Trendfortsættelsesstrategier er nogle af de mest pålidelige handelsstrategier. Dette skyldes, at trendfortsættelsesstrategier ikke går imod trenden, men i stedet handler på de tilbagetrækninger, som udvikler sig, efterhånden som trenden skrider frem.

Denne strategi er en simpel trendfortsættelsesstrategi, som bruger to pålidelige trendfølgende indikatorer.

Non Lag Dot Indicator

Non Lag Dot Indicator blev udviklet som en udbuds- og efterspørgselsindikator, der indikerer mulig trendvending og trendretning baseret på de dominerende markedskræfter. Hvis du nøjes med Non Lag Dot Indicator, vil du observere, at det er en trend efter teknisk indikator, som identificerer og angiver den kortsigtede trendretning.

Non Lag Dot Indicator angiver trendretning ved at plotte prikker på prisdiagrammet. Disse prikker har en tendens til at følge prishandlingen ganske tæt. Farven på prikkerne angiver også retningen af momentum. Den plotter grønne prikker for at angive en bullish trendretning, og magenta prikker for at angive en bearish trendretning.

Non Lag Dot Indicator er baseret på en underliggende glidende gennemsnitslinje, som prikkerne følger. Den sammenligner derefter værdien af den aktuelle prik med den foregående prik. Den plotter en grøn prik, når den aktuelle prik har en højere værdi end den foregående prik, og en magenta prik, når den aktuelle prik har en lavere værdi sammenlignet med den foregående prik. Det er også meningen, at den skal plotte grå prikker, når prikkerne har samme værdi som dens foregående prik. Dette scenarie forekommer dog ikke ofte.

Hvis du ville overveje konceptet bag denne indikator nøje, ville du indse, at det er baseret på konceptet med at bruge hældningen af glidende gennemsnitslinjer som grundlag for at identificere trendretning, hvor trenden er bullish, når den glidende gennemsnitslinje hælder opad , og bearish, når den glidende gennemsnitslinje hælder nedad.

Handlende kan bruge farven på prikken som grundlag for at identificere trendretning og bruge indikatoren som et trendretningsfilter. I sådanne tilfælde kan handlende undgå at handle mod trendens retning ved at undgå handler, der går imod trenden angivet af Non Lag Dot Indicator.

Når du bruger forudindstillingen af denne indikator, kan denne indikator fungere godt som en trend-vendende signalindikator baseret på den kortsigtede trend. Handlende kan bruge ændringen af farven på prikkerne som et trendvendingssignal og åbne handler baseret på det. Dette anvendes dog bedst i sammenhæng med en langsigtet trend eller anden teknisk analyseindikation.

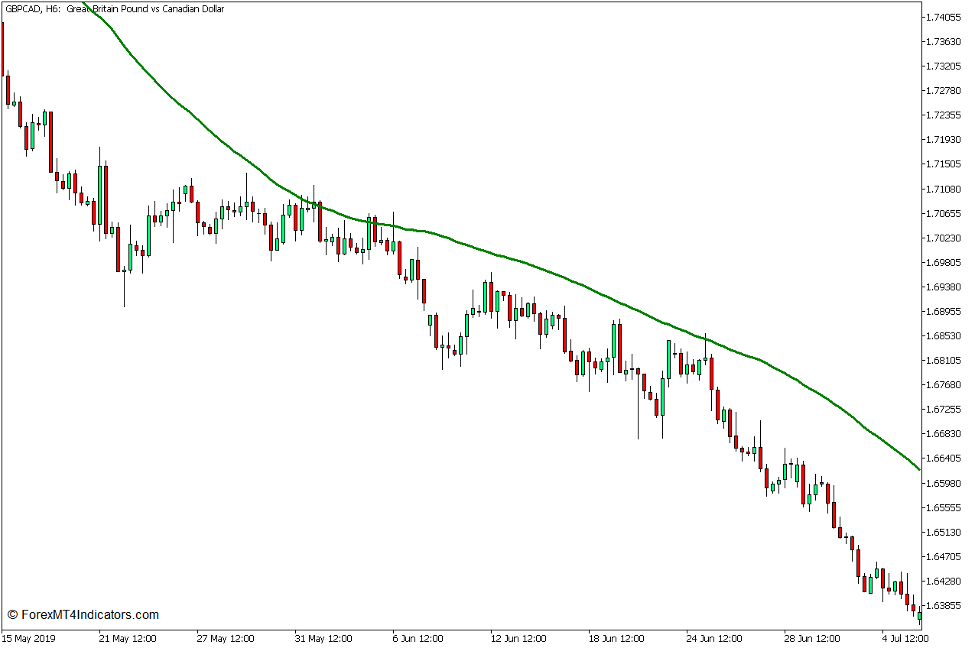

50 Simpelt glidende gennemsnit

50 Simple Moving Average (SMA)-linjen er en af de mest udbredte glidende gennemsnitslinjer. Det er faktisk almindeligt accepteret som en væsentlig indikation af den mellemlange tendens.

Der er mange erfarne forhandlere, der bruger 50 SMA-linjen som grundlag for at identificere hovedtrendretningen. Faktisk er der også mange erfarne handlende, som aldrig ville handle mod 50 SMA-linjen som en del af deres handelsregler.

Der er et par måder, hvorpå handlende identificerer trendretning baseret på 50 SMA-linjen. Man ville være baseret på, hvor prishandling generelt er i forhold til 50 SMA-linjen. Tendensen betragtes som bullish, når prishandlingen generelt er over 50 SMA-linjen, og bearish, når prishandlingen generelt er under 50 SMA-linjen.

En anden mulighed ville være at identificere trendretning baseret på hældningen af 50 SMA-linjen. 50 SMA-linjen følger, hvor prishandling generelt er. Som sådan har den også en tendens til at krølle og hælde i retning af, hvor prishandlingen er. Så handlende kan også identificere trendretning baseret på hældningen af 50 SMA-linjen. Tendensen er bullish, når den hælder op, og bearish, når den hælder ned.

Bortset fra dette kan 50 SMA-linjen også være nyttig som en dynamisk støtte- eller modstandslinje. Prisen har en tendens til at hoppe af den eller området omkring den efter en retracement, når markedet trender i én retning.

50 SMA-linjen er en indbygget indikator på MT5-platformen, som kan tilgås som Moving Average Indicator. Brugere skal blot ændre de forudindstillede input, hvor Perioden er indstillet til 50 barer, og metoden er indstillet til Simple.

Handelsstrategikoncept

Denne handelsstrategi er en trendfortsættelsesstrategi, som er baseret på tilpasningen af mellem- og kortsigtede tendenser.

Mid-term trendretningen er baseret på 50 SMA-linjen. Dette vil være baseret på, hvor prishandlingen generelt er i forhold til 50 SMA-linjen, samt retningen af dens hældning.

Brugere bør derefter vente på, at prishandlingen trækker sig tilbage, hvilket ville få Non Lag Dots til midlertidigt at skifte farve i modstrid med trendretningen for 50 SMA-linjen.

Non Lag Dots bør derefter vende tilbage til den farve, der korrelerer med trendretningen for 50 SMA-linjen, når tilbagetrækningen slutter, og trenden fortsætter. Dette ville så være vores signal om, at tendensen fortsætter og ville være vores indgangssignal.

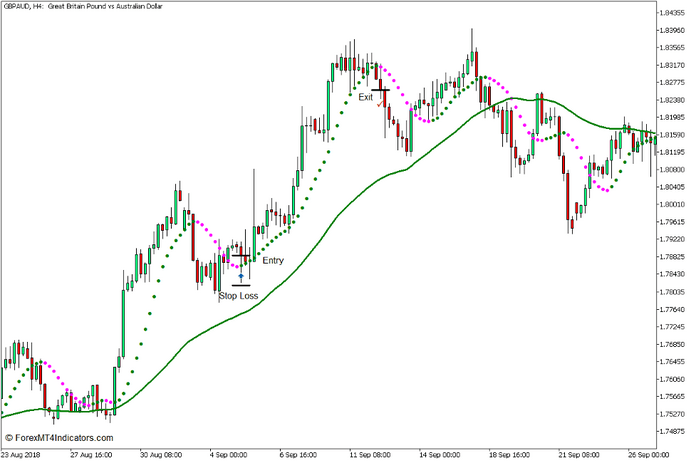

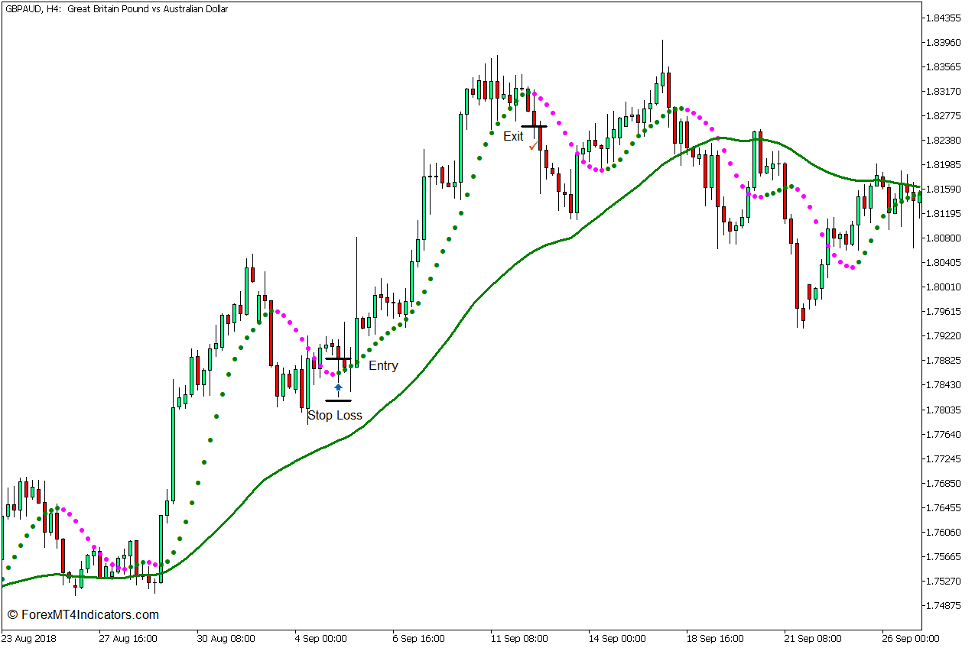

Køb Trade Setup

Indgang

- Prishandling bør generelt være over 50 SMA-grænsen.

- 50 SMA-linjen skal hælde opad.

- Prishandlingen skulle trække sig tilbage nær 50 SMA-linjen, hvilket får Non Lag Dots til midlertidigt at skifte til magenta.

- Åbn en købsordre, så snart Non Lag Dots skifter tilbage til grønne.

Stop Loss

- Indstil stop loss på støtten under indgangslyset.

Udgang

- Luk handelen, så snart Non Lag Dots skifter tilbage til magenta.

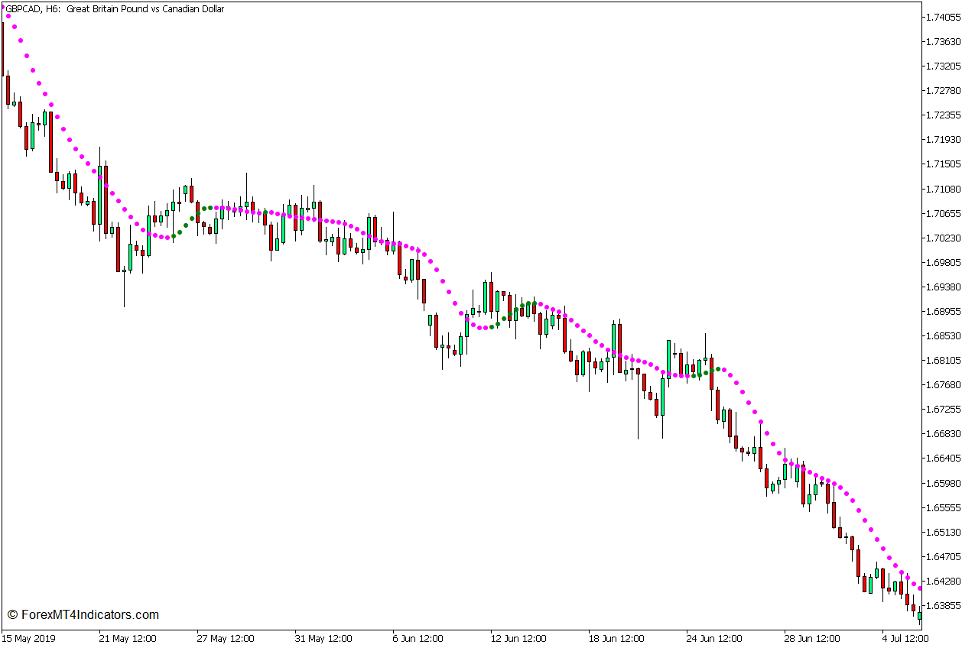

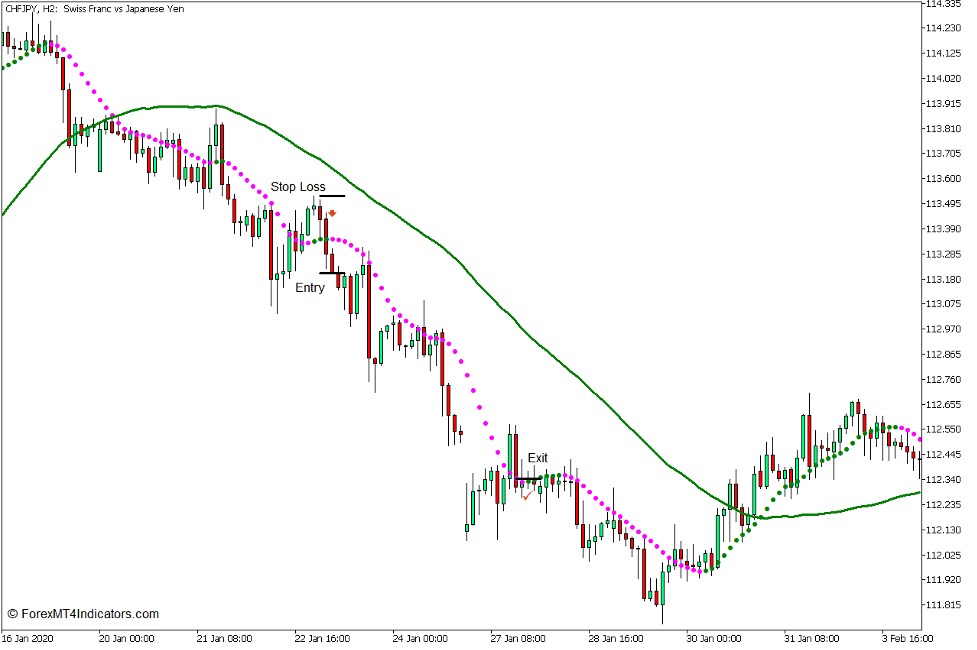

Sælg handelsopsætning

Indgang

- Prishandling bør generelt være under 50 SMA-grænsen.

- 50 SMA-linjen skal hælde nedad.

- Prishandling bør trække sig tilbage nær 50 SMA-linjen, hvilket får Non Lag Dots til midlertidigt at skifte til grønne.

- Åbn en salgsordre, så snart Non Lag Dots skifter tilbage til magenta.

Stop Loss

- Indstil stoptabet på modstanden over indgangslyset.

Udgang

- Luk handelen, så snart Non Lag Dots skifter tilbage til grønne.

Konklusion

Denne handelsstrategi kan være en effektiv trendfortsættelsesstrategi. Det fungerer bedst i starten af en ny trend, som kunne være den første eller anden tilbagetrækning på trenden. Jo længere tendensen er, jo større er sandsynligheden for, at den vil ende. Det er bedst at handle disse signaler på de første to tilbagetrækninger.

Anbefalede MT5-mæglere

XM Broker

- Gratis $ 50 For at begynde at handle med det samme! (Tilbagetrækbar fortjeneste)

- Indbetalingsbonus op til $5,000

- Ubegrænset loyalitetsprogram

- Prisvindende Forex Broker

- Yderligere eksklusive bonusser Gennem året

>> Tilmeld dig XM Broker-konto her <

FBS mægler

- Handel 100 bonus: Gratis $100 for at kickstarte din handelsrejse!

- 100% indbetalingsbonus: Fordoble dit indskud op til $10,000, og handel med øget kapital.

- Udnyttelse op til 1: 3000: Maksimering af potentielle overskud med en af de højeste gearingsmuligheder, der findes.

- Prisen 'Bedste kundeservicemægler Asia': Anerkendt ekspertise inden for kundesupport og service.

- Sæsonbestemte kampagner: Nyd en række eksklusive bonusser og kampagnetilbud hele året rundt.

>> Tilmeld dig FBS Broker-konto her <

Klik her nedenfor for at downloade: