5-In 5-Out Scalping Forex Trading Strategy

Many strategies that could work are often ruined by a couple of things – fear and greed. In this strategy we will try to address the latter – greed.

For this case study, we will take a look at a very common indicator that many traders use, the Moving Average Convergence Divergence (MACD) indicator.

To get beginners up to speed, let us review how the MACD is traditionally used.

MACD is composed of two major components, the MACD line which is the difference between a couple of EMAs, usually the 12 and 26 EMA, and the signal line which is also an EMA, usually a 9-EMA.

To trade the MACD, on a regular MACD window, a buy signal is generated if the MACD line or bar crosses the signal line to the upside. On the other hand, a sell signal is generated if the MACD line or bar crosses the signal line to the downside. For better results, it is better to take buy signals only when the signal is below zero and sell signals only when the signal is above zero. Ideally, the MACD should cross the zero line before it reverses. Usually, when this happens, traders who use the MACD should be in profit. Although there are instances that the MACD reversal crossover occurs before reaching the zero line.

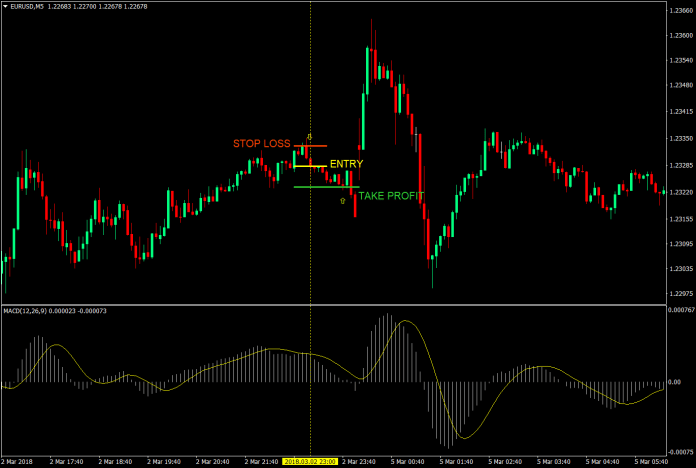

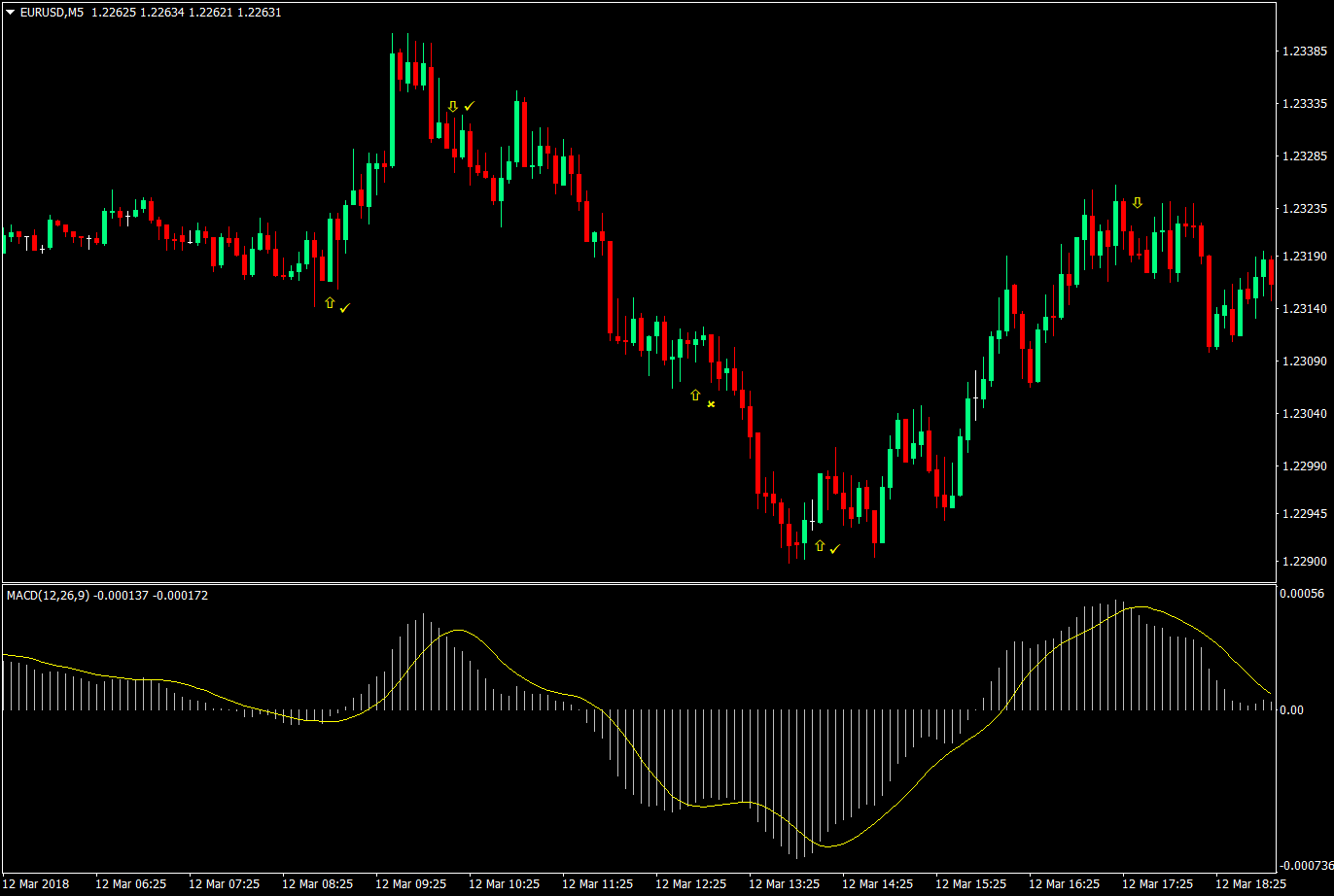

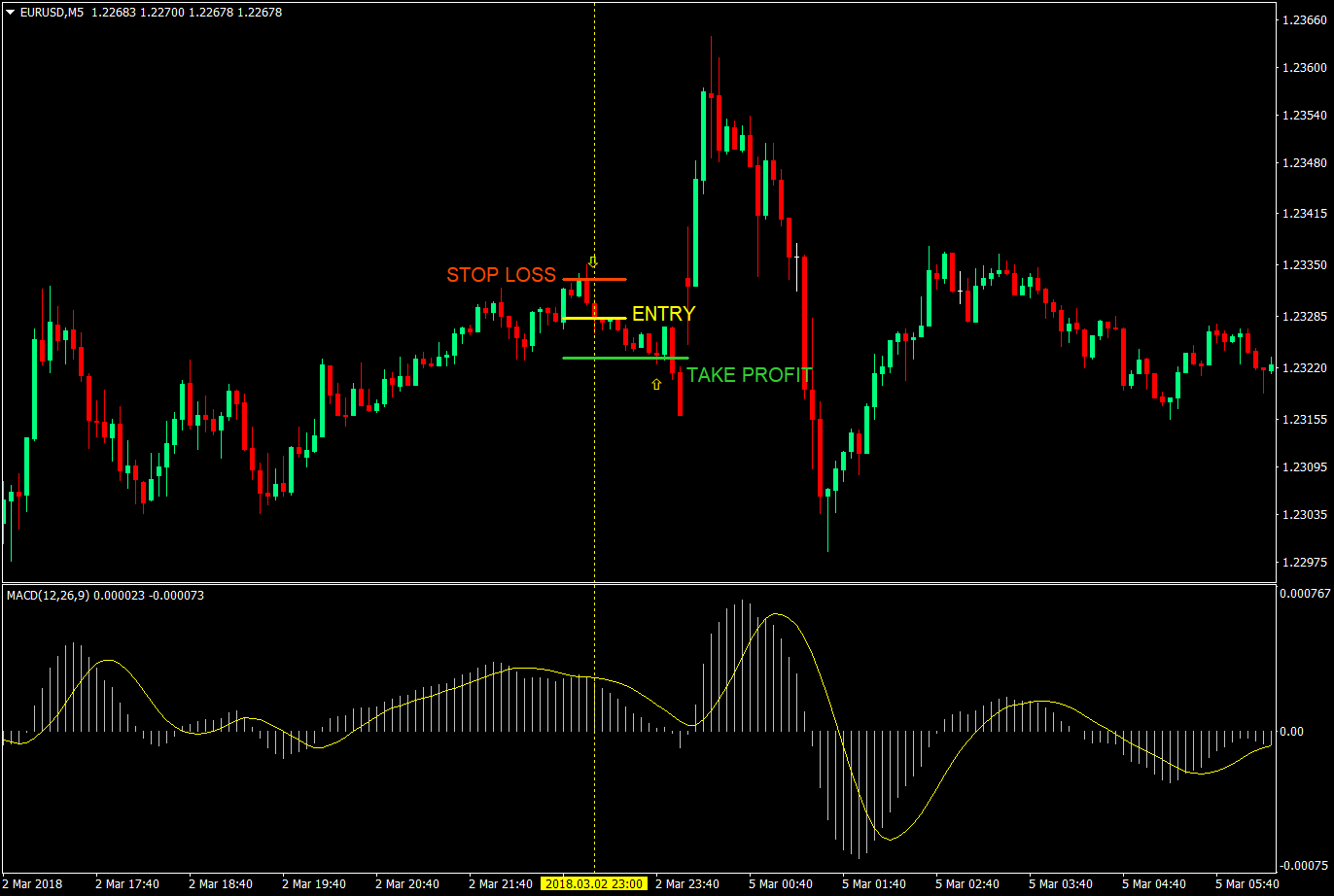

Below is an example of the entries based on the MACD.

As you would notice, there were several trade setups that could have been traded. Some would have been for a profit, while some would have been at a loss. However, if you would notice, there were several profitable setups that would have allowed traders to catch big moves.

Many newbie traders would start seeing dollar signs if they see a chart like this. However, this is not the whole story. There will be stretches when the market would start to whipsaw causing the MACD to crossover too often too soon. This will cause traders a loss.

In fact, there was a back test done on the MACD on a specific period and market, which resulted in a loss. Why? There will be times when if we would wait for the crossover because would want to catch the whole move, the crossover candle would be just at the point when much of the profits will be given back and even end at a loss. When this happens, the newbie trader would see a big gain on the trade only to see it end up losing money when the market reverses. This is a prime example of greed.

What if we try to curb greed and take the small profits right away instead? I’d like to propose using this relatively slow-moving oscillating indicator to take trades then take small profits of just 5-pips. Let’s curb the greed and be content of the small gains, instead of waiting for the market to reverse on us.

The Setup: Scalping 5-pips Using the MACD

This strategy is being tested out on the EURUSD pair to take advantage of the tight spreads of this particular pair. In fact, some brokers have spreads as low as 0.1 pip at times.

The timeframe that we are trading at is at the 5-min chart. This might cause us to hold our trades a little longer than a few minutes, and some scalping purists might not call it a scalping trade. However, we are just aiming for 5-pips, so I’d still consider this a scalp trade.

Buy Entry:

- MACD should be below the zero-line

- MACD bar should cross above the signal-line

- Enter a buy market order on the candle corresponding to the MACD crossover

Stop Loss: Stop loss should be 5 pips below the entry.

Take Profit: Take profit should be 5 pips above the entry.

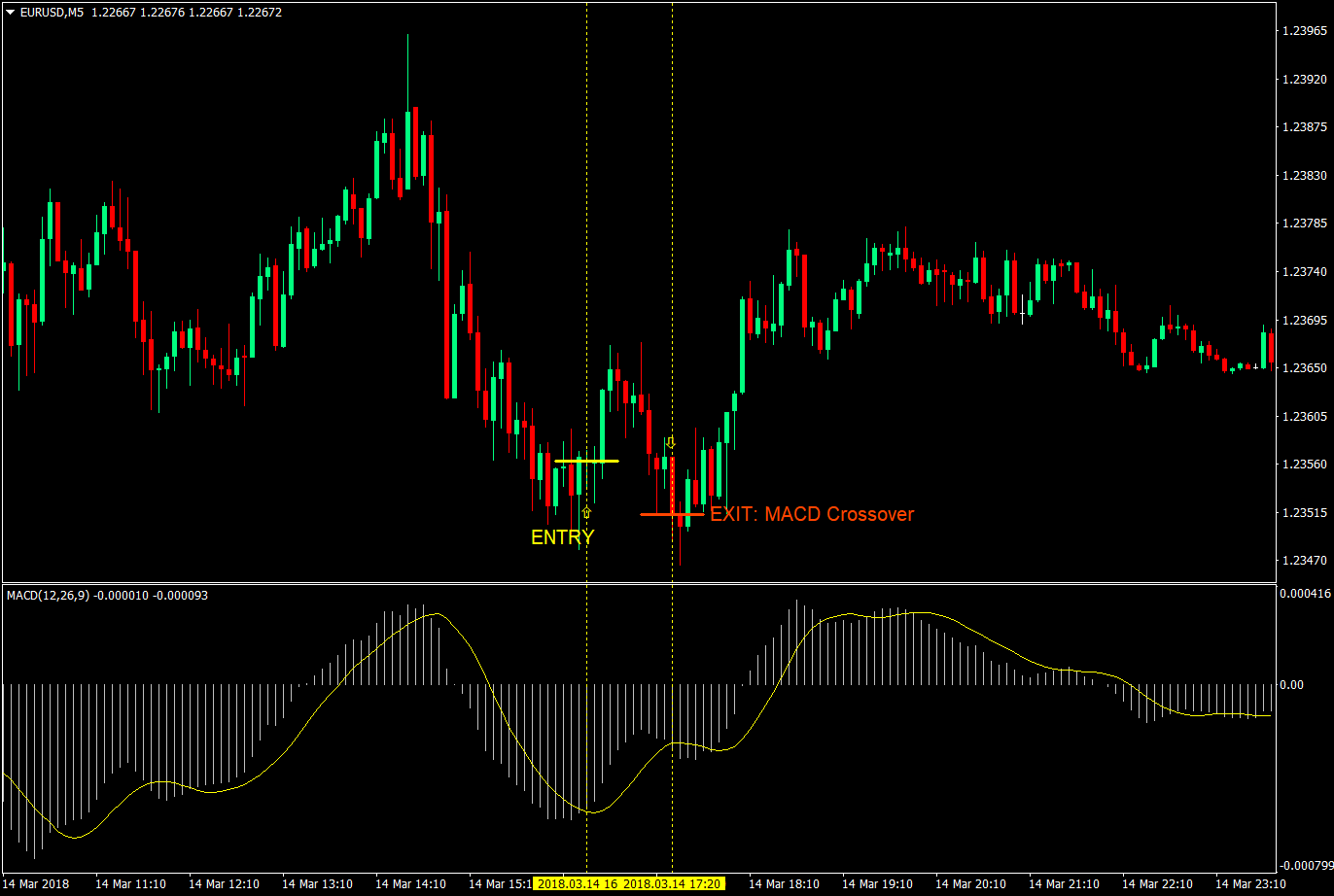

If we would have waited for the MACD to cross the zero line and crossover to reverse our trade, we would have definitely been at a loss. In fact, the MACD wasn’t able to cross the zero line.

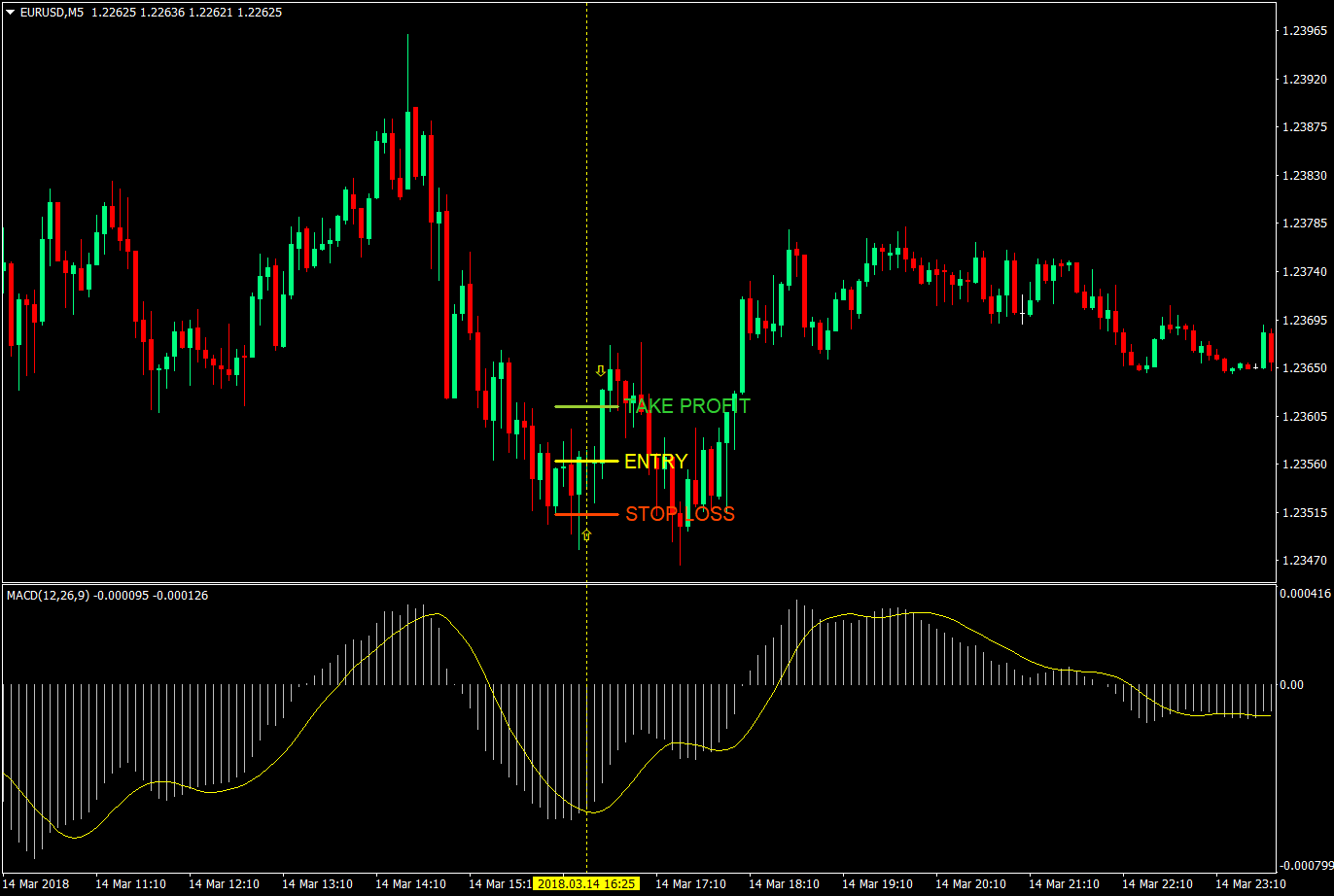

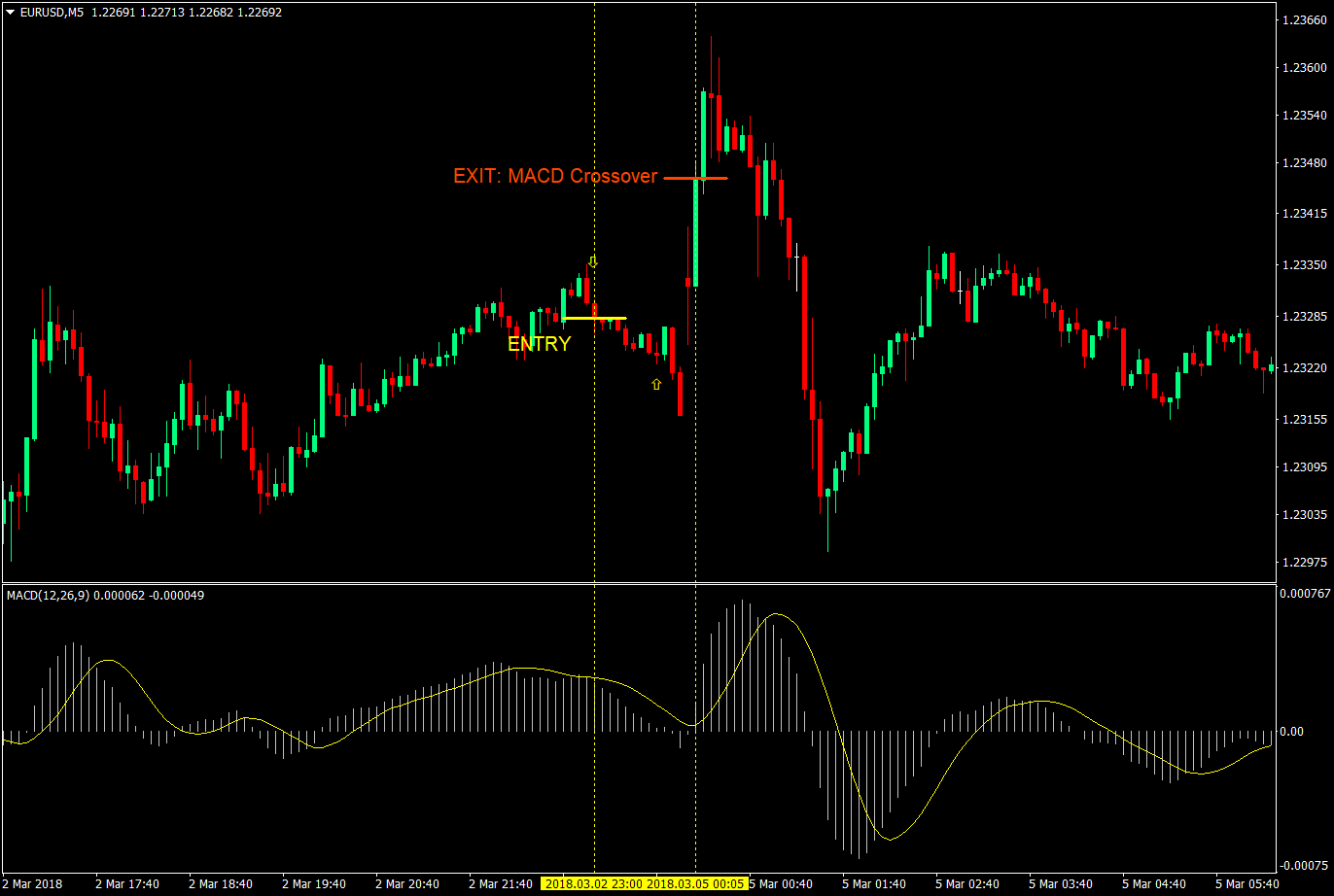

Sell Entry:

- MACD should be above the zero-line

- MACD bar should cross below the signal-line

- Enter a sell market order on the candle corresponding to the MACD crossover

Stop Loss: Stop loss should be 5 pips above the entry.

Take Profit: Take profit should be 5 pips below the entry.

Again, if we would have waited for the MACD crossover before we close the trade, trying to catch a big chunk of the move, we would have lost money. The gapping candle would have caused our trade to lose all profits and put us on the red. To make matters worse, another long green candle had to close to complete the MACD crossover putting our trade deeper in the losing territory.

Conclusion

Many traders who use the MACD aim for the fences. They try catch the whole move by waiting for the reverse MACD crossover. However, the MACD crossover strategy on its own does have a lot of premature reversals causing losing trades.

Another reason is that the MACD indicator is relatively lagging compared to others. It moves slowly but surely. By doing this, it somehow lessens false signals. But it also causes traders to enter the trade late. To make matters worse, it also causes traders to exit the trade a little too late.

But one good thing about the MACD is that it tries to confirm both trend and momentum. Given that it also indicates momentum, aiming for small gains is very much achievable. Aiming for 5 pips at a time is a very reasonable target for a MACD based scalping strategy. This increases the probability of a successful trade using this strategy.

However, this strategy still can be improved further. For example, if you’d like to maximize more profits, you may back test this strategy a bit more and see if you could widen the target a bit. You may also take a look at ATRs in relation to your targets. You may also change the timeframe if you think the 5-minute chart is a little too slow or too fast. Tweak, improve, and make it yours.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: