Different traders have different approaches when it comes to trading the forex market. Many view forex trading as a fixed science. They would look for recurring scenarios in the forex market, identify the common confluences between these scenarios based on technical indicators, and gather data and identify whether the trade setup they have identified is a high probability trade setup or not. Then, they would trade these setups if the probability is good enough.

On the other hand, some traders also approach trading the forex market like an art. Instead of using fixed objective data as a basis for a trade setup, they would look for recurring patterns which they could base their trade on. Some would trade on price patterns or candlestick patterns, while others will trade based on market flow support and resistances. While these setups may be subjectively identified, it could work very well for the right trader.

One of the most popular recurring patterns in the trading market is price pulling back towards the Fibonacci Ratios before pushing for another breakout. While there is no scientific basis or logic regarding why price does this, it does seem to work very well for many traders.

Fibonacci Ratios

The Fibonaci Ratios is a a series of numbers which represent a ratio which is recurring in nature. This ratio and proportion are found in the helix of a shell, the veins of a leaf, the fractals in a snowflake, the limbs in a human body, and more. It is also said to be the standard ratio that is most appealing to many people.

This ratio also occurs in the pullbacks of price action in a price chart. Although there is no scientific basis as to why it happens, price does tend to bounce off at retracements which are significant Fibonacci Ratios. Among these ratios, the most popular is the Golden Ratio, which is equivalent to 1.618. It is observed that price bounces off at levels around 61.8% of a price swing. And could often push further at 161.8% of the previous price swing.

Technical charting tools which are available in most trading platforms, including the MT4, include the Fibonacci Retracement ruler. This tool is widely used by many traders in order to identify such pullback points.

Pin Bar

The Pin Bar is a recurring candlestick pattern which is very popular among many price action traders. It represents a sudden reversal which occurs within one candlestick bar. This sudden reversal forms a candlestick with a very small body on one side and a long wick or tail on the other side.

This candlestick pattern indicates a very strong reversal indication. In fact, many traders use it as an entry trigger. They would use these patterns as a basis for a trade setup.

The Pin Bar indicator is a custom technical indicator which helps traders identify such patterns easily. It plots an arrow pointing up whenever it detects a bullish pin bar and an arrow pointing down whenever it detects a bearish pin bar.

Chandelier Exit

The Chandelier Exit indicator is a custom trend following technical indicator which is based on the Average True Range (ATR).

This indicator identifies the direction of the prevailing trend. It then plots a line which trails behind price action by a multiple of the ATR. The trend is bullish if the line trails below price action. On the other hand, the trend is bearish if the line trails above price action. The color of the line also changes depending on the direction of the trend. An orange line indicates a bullish trend, while a magenta line indicates a bearish trend.

This indicator can be used as a trend reversal indicator based on the shifting of the Chandelier Exit line, a trailing stop loss wherein traders can place their stop loss behind the line, and a trend direction bias filter wherein traders would trade only in the direction of the trend indicated by the Chandelier Exit line.

Trading Strategy

Golden Ratio Pullback Forex Trading Strategy is a Fibonacci Retracement pullback strategy which trades based on pullbacks and price rejections occurring on the area between 50% and 61.8% of the Fibonacci Ratio.

First, we should identify the swing points and connect a Fibonacci Retracement ruler between the swing points.

Then, we should confirm if the trend bias indicated by the Chandelier Exit line agrees with the direction of our trade.

Then, we wait for a pin bar pattern to occur on the area between 50% and 61.8% of the Fibonacci Retracement ruler. The Pin Bar indicator would make it easier for us to identify these patterns since it should plot an arrow pointing the direction of the pin bar pattern.

We then enter the trade with our targets at the previous opposing swing point.

Indicators:

- Pinbar

- ChandelierExit

Preferred Time Frames: 1-hour and 4-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

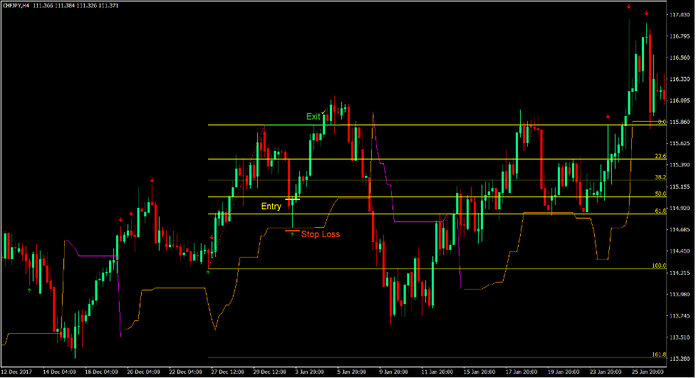

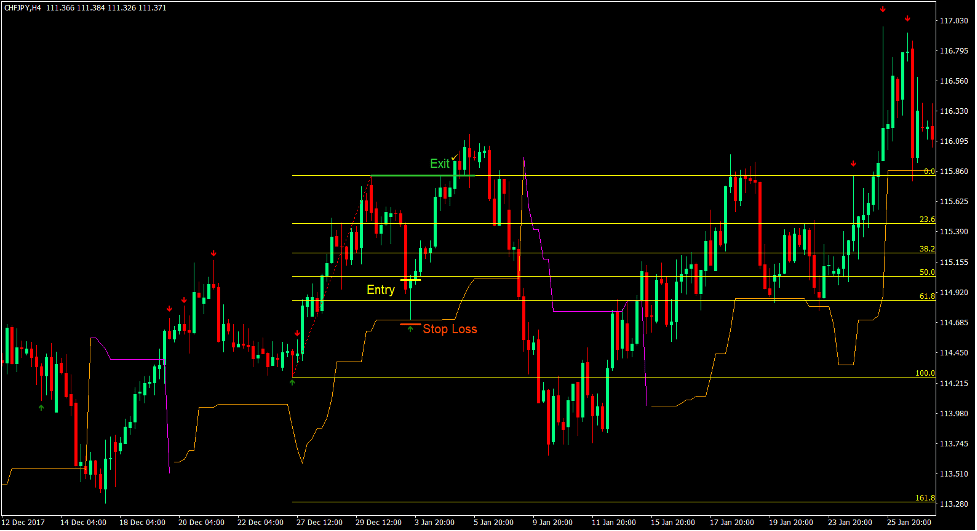

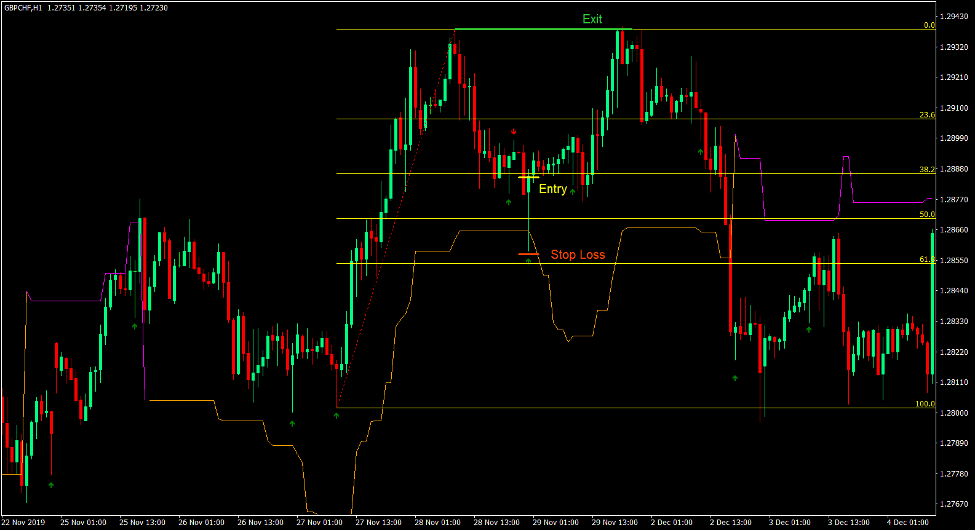

Buy Trade Setup

Entry

- Connect the Fibonacci Retracement ruler from the swing low to the swing high.

- Price action should be above the Chandelier Exit line.

- Price should pull back towards the area between 50% and 61.8% of the Fibonacci Retracement ruler and reject the said area.

- The Pin Bar indicator should plot an arrow pointing up.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss at the support below the entry candle.

Exit

- Set the take profit target at the previous swing high.

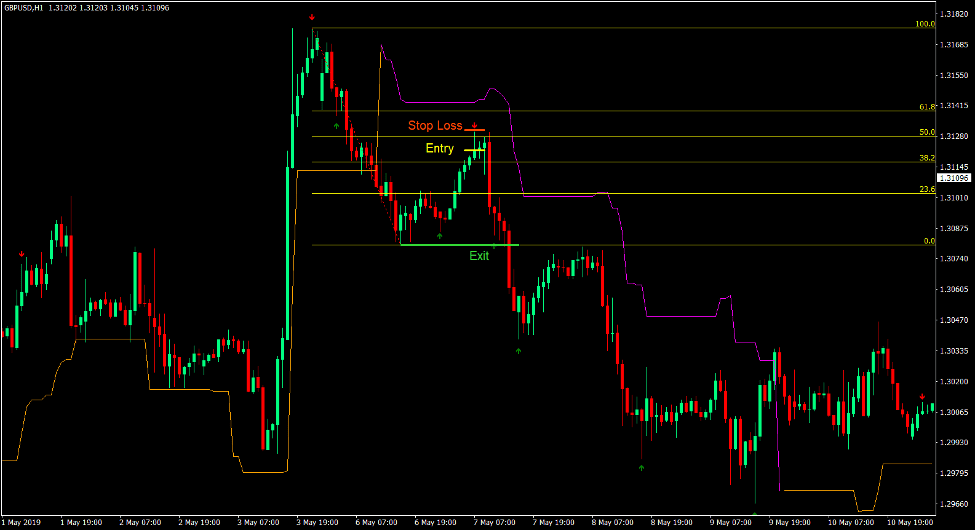

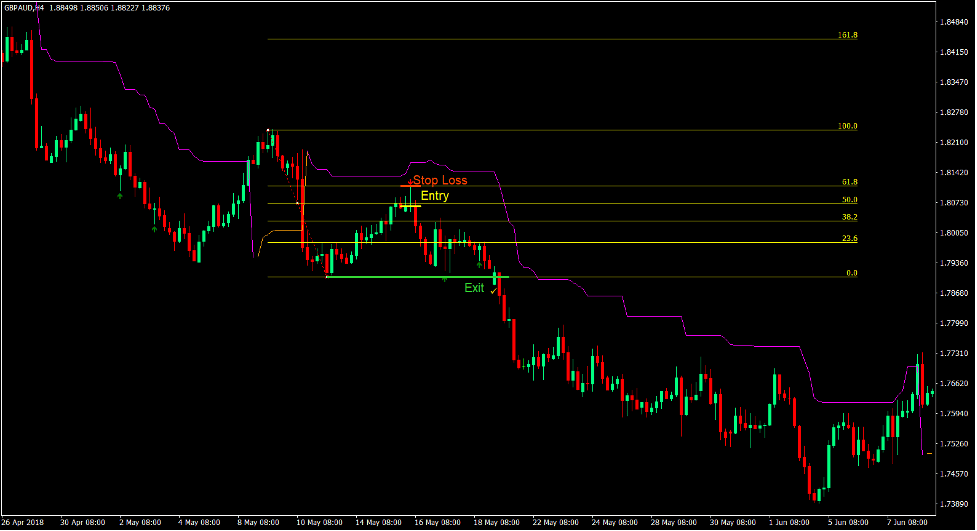

Sell Trade Setup

Entry

- Connect the Fibonacci Retracement ruler from the swing high to the swing low.

- Price action should be below the Chandelier Exit line.

- Price should pull back towards the area between 50% and 61.8% of the Fibonacci Retracement ruler and reject the said area.

- The Pin Bar indicator should plot an arrow pointing down.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss at the resistance above the entry candle.

Exit

- Set the take profit target at the previous swing low.

Conclusion

Trading based on Fibonacci Retracement pullbacks is a widely used trading strategy. Many professional traders trade according to this type of setup. Some would trade purely on price action rejections at 61.8%, while others would trade on levels 50% and 38.2%. The deeper the retracement, the better the risk-reward ratio. Some traders would be conservative and target only the prior swing point, while others would target the 161.8% level. Traders can adjust according to their risk appetite using this type of strategy.

The inclusion of the Chandelier Exit indicator allows traders to filter trades based on the trend bias. This allows traders to have a better win probability.

Although these trade setups are not easy to find, these setups tend to be very effective and is used by many professional traders around the world.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: