20 Pips a Day Scalping Forex Trading Strategy

Simple strategies that you could do mechanically every day without having to worry a lot usually works in trading. Caveat is that as long as the strategy has an edge. What I mean by this is that if you would do it again and again for a thousand more times, you would end up being in the green rather that losing money by having the right combination of win-loss ratio and risk-reward ratio.

What we have today is a simple strategy that you could mechanically do every day again and again and could give you 20 pips per trade.

It is a simple strategy that should be implemented on the major pairs – EUR/USD, GBP/USD, and USD/JPY. We will be trading these pairs only because it has tighter spreads and a fair amount of volatility. Also, we are to trade these pairs only during the London and New York sessions. This is because these are the markets that is the source of the bulk of volatility during a trading day. The Asian session is a tad too timid to be targeting 20 pips. Maybe it could work, but with a shorter target and stop loss.

This is also a variation of a crossover strategy that combines a very long-term moving average and a very fast moving average. The beauty of this type of combination is that the fast moving average represents a strong momentum as it cuts through the slow moving average and hopefully it would yield us the pips that we want.

The Setup: Trading the 20 Pips a Day Crossover Strategy

For this strategy we would be using only two moving averages as an indicator below.

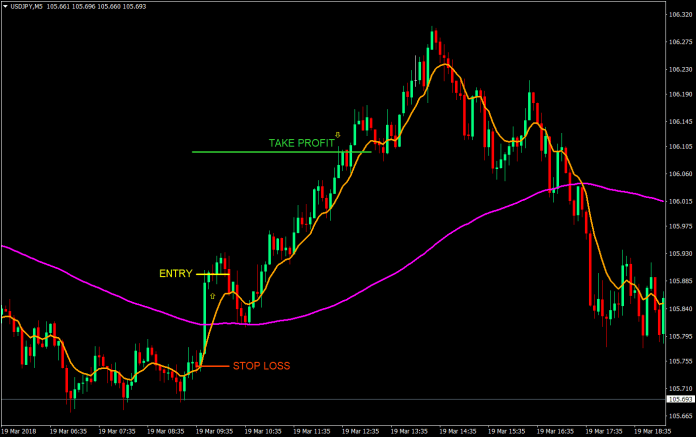

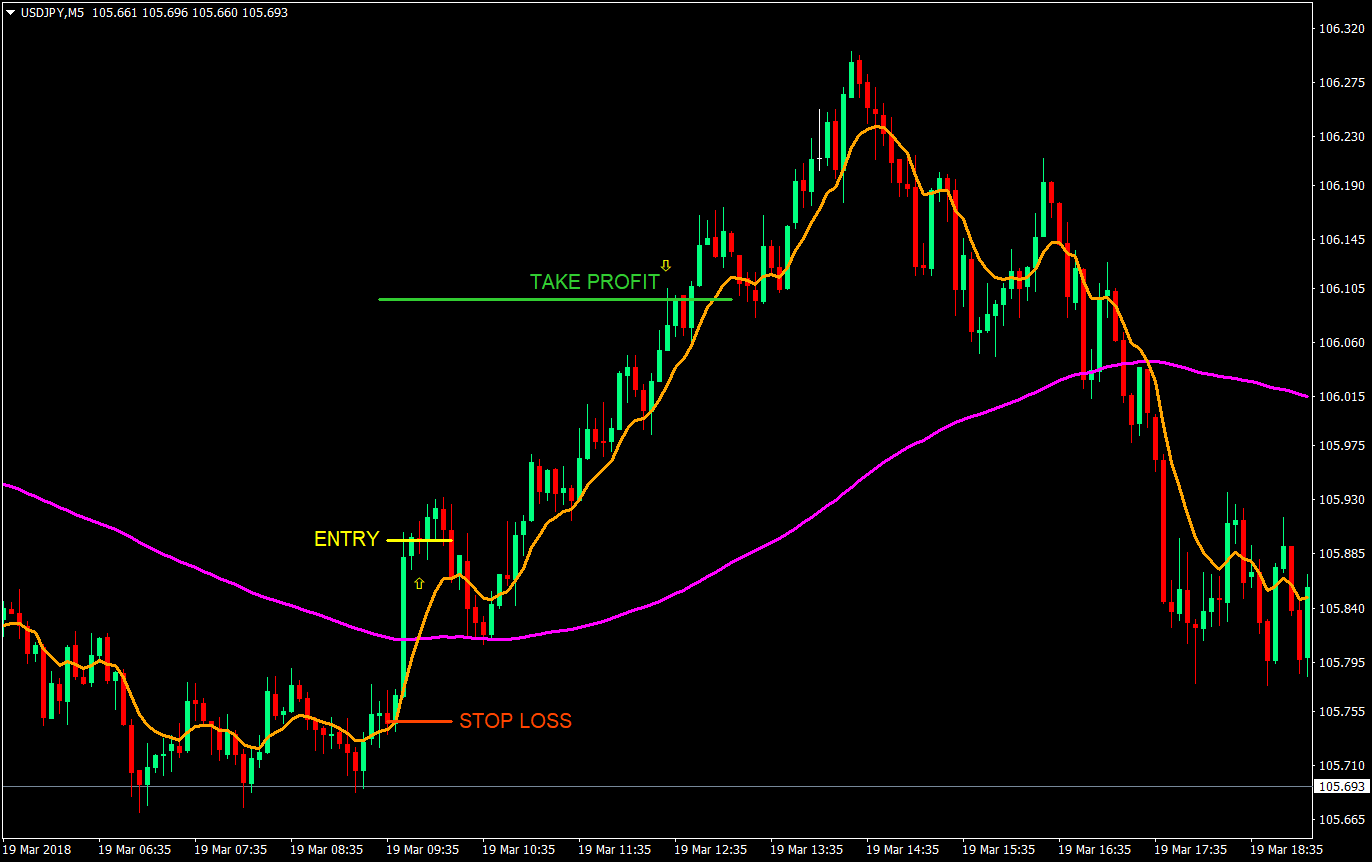

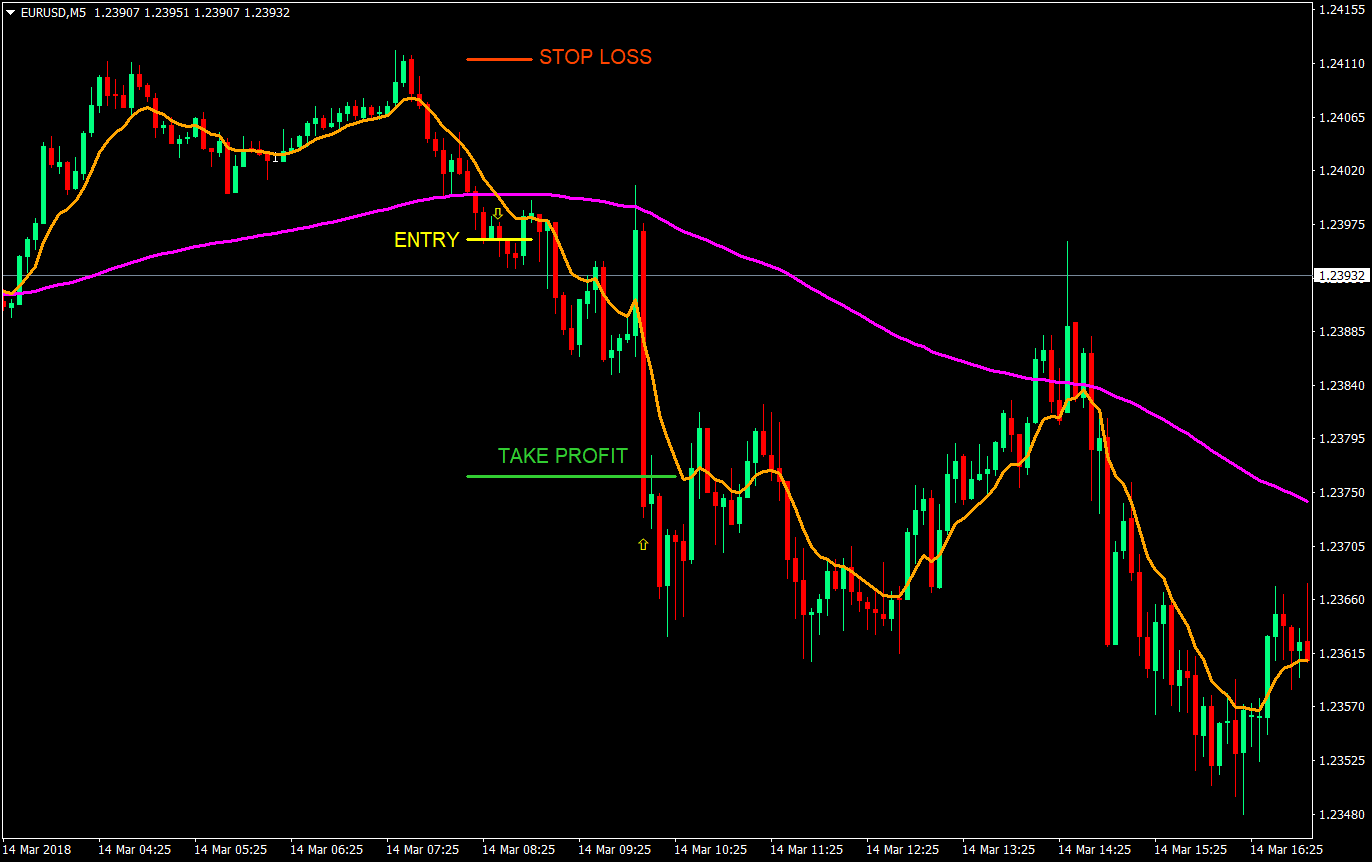

- 5 Smoothed Moving Average (SMA) – Orange

- 144 Weighted Moving Average (WMA) – Magenta

The 5 SMA represents our fast moving average, while the 144 WMA represents our slow moving average.

Buy Entry: Enter the trade as soon as the 5 SMA (orange) crosses above the 144 WMA (magenta).

Stop Loss: Stop loss should be 15 pips below the entry price.

Take Profit: The target take profit should be 20 pips from the entry price.

Sell Entry: Enter the trade as soon as the 5 SMA (orange) crosses below the 144 WMA (magenta).

Stop Loss: Stop loss should be 15 pips above the entry price.

Take Profit: The target take profit should be 20 pips from the entry price.

Note: Trail the stop loss to breakeven as soon as the trade is 5 pips in profit.

Conclusion

Many crossover strategies have already lost its edge. This is because crossover strategies just don’t work on ranging and whipsaw markets and it is banking on the hopes of catching a big one that covers for all the losses during the whipsaws. However, even though there are times when traders catch a big one, they end up giving it back up to the market. This is because they close their trades on the reversing crossover. By that time, much of the profit would have been given up or worse, the trade would be at a loss.

However, this one is quite different since it doesn’t wait for the market to take back the profits before the trader could exit the position. Instead, the trader sets the Take Profit of 20 pips at the open of the trade. Also, the Stop Loss is also preset to 15 pips. By doing this, the trader locks the reward-risk ratio to 4:3, instead of letting the market dictate what it wants to give. This secures one part of the edge of profitable strategies, the reward-risk ratio.

Now, the note at the bottom of the charts is very important. The trader should trail the stop loss to breakeven as soon as possible. This is to secure the second part of our edge, which is the win-loss ratio. By moving our stop loss as soon as possible, we are making sure that we will not lose on the trade. 20 pips is quite a tall order for a scalp, but 5 pips is an easy target. By trailing the stop loss at 5 pips, we are raising our win ratio exponentially. At the same time, we allow ourselves to reach for big profits since our 20 pips take profit is still at play.

This strategy, if not for the trailing of the stop loss, is quite aggressive. But with the trailing of the stop loss, we lower our risk. If you’d like to, you could tweak this strategy yourself. At times, the market reverses prior to the 20 pips. With this in mind, you could tweak the strategy yourself and make it your own.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: