MTF CCI Indicator, also known as the Multi-Time Frame Commodity Channel Index Indicator, is a technical analysis tool used to identify potential overbought and oversold conditions in the market. The indicator is based on the Commodity Channel Index (CCI), which was developed by Donald Lambert. The MTF CCI Indicator takes the concept of the CCI a step further by incorporating multiple time frames into its calculations.

Why Is It Important?

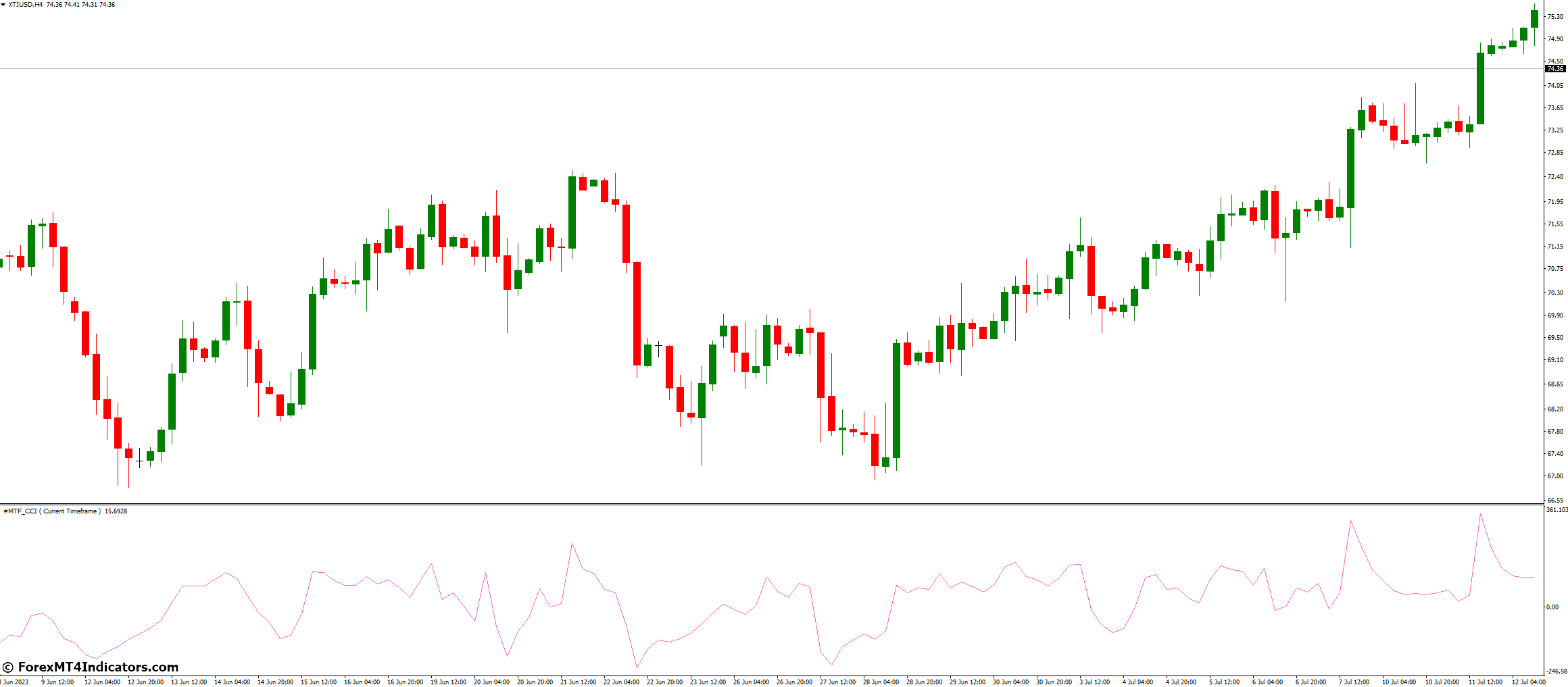

The MTF CCI Indicator is important because it provides a broader perspective on market momentum and trends. While the traditional CCI indicator oscillates between -100 and +100, this indicator has a wider range between -400 to +400. This wider range allows traders to identify potential overbought and oversold conditions more accurately.

How Does It Work?

The MTF CCI Indicator works by calculating the difference between the typical price and its simple moving average. The single line represents the CCI value, which is calculated based on this difference. The indicator then incorporates multiple time frames into its calculations to provide a broader perspective on market momentum and trends.

What Are The Benefits Of Using It?

The benefits of using the MTF CCI Indicator include:

- Identifying potential overbought and oversold conditions more accurately.

- Providing a broader perspective on market momentum and trends.

- Incorporating multiple time frames into its calculations.

What Are The Drawbacks Of Using It?

The drawbacks of using the MTF CCI Indicator include:

- False signals can occur if the indicator is not used in conjunction with other technical analysis tools.

- The indicator can be difficult to interpret for novice traders.

What Are The Best Practices For Using The Mtf Cci Indicator?

The best practices for using the MTF CCI Indicator include:

- Using the indicator in conjunction with other technical analysis tools.

- Setting appropriate parameters for the indicator.

- Using the indicator on multiple time frames to get a broader perspective on market momentum and trends.

How to Trade with MTF CCI Indicator

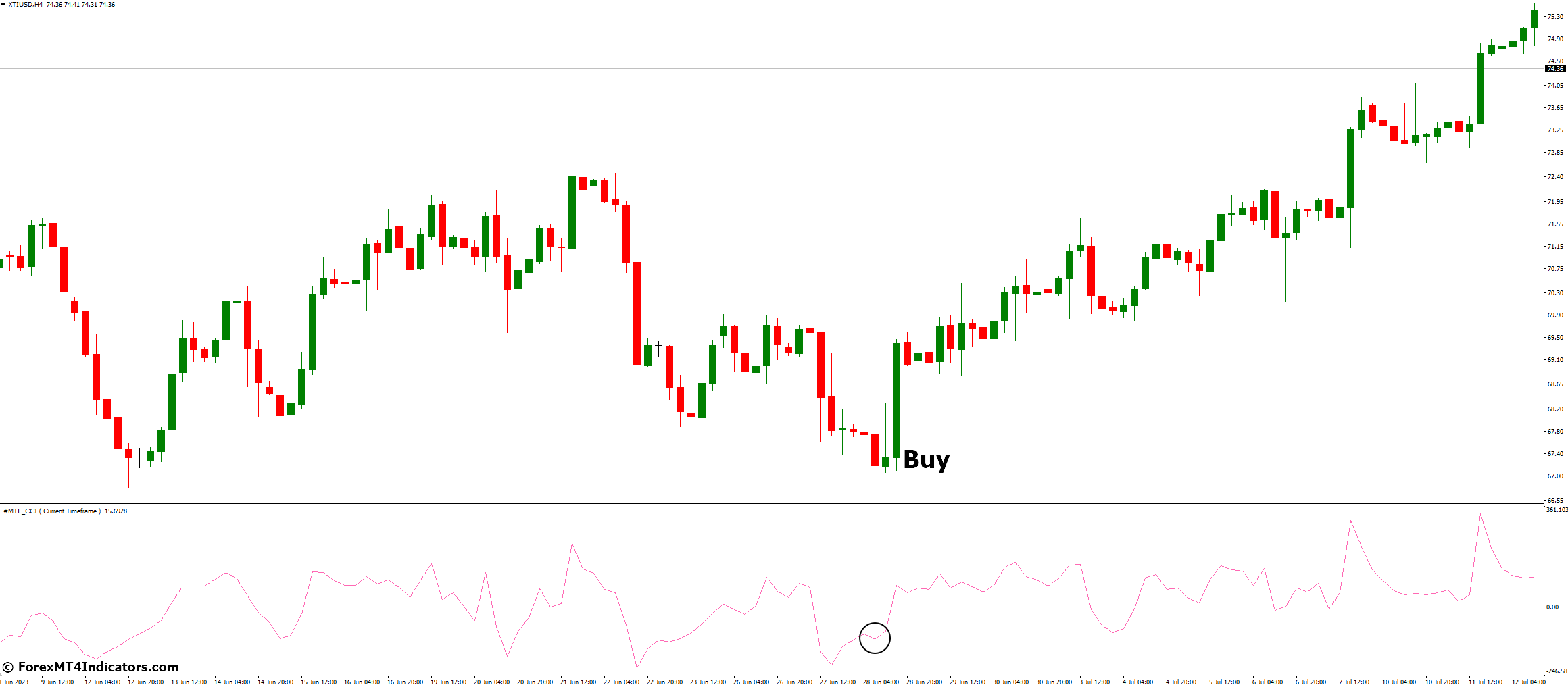

Buy Entry

- Wait for the CCI line to drop below the lower threshold (-400) and then rise above it.

- Look for a bullish candlestick pattern to confirm the buy signal.

- Enter a long position at the opening of the next candle.

- Place a stop-loss order below the low of the bullish candlestick pattern.

- Place a take-profit order at a predetermined level or use a trailing stop to lock in profits.

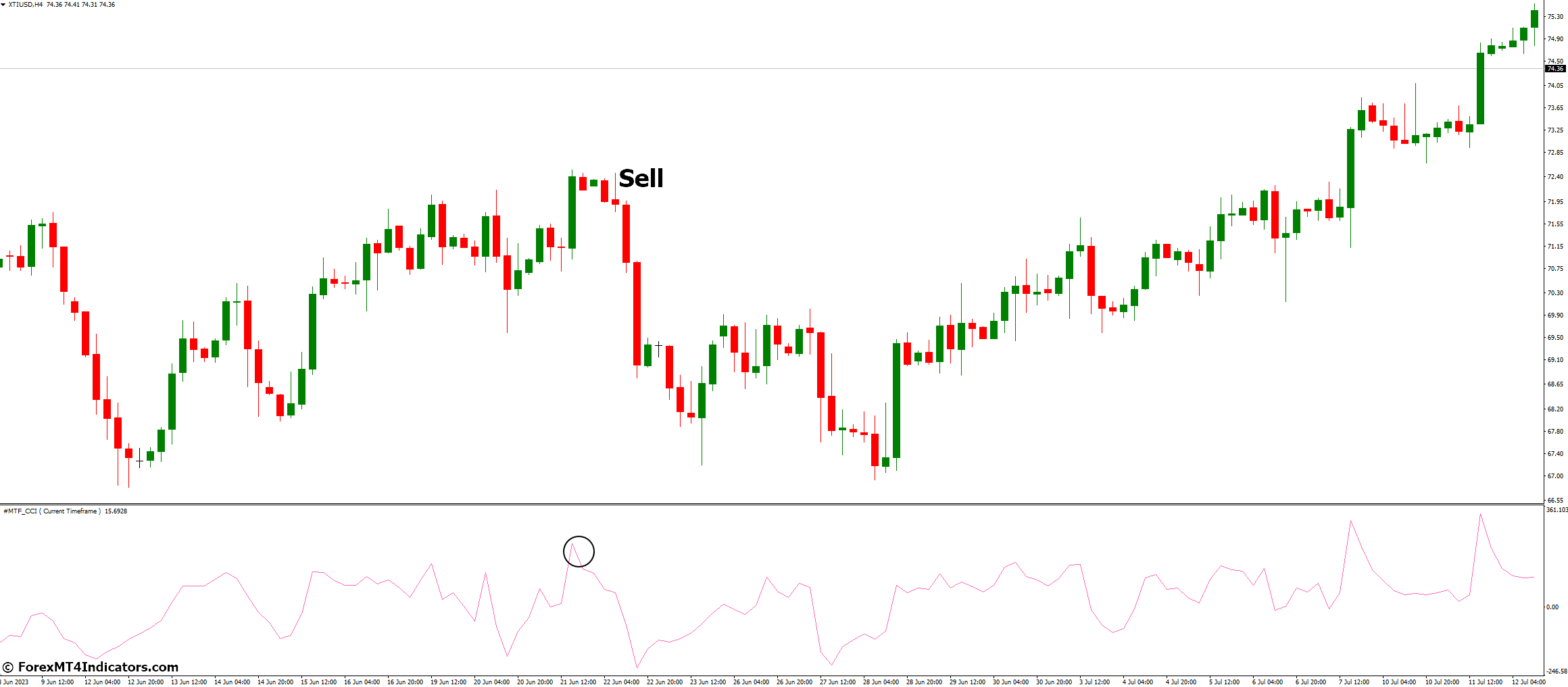

Sell Entry

- Wait for the CCI line to rise above the upper threshold (+400) and then drop below it.

- Look for a bearish candlestick pattern to confirm the sell signal.

- Enter a short position at the opening of the next candle.

- Place a stop-loss order above the high of the bearish candlestick pattern.

- Place a take-profit order at a predetermined level or use a trailing stop to lock in profits.

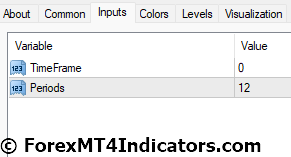

MTF CCI Indicator Settings

Conclusion

MTF CCI Indicator is a technical analysis tool used to identify potential overbought and oversold conditions in the market. The indicator is based on the Commodity Channel Index (CCI) and incorporates multiple time frames into its calculations to provide a broader perspective on market momentum and trends.