Trading is easy, but it very difficult to master. This is the paradox of trading the forex markets. Truth is trading is easy to understand. The concept is very simple. Buy low, then sell high. Find an opportunity where prices are low and could be going higher, trade, wait for price to go higher, exit, then repeat. If you could do this successfully again and again, then you are on your way to earning a fortune in forex trading.

However, this is easier said than done. Traders aim to do the same thing, yet most end up doing exactly the opposite. They buy high, then sell low. For sure, this is not what they want to do. However, as price moves on the journey towards their desired exits, price would fluctuate up and down causing traders to see their profits or losses go up and down. This creates a roller coaster of an emotional ride. Emotional highs and emotional lows, fear and greed, all this come into play causing traders to make mistakes.

Some try to solve this by coming up with different solutions and different strategies that think they should do in order to avoid experiencing that painful experience of a loss. What they do not know is that the more they try to add layers of decisions in their strategies, the more confusing and complicated their trade plans become. The more complicated their plan is, the more they are predisposed to make mistakes.

EZ Trend Forex Trading Strategy on the other hand takes the opposite route. It approaches the market in the simplest way it can. It trades on simple crossovers and confluences of momentum and trend reversal signals using a few highly complementary technical indicators.

EMA Angle Zero

EMA Angle Zero is a trend following technical indicator based on the slope of an Exponential Moving Average (EMA).

Moving average indicators are mainly used to identify trends and trend directions. There are many ways to identify trends based on moving averages. One of the most popular ways to identify trends using a moving average is by looking at the slope of the moving average line. This is the concept in which the EMA Angle Zero indicator is based from.

EMA Angle Zero identifies trend direction based on the slope of an EMA line. It does this by duplicating an underlying EMA line and shifting it forward. The indicator then looks for the difference between the leading EMA line and the lagging EMA line. The difference is then plotted as a histogram bar on a separate window. This creates an oscillator type of indicator which identifies trend direction based on whether the slope of the line is positive or negative.

The EMA Angle Zero plots positive lime green bars to indicate a bullish trend bias and negative yellow bars to indicate a bearish trend bias. It also plots firebrick bars if the slope of the underlying EMA line is below the threshold for identifying trending markets.

EMA 5-10-34 Crossover

EMA 5-10-34 Crossover is a trend reversal signal indicator based on the crossing over of Exponential Moving Average (EMA) lines.

As the name suggests, the EMA 5-10-34 Crossover indicator provides trend reversal signals whenever the 5-period, 10-period and 34-period EMA lines crossover and stack in a way wherein either the 5 EMA line is above and the 34 EMA is below, indicating a bullish trend, or the 5 EMA is below and the 34 EMA is above, indicating a bearish trend.

This indicator simplifies the process of identifying trend reversals because it conveniently plots a signal arrow indicating the direction of the new trend. Traders can simply take trades whenever the indicator plots an arrow to capitalize on the fresh trend being developed.

Trading Strategy

This trading strategy is a systematic trend reversal strategy which trades on the confluence of momentum price action, crossovers of price action and a moving average line, and trend reversal signals coming from the two indicators mentioned above.

First, the EMA Angle Zero indicator should reverse based on the shifting of the bars over zero. The bars should also change color either to yellow or lime green depending on the direction of the trend in order to confirm that there is momentum behind the trend reversal.

At the same time the EMA 5-10-34 Crossover indicator should also plot an arrow pointing the direction of the new trend, agreeing with the EMA Angle Zero indicator.

Price action should also crossover a 50-period Exponential Moving Average (EMA) line. The corresponding crossover price action should also exhibit momentum in the direction of the new trend.

Indicators:

- EMA 5 10 34 Crossoverl

- 50 EMA

- EMAAngleZero

Preferred Time Frames: 1-hour and 4-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

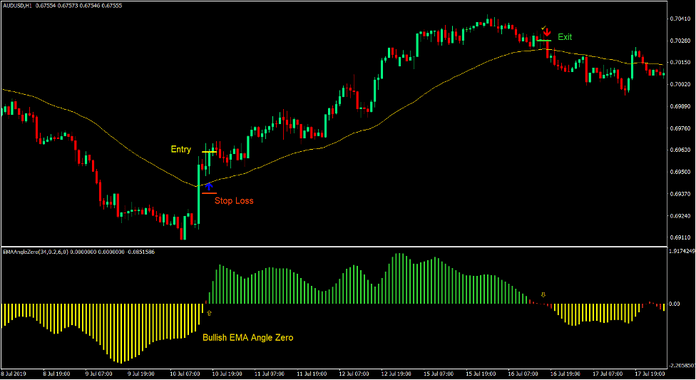

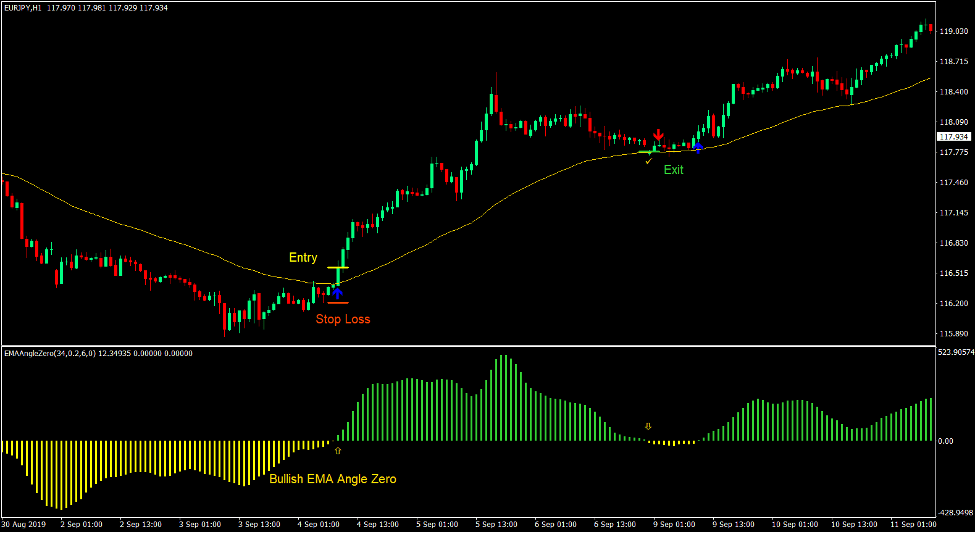

Buy Trade Setup

Entry

- The EMA Angle Zero bars should shift above zero and should be lime green.

- The EMA 5-10-34 Crossover indicator should plot an arrow pointing up.

- Price action should cross above the 50 EMAline.

- Price action should exhibit bullish momentum.

- Enter a buy order on the confluence of these conditions.

Stop Loss

- Set the stop loss on the support level below the entry candle.

Exit

- Close the trade as soon as the EMA Angle Zero bars shift below zero.

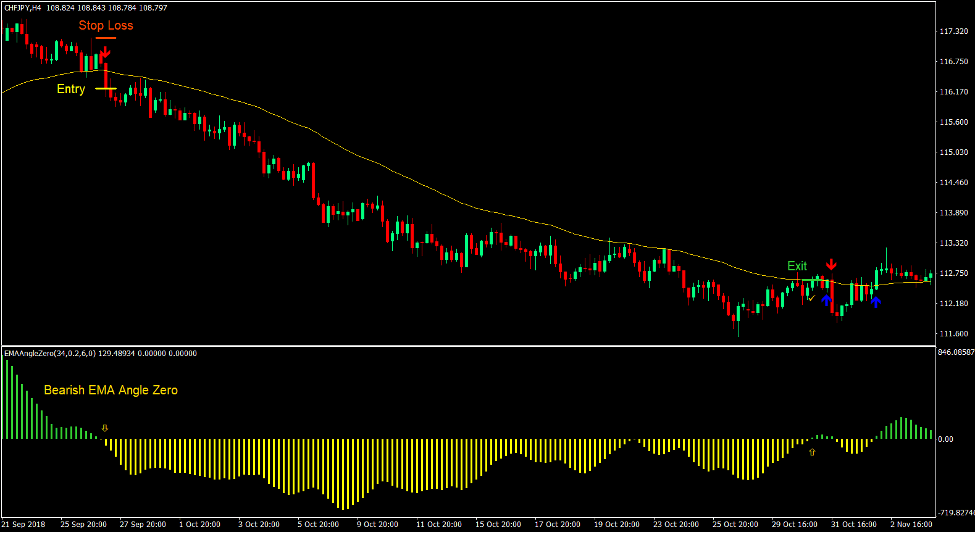

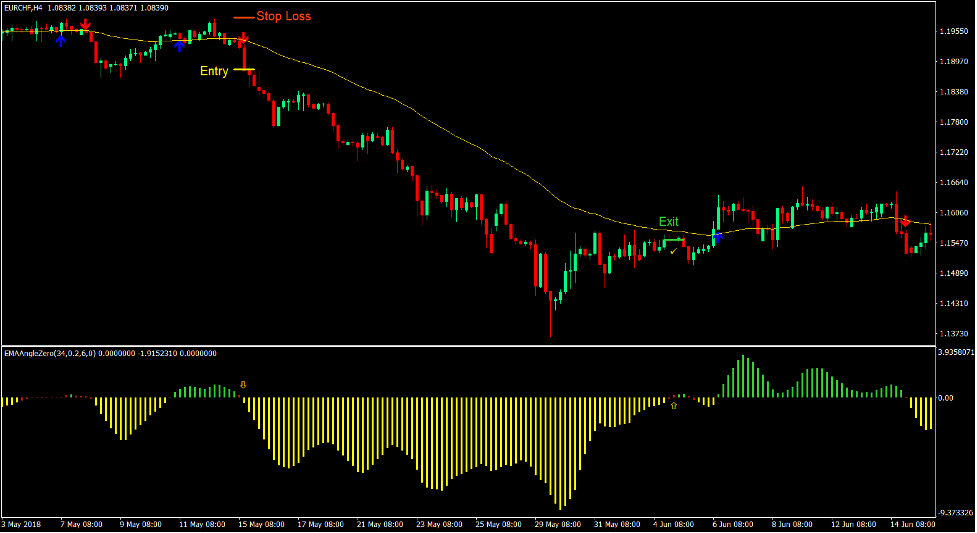

Sell Trade Setup

Entry

- The EMA Angle Zero bars should shift below zero and should be yellow.

- The EMA 5-10-34 Crossover indicator should plot an arrow pointing down.

- Price action should cross below the 50 EMA line.

- Price action should exhibit bearish momentum.

- Enter a sell order on the confluence of these conditions.

Stop Loss

- Set the stop loss on the resistance level above the entry candle.

Exit

- Close the trade as soon as the EMA Angle Zero bars shift above zero.

Conclusion

This trading strategy is a working trend reversal strategy. It is based on the crossing over of price action and the 50 EMA line, which is a moving average line which many traders use as a basis for the mid-term trend.

There are many traders who trade on such reversals. However, one thing to look out for is that there are also many traders who trade on bounces off this area. Therefore, it is important to observe for characteristics of a strong momentum in the direction of the trend reversal based on price action. Traders who can objectively identify valid mid-term trend reversals using price action and confirm it with these setups can profit from the market.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: