“Trade with the trend!” “Buy low, sell high!”

You would often hear these words of wisdom from seasoned traders. But how do you trade with the trend and at the same time buy low and sell high? How do you ensure that you are not chasing price? Trend traders are notorious for making the mistake of chasing price. The answer is retracement.

Retracements are the temporary pull backs of price during a trending market environment. Although price generally tends to go on one direction during a trending market environment, price would always have instances wherein price will pause for a while and pull back a bit before it resumes its trend. This is caused by traders who have already made some money out of a trend who are already scaling out or locking in some profits. This causes price to retrace a bit. This one of the most logical points to get in on a trend. You get to trade with the trend while getting in at a discount.

The Real MACD Bounce Forex Trading Strategy is one which adheres to this idea of trading on pullbacks. This is done by making use of a custom MACD indicator and moving averages.

Guppy Multiple Moving Averages

Moving Averages is probably the most widely used technical indicator among many traders. This is because moving averages have many uses. It could be used as a trend indicator, a crossover strategy, a trend filter, etc.

One way of using moving averages is as a tool to identify probable retrace entry points. This is because moving averages also act as dynamic supports and resistances. Since moving averages are the mean of price, in a trending market condition prices near the area of a moving average could be considered as a discount. Many traders tend to enter at the direction of the trend whenever price would retrace back to a moving average. As a result of this, price would tend to bounce off a moving average, which would usually cause the trend to resume.

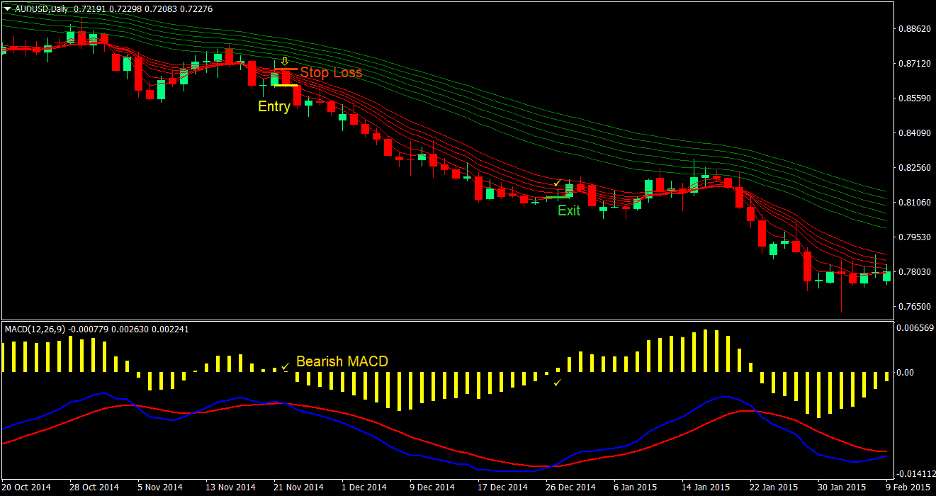

The Guppy Multiple Moving Averages makes use of two sets of multiple moving averages. The first set of moving averages is colored green. This the slower set of moving averages and represents the long-term trend. The second set of moving averages is colored red. This set is the faster set of moving averages and represents the short-term trend.

Real MACD

The Moving Average Convergence and Divergence (MACD) is one of the more popular technical indicators available. In fact, it is a staple tool in most trading platforms and charting software.

The MACD is an oscillating indicator that is based on the difference of two moving averages in relation to another moving average, which is considered the signal line. In a way, the MACD is a derivative of a crossover strategy.

MACDs are very popular due to its effectivity in determining trends. However, it is often considered a lagging indicator. It tends to respond a little bit later than some indicators would.

The Real MACD however is a modified version of the standard MACD indicator. The Real MACD tries to reduce the lag that is present in the standard MACD version, making it an even more powerful to use.

Trading Strategy Concept

This strategy is a simple trend continuation type of strategy based on the Guppy Multiple Moving Averages and the Real MACD.

The Guppy Multiple Moving Averages serve both as a trend filter and as an area which we could use for our entries. Trend direction is based on how the sets of moving averages are stacked. On a bullish trend, the faster set of moving averages should be above the slower set of moving averages. On the other hand, the faster set of moving averages would be below the slower set during a bearish market condition. Trade entries should adhere to the trend direction of the Guppy Multiple Moving Averages.

The second use of the Guppy Multiple Moving Averages would be as a dynamic area of support and resistance. Once the trend direction is established, we will be making use of the red set or the short-term trend moving averages as an area where we will be observing for possible bounces off the average price. During a trending market condition, we will be waiting for price to retrace to this area. Then as price revisits the area, we will be observing for possible bounces off the moving averages.

The Real MACD would be our entry trigger. During the retrace period of a strong trend, the Real MACD would have a temporary reversal. As price revisits the red Guppy Multiple Moving Averages, the Real MACD would start to revert back to its original direction in line with the long-term trend. Viable entries will be considered as soon as the Real MACD crosses over to the direction of the long-term trend.

Indicators:

- guppy_multiple_moving_averages

- realMACD

Timeframe: preferable 1-hour, 4-hour and daily charts

Currency Pair: major and minor pairs only

Trading Session: Tokyo, London and New York session

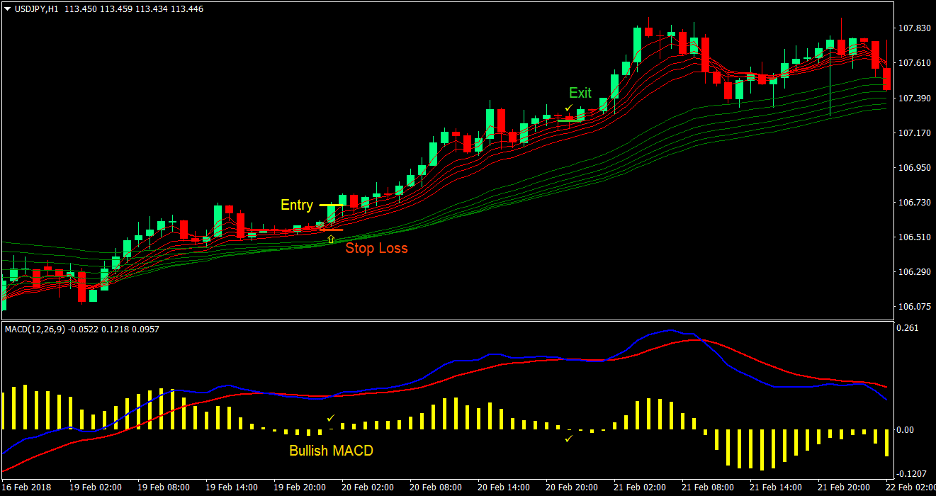

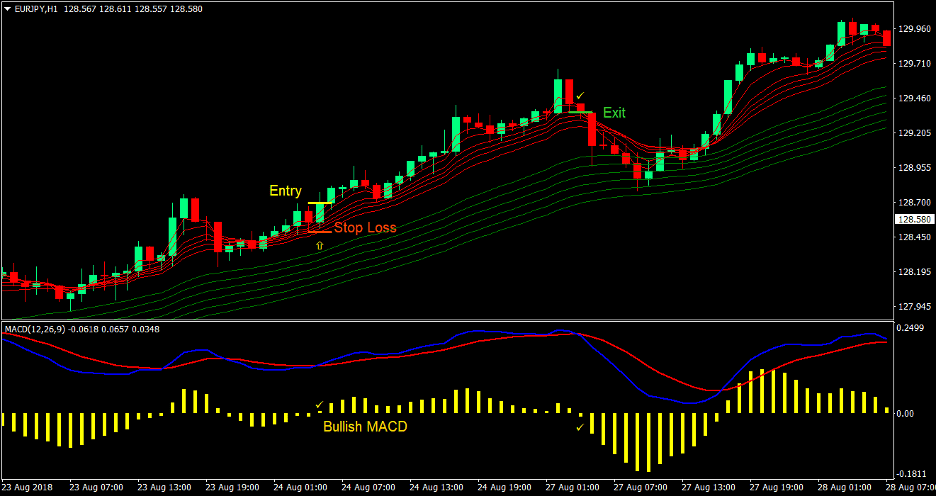

Buy (Long) Trade Setup

Entry

- Price should be above the green set of multiple moving averages

- The red set of multiple moving averages should be above the green set indicating a bullish long-term trend

- Wait for price to retrace to the red set of multiple moving averages

- The Real MACD should have negative histogram bars indicating the retrace period

- Enter a buy order as soon as the Real MACD prints a positive histogram indicating the possible resumption of the bullish trend

Stop Loss

- Set the stop loss below the red set of multiple moving averages

Exit

- Close the trade as soon as the Real MACD prints a negative histogram

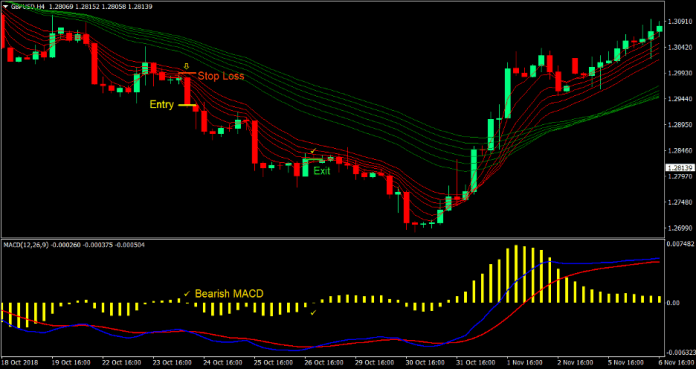

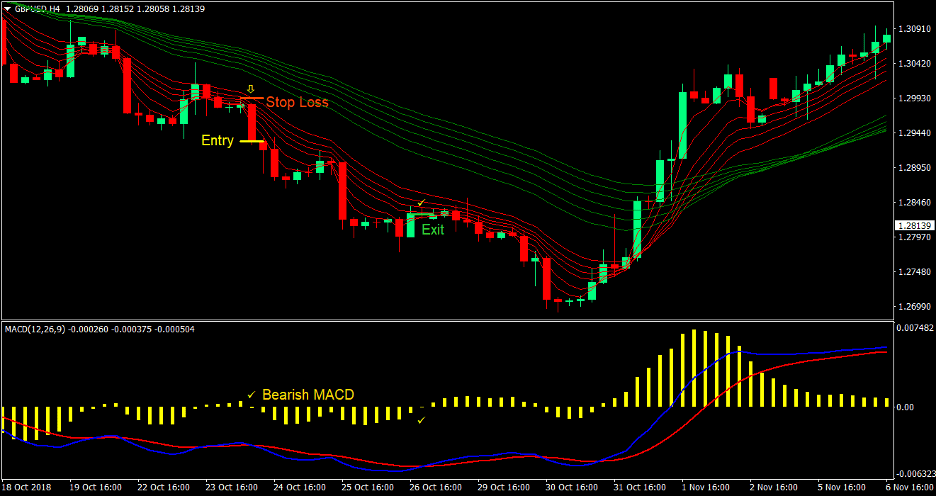

Sell (Short) Trade Setup

Entry

- Price should be below the green set of multiple moving averages

- The red set of multiple moving averages should be below the green set indicating a bearish long-term trend

- Wait for price to retrace to the red set of multiple moving averages

- The Real MACD should have positive histogram bars indicating the retrace period

- Enter a sell order as soon as the Real MACD prints a negative histogram indicating the possible resumption of the bearish trend

Stop Loss

- Set the stop loss above the red set of multiple moving averages

Exit

- Close the trade as soon as the Real MACD prints a positive histogram

Conclusion

This strategy is an excellent trend continuation strategy. The whole picture of the trend direction is clearly identified due to the Guppy Multiple Moving Average indicator, from the short-term to the long-term. Having the short-term trend aligned with the long-term trend ensures that we are trading a strong trend. The Real MACD on the other hand allows us to enter on deeper retraces.

This strategy is best paired with a breakout of diagonal supports and resistances that would typically coincide with the retrace. Having some knowledge of price action and how price behaves during the retrace would also be beneficial.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: