The Adaptive Renko Indicator calculates brick size dynamically based on recent price volatility. It considers factors like average true range (ATR) and adjusts the brick size accordingly. This adaptability makes it ideal for capturing trends across various timeframes.

How It Differs From Traditional Renko Charts

Unlike traditional Renko charts, where brick sizes remain fixed, the Adaptive Renko responds to market conditions. During high volatility, the bricks become larger, allowing traders to spot significant price movements. Conversely, in calmer markets, smaller bricks maintain clarity.

Key Features And Benefits

- Dynamic Brick Size: The indicator adjusts brick size based on volatility, providing a more accurate representation of trends.

- Enhanced Trend Identification: Adaptive Renko highlights trends effectively, making it easier to spot potential entry and exit points.

- Reduced Noise: By filtering out minor price fluctuations, it minimizes noise and keeps the focus on significant moves.

The Triangular Moving Average (TMA) Explained

The TMA is a moving average that smooths price data. When combined with Renko charts, it helps identify trend direction. The Adaptive Renko Indicator integrates TMA, enhancing its effectiveness.

Linking Tma With Renko Charts

As the Adaptive Renko adjusts brick sizes, it considers TMA values. When TMA slopes upward, bullish trends are confirmed, and vice versa. Traders can use this synergy to validate signals.

Why Tma Is Crucial For Adaptive Renko

TMA acts as a trend filter, ensuring that Adaptive Renko captures meaningful trends. It prevents false signals and keeps traders on the right track.

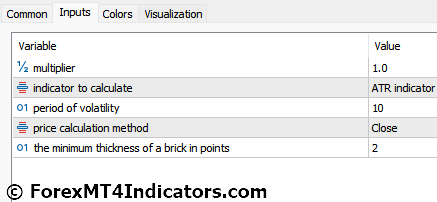

Configuring Parameters And Settings

Customize the indicator by adjusting parameters like ATR period, brick size, and color scheme. Experiment to find the optimal settings for your trading style.

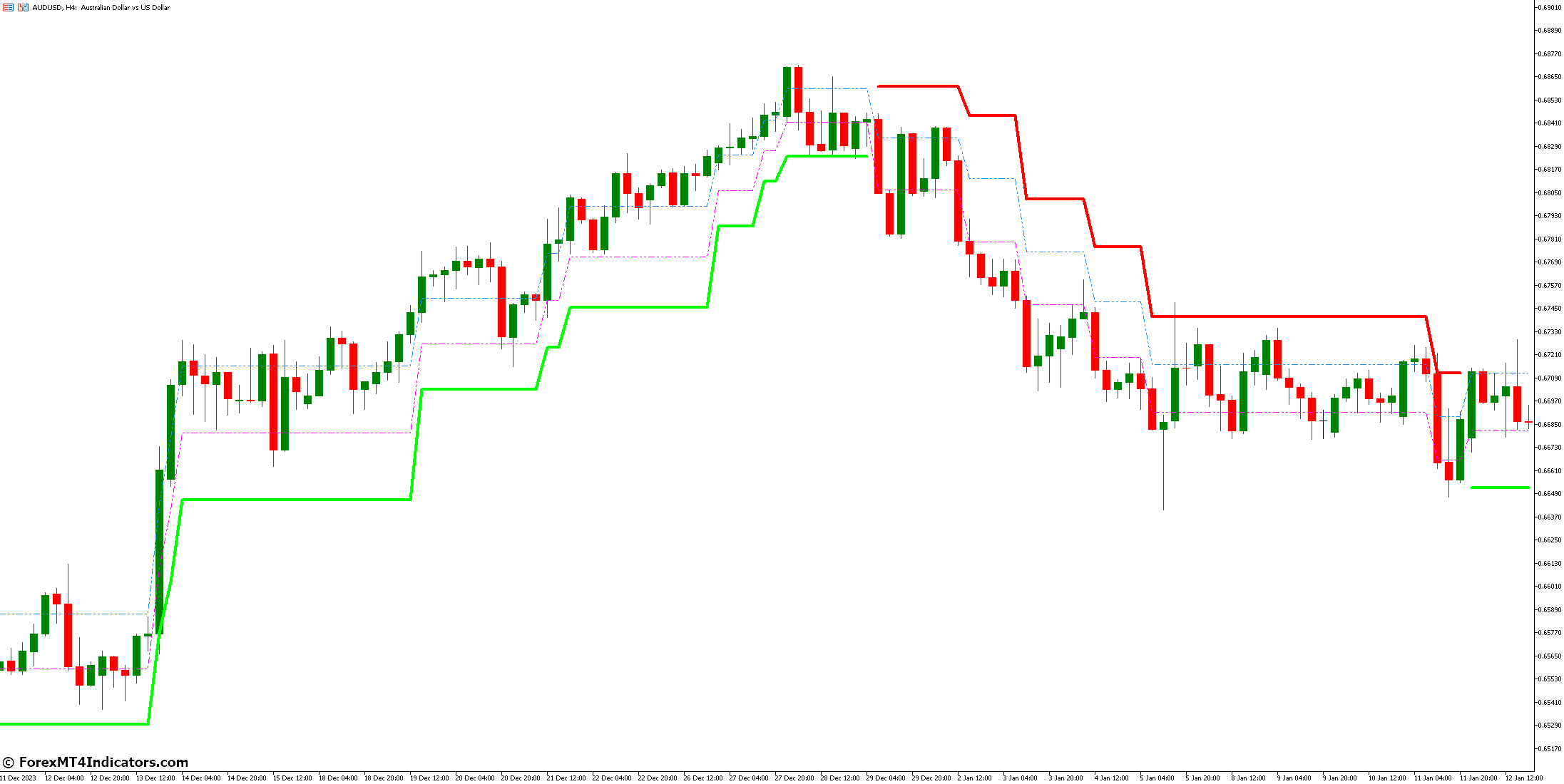

Analyzing The Indicator On Your Chart

When applied to a chart, the Adaptive Renko Indicator displays bricks. Each brick represents a price movement beyond the specified threshold.

Dotted And Bold Lines: Red Vs. Green

Dotted lines indicate bearish trends, while bold lines represent bullish trends. Pay attention to crossovers and color changes.

Channel Fluctuations And Support/Resistance Levels

Observe how the indicator interacts with support and resistance levels. Channels formed by bricks provide valuable insights.

Advantages & Disadvantages

Advantages

- Accurate Trend Identification: The Adaptive Renko Indicator adapts to market conditions, providing a clearer view of trends. Traders can confidently identify bullish or bearish movements.

- Dynamic Brick Size: By adjusting brick sizes based on volatility, the indicator ensures responsiveness. It captures both small and large price movements effectively.

- Enhanced Profitability: When used in conjunction with other technical tools, the Adaptive Renko improves trading profitability. It helps traders stay aligned with prevailing trends.

Disadvantages

Delayed Signals: Like any trend-following indicator, the Adaptive Renko may lag behind price changes. Traders must exercise patience and combine it with other tools for timely entries.

Parameter Sensitivity: Configuring the indicator’s parameters (e.g., ATR period) requires careful consideration. Incorrect settings may lead to suboptimal results.

Not Suitable For All Strategies: While effective for trend trading, the Adaptive Renko may not suit scalping or high-frequency strategies. Traders should assess their trading style before relying solely on this indicator.

How to Trade with Adaptive Renko Indicator

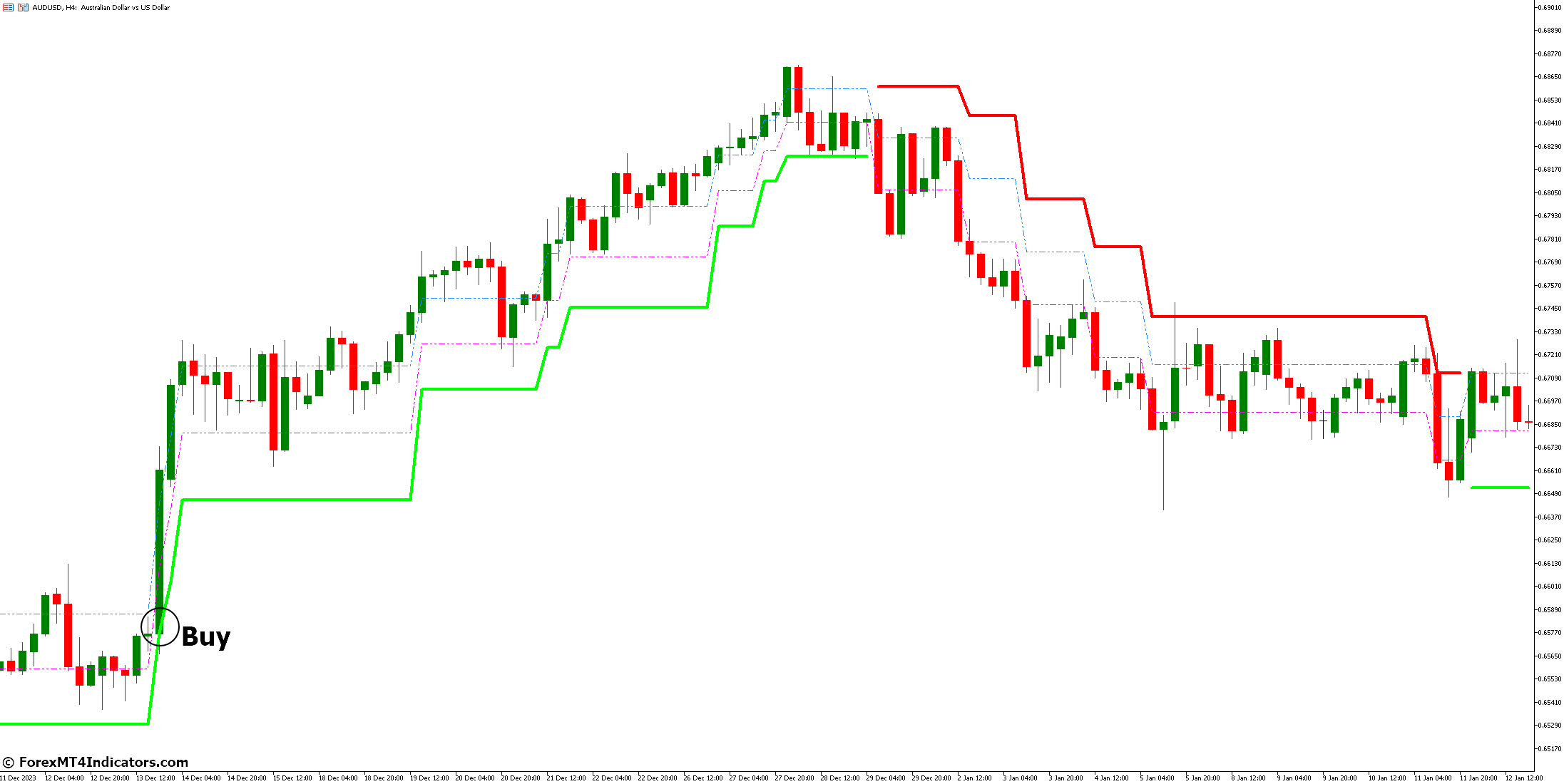

Buy Entry

- Look for the start of a green Renko line on the chart.

- Place your stop-loss below the most recent swing low price.

- Exit the buy trade when an opposite sell trading signal occurs on the chart.

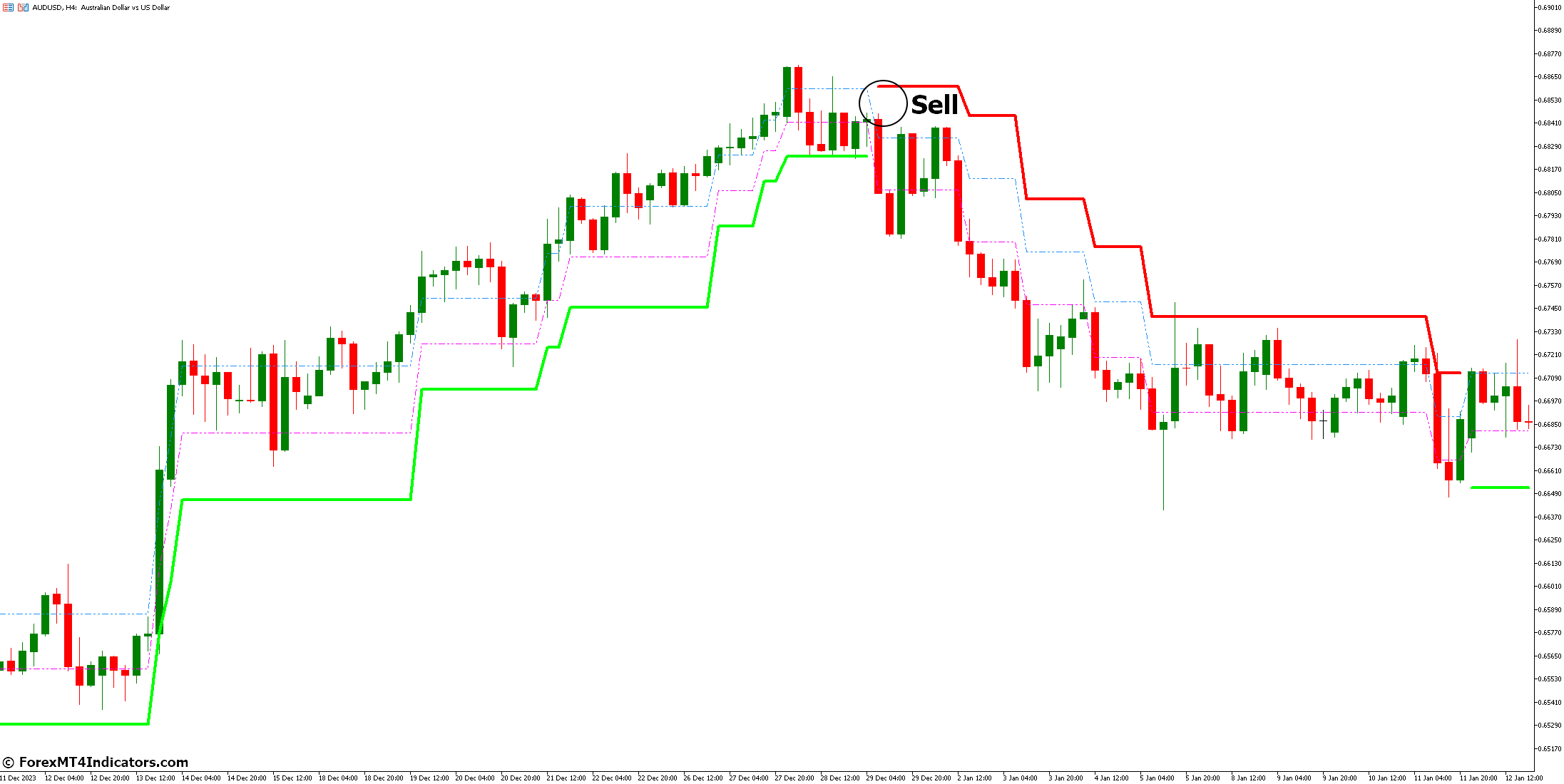

Sell Entry

- Observe the beginning of a red Renko line on the chart.

- Set your stop-loss above the most recent swing high price.

Adaptive Renko Indicator Settings

Conclusion

Adaptive Renko Indicator for MetaTrader 5 offers a flexible approach to Renko charting. Its ability to adapt to changing market conditions makes it a valuable tool for trend identification. Remember to combine it with other indicators and price action analysis for a comprehensive trading strategy.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download: