Fisher and Stochastics Scalping Strategy

To scalp or not to scalp? That is the question. Well, for some traders, that is the question.

Many traders tend to shun away from scalping. And to some extent, they are right to do so. Scalping is difficult. Scalping consumes much of your time. Scalping drains your energy. Scalping drains money out of many traders.

But with a good strategy, it is a very profitable endeavor to take. Why? Well, the number of opportunities presented to a trader in a day is so much more as compared to swing trading. This allows a trader to steadily increase his account faster than swing traders. And it allows probabilities and the law averages to play out better than just having one trade a day.

The Fisher Indicator

The Fisher indicator is a custom indicator which oscillates around a zero line, presented as a histogram. This conveniently provides a buy or sell signal. Histograms with lime color indicate that the trend’s bias is bullish, while histograms with red color indicate the trend’s bias is bearish.

The Fisher indicator on its own is good. However, it is best to use it in combination with other indicators or strategies.

The Stochastic Indicator

Stochastic indicators are one of the more popular indicators in trading. It is a basic indicator provided as a staple MT4 or MT5 indicator.

One of the advantages of the stochastic indicator is its ability to react quickly with what price is doing. This allows the trader to see minor swings, which scalpers love to take profit from. Another feature that the stochastic indicator has is its overbought and oversold levels. If the indicator is above 80, the market is considered overbought. If the indicator is below 20, then the market is considered oversold.

The Buy Setup – Entries, Stop Losses & Take Profits

Tying it all up together, we will be combining the Fisher indicator and the stochastic indicator.

To enter the market for a buy setup, these two rules must be met.

- The Fisher indicator should be plotting lime histograms indicating that the market’s bias is bullish.

- The stochastic indicator should be crossing the 20-line from the oversold area.

The stop loss should be placed just a few pips below the latest minor swing low. Often, due to the stochastic indicator’s responsiveness, the swing low would also be the entry candle itself.

If for some reason, the trend reverses causing the Fisher indicator to plot bearish histograms, then the trade should be manually closed, whether in profit or at a loss.

Since this is a scalping strategy, we will be a bit more conservative with our take profits. We will be using a 2:1 risk-reward ratio as our target take profit. This increases the probability that the take profit would be hit more often and still give us a profit that is twice our risk.

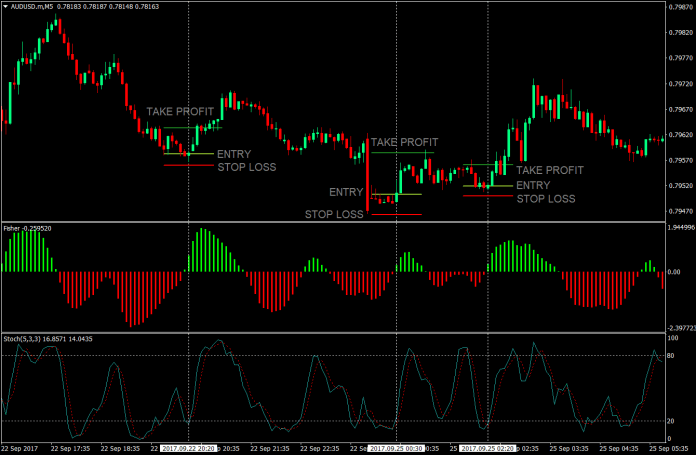

On the chart below, three buy opportunities were spotted in a span of 4 hours.

On this chart, if following the rules presented, all the take profit targets would have been hit. If for example, the risk taken per trade is 0.5%, then the account could have grown by 3% in a span of 4 hours.

The Sell Setup – Entries, Stop Losses & Take Profits

As for the sell setup, the following rules should be checked to trigger a sell trade:

- The Fisher indicator should be plotting red histograms indicating that the market/s bias is bearish.

- The stochastic indicator should be crossing the 80-line from the overbought area.

The stop loss should be place just a few pips above the most recent swing high.

If in case the market’s bias shifts causing the Fisher indicator to plot bullish histograms, then the trade should also be manually closed.

Still, for the take profits, we will be setting a 2:1 risk-reward ratio as a basis for our target take profits.

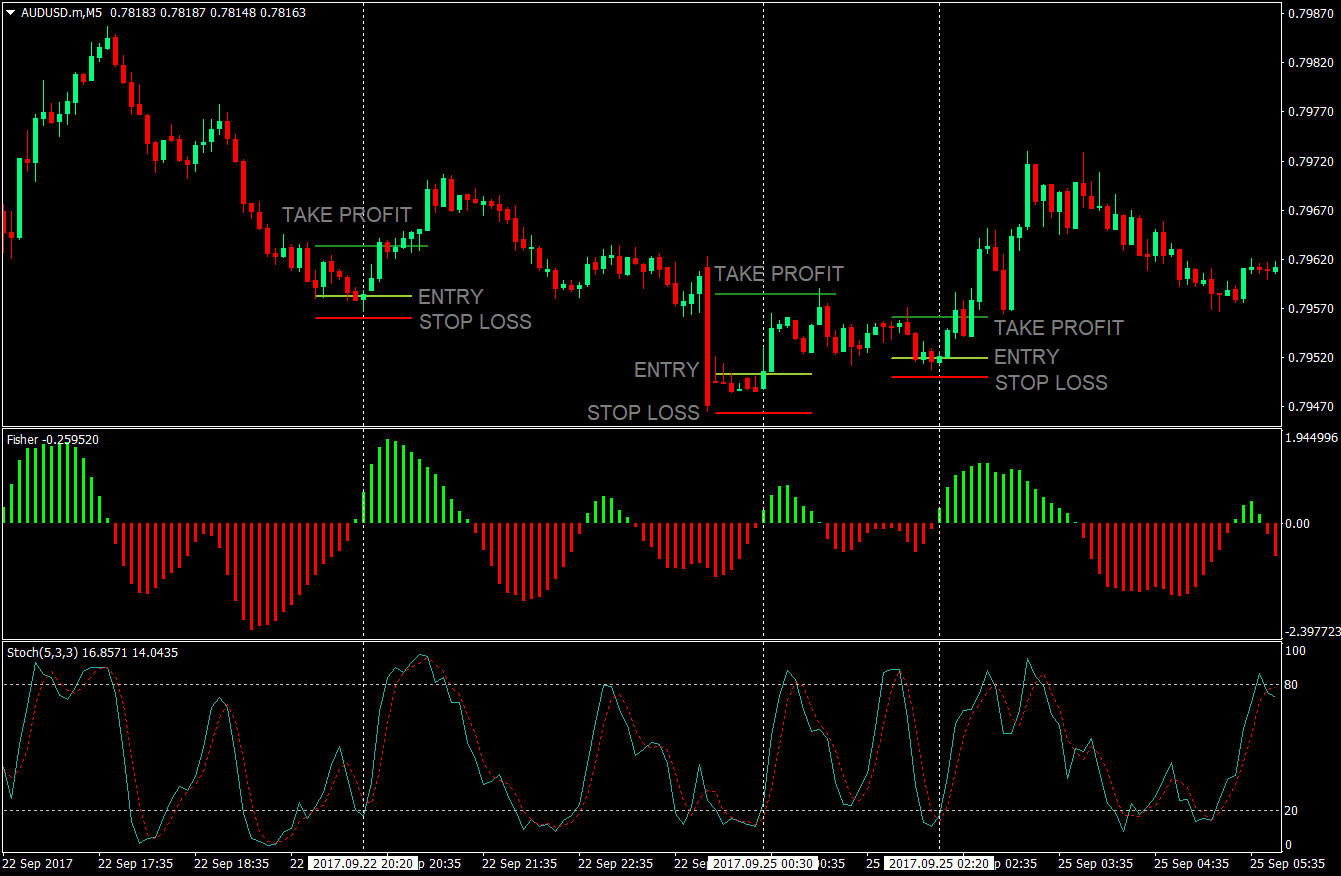

On the chart below, three trades could have been taken in a span of 8 hours on the 5-minute chart.

Again, if the risk taken per trade is at 0.5%, the account could have grown by another 3% that day.

Conclusion

This combination of Fisher and stochastic indicators is a winning strategy. The Fisher confirms the direction and the stochastic acts as a trigger for the trade. Using the Fisher indicator as a filter is very effective due to its responsiveness. While using the stochastics as a trigger increases the reliability of the trades.

However, due to its precise rules, many of the minor swings would not be considered for the trade. This would mean a lot of sitting and waiting, even though this is a scalping strategy. The trader should think and act like a sniper, stalking those trades for a few hours to get those precise entries. Learn and master the strategy, and gain the needed patience, then you might be having a strategy that would steadily grow your account.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: