In the dynamic world of trading, having the right tools at your disposal can make all the difference. One such powerful tool is the Aroon Oscillator, designed for MetaTrader 5 (MT5). In this article, we’ll delve into the details of this indicator, exploring its significance, functionality, and practical applications.

Why is it Important?

Aroon Oscillator provides crucial insights into market trends. By analyzing price movements, it helps traders identify potential turning points, whether a trend is about to reverse, or if the market is entering a consolidation phase. Understanding these shifts is essential for making informed trading decisions.

How Does it Work?

Aroon Oscillator is calculated based on two components: the Bullish indicator and the Bearish indicator. Let’s break it down:

- Bullish indicator: Measures the time elapsed since the highest high within a specified period.

- Bearish indicator: Measures the time elapsed since the lowest low within the same period.

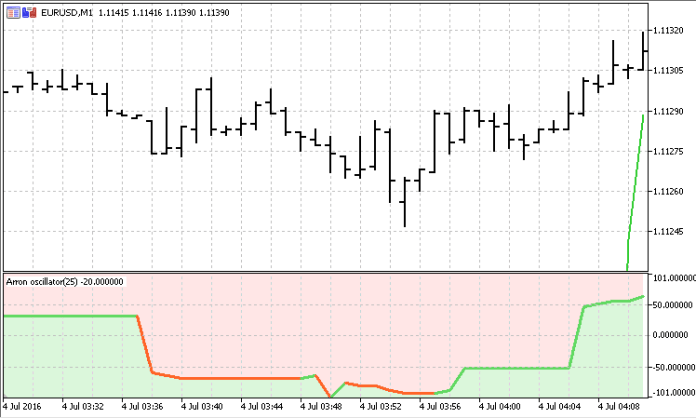

The Aroon Oscillator then subtracts the Bearish indicator from the Bullish indicator. The resulting value oscillates between -100 and +100, indicating the strength and direction of the trend.

Aroon Oscillator Interpretation

Aroon Oscillator’s value oscillates between -100 and +100. Here’s how to interpret it, we have two types of values. Positive Values, When the Aroon Oscillator is positive (above 0), it indicates a bullish trend. The higher the value, the stronger the trend. Negative Values, Conversely, negative values (below 0) signal a bearish trend. Again, the magnitude matters—the more negative, the stronger the bearish sentiment.

Timeframes and Sensitivity

Adjust the Aroon Oscillator’s period to match your trading timeframe. Shorter periods (e.g., 14) capture recent price movements, while longer periods (e.g., 50) provide a broader perspective. Higher sensitivity (lower period) responds quickly to price changes, but it may generate more false signals. Lower sensitivity (higher period) smoothes out noise but may lag behind major trends.

Combining Aroon with Moving Averages

Golden Cross, When the Aroon Up crosses above the Aroon Down, it can confirm a bullish trend. Combine this with a moving average crossover for added confirmation. Death Cross Conversely, when the Aroon Down crosses above the Aroon Up, it suggests a bearish trend.

What are Trading Strategies While Using this Indicator?

- Trend Reversals: Use extreme Aroon values to anticipate trend reversals.

- Divergence: Look for discrepancies between price and Aroon Oscillator readings.

- Crossovers: Pay attention to Aroon Up and Aroon Down crossovers.

How to Trade with Aroon Oscillator Indicator

Buy Entry

- Aroon Up Crosses Above +50:

- When the Aroon Up line crosses above the +50 level, it signals a potential bullish trend.

- Open a long position when this crossover occurs.

- Look for additional confirmation from price action. Ensure that the price is also showing signs of an upward move.

- Consider candlestick patterns or other technical indicators aligning with the bullish signal.

- Set a stop-loss below the recent swing low or a predetermined support level.

- Set a take-profit level based on your risk-reward ratio.

Sell Entry

- Aroon Down Crosses Below -50:

- When the Aroon Down line crosses below the -50 level, it indicates a potential bearish trend.

- Open a short position when this crossover occurs.

- Validate the bearish signal with price action.

- Look for candlestick patterns or other technical indicators supporting the downtrend.

- Place a stop-loss above the recent swing high or a significant resistance level.

- This limits losses if the market unexpectedly reverses.

- Determine a take-profit level based on your risk-reward ratio.

Conclusion

Aroon Oscillator is a valuable addition to any trader’s toolkit. By mastering its nuances, you can enhance your ability to navigate the markets effectively. Remember to combine it with other indicators and always practice risk management.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download: