There are many instances in the market wherein as we see the market unfold, we are just left hoping we had ridden that big trending wave. The question is how?

There are many ways to trade that could allow us to ride the wave from start to finish. One of the more popular ways to do it is by using moving average crossover strategies. It is simple, easy to follow, and if used on the right market condition, could allow traders to catch those big trending waves.

The Guppy Trend Forex Trading Strategy is one of those strategies that is based on a crossover strategy. It is a trend following strategy that aims to catch trends right from the start and ride it out until the end. This allows for a high reward-risk ratio type of trading strategy.

The Guppy Multiple Moving Average Indicator

The Guppy Multiple Moving Average Indicator is a custom indicator that is based on two main modified moving averages which are then multiplied to different periods. This then shows two groups of multiple moving averages that crisscross each other. These moving averages also tend to fan out whenever the market starts to trend and contracts whenever the trend is slowing down.

There are many ways in which the Guppy Multiple Moving Average indicator could be used. It could be used as a way to identify trend direction. This could be done by identifying the location of price in relation to the moving averages. If price is above the slower set of moving averages colored green, then the mid-term trend is said to be bullish. If price is above both the slower and faster sets, green and red, then both the mid-term and short-term trend is said to be bullish. On the other hand, if price is below the green moving averages, then the mid-term trend is said to be bearish. If price is below both the green and red bands, then both the mid-term and short-term trend is bearish.

Another way to look at this indicator is to identify how the moving averages are stacked. If the faster moving averages are above the slower moving averages, then the trend is said to be bullish. If it is the inverse, having the faster moving averages below the slower moving averages, then the trend is considered bearish.

We could also visually assess the strength of the trend based on the characteristics of the moving averages. If the moving averages are fanning out, then the trend tends to be stronger. On the other hand, if the moving averages are contracting, then the trend could be slowing down.

Trading Strategy Concept

This strategy is based on using the Guppy Multiple Moving Average Indicator as a crossover strategy in line with the long-term trend.

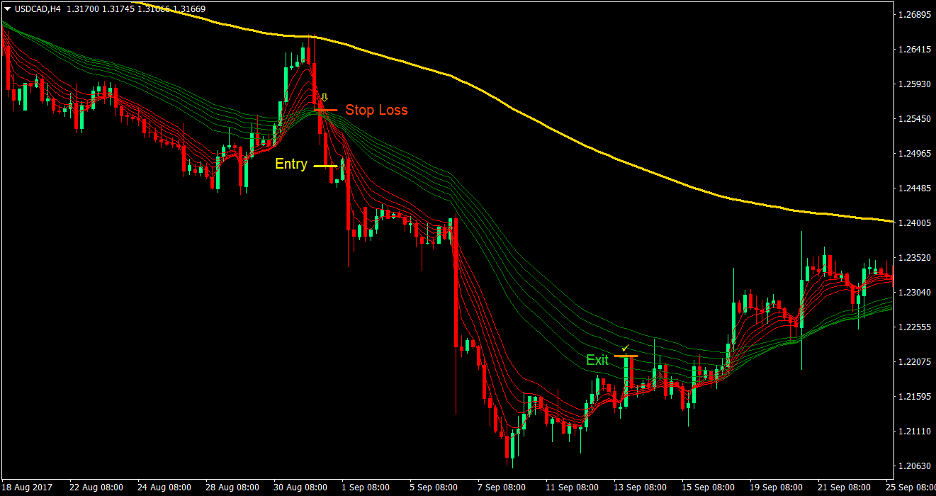

Our primary filter would be the 200-period Exponential Moving Average (EMA). Trades should be taken only on the direction of the 200 EMA. Whenever the Guppy Multiple Moving Average indicator is above the 200 EMA, we would only be looking to take buy trades. If on the other hand, the Guppy Multiple Moving Average indicator is below the 200 EMA, then we would only be taking sell trades.

Then, we wait for the crossover to occur on the direction of the 200 EMA. On a bullish long-term trend, we would be waiting for price to retrace allowing the faster band of moving averages colored red, to go below the slower band colored green. Then, we wait for the red moving averages to cross back above the green moving averages. This would indicate that price is resuming the direction of the long-term trend. This would be our buy entry signal.

As for sell trades, the Guppy Multiple Moving Average indicator should be below the 200 EMA. We then wait for price to retrace causing the red band of moving averages to cross above the green band. Then, we wait for the red band to cross back below the green band indicating the resumption of the bearish trend. This would then be our sell signal.

Indicators:

- 200 EMA (gold)

- guppy_multiple_moving_averages

Timeframe: 15-min, 30-min, 1-hour and 4-hour charts

Currency Pair: any major and minor pair plus some crosses

Trading Session: any

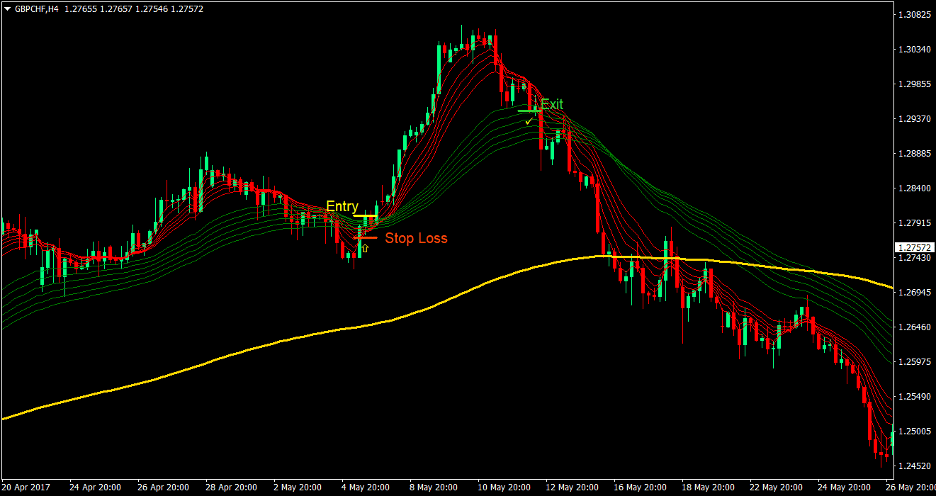

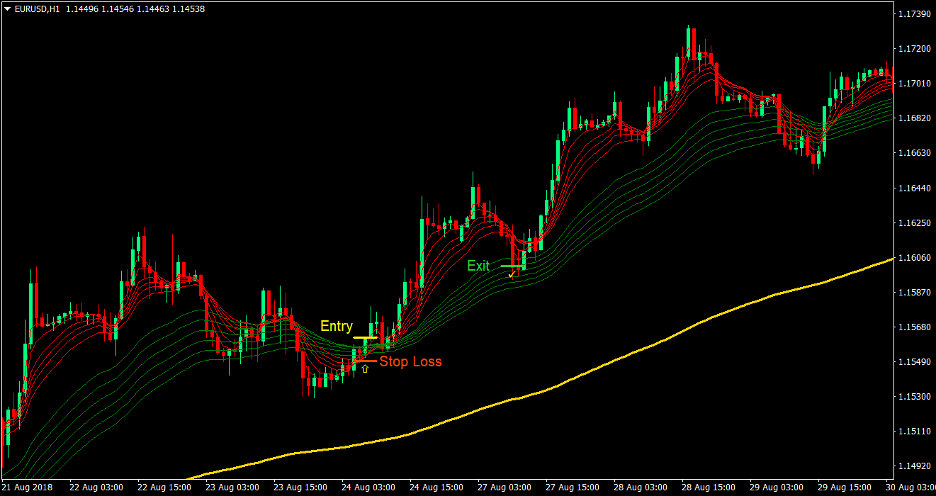

Buy (Long) Trade Setup

Entry

- Price should be above the 200 EMA

- The Guppy Multiple Moving Average bands should be above the 200 EMA

- Price should retrace causing the red moving averages to go below the green moving averages

- Wait for the red moving averages to cross back above the green moving averages indicating the resumption of the bullish trend

- Enter a buy order on the confluence of the above conditions

Stop Loss

- Set the stop loss below the Guppy Multiple Moving Average lines

Exit

- Close the trade if price closes back within the green multiple moving average band

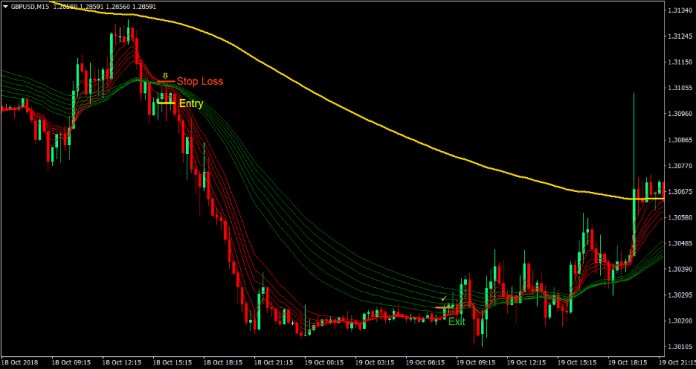

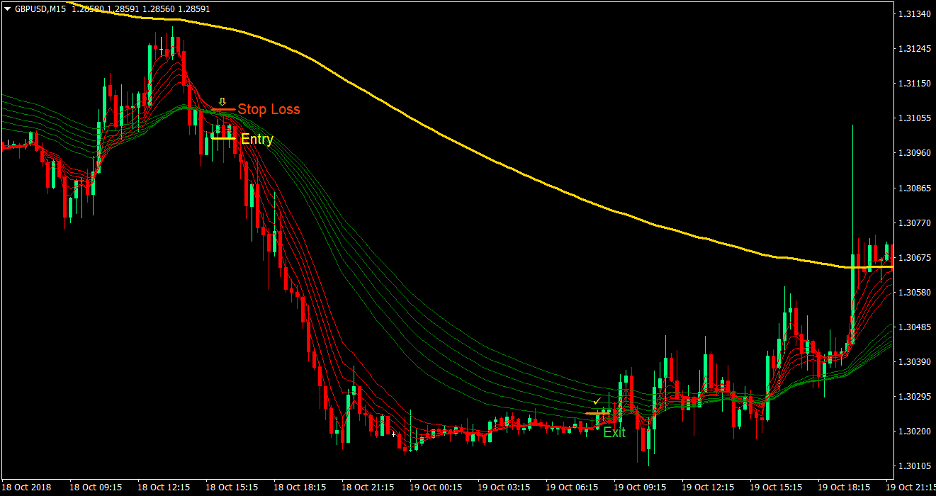

Sell (Short) Trade Setup

Entry

- Price should be below the 200 EMA

- The Guppy Multiple Moving Average bands should be below the 200 EMA

- Price should retrace causing the red moving averages to go above the green moving averages

- Wait for the red moving averages to cross back below the green moving averages indicating the resumption of the bearish trend

- Enter a sell order on the confluence of the above conditions

Stop Loss

- Set the stop loss above the Guppy Multiple Moving Average lines

Exit

- Close the trade if price closes back within the green multiple moving average band

Conclusion

This strategy is a version of a crossover strategy which makes use of multiple moving averages based on the Guppy Multiple Moving Average indicator. This allows us to see the bigger picture by having multiple moving averages in consideration.

This strategy, like many moving average crossover strategies is a high reward-risk ratio type of strategy. This is because the strategy allows traders to take the trade near the start of a trend and close the trade once the trend is about to end. However, this strategy should be used in markets with tendencies to trend. Markets which tend to be more range bound could result to trades with low returns or even losses. However, when used on a trending market or a market that has tendencies to trend, this strategy could result to large profits.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: