Fast EMA Bounce Forex Trading Strategy

Moving Averages are simple indicators that many traders, beginners and professionals alike, have come to love and use. Often you would see it as part of a system or a strategy. Some use it as a trend direction indicator, while many use it as a crossover strategy. Either way, as long as tested and proven, these popular uses of moving averages do work.

However, there is a use of moving averages that seemed to be overlooked by many. The concept of moving averages being dynamic supports and resistances. Moving Averages, as the name implies, are averages of price for a given period, plotted in a visual manner. As such, during a trending market, price often drifts away from these averages creating a gap between price and the averages. Many momentum traders use this as part of their strategy. However, by trading when price has already drifted away from the moving averages, we are in effect chasing price, which could be a recipe for disaster.

So, how do we trade into the trend without chasing price? The answer? Short-term mean reversions.

First off, what is a mean reversion? It is the assumption that price would always come back to the average price.

Think of it this way, if you are a vendor in a real world wet market, let’s say a fishmonger, and you notice that the price of fish is becoming more expensive by the day, you would tend to price your goods as with other vendors, driving the price of fish even higher. This would be considered as a trending market. But as buyers take notice of the rapid increase in the price of fish, two things could happen: they could either decide to stockpile on fish before it gets even more expensive, which is known as hyperinflation and occurs very rarely, or they could avoid buying fish altogether, driving the price of fish back down, which happens more often. The second scenario is a classic example of mean reversion, price coming back to its average price.

Continuing on with this idea, often, as long as there is still demand for fish, buyers would take notice that price has come back to a more reasonable price. They start buying fish once again, and price resumes its trend.

This same concept is also true in a trader’s market, whether it be the stock market, commodities market, or the forex market, etc. And one of the most basic ways to determine mean reversion is the use of moving averages, simply because mean reversion means price going back to the average.

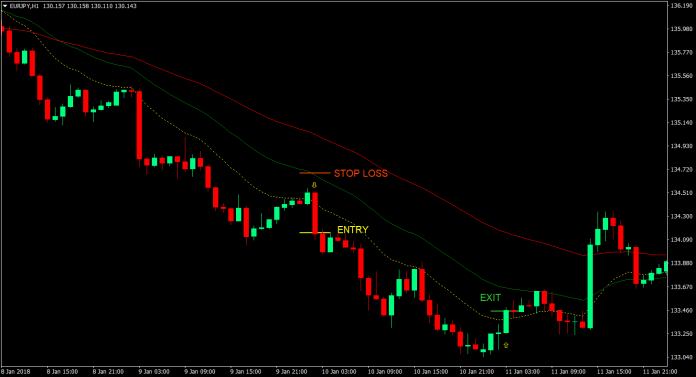

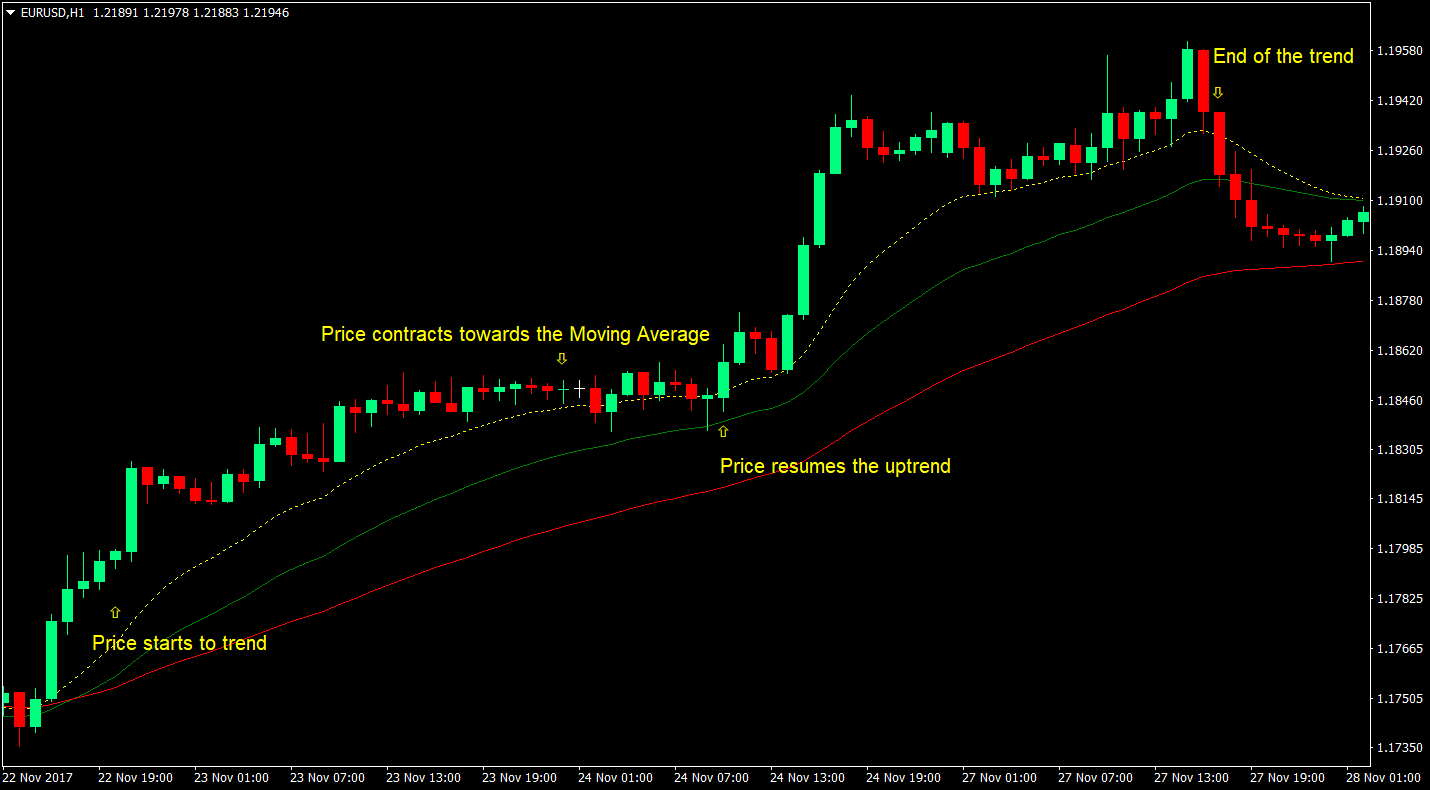

Below is a classic example of price going back to the moving averages before continuing the trend.

The Setup: How to Trade this Setup?

To trade this type of setup, we will be using three Exponential Moving Averages (EMA).

- 15 EMA: yellow dashed line

- 30 EMA: green line

- 60 EMA: red line

The 15 EMA serves as our trigger line, while the 30 EMA and 60 EMA will serve as a filter to avoid trading against the trend.

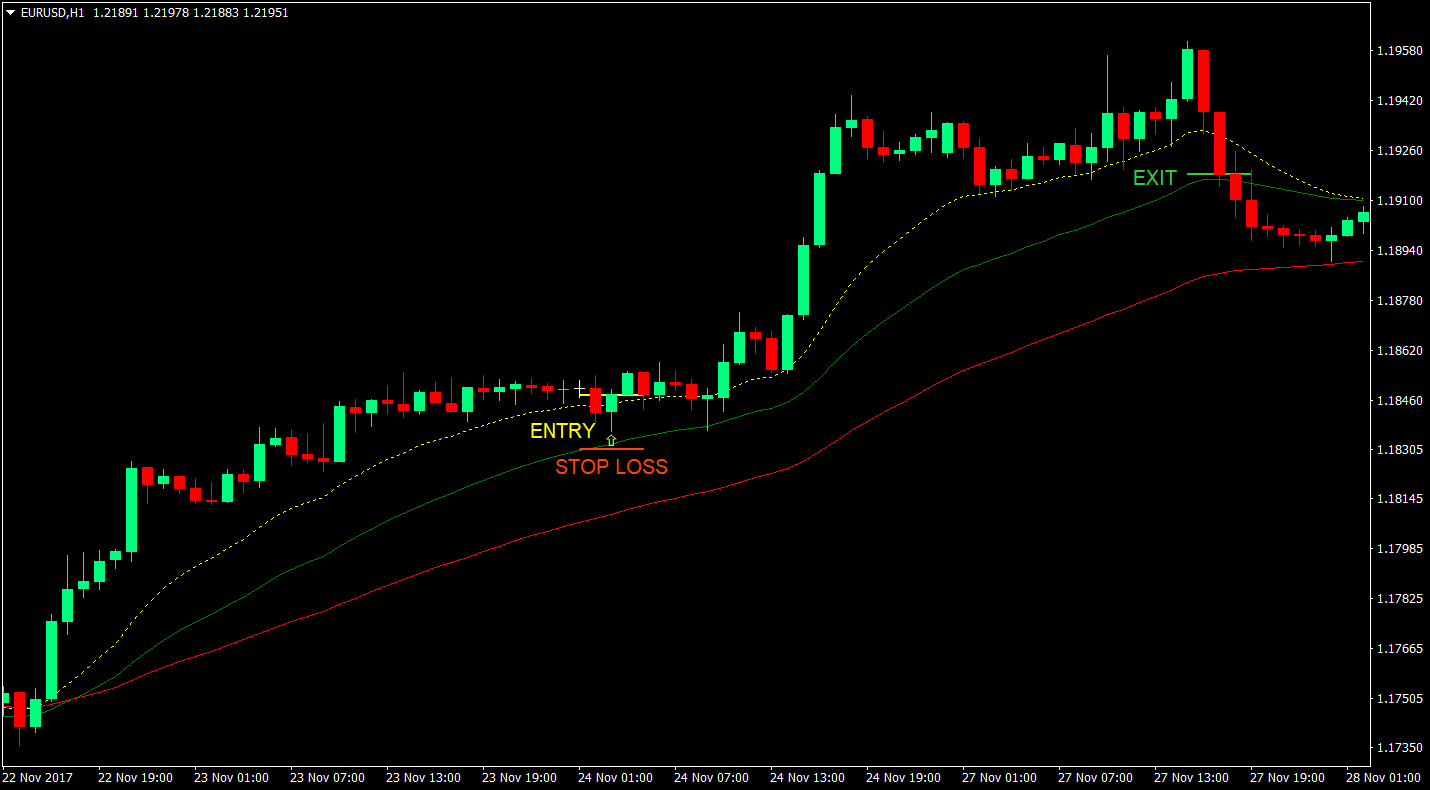

Buy Signal

- Price crosses and closes above the 15 EMA

- 30 EMA is above the 60 EMA

Stop Loss: Few pips below the 30 EMA

Exit: Price crosses and closes below the 15 EMA

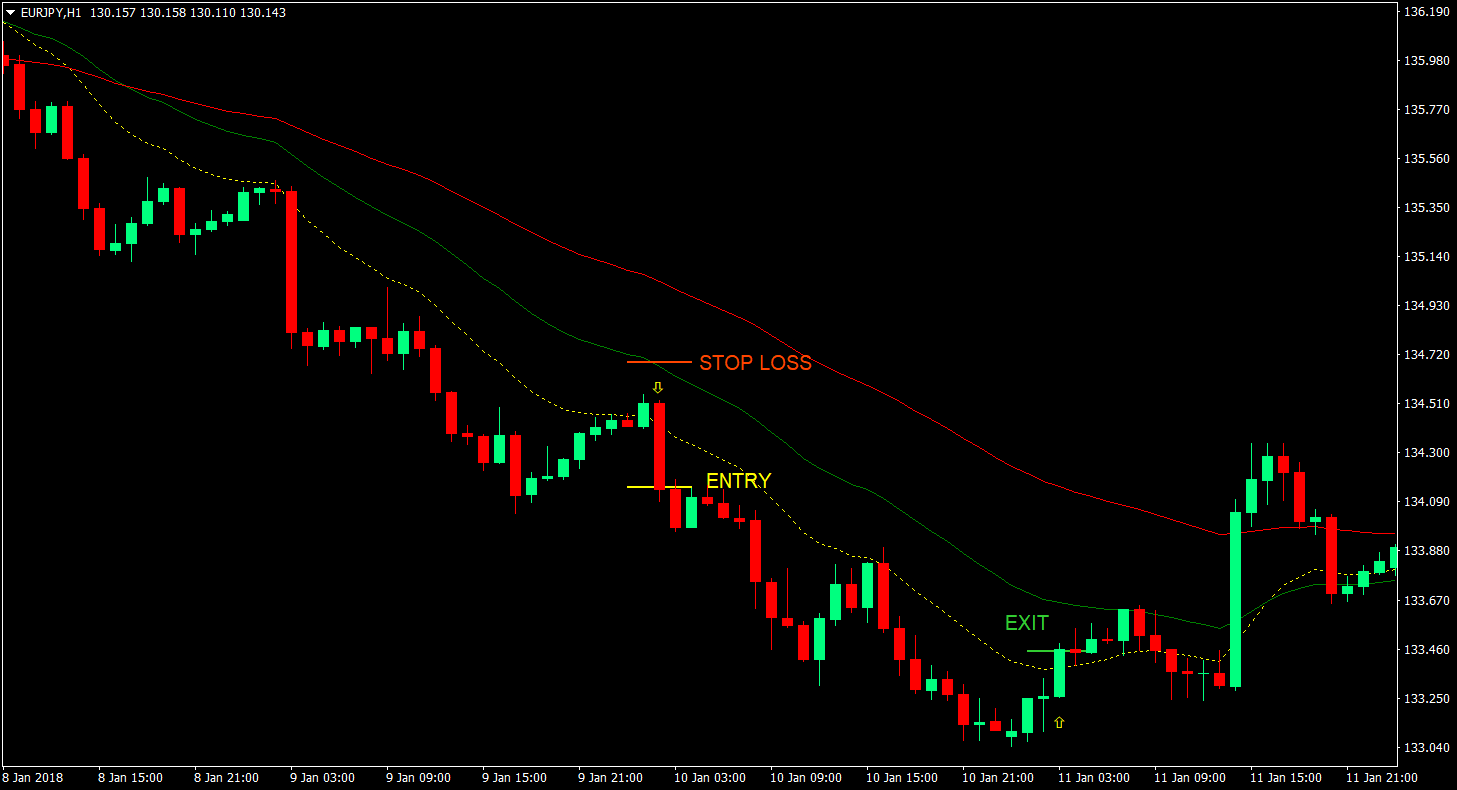

Sell Signal

- Price crosses and closes below the 15 EMA

- 30 EMA is below the 60 EMA

Stop Loss: Few pips above the 30 EMA

Exit: Price crosses and closes above the 15 EMA

Conclusion

The concept of not trading against the trend and not chasing price is combined in this strategy making it very effective. However, as with other strategies, this is not perfect. There will be some false signals generated by these rules. If you would look at the end of the sell setup example, another sell signal was generated yet would have resulted at a loss. However, this could be a framework which you could start on and develop.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: