Gennemsnitlige vendingshandelsstrategier er ikke så populære som andre typer handelsstrategier. De fleste handlende ville ofte gå efter momentum handelsstrategier, breakout-handelsstrategier, trendfølgende strategier eller trendvendende handelsstrategier.

Men på trods af at de ikke er så populære som andre typer af strategier, er middeltilbageførselshandelsstrategier en af de mere effektive typer strategier. Dette skyldes, at middeltilbageførselsstrategier fungerer godt under forskellige typer handelsbetingelser. Det kan bruges på forskellige markeder og trendmarkeder, hvilket giver mulighed for, at handler tages i retning af trenden.

Gennemsnitlige vendingsstrategier har nogle ligheder med fuldblæste trendvendingsstrategier. Begge strategier sigter mod at sælge på top og købe på bund. Forskellen ligger i den type tendenser, der forventes at vende. Mens trendreverseringsstrategier er rettet mod vendinger fra en længerevarende trend, er gennemsnitlige vendingsstrategier rettet mod kortsigtede vendinger forårsaget af ubalancen mellem overkøbte eller oversolgte markeder. Disse prisekstremer får ofte prisen til at vende tilbage til middelværdien, hvilket forårsager en kortsigtet vending.

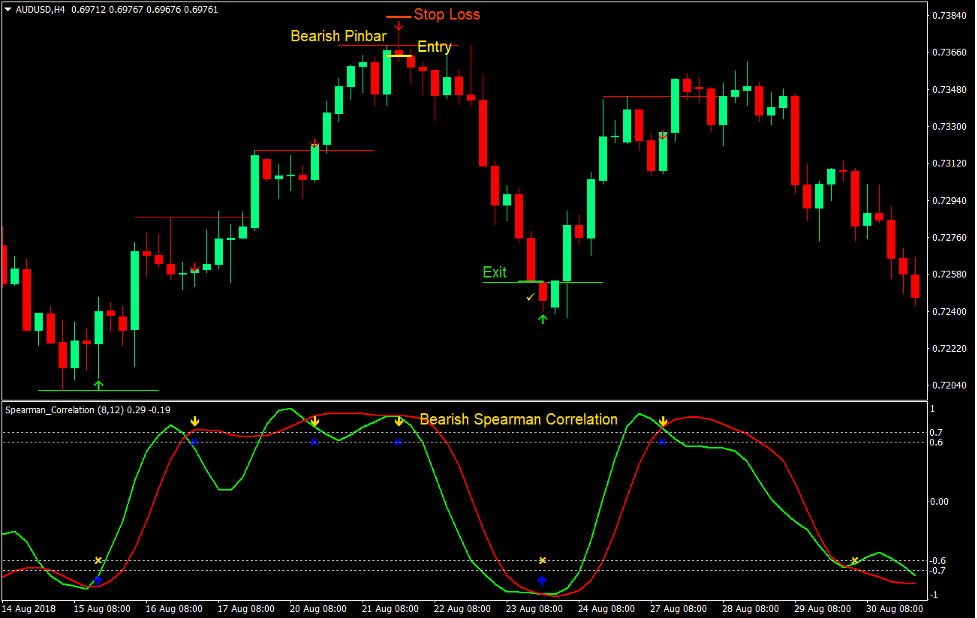

Pin Bar Korrelation Tilbageførsel Forex Trading Strategi er en kortsigtet middel omvendt handel strategi. Den identificerer overkøbte og oversolgte forhold ved hjælp af en unik indikator. Den udpeger også sandsynlige vendingsprispunkter og det faktiske vendingssignal, hvilket gør handelen meget lettere.

Spearman Korrelation

Spearmans rangkorrelationskoefficient eller Spearmans rho, opkaldt efter Charles Spearman, er en type korrelation, der bruges i statistik, som er et ikke-parametrisk mål for rangkorrelation. Dette vedrører den statistiske afhængighed mellem rangeringen af to variable.

Denne metode til statistisk korrelation anvendes derefter til handel og udvikles som en teknisk indikator.

Spearman-korrelationsindikatoren korrelerer prisbevægelsen og et simpelt bevægeligt gennemsnit (SMA). Fordi SMA er afledt af prisbevægelser, er det naturligt, at de to er direkte korrelerede. Den interessante del er dog, at hvis Spearman-korrelationslinjen er plottet på et vindue sammen med SMA-linjen, kunne der observeres en effektiv oscillerende indikator.

Denne oscillerende indikator deler de samme egenskaber som den stokastiske oscillator. Den har to linjer, der oscillerer i et interval mellem -1 og 1. Den hurtigere linje er Simple Moving Average, mens den langsommere linje er Spearman Correlation-linjen afledt af SMA.

Da linjerne svinger inden for et interval, kunne overkøbte og oversolgte forhold let observeres. I denne opsætning betragtes linjer over 0.7 som overkøbte, og linjer under -0.7 betragtes som oversolgte. Gennemsnitlige vendings-handelssignaler genereres, når linjerne krydser hinanden, mens de er overkøbt eller oversolgt.

Indikatoren identificerer også sandsynlige overbelastningspriser, når de to linjer begynder at trække sig sammen, mens de er overkøbt eller oversolgt. Dette giver handlende en tidlig indikation af, hvor prisen kan vende på kort sigt.

Trading Strategi

Denne handelsstrategi giver handelssignaler baseret på Spearman Correlation-indikatoren.

For at bruge denne strategi bør linjerne på Spearman Correlation-indikatoren angive en overkøbt eller oversolgt markedstilstand. Indikatoren skal også markere det område, som prisen kan afvise.

Handelssignaler anses for at være gyldige, når et pin bar prismønster opstår i sammenløb med et indgangssignal leveret af Spearman Correlation-indikatoren.

Indikatorer:

- Korrelation-mt4-indikator (standardindstilling)

Foretrukne tidsrammer: 15-minutters, 30-minutters, 1-timers og 4-timers diagrammer

Valuta Par: dur og mol par

Handelssessioner: Tokyo, London og New York parrer

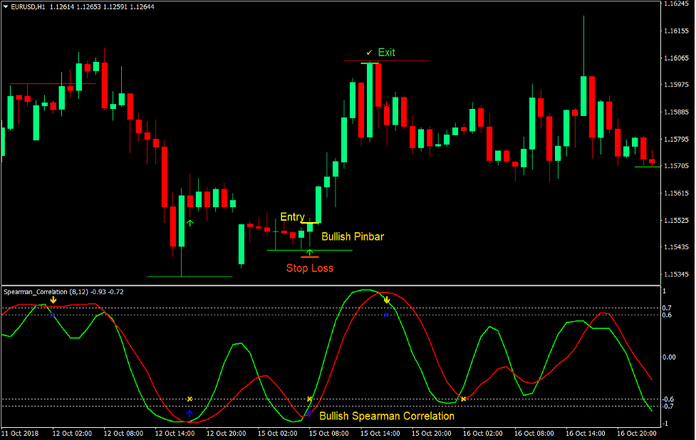

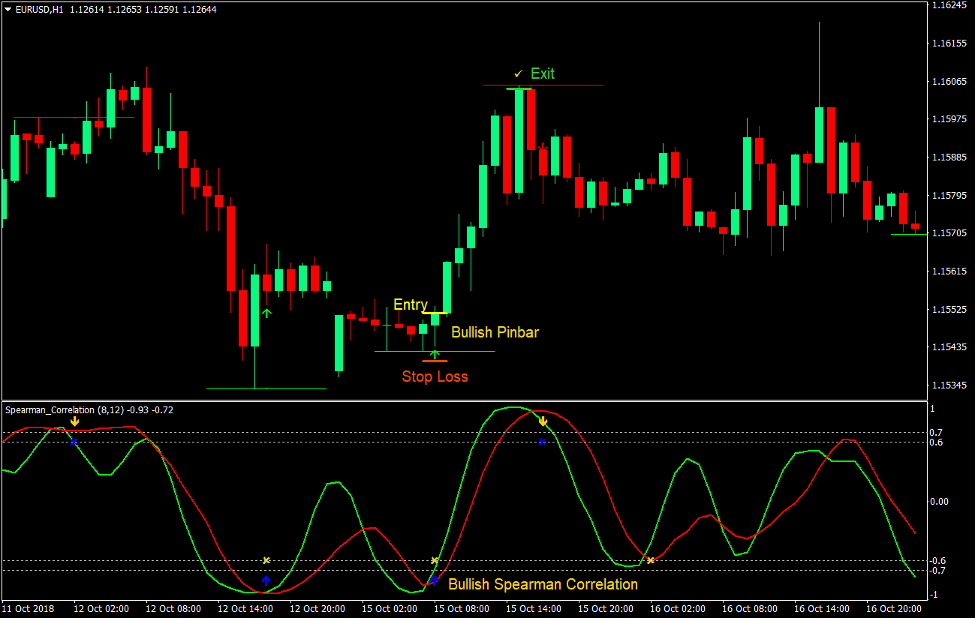

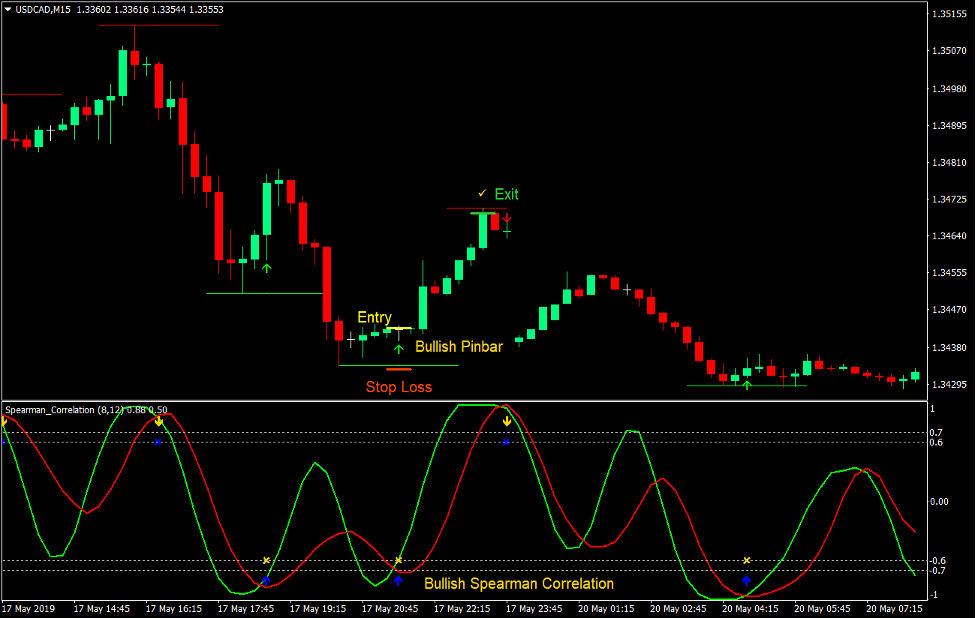

Køb Trade Setup

Indgang

- Spearman Correlation-linjerne skal begge være under -0.7, hvilket indikerer en oversolgt tilstand.

- Indikatoren skal markere en limelinje på prisdiagrammet, der angiver det område, hvor prisen kan vende.

- Prisen skal røre kalklinjen.

- Indikatoren skal give et indgangssignal angivet med en pil, der peger opad.

- Det stearinlys, der svarer til indgangssignalet, skal være et bullish pin bar stearinlys.

- Indtast en købsordre på bekræftelsen af disse betingelser.

Stop Loss

- Indstil stop losset under indgangslyset.

- Indstil stoptabet under kalklinjen.

Udgang

- Luk handlen, så snart et stearinlys rører den røde linje markeret med indikatoren.

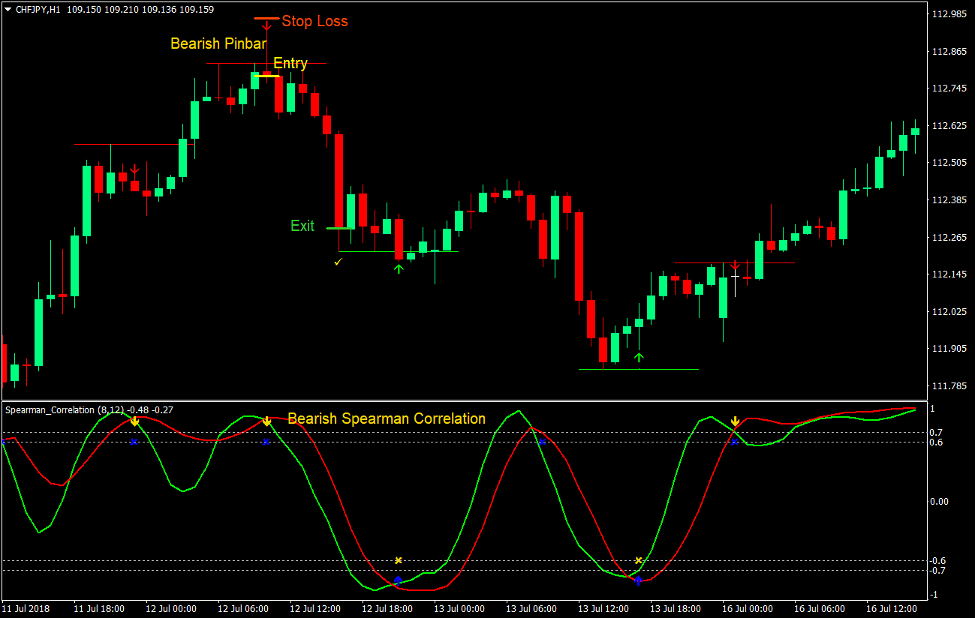

Sælg handelsopsætning

Indgang

- Spearman-korrelationslinjerne skal begge være over 0.7, hvilket indikerer en overkøbt tilstand.

- Indikatoren skal markere en rød linje på prisdiagrammet, der angiver det område, hvor prisen kan vende.

- Prisen skal røre den røde linje.

- Indikatoren skal give et indgangssignal angivet med en pil, der peger nedad.

- Det stearinlys, der svarer til indgangssignalet, skal være et bearish pin bar stearinlys.

- Indtast en salgsordre ved bekræftelsen af disse betingelser.

Stop Loss

- Indstil stop losset over indgangslyset.

- Indstil stop loss over den røde linje.

Udgang

- Luk handlen, så snart et stearinlys rører kalklinjen markeret med indikatoren.

Korrelation

Gennemsnitlige vendingsstrategier er en af de mest effektive typer handelsstrategier, og denne opsætning af et middel vendingssignal er et af de mest nøjagtige signaler.

Hvis du visuelt ville observere historiske priser, ville du bemærke, hvordan prisen ofte ville følge retningen fra indikatoren baseret på oscillationen af de to linjer. Prisen vil typisk vende til nedadgående, når et signal genereres, mens det overkøbes, og prisen vil også vende til opsiden, når et købssignal genereres, mens det bliver oversolgt.

Der er dog tilfælde, hvor signaler genereres, og prisen ville give nogle indikationer på en overbelastning, som kan føre til en kortsigtet vending, men prisen vil fortsætte sin oprindelige trendretning. Dette er grunden til, at det stadig ville være smart at tilpasse handelsopsætninger til den langsigtede tendens.

Samlet set er denne strategi meget effektiv og kan give ensartet overskud på lang sigt. Mestrer dette, og du kan være på vej til konsekvent overskud.

Anbefalede MT4-mæglere

XM Broker

- Gratis $ 50 For at begynde at handle med det samme! (Tilbagetrækbar fortjeneste)

- Indbetalingsbonus op til $5,000

- Ubegrænset loyalitetsprogram

- Prisvindende Forex Broker

- Yderligere eksklusive bonusser Gennem året

>> Tilmeld dig XM Broker-konto her <

FBS mægler

- Handel 100 bonus: Gratis $100 for at kickstarte din handelsrejse!

- 100% indbetalingsbonus: Fordoble dit indskud op til $10,000, og handel med øget kapital.

- Udnyttelse op til 1: 3000: Maksimering af potentielle overskud med en af de højeste gearingsmuligheder, der findes.

- Prisen 'Bedste kundeservicemægler Asia': Anerkendt ekspertise inden for kundesupport og service.

- Sæsonbestemte kampagner: Nyd en række eksklusive bonusser og kampagnetilbud hele året rundt.

>> Tilmeld dig FBS Broker-konto her <

Klik her nedenfor for at downloade: