Support og modstandsområde Bounce Forex-strategi

"Se til venstre!" Det er en af de enkleste, men dybe tanker, du kunne få i handelsverdenen. Hvorfor? Fordi handel ved hjælp af teknisk analyse simpelthen handler på markederne ved hjælp af historisk information.

De fleste handlende handler baseret på tekniske indikatorer, og det er helt fint. Hvis en erhvervsdrivende har en fordel i forhold til markedet ved at bruge en kombination af haltende indikatorer, så er det fint. Hver til sit. Men handel baseret på, hvad prisen har gjort på prisdiagrammet, giver handlende de rå data om, hvor markedet tidligere så, at prisen var for dyr eller billig. Derfor kigger vi til venstre.

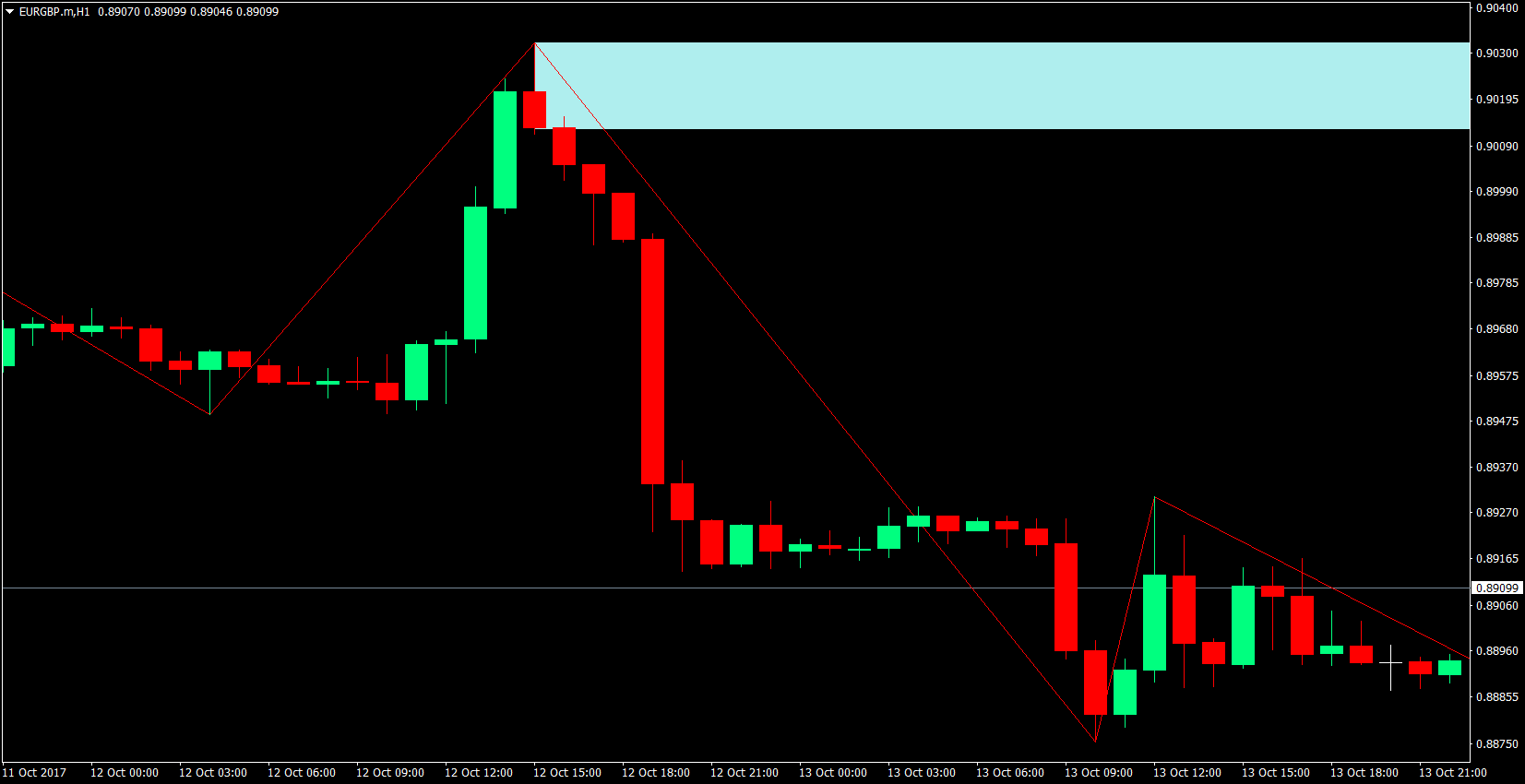

Læg mærke til, hvordan prisen normalt respekterer områder, hvor markedet mente, at prisen var for dyr eller for billig, og derfor omvendt. Prisen vender normalt i det samme område, fordi mange handlende tidligere besluttede, at prisen var billig eller dyr og derfor købte eller solgte.

Disse områder kaldes vandrette understøtninger og modstande. Støtter og modstande kunne antage mange former. Det kunne være diagonalt ved hjælp af diagonale trendlinjer. Det kunne være dynamisk ved hjælp af glidende gennemsnit. Eller det kunne være vandret, som det er vist ovenfor.

Fordelen ved vandrette understøtninger og modstande er dog, at du i modsætning til trendlinjebaseret diagonal støtte og modstande ikke behøver at forbinde to høje eller lave niveauer for at begynde at observere det som en mulig støtte eller modstand. Du skal blot have en høj eller lav, og udvide dens område til højre. Dette giver dig fordelen ved at vide, hvornår og hvor du skal observere prisens adfærd.

Jeg foretrækker også at se på disse støtter og modstande som et område. Prisen er så dynamisk, fordi den flyttes af millioner af handlende, der handler med valutaparret over hele verden og af forskellige årsager. Af denne grund stopper prisen normalt ikke ved nøjagtige punkter. Derfor mener jeg, at vi bør se på vandrette områder, ikke linjer.

ZigZag-værktøjet

Korrekt identificering af højder og nedture er en færdighed, der læres gennem øvelse og skærmtid. Selv erfarne handlende finder det svært, fordi det ofte er subjektivt. Men der er ingen grund til bekymring. Der er et værktøj, som vi kunne bruge til at gøre tingene lettere for os. ZigZag-indikatoren.

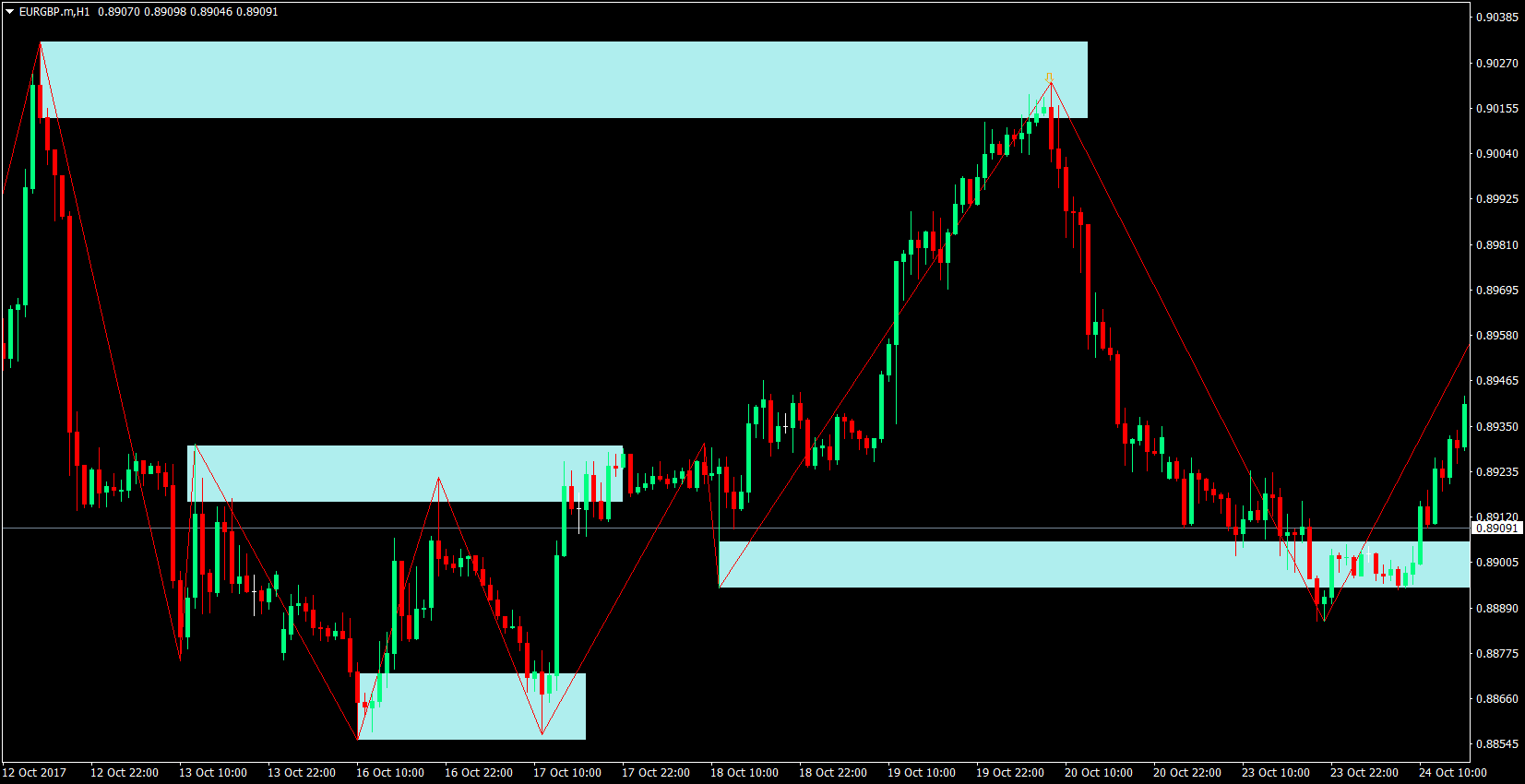

ZigZag-indikatoren forbinder op- og nedture og skaber en zigzaggende linje på tværs af prisdiagrammet. Dette gør det nemmere for handlende at identificere op- og nedture.

Sådan handler du ved hjælp af støtte- og modstandsområder

Det første trin er at identificere op- og nedture på diagrammet ved hjælp af ZigZag-indikatoren. For at identificere højden af området, der skal forlænges på en gynge høj, vil vi inkludere den høje repræsenteret af den øvre væge op til kroppen af stearinlyset. På en gynge lav, vil vi inkludere det lave af stearinlyset op til dets krop.

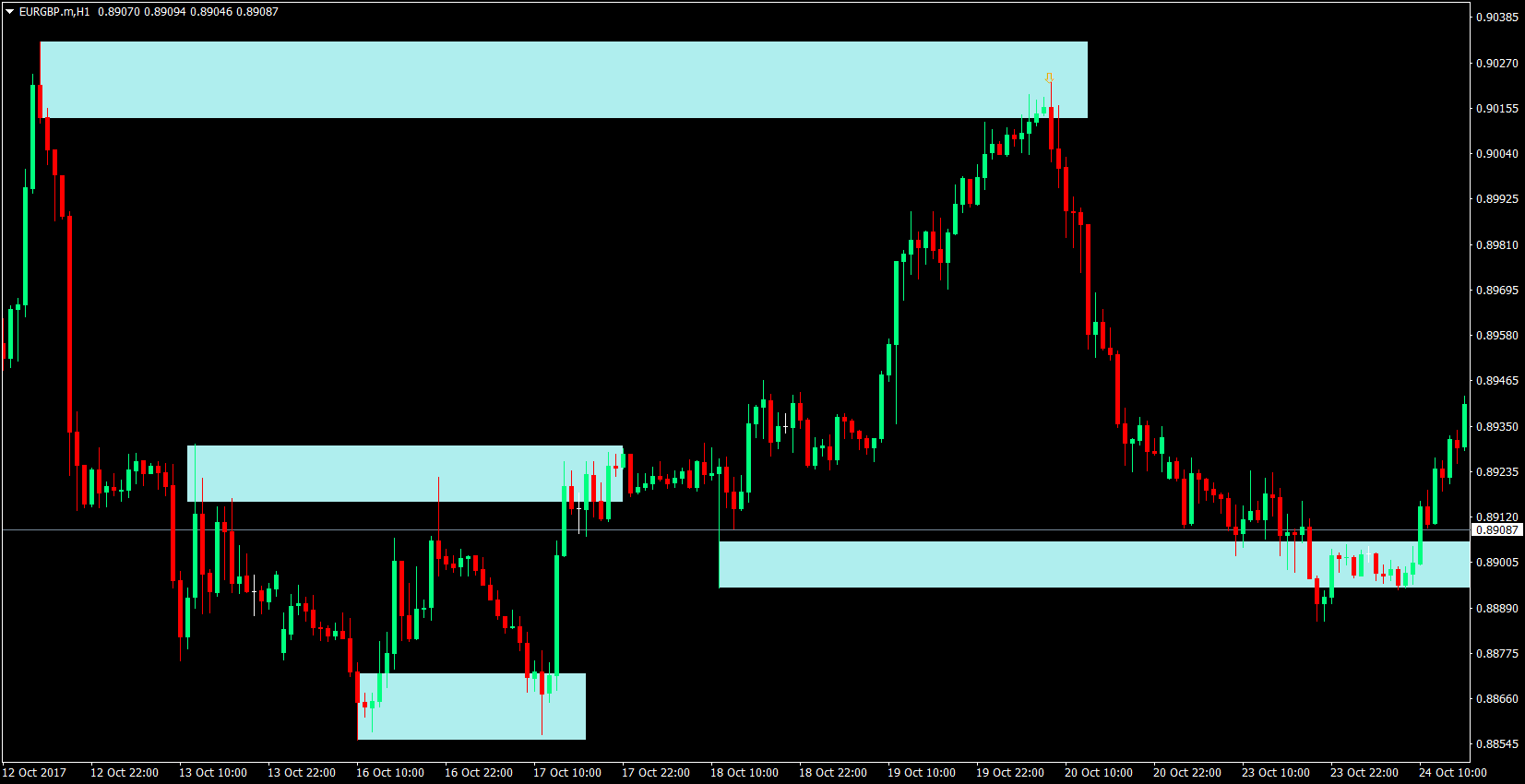

Så bør vi identificere de understøtninger og modstande, der endnu ikke var gennembrudt efter pris. Områder, der var gennembrudt, skulle fjernes, mens områder, der endnu ikke var gennembrudt, skulle blive. Af dem, der ikke blev fjernet, fordi prisen endnu ikke er brudt igennem den, er den støtte og modstand, der støder mest op til den nuværende pris, de eneste to støtte og modstand, der bør forblive på diagrammet.

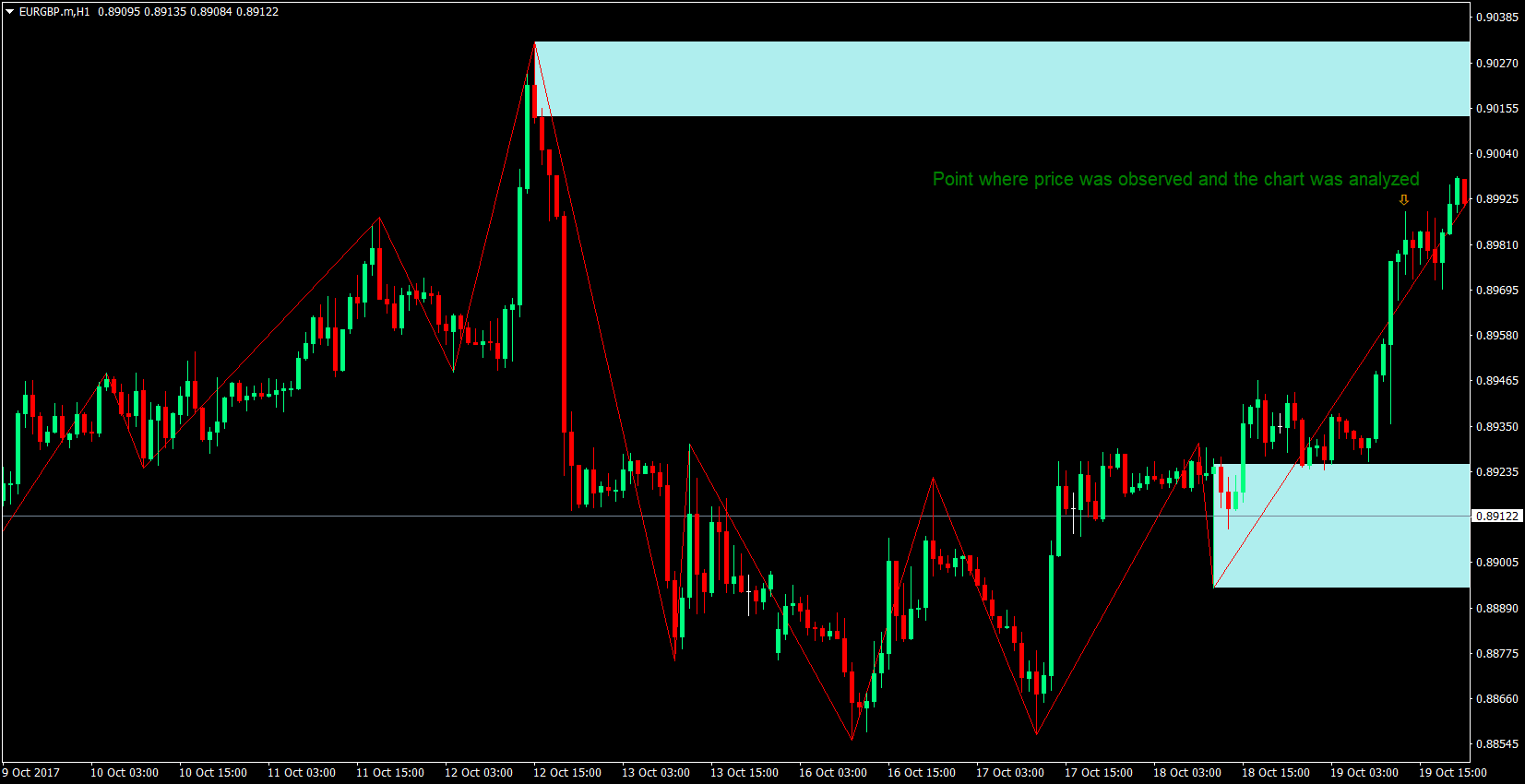

For eksempel begyndte vi at analysere diagrammet på det punkt, der er angivet ovenfor. Diagrammet skal se ud som det, der er vist ovenfor efter analysen. Kun områder, der ikke var gennembrudt af pris, og som er tættest på den nuværende pris, er tilbage som områder med støtte og modstand.

Den sidste ting, vi bør gøre, er at vente på, at prisen når et af disse områder, og observere, hvordan prisen reagerer på disse områder.

Så snart prisen når et af disse områder, udskriver et vendelys og lukker under det på en modstandsområdesreaktion, eller over det for en støtteområdereaktion, har vi en handelsopsætning og kunne gå ind i handelen.

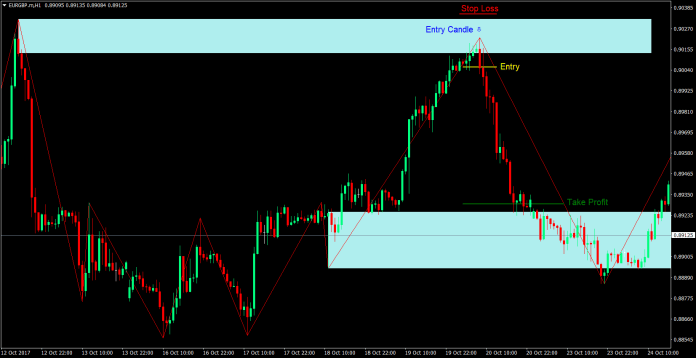

Handelsopsætningen: Entry, Stop Loss & Take Profit

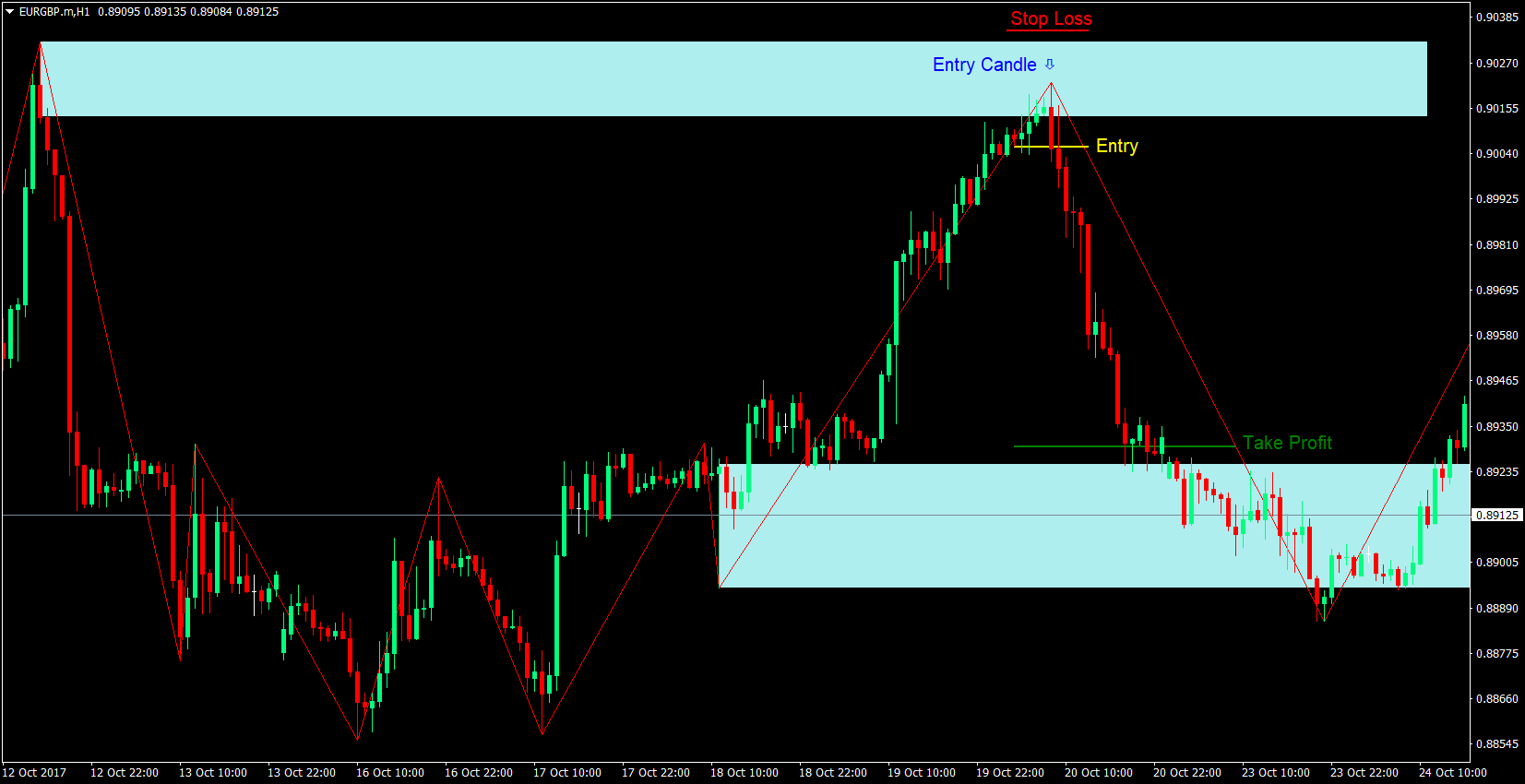

På denne handelsopsætning rørte prisen modstandsområdet og reagerede på det. Derfor har vi et salgs-setup.

Sælg indgang: Så snart prisen rørte modstandsområdet, reagerede på det og lukkede under modstandsområdet med et bearish stearinlys, går vi ind i handelen.

Stop Loss: Stoptabet skal være et par pips over modstandsområdet.

Target Take Profit: Målet for take-profit bør være et par punkter over det nærmeste ubrudte støtteområde.

Konklusion

Dette er en af de mest logisk forsvarlige strategier, som en erhvervsdrivende kunne have. Det handler grundlæggende på områder, hvor prisen tidligere blev anset for at være for høj eller for lav.

Ved at gøre dette behøver handlende ikke at jage efter prisen. I stedet for at gå ind i en jagttilstand, kommer handlende ind i en ventetilstand, som en snigskytte, der venter på, at prisen kommer ind i sit trådkors og går ind i handlen på det nøjagtige område, hvor den erhvervsdrivende forventer, at prisen vil vende.

Disse typer handler bør dog udføres ordentligt. Der er tidspunkter, hvor prisen ikke preller af området, men i stedet bryder igennem det. Derfor, ligesom en snigskytte gør, er den vigtigste egenskab, som handlende bør have, tålmodighed. Vi burde vente på, at lyset lukker. Ved at gøre dette undgår vi handler med mislykkede opsætninger.

En anden ting at være opmærksom på er at beregne risikobelønningsforholdet, før du går ind i handelen. Nogle støtte- og modstandsområder er for brede, hvilket får stoptabet til også at være for bredt. Dette er fint, hvis det næste område med støtte eller modstand er langt fra indgangen, hvilket giver mulighed for et positivt risikobelønningsforhold. Men hvis stop-losset er for bredt, og målet for take-profit er for lavt, kan det være klogt ikke at gå ind i en handel med lav risiko-belønning.

Alt i alt er denne type handelsopsætning en god strategi. Kombiner det med andre strategier, der hjælper med at identificere tilbageførsler, så kan det være mere kraftfuldt.

Anbefalet MT4 Broker

- Gratis $ 50 For at begynde at handle med det samme! (Udtrækbar fortjeneste)

- Indbetalingsbonus op til $5,000

- Ubegrænset loyalitetsprogram

- Prisvindende Forex Broker

- Yderligere eksklusive bonusser Gennem året

Klik her nedenfor for at downloade: