Some traders argue that trades should be quick. They believe that the longer you keep a trade, the more susceptible you are to inadvertent market reversals. A news release may come up that does not favor your trade position. A big institutional trader from the big banks may take a position that moves the market against your favor. Maybe the market would just reverse for no reason. The shorter your trade stays open, the less susceptible you are to such negative trade scenarios.

This is especially true with momentum trading. Momentum trade signals often push price in the direction of the signal within the next few candles. Then, price action and candle stick patterns may show signs of momentum slowing down. After that, it is anybody’s game. Price may reverse or it may be just a slight retracement for a bigger trend. This is also a balancing act. Taking trades with such short time spans may favor your accuracy, but it may shorten your reward-risk ratio. It is all up to you as a trader what you go for. Will you be aiming for the high rewards of a trend or are you securing the profits of a short trade?

Donchian Steps Momentum Forex Trading Strategy is a quick trading strategy that trades based on momentum signals that are aligned with a strong trending market. It makes use of a couple of indicators that could help traders identify such strong trends and identify clear entry signals.

Donchian Channels

The Donchian Channels is a trend following technical indicator which helps traders identify trend direction based on the extremes of price movements.

This indicator plots a band like structure by taking the highest high and lowest low within a period. It then plots a line indicating the two extremes forming the upper and lower portion of the channel. It also plots a middle line which is the median of the high and low of the period.

The Donchian Channel can help traders identify trends and volatility.

As a trend indicator, traders can visually identify the trend direction by looking at how the middle line is sloped. If the middle line is constantly rising, then the market can be in an uptrend. On the other hand, if the middle line is constantly dropping, then the market can be in a downtrend.

The Donchian Channel is also very useful as a volatility indicator because it is based on the high and low of a period, which is basically the range of price movements within the period. If the channel is contracting, then volatility is lower, while if the channel is widening, then volatility is increasing.

MACD Cross

The Moving Average Convergence and Divergence (MACD) is a popular technical indicator used by many professional traders, both retail and institutional.

The MACD is an oscillator which computes for the difference between two moving average lines, typically set at 12 and 26 periods. It is then plotted as a line on its own window. Then, a second line called a signal line is derived from the MACD line. This line is basically a moving average of the MACD line. Crossovers between the MACD line and the signal line are considered as trend reversal indications. The MACD line crossing above the signal line indicate a bullish trend, while the inverse indicates a bearish trend. Some MACD indicators plot a histogram bar to indicate the difference between the two lines.

The MACD Cross indicator simplifies this by plotting dots to indicate such crossovers. A bullish crossover is indicated by a blue dot plotted below the price candles. A bearish crossover is indicated by a red dot plotted above the price candles.

Trading Strategy

This trading strategy is a momentum strategy that trades in the direction of the trend as observed based on the Donchian Channels.

The trend is based on how the middle line of the Donchian Channel is moving, whether it is consistently rising or falling. Traders could also observe the movement of price action based on the swing highs and swing lows.

If the trend direction is confirmed, we could then wait for an entry signal based on the confluence of a momentum candle and the MACD Cross signal. A momentum candle that is in confluence with the MACD Cross indicator would mean that the momentum signal is strong enough to cause a signal on the MACD Cross indicator.

Trades are then held for a few candles and are exited as soon as the next momentum candle ends.

Indicators:

- MACD_Cross

- DonchianChannels

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

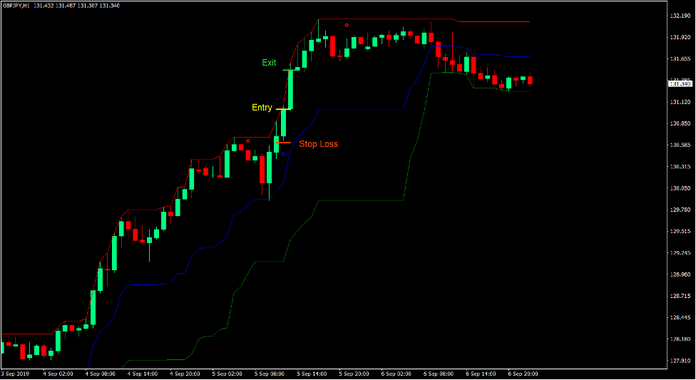

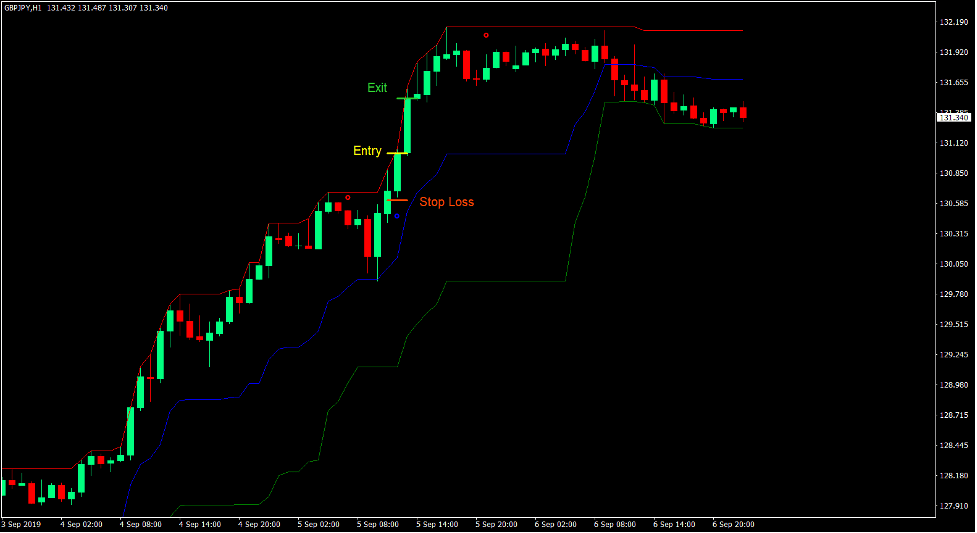

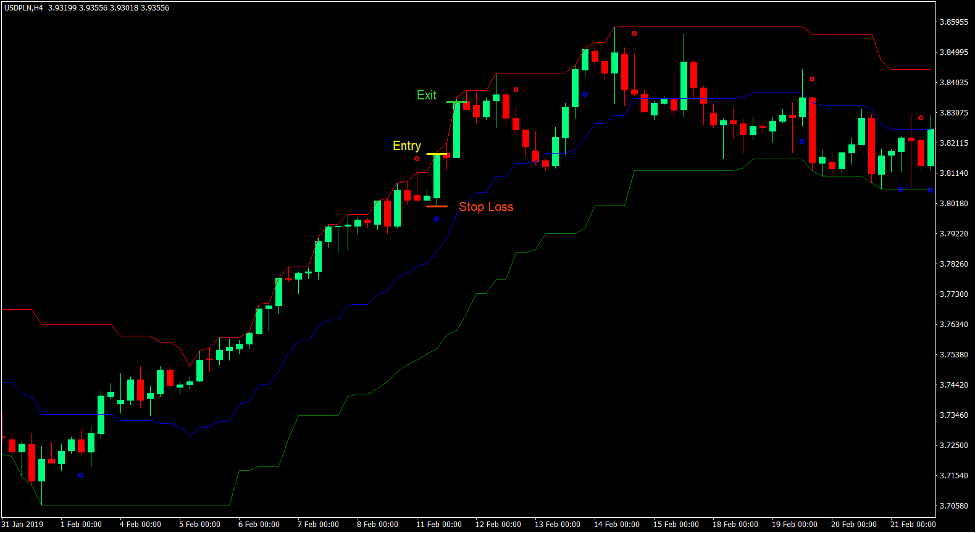

Buy Trade Setup

Entry

- The middle line of the Donchian Channels should be consistently rising.

- Price action should show a bullish trend based on the swing highs and swing lows.

- A bullish momentum candle should be formed.

- The bullish momentum candle should be in confluence with the MACD Cross blue dot.

- Enter a buy order upon confirmation of these conditions.

Stop Loss

- Set the stop loss on the low of the entry candle.

Exit

- Close the trade at the close of the next momentum candle.

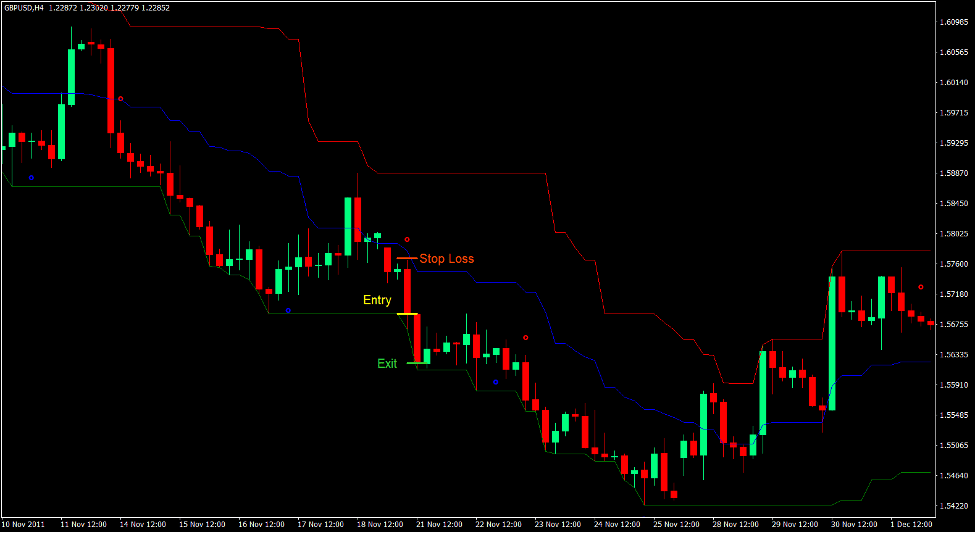

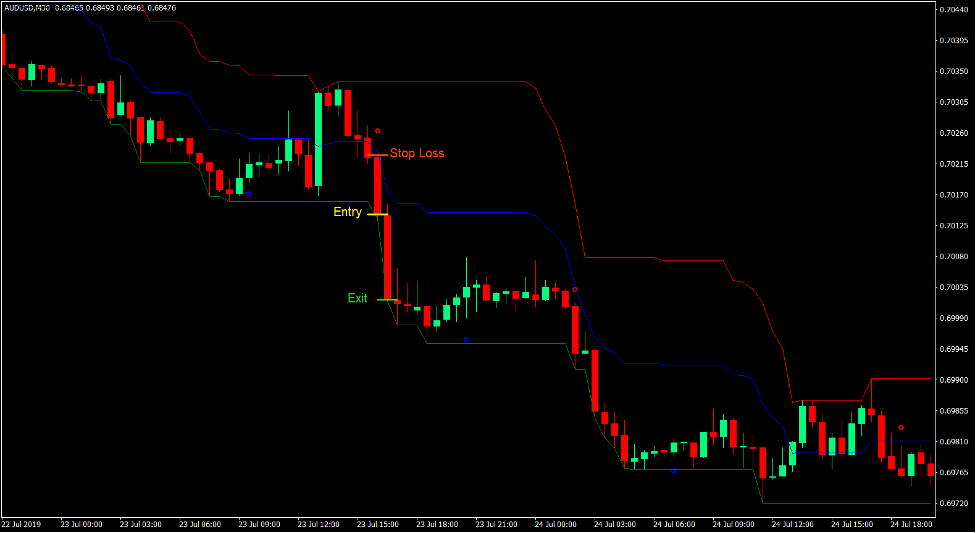

Sell Trade Setup

Entry

- The middle line of the Donchian Channels should be consistently dropping.

- Price action should show a bearish trend based on the swing highs and swing lows.

- A bearish momentum candle should be formed.

- The bearish momentum candle should be in confluence with the MACD Cross red dot.

- Enter a sell order upon confirmation of these conditions.

Stop Loss

- Set the stop loss on the high of the entry candle.

Exit

- Close the trade at the close of the next momentum candle.

Conclusion

This trading strategy is a quick trade momentum strategy. It allows traders to enter in and out of the market within a few candles of each other, allowing only a small window for noise to cause the signal to be invalid.

It has a low reward-risk ratio because it does not allow price to run. However, it has a good win rate due to the quick entries and exits generated. If done properly, traders could still be consistently profitable using this strategy due to the high win rate that this strategy gives.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: