Fibonacci Fan Trading Strategy

If you’ve been into trading for quite some time, you might have heard of Fibonacci, right? Yeah, sure! The guy who has these magical ratios, which everything adheres to, even mother nature herself. You probably also have an idea on how to use it for forex trading. The usual, using the Fibonacci Retracements as a strategy for entries, stop–losses and take-profits, and heck, it does work.

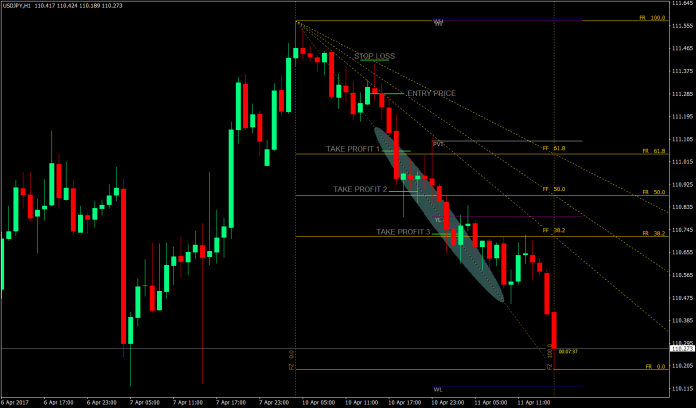

What about Fibonacci Fan? Some have, many haven’t heard of it yet. Are they fanboys of Mr. Fibonacci? Probably, coz Mr. Fibonacci might have given them lots of money in forex trading. But seriously though. Fibonacci Fan is not that. Fibonacci Fan is a whole different way of looking at and using Fibonacci ratios for forex trading. Let me show you how it looks.

Alright, so it probably didn’t make sense yet. But let me run you through it before you throw the idea out the window.

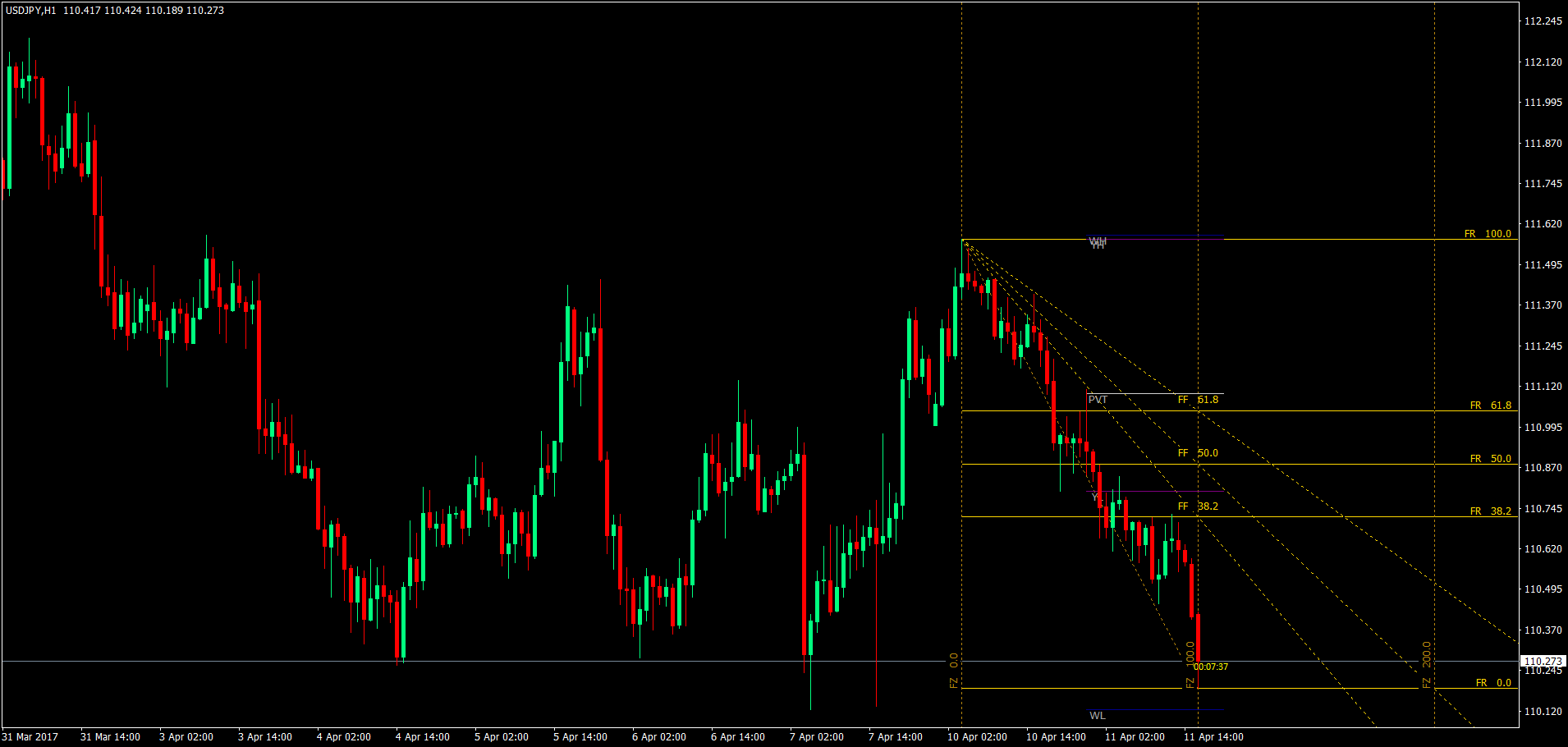

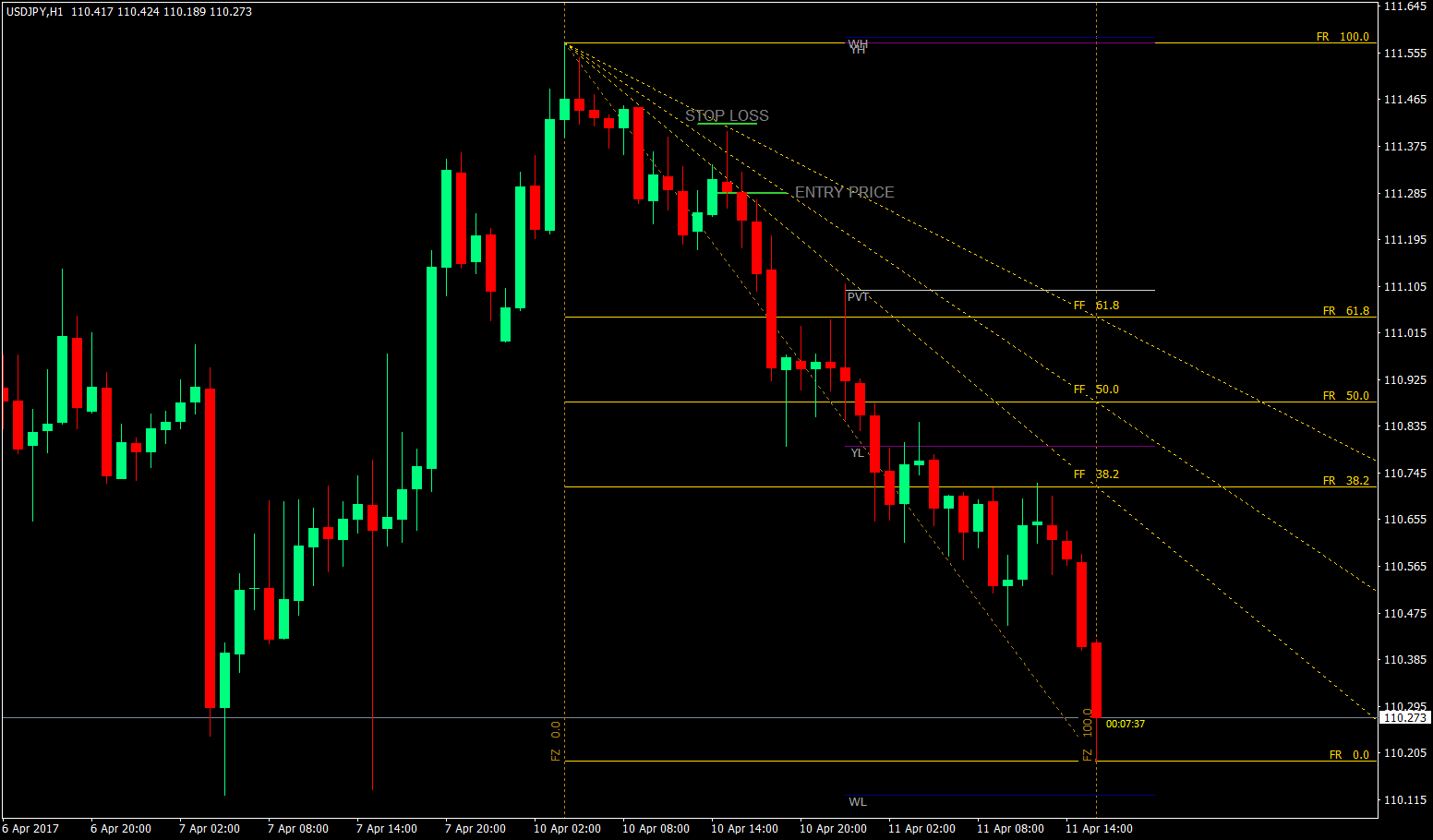

You might probably be familiar with Fibonacci Retracements, as this is the usual way of using Fibonacci ratios for forex trading. If Fibonacci Retracements refer to the use of the fib ratios horizontally, Fibonacci Fan lines are those diagonal lines based on the ratios. You could see it in this chart labeled as FF.

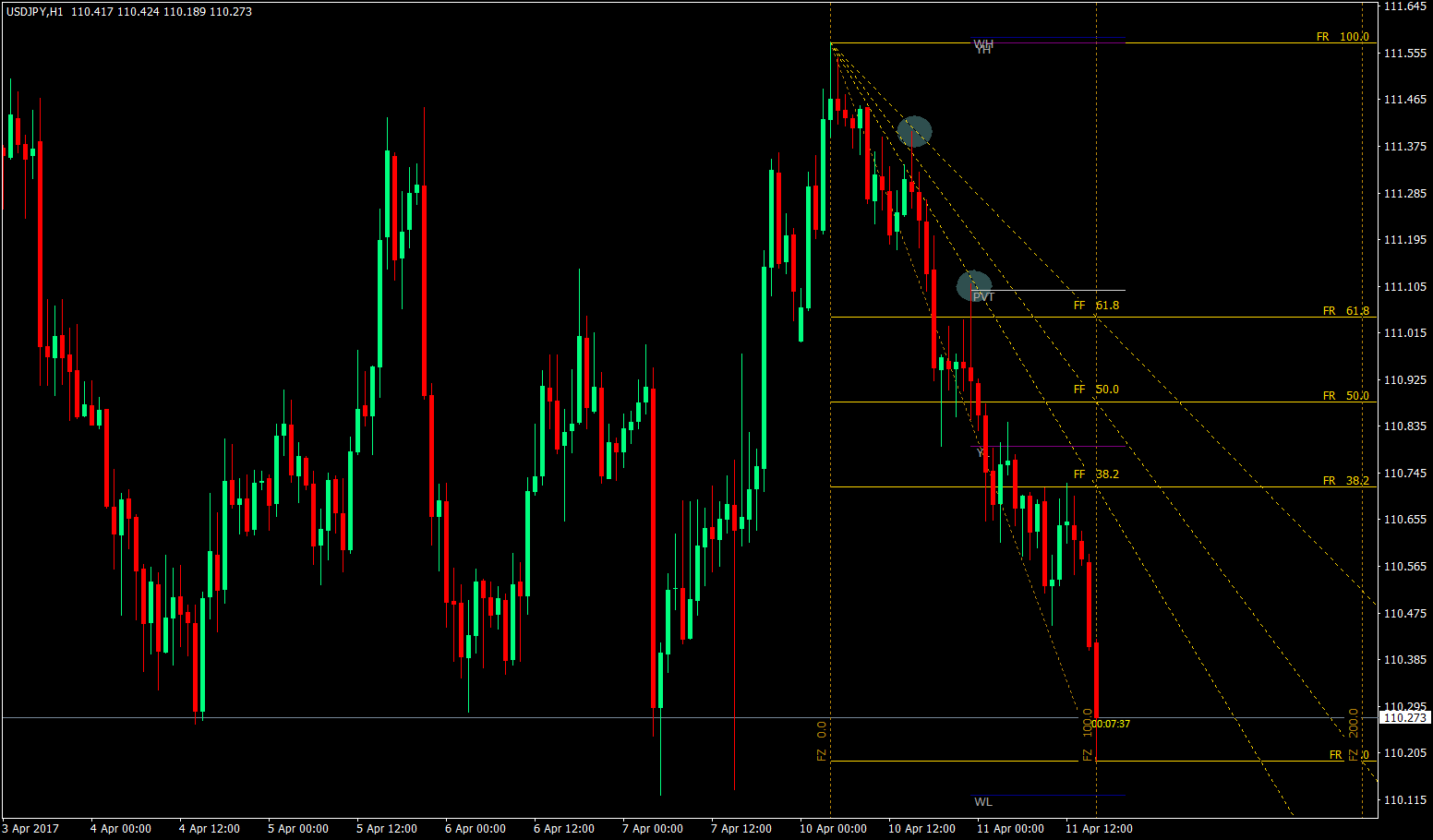

So, how do we use it? Just like the Fibonacci Retracements, the Fibonacci Fan lines are also areas wherein price could retrace to. And if we have an idea where to look for price reversals, then we could have some serious cashing-in to do. If you’d look at these reversal areas, you could see that prices did retrace to the fib fan lines, before continuing down, and if you caught it at the right time, you would have cashed-in too.

If you would have noticed, the Fibonacci Fan lines also act the same way as diagonal supports and resistances. The advantage of the fibo fan line though is that, unlike the traditional support and resistance, it wouldn’t need two or three points on your chart as a high or low to confirm that it is a support or a resistance. That means that you are one step ahead compared to those using traditional support and resistances.

So yes, it does work… Now how do we trade it? Don’t worry, I’ll show you how.

The Entry

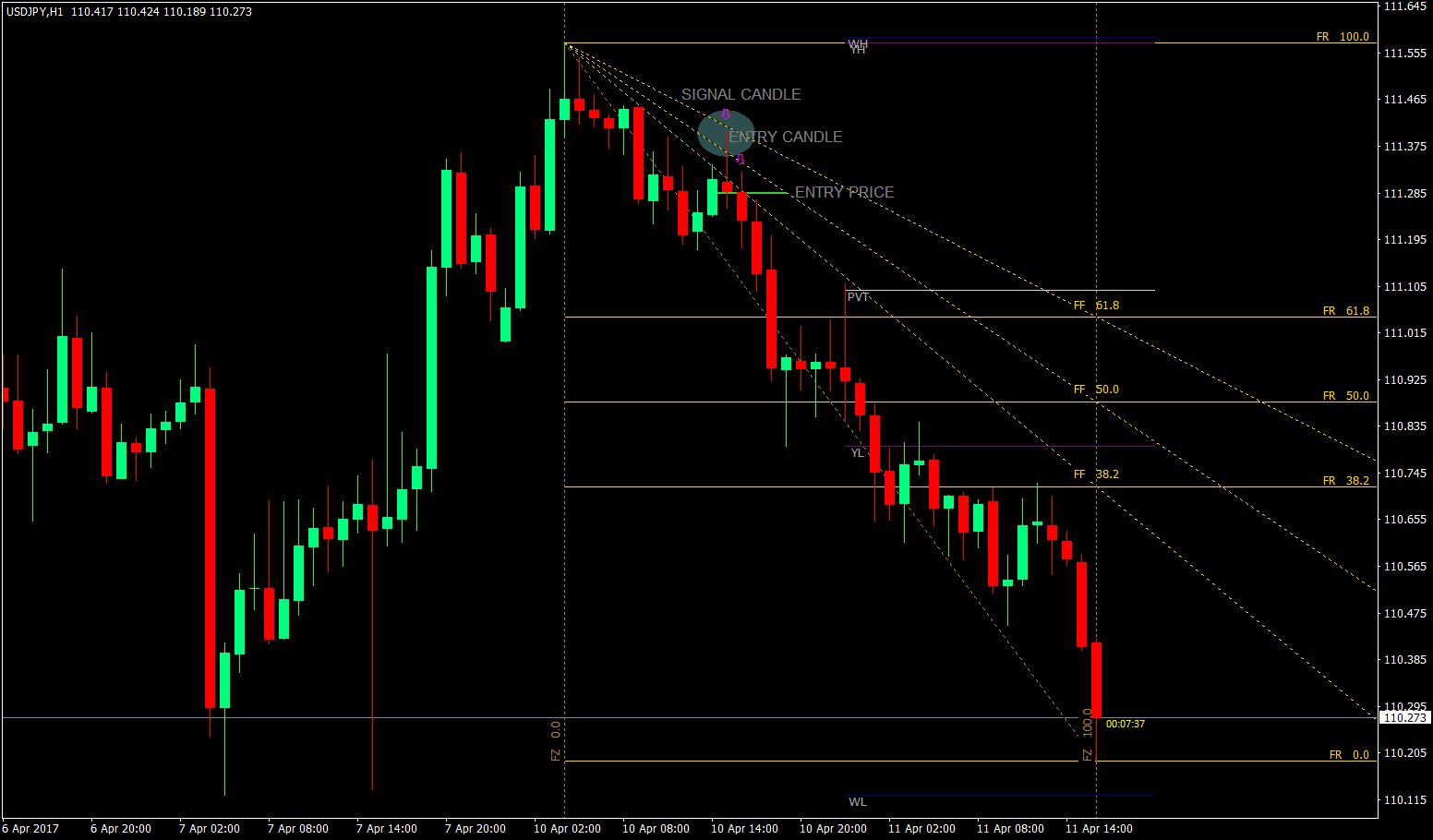

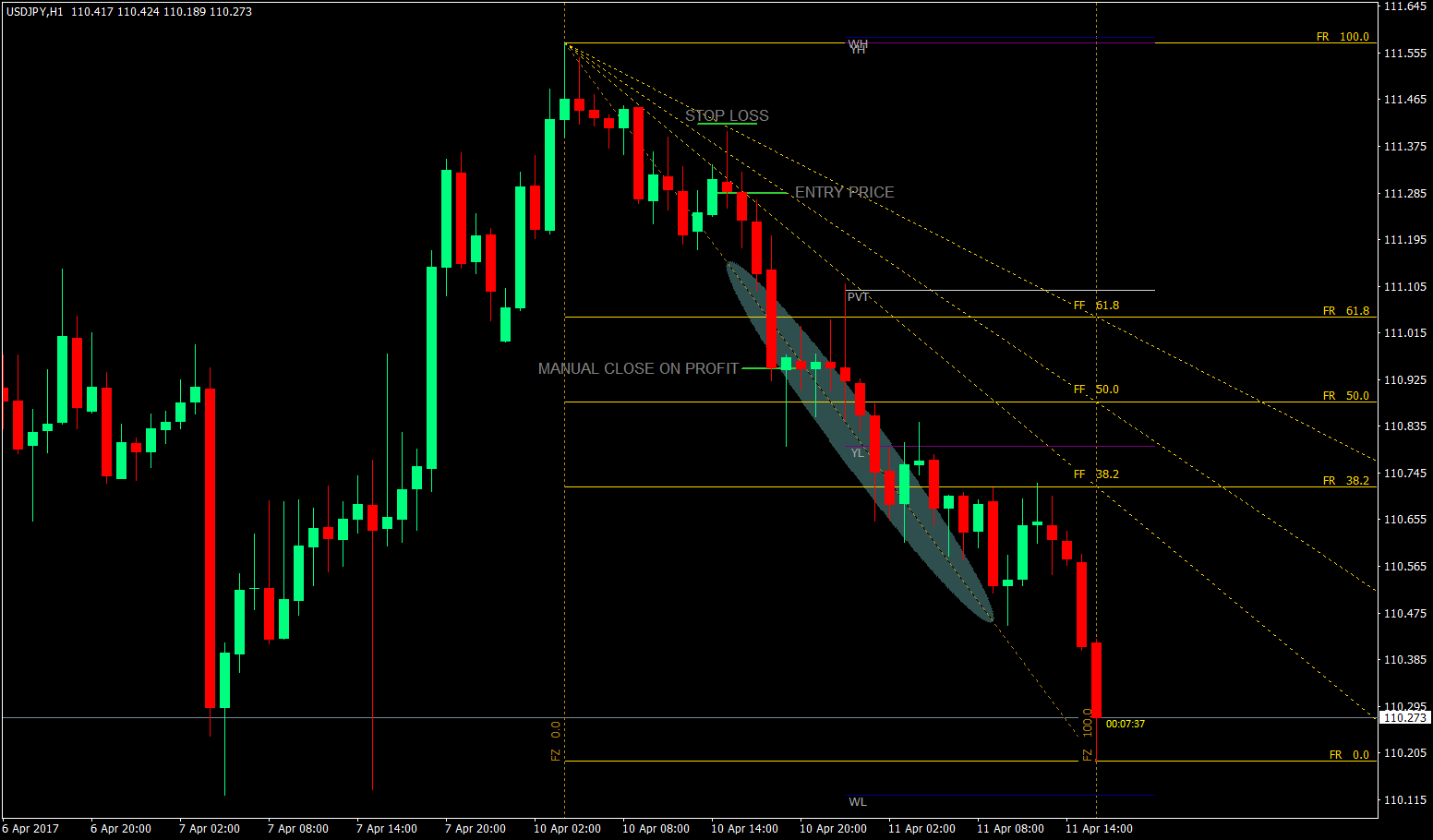

To have a precise entry, we will be looking at the close of each candle. Once we see a candle that retraces back, yet respects the Fibonacci Fan line, then we could enter the market on the open of the next candle.

Be careful though, there are many who make the fatal mistake of not waiting for the close of the candle. Yes, you could gain more pips if the candle does not reverse, but you could be in a lot of trouble if it does reverse. Why? Because it would mean that the candle has breached your fibo fan line, and chances are your candle is also going the opposite direction. This means that you have no strategy at all on a trade like that. Also, when you are in this situation, if things temporarily go sideways, you wouldn’t have the conviction to stay on the trade because your trade is wrong in the first place.

The Stop Loss

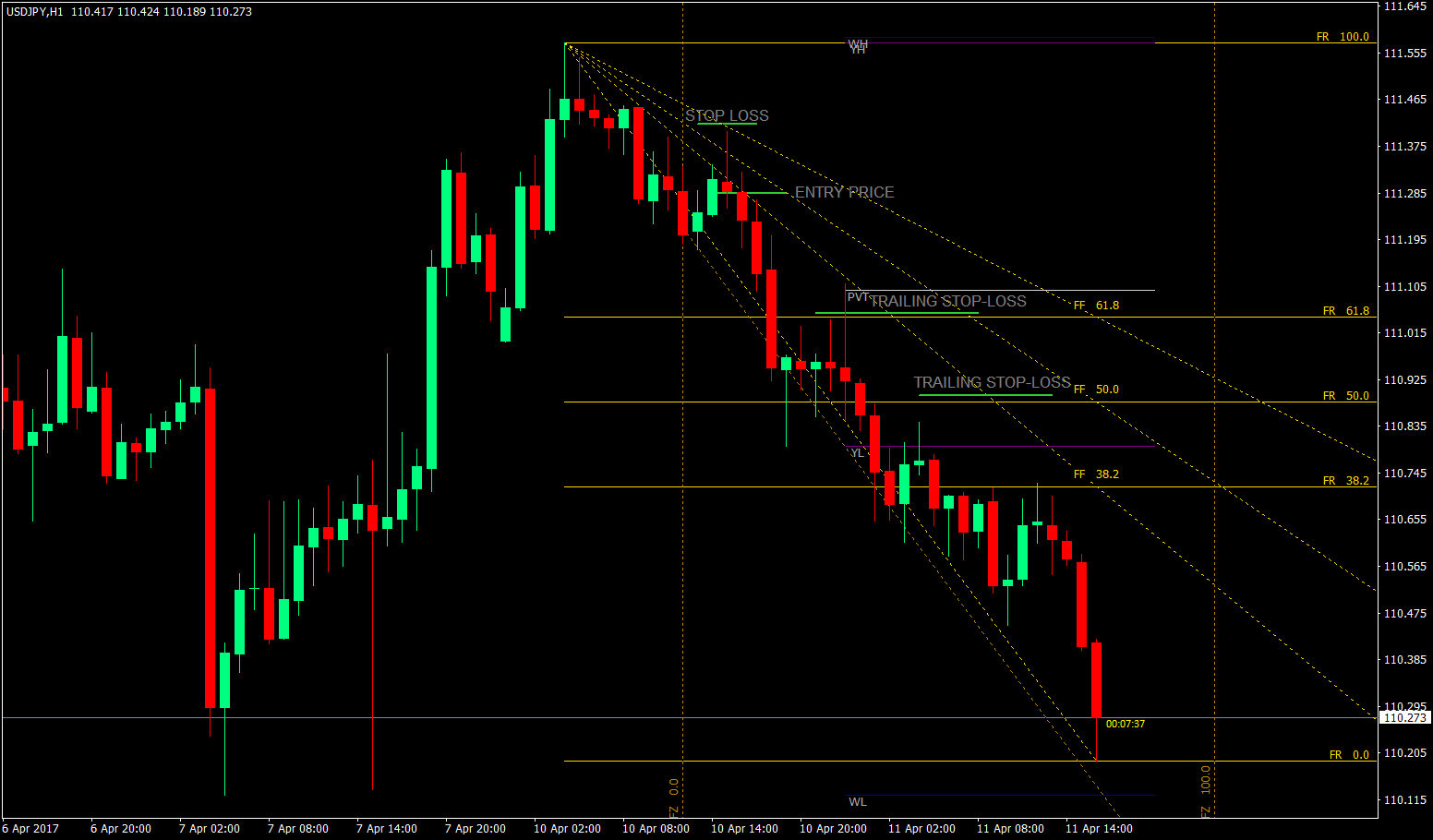

The Stop-Loss would be just a few pips above the Fibonacci Fan line. The logic behind this is that since your basing your strategy on Fibonacci Fan lines, and since you see the price action bouncing off the fibo fan line, then you believe that the price won’t go beyond the fibo fan line. This allows the trade to breathe a little, and at the same time, protect you from a major drawdown from your account.

Another thing that we could do apart from using the fibo fan line, is that we could also use the retracement levels as trailing stop-losses. This means that once the price goes past a certain target level, then you could trail your stop-losses behind the fibo fan lines.

Take Profits

What about our Take Profits? What will be our Target Price?

There are two ways of attacking this market using this strategy, one with a target, the other with none. Say that again… no targets? Well, it is not a fixed target, but a moving target. Since the fibo fan lines are diagonal, as opposed to horizontal retracement levels, and support and resistance lines, that would mean that prices along the fibo fan lines are also dynamic. Therefore our target price is not a fixed price but an area along the fibo fan line. As soon as price closes beyond the next fibo fan line, then it is already time to close the trade.

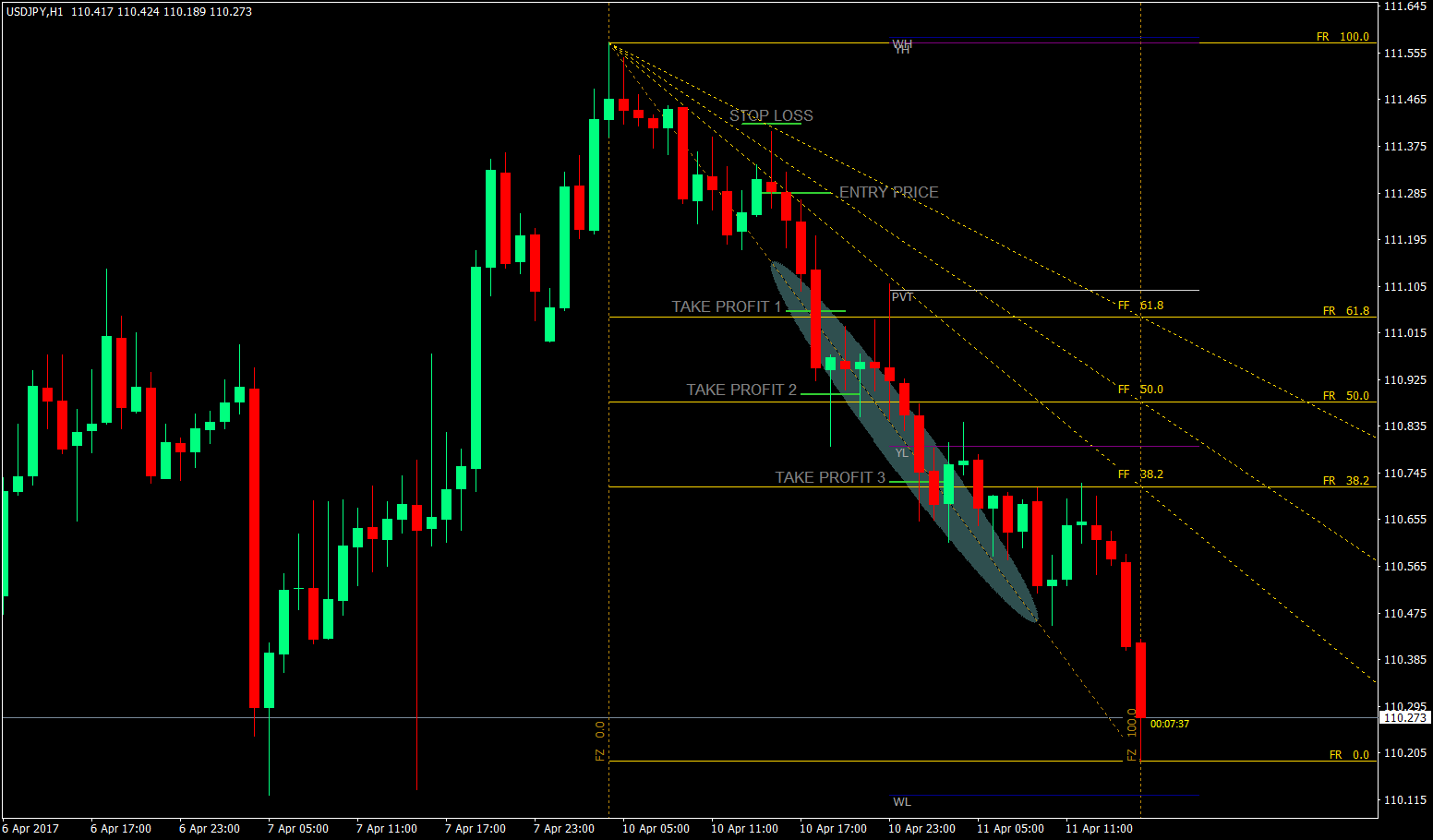

There are many however who are not comfortable doing manual closing of trades, as they prefer having a fixed target price. This is also a very logical decision as this removes your emotions from the decision-making process when it is time to exit the trade. But, is this possible with this type of strategy? Using the fibo fan lines alone wouldn’t fit the bill. You would need the help of the good old Fibonacci Retracement lines. Another advantage that this offer is that you could have multiple take profits, one take profit each retracement level. All we need to do is set a take profit a few pips before the retracement levels.

Conclusion

Fibonacci ratios are a great tool in forex trading. Once you learn and master it, it somehow gives a trader a certain level of confidence when trading. Though it is not perfect, but coupled with the right money management strategy, it could be your ticket to the high life. This chart shows you why. On this chart alone you could have earned more than 50 pips in a span of 9 hours, and this is just one currency pair and in just one timeframe. Now, these opportunities happen every day, multiple times in a day, on all currencies, and on all time frames. It is just a matter of waiting for the price to test and respect your fibo fan lines. Use it wisely and you could add this to your arsenal of strategies.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: