.

Trading Strategy

This strategy is based on the confluence of the MACD and the Half Trend indicator. The entry signal from the MACD will be based on the crossing over of the histogram over the midline. This is a basic entry strategy used by traders who use the MACD. However, when this entry signal is combined with the trend reversal signal of the Half Trend Indicator, the probability of having a profitable trade becomes even better. These two complimentary indicators seem to do very well together.

Indicators

- HalfTrend-1.02

- Amplitude: 4

- MACD

Timeframe: 1-hour, 4-hour and daily timeframes

Currency Pair: major and minor pairs

Trading Session: Tokyo, London and New York

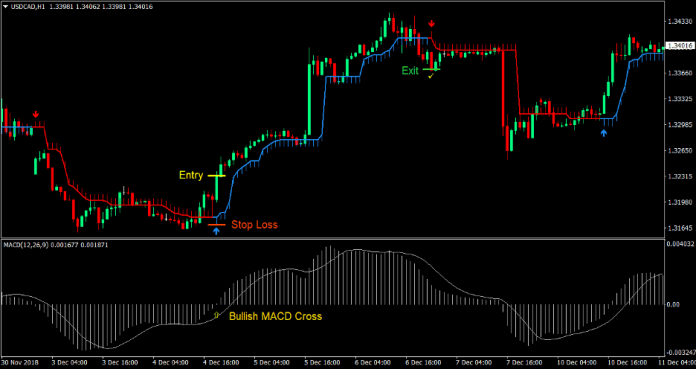

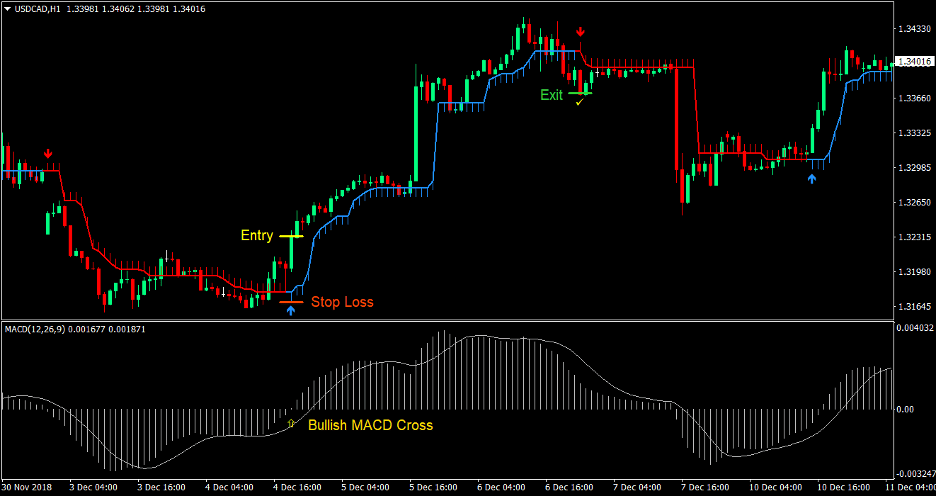

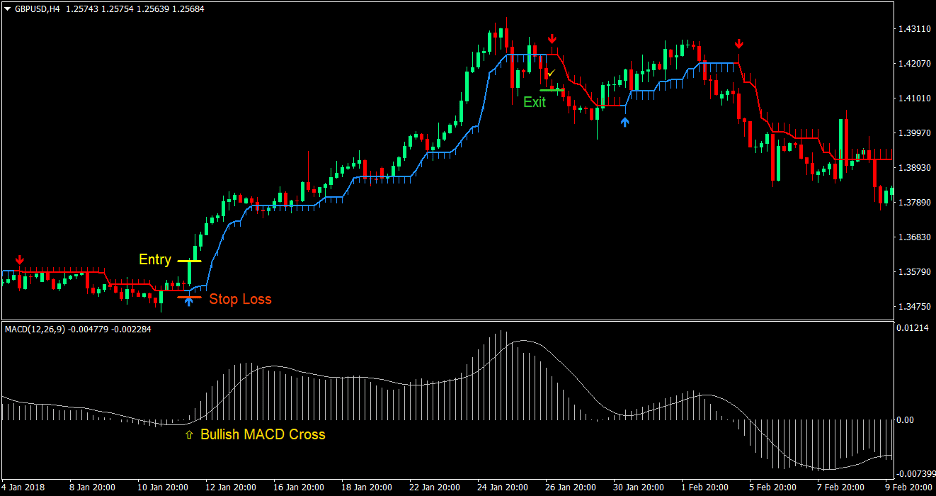

Buy Trade Setup

Entry

- The MACD histogram should cross from negative to positive indicating a possible bullish trend reversal

- The Half Trend Indicator should change to blue with the bars shifting below the line indicating a possible bullish trend reversal

- These two bullish entry signals should be somewhat aligned

- Enter a buy order on the confluence of the above conditions

Stop Loss

- Set the stop loss below the Half Trend Indicator

Exit

- Close the trade if the MACD histogram crosses back to negative

- Close the trade if the Half Trend Indicator changes to red

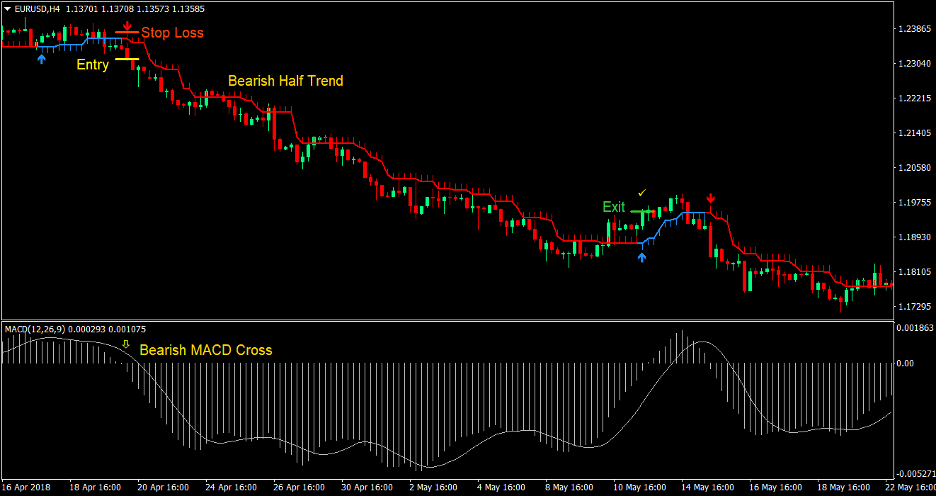

Sell Trade Setup

Entry

- The MACD histogram should cross from positive to negative indicating a possible bearish trend reversal

- The Half Trend Indicator should change to red with the bars shifting above the line indicating a possible bearish trend reversal

- These two bearish entry signals should be somewhat aligned

- Enter a sell order on the confluence of the above conditions

Stop Loss

- Set the stop loss above the Half Trend Indicator

Exit

- Close the trade if the MACD histogram crosses back to positive

- Close the trade if the Half Trend Indicator changes to blue

Conclusion

This simple trading strategy based on confluence of two popular and widely used indicators is a high probability trend following strategy, which also allows traders to catch big trending moves.

This strategy allows traders to catch trades that could result in a reward-risk ratio of 3:1 or even more. This allows traders to be in profit even if some losses would occur. Add to it the fact that trades usually end up being high probability trade setups.

Trade management is also a good thing to master when using this strategy. There are some cases when the trend would reverse in spite of the confluence, right after a short thrust towards the direction of the trade. Moving the stop loss to breakeven would allow traders to earn a profit even if price does reverse a bit too early.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: