Reversals after extreme market price extensions are one of the most commonly used type of market reversal trading strategies. The Gann Bands Forex Trading Strategy employs the same concept using the widely used Bollinger Bands plus an entry confirmation using the Gann HiLo Activator Bars.

Bollinger Bands

The Bollinger Bands is a popular technical indicator developed by John Bollinger. The uniqueness of the Bollinger Bands is that it is a moving average indicator, a trend and momentum indicator, a volatility indicator, and an overbought and oversold indicator all rolled up into one.

The Bollinger Bands is composed of three parts, the middle line and two outer bands. The middle line is a simple moving average usually set to 21-periods. The two outer bands on the other hand is plotted based on a standard deviation from the simple moving average and is usually set to two standard deviations. However, these parameters could be adjusted depending on the trader’s preference.

The two outer bands allow traders to identify price extremes as price going over these lines are considered overbought or oversold. On a trending market condition, price would usually hug near these extremes, while during reversals, price would typically show signs of price rejection.

Another added feature to the outer bands is that it could also indicate volatility. Low volatility market conditions would often cause the bands to tighten while high volatility market conditions would typically cause the bands to expand.

Gann HiLo Activator Bars

The original Gann HiLo Activator is basically a simple moving average based on the high and the low of past prices. This is why the typical Gann HiLo Activator is plotted as moving average would.

The Gann HiLo Activator Bars however is a bar plotted on the candlesticks. These bars changes colors whenever the Gann HiLo Activator changes direction. This feature makes the Gann HiLo Activator Bars an excellent custom indicator to use as an entry signal. It is even more effective on short-term trends. It also allows traders to ride on to a trending market environment as the Gann HiLo Activator usually stays in the same color during a strong trend.

Trading Strategy Concept

Bollinger Band price extremes based on the outer bands are an excellent basis for price reversal trade setups. It objectively shows if price is overbought or oversold and allows traders to observe price action as it rejects the price around these areas. This strategy is a reversal trading strategy based on the Bollinger Band price extremes. However, we will be incorporating the confirmation of the Gann HiLo Activator Bars as the entry signal.

We will be waiting for price to touch the area near the overbought or oversold outer bands. Then, we observe how price is reacting to it. If price starts to reject these areas, then we would wait for price to start reversing. As price reverses, the Gann HiLo Activator Bars should also change color indicating that the short-term trend has already reversed. This should also be accompanied by price crossing and closing over the midline indicating that the trend based on the 20-period simple moving average of the Bollinger Band has already reversed. The confluence of these conditions confirms the strategy’s price reversal trade setup. We then allow price to run as the reversal leads to a trend on the opposite direction.

Indicators

- Bollinger Bands

- Gann HiLo activator bars

Timeframe: 15-min, 30-min, 1-hour, 4-hours and daily timeframes

Currency Pairs: any major or minor pairs and some crosses

Trading Session: any

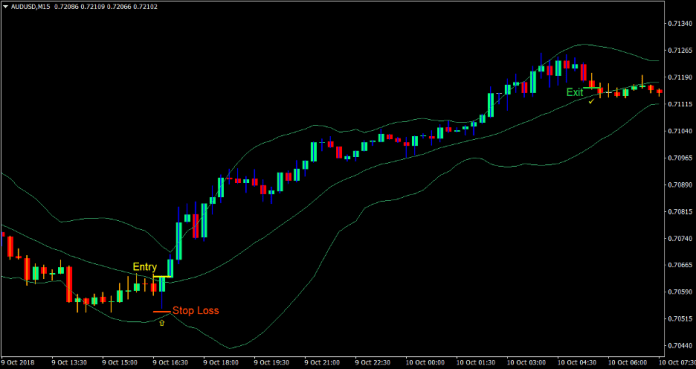

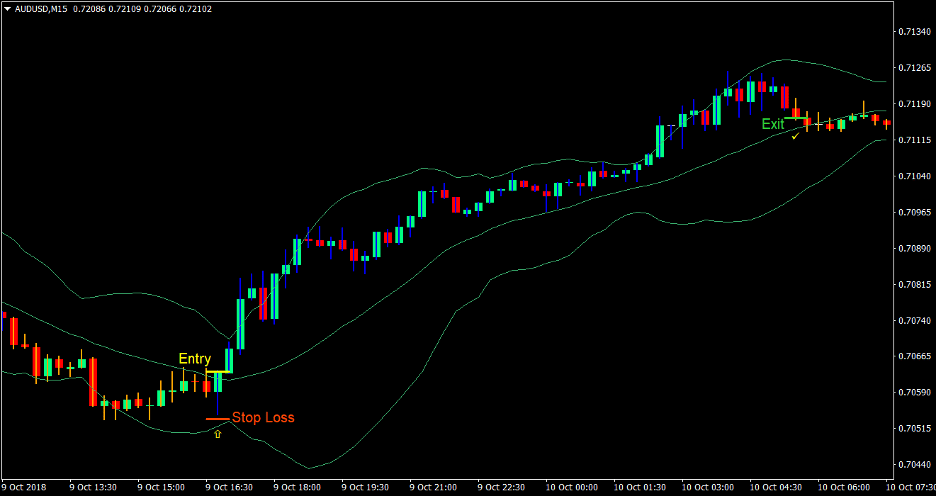

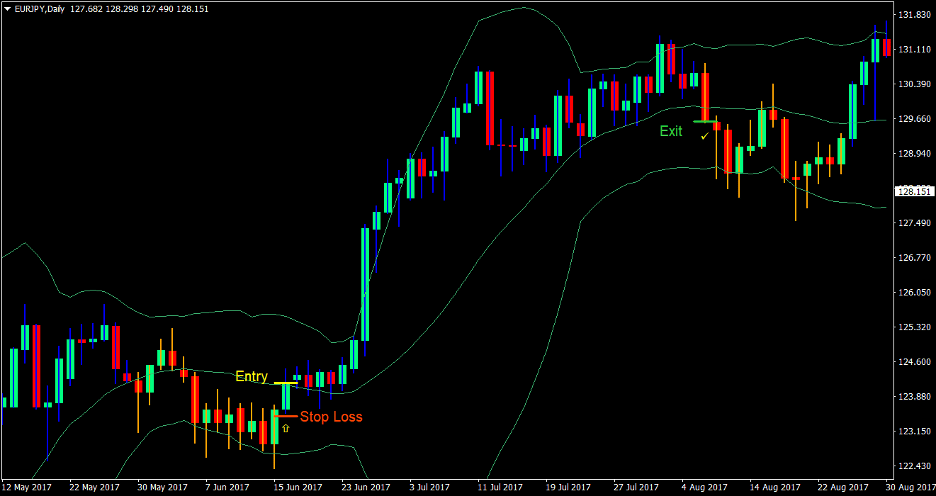

Buy (Long) Trade Setup

Entry

- Price should touch the lower outer band of the Bollinger Bands indicating that price is at the oversold area

- Price action should show signs of price rejection on the area of the lower outer band

- Price should crossover and close above the midline of the Bollinger Bands indicating a change in the mid-term trend

- The Gann HiLo Activator Bars should change to color blue indicating a change in the short-term trend

- Open a buy order at the confluence of the above rules

Stop Loss

- Set the stop loss below the low of the Gann HiLo Activator Bars

Exit

- Close the trade as soon as the Gann HiLo Activator Bars change to color orange indicating the end of the trend

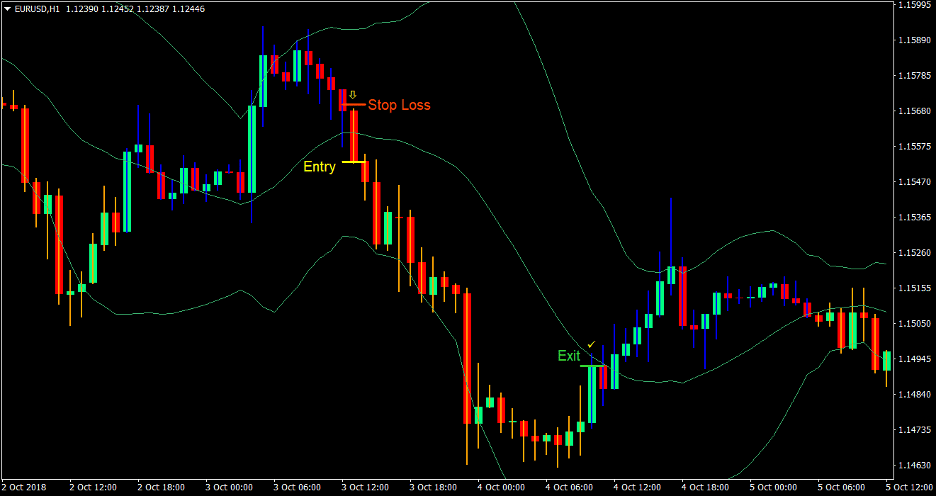

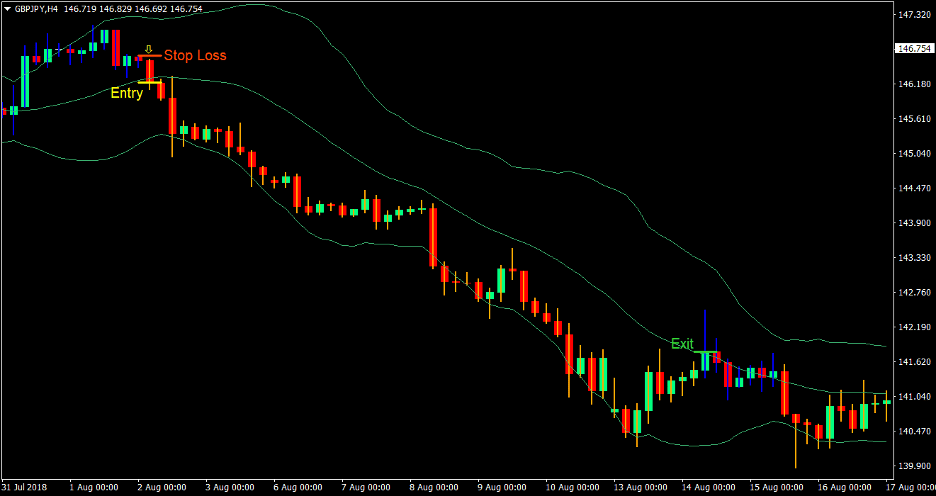

Sell (Short) Trade Setup

Entry

- Price should touch the upper outer band of the Bollinger Bands indicating that price is at the overbought area

- Price action should show signs of price rejection on the area of the upper outer band

- Price should crossover and close below the midline of the Bollinger Bands indicating a change in the mid-term trend

- The Gann HiLo Activator Bars should change to color orange indicating a change in the short-term trend

- Open a sell order at the confluence of the above rules

Stop Loss

- Set the stop loss above the high of the Gann HiLo Activator Bars

Exit

- Close the trade as soon as the Gann HiLo Activator Bars change to color blue indicating the end of the trend

Conclusion

Trading price reversals based on bounces off the Bollinger Bands’ overbought and oversold areas is a trading strategy in itself. Using the Gann HiLo Activator Bars adds confirmation to the trade setup.

This strategy works well on markets where price would typically trend after a reversal. It would be difficult to use this strategy on a choppy market as the short-term trend changes would not be enough to cover the immediate reversals. One way to counteract this though is to move the stop loss as soon as possible, however this would also increase the chances of a trading getting prematurely stopped out.

It would also be better if this strategy is combined with price action. This includes reversals on support and resistance levels as well as observing for reversal patterns on the area of the Bollinger Bands’ overbought and oversold lines.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: