Beim Handel an den Märkten kommt es vor allem auf die Stimmung an. Es geht um die menschliche Natur und die Psychologie der Masse. Ob Aktienhandel, Gold, Öl, Rohstoffe, Kryptowährungen oder Devisen. Es wird immer diejenigen geben, die einer bestimmten Ware optimistisch gegenüberstehen, und diejenigen, die ihr gegenüber pessimistisch sind. Sie werden Bullen und Bären genannt. Wer sich zu einem bestimmten Zeitpunkt als stärker erweist, würde gewinnen. Als Händler ist es nicht unsere Aufgabe, zu erraten, in welche Richtung sich der Markt entwickelt. Unsere Aufgabe ist es, ein Gefühl für den Markt zu bekommen. Wer ist derzeit stärker? Sind es die Bullen oder die Bären?

Die Bulls Bears Stop Forex Trading Strategy ist eine Handelsstrategie, die sich auf die Idee konzentriert, die Marktstimmung zu bestimmen. Diese Strategie zielt darauf ab, vom Devisenmarkt zu profitieren, indem die Stärke der Bullen und der Bären objektiv gemessen wird. Dies gibt uns einen Hinweis darauf, welche Richtung wir einschlagen sollten, um dauerhaft vom Devisenmarkt zu profitieren. Solange wir eine Vorstellung davon haben, in welche Richtung der Markt gehen möchte, ist der Kampf zur Hälfte geschafft.

Bullen- und Bären-Leistungsindikatoren

Die Bullen- und Bärenindikatoren sind Indikatoren, die versuchen, die Stärke der Bullen und Bären in einem Markt zu messen. Auf diese Weise bekommen wir ein Gefühl dafür, wohin sich der Markt aufgrund ihrer jeweiligen Stärken entwickelt.

Bei den Bulls- und Bears-Indikatoren handelt es sich um einfache oszillierende Indikatoren, die den Abstand zwischen Hoch und Tief messen und ihn mit einem exponentiellen gleitenden Durchschnitt (EMA) vergleichen. Positive Bullen und Bären deuten darauf hin, dass sowohl die Höchst- als auch die Tiefstwerte des Preises im Vergleich zum Durchschnittspreis steigen. Dies bedeutet, dass die Marktstimmung bullisch ist. Wenn andererseits der Bullen- und Bären-Indikator negativ ist, bedeutet dies, dass die Hochs und Tiefs der Preisbewegung im Vergleich zum Durchschnittspreis fallen, was bedeutet, dass der Markt rückläufig ist.

Kronleuchterstopps oder Kronleuchterausgänge

Der Kronleuchter-Stopps-Indikator, auch bekannt als „Cluster-Exits“, ist ein Trailing-Stop-Indikator, der Händler dabei unterstützt, die ideale Platzierung von Stop-Losses zu bestimmen. Er ähnelt stark dem Parabolic Stop and Reverse Indicator (PSAR), ist jedoch eine einfachere Version davon.

Der Kronleuchter-Stopps-Indikator misst Stop-Loss-Punkte basierend auf dem Maximalwert des Hochs und Tiefs. Andere Versionen verwenden den Maximalwert des Schlusskurses. Anschließend wird ein Puffer zwischen dem Maximalwert platziert, indem der Average True Range (ATR) für einen bestimmten Zeitraum berechnet und über dem Maximalhoch addiert oder vom Maximaltief subtrahiert wird. Dies ermöglicht es Händlern, den Sicherheitsabstand zu ermitteln, in dem sie ihre Stop-Losses verfolgen. Das Argument ist, dass angenommen wird, dass sich der Trend bereits umgekehrt hat, wenn sich der Preis jemals um ein Vielfaches der ATR umkehren würde.

Trading-Strategie

Bei dieser Handelsstrategie handelt es sich um eine auf Marktstimmungsstärke basierende Strategie, die versucht, den Trend anhand der Stärke der Bullen und Bären zu bestimmen. Dies geschieht mithilfe der Bulls- und Bears-Power-Indikatoren.

Trades werden basierend auf der Richtung der Bulls- und Bears-Indikatoren getätigt. Wenn die Bullen- und Bärenindikatoren positiv sind, könnte ein Kaufhandel ausgelöst werden. Wenn diese Indikatoren hingegen negativ sind, könnte ein Verkaufshandel ausgelöst werden.

Der Kronleuchter-Stopps-Indikator, ein Trailing-Stop-Indikator, würde als Trendrichtungsindikator verwendet. Diese spezielle Version der Kronleuchterstopps zeichnet nur die Linie entgegen der Trendrichtung. Immer wenn der Trend bullisch ist, zeichnet der Indikator nur die untere Linie. Wenn der Trend rückläufig ist, würde er nur die obere Linie zeichnen. Dadurch erfahren wir bequem, in welche Richtung der Trend anhand des Indikators geht.

Obwohl die oben genannten Einstiegssignale von hoher Qualität sind, werden wir dennoch Trades herausfiltern, die gegen den langfristigen Trend laufen. Dazu verwenden wir den 200-Perioden Exponential Moving Average (EMA). Dieser gleitende Durchschnitt ist ein weit verbreiteter langfristiger Trendindikator. Trades sollten nur dann getätigt werden, wenn die anderen drei Indikatoren mit dem 200 EMA übereinstimmen.

Indikatoren:

- 200 EMA (Gold)

- KronleuchterStops-v1

- Länge: 28

- ATR-Zeitraum: 18

- Kv: 3.5

- Bulls

- Zeitraum: 50

- Bären

- Zeitraum: 50

Zeitrahmen: 4-Stunden- und Tageskarten

Währungspaare: Dur- und Moll-Paare

Handelssitzung: Tokio, London und New York

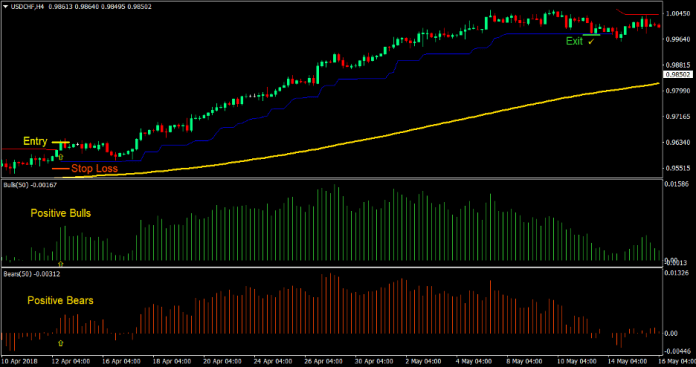

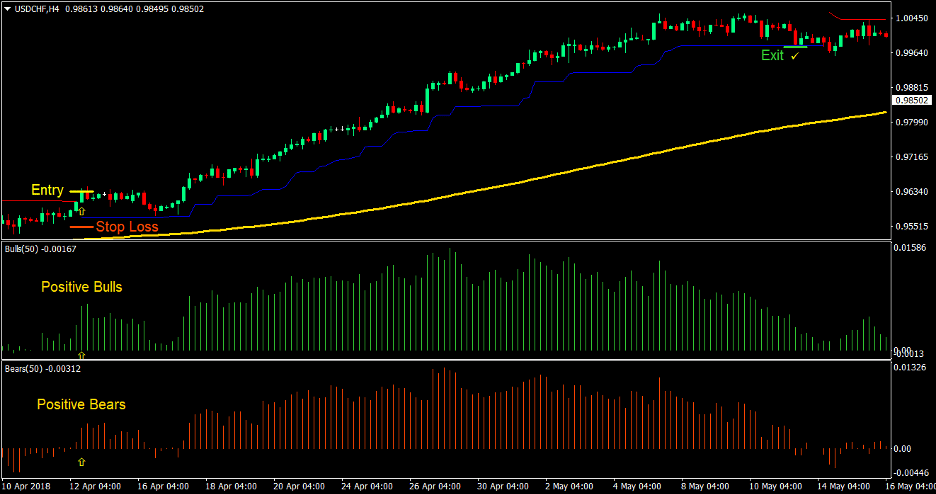

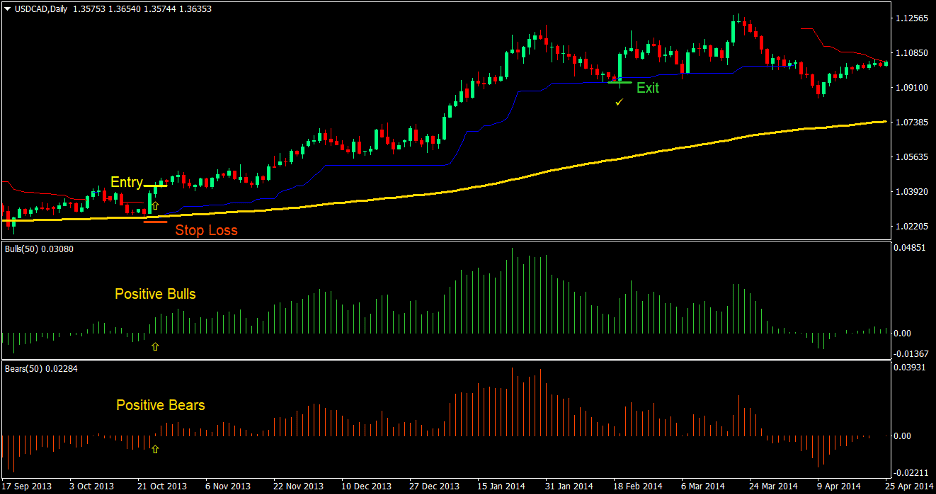

Trade-Setup kaufen

Eintrag

- Der Preis sollte über dem 200 EMA liegen, was auf einen zinsbullischen langfristigen Trend hindeutet

- Die Bulls and Bears Power-Indikatoren sollten positiv sein, was auf eine bullische Marktstimmung hindeutet

- Der Kronleuchter-Stopps-Indikator sollte eine blaue Linie unter der Preisbewegung drucken, was auf einen Aufwärtstrend hinweist

- Geben Sie bei Zusammentreffen der oben genannten Marktbedingungen einen Kaufauftrag ein

Stop-Loss

- Setzen Sie den Stop-Loss auf das Unterstützungsniveau unterhalb der Einstiegskerze

Beenden

- Verfolgen Sie den Stop-Loss unterhalb der blauen Kronleuchter-Stopp-Linie, bis der Stopp im Gewinn endet

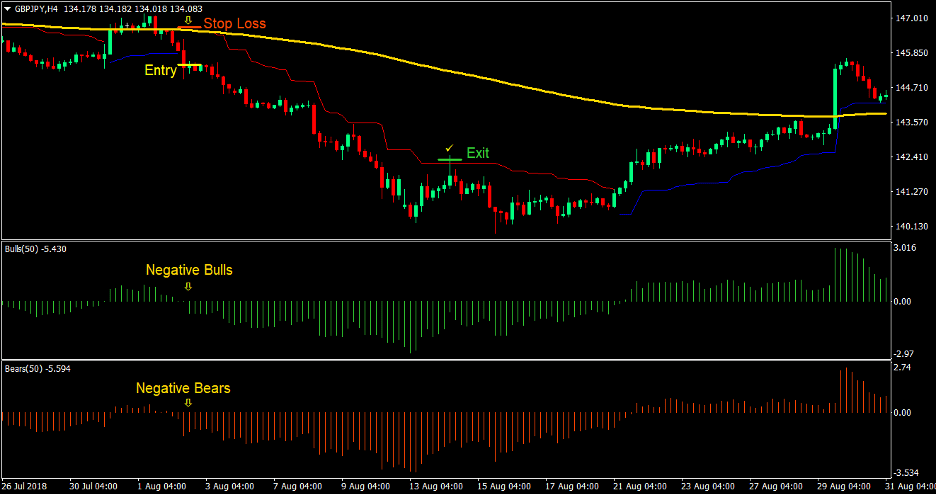

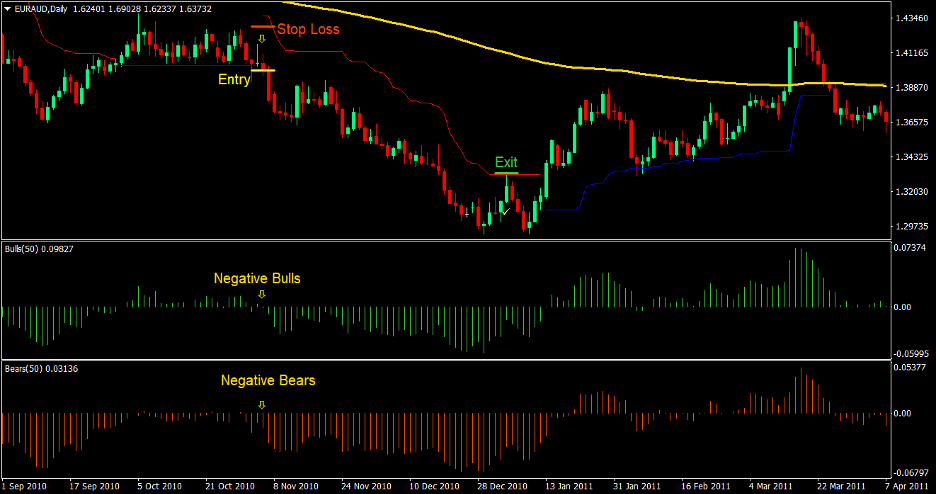

Handelseinrichtung verkaufen

Eintrag

- Der Preis sollte unter der 200 EMA liegen, was auf einen rückläufigen langfristigen Trend hindeutet

- Die Bulls- und Bears-Power-Indikatoren sollten negativ sein, was auf eine rückläufige Marktstimmung hindeutet

- Der Kronleuchter-Stopps-Indikator sollte eine rote Linie über der Preisbewegung drucken, was auf einen rückläufigen Trend hinweist

- Geben Sie einen Verkaufsauftrag ein, wenn die oben genannten Marktbedingungen zusammentreffen

Stop-Loss

- Stellen Sie den Stop-Loss auf das Widerstandsniveau über der Einstiegskerze ein

Beenden

- Verfolgen Sie den Stop-Loss über der roten Linie der Kronleuchter-Stops, bis der Stopp im Gewinn endet

Zusammenfassung

Diese Handelsstrategie ist eine anständig profitable Handelsstrategie. Die Gewinnquote ist recht ordentlich, da der Trend auf der Marktstimmung basiert und die Trades gefiltert werden, um sie an den langfristigen Trend anzupassen. Auf diese Weise nehmen wir Trades an, bei denen die Wahrscheinlichkeit größer ist, dass sie in die Richtung unseres Trades tendieren, da es weniger dynamische Unterstützungs- und Widerstände gibt, die die Trades überwinden müssen. Diese Handelsstrategie verfügt außerdem über ein faires Chance-Risiko-Verhältnis, das je nach Marktlage von 2:1 auf 4:1 steigen kann.

Empfohlene MT4-Broker

XM-Vermittler

- Gratis $ 50 Um sofort mit dem Handel zu beginnen! (Auszahlbarer Gewinn)

- Einzahlungsbonus bis zu $5,000

- Unbegrenztes Treueprogramm

- Preisgekrönter Forex-Broker

- Zusätzliche exklusive Boni Während des ganzen Jahres

>> Melden Sie sich hier für ein XM-Broker-Konto an <

FBS-Broker

- Tauschen Sie 100 Bonus: Kostenlose 100 $, um Ihre Handelsreise anzukurbeln!

- 100% Deposit Bonus: Verdoppeln Sie Ihre Einzahlung auf bis zu 10,000 $ und handeln Sie mit erhöhtem Kapital.

- Nutzen Sie bis zu 1: 3000: Maximierung potenzieller Gewinne mit einer der Optionen mit der höchsten verfügbaren Hebelwirkung.

- Auszeichnung als „Bester Kundenservice-Broker Asiens“.: Anerkannte Exzellenz in der Kundenbetreuung und im Service.

- Saisonale Sonderangebote: Genießen Sie das ganze Jahr über eine Vielzahl exklusiver Boni und Aktionsangebote.

>> Melden Sie sich hier für ein FBS-Brokerkonto an <

Klicken Sie hier unten, um herunterzuladen: