Traders leder ofte efter spændende handelsstrategier, der giver dem mulighed for at tage flere handler på en given dag. Selvom det er spændingen ved at tjene penge, der trækker mange mennesker til at handle, er det netop denne form for adfærd, der forhindrer dem i at drage fordel af valutamarkederne. Hvis det er spænding, du leder efter, så gå hellere til et kasino. Men hvis det er at tjene penge, der gør dig interesseret, er Momentum Crossover Forex Trading Strategi måske lige noget for dig.

Momentum Crossover Forex Trading Strategy er en trendfølgende strategi, der giver handlende gode handelsindgange, der kommer fra momentumvendinger. Disse momentumvendinger giver handlende mulighed for at komme ind på markedet, så snart den nye trend er bekræftet.

Bevægende gennemsnitlige crossovers

Moving Average Crossovers er en af de mest grundlæggende typer handelsstrategier. Det er en simpel strategi, der let kan følges af enhver erhvervsdrivende, uanset om det er en erfaren veteran eller en nybegynder.

For at handle glidende gennemsnits-crossovers bruger handlende to glidende gennemsnit med forskellige parametre. Det kan variere afhængigt af typen af glidende gennemsnit, antallet af perioder, der er dækket af de glidende gennemsnit eller andre ændringer. Nøglen er at finde den rigtige parring af glidende gennemsnit, som giver handlende mulighed for at identificere mulige trendvendingspunkter. Et af de glidende gennemsnit skal repræsentere et kortere sigt eller et hurtigere glidende gennemsnit, mens det andet glidende gennemsnit skal være noget langsommere end det første. Efterhånden som tendenserne vender, har disse glidende gennemsnit også en tendens til at krydse hinanden på grund af ændringen af prisens retning.

Nogle handlende synes måske, at crossover-strategier er for grundlæggende og mangler spænding. Nogle handlende overser crossover-trendvendingsstrategier på grund af dens enkelhed. Handelssucces er dog ikke baseret på planens kompleksitet, men på planens potentiale til at give enorme overskud. Crossover-strategier kan være enkle, men med den rigtige opsætning er crossover-strategier i stand til at producere handler, der giver høj fortjeneste.

Yang Trader Indikator

Yang Trader-indikatoren er en brugerdefineret indikator, som har mange anvendelser til forskellige forhandlere. Denne indikator er hovedsageligt beregnet til at blive brugt af forhandlere med gennemsnitlig tilbagevenden, men kan også være meget nyttig for momentumhandlere.

Yang Trader er en oscillerende indikator, som tegner en linje, der er karakteristisk meget glat. Den har en oversolgt markør ved 15 og en overkøbt markør ved 80. Prisen anses for at vende tilbage fra en oversolgt position tilbage til gennemsnittet, når Yang Trader-linjen krydser over 15. Omvendt, når Yang Trader-linjen krydser under 80, er prisen anses for at vende tilbage fra en overkøbt tilstand.

Momentum-handlere på den anden side bruger Yang Trader-indikatoren anderledes. I stedet for at handle på den overkøbte og oversolgte gennemsnitlige vending, ville de vente på, at Yang Trader-linjen krydsede midterlinjen, som er 50. Dette kunne betragtes som mere en trendvending snarere end en midlertidig middelvending og opstår normalt når momentum af prisen skifter i den modsatte retning. En crossover over 50 betragtes som en bullish trendvending, mens en crossover under den betragtes som en bearish trendvending.

Trading Strategi

Denne trendvendende strategi er baseret på sammenløbet af en meget lydhør crossover-handelsopsætning og trendvendingssignalet fra Yang Traders brugerdefinerede indikator.

Til crossover-strategien vil vi bruge XMA-indikatoren og 24-perioders eksponentielt bevægende gennemsnit (EMA). XMA er et modificeret glidende gennemsnit, der hjælper handlende med at undgå falske indtastninger under ujævne markedsforhold, men det er også meget lydhør over for kortsigtede trendændringer. XMA vil blive brugt til at repræsentere den kortsigtede tendens. 24 EMA vil repræsentere den langsigtede tendens.

Hvad angår Yang Trader-indikatoren, vil vi lede efter dens linje til crossover 50 i retning af crossover. Dette ville indikere, at crossover-signalet er i samspil med skift af momentum baseret på Yang Trader-indikatoren.

Indikatorer:

- Xma

- 24-perioders eksponentielt glidende gennemsnit (guld)

- YangTrader

Tidsramme: helst 1-timers, 4-timers og daglige diagrammer

Valuta Par: dur og mol par

Handelssession: Tokyo, London og New York

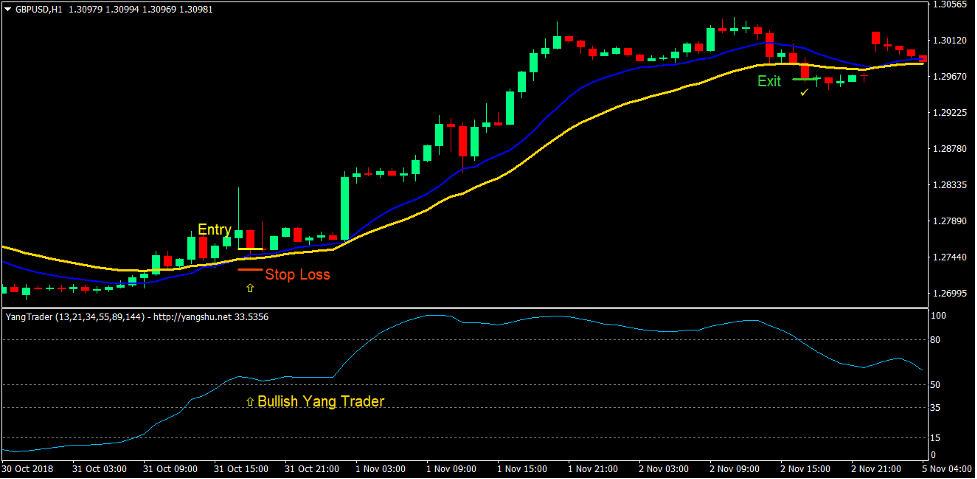

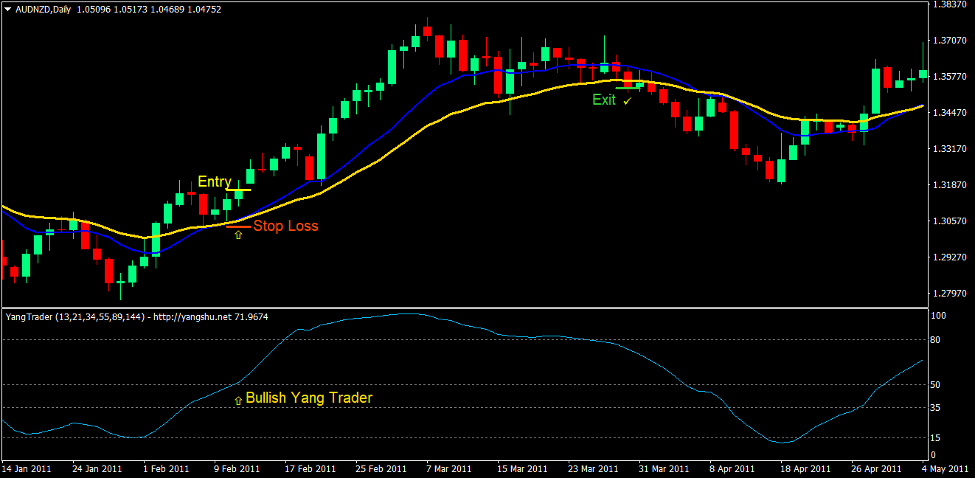

Køb Trade Setup

Indgang

- Yang Trader-indikatorlinjen bør krydse over 50, hvilket indikerer en bullish trendvending

- Den blå linje på XMA-indikatoren bør krydse over guldlinjen på 24 EMA, hvilket indikerer en bullish trendvending

- Disse bullish trendvendende signaler burde være en smule afstemt

- Indtast en købsordre på sammenløbet af ovenstående betingelser

Stop Loss

- Indstil stop loss på støtteniveauet under indgangslyset

Udgang

- Luk handlen, så snart prisen lukker under guldlinjen i 24 EMA

- Luk handelen, så snart Yang Trader-linjen krydser under 50

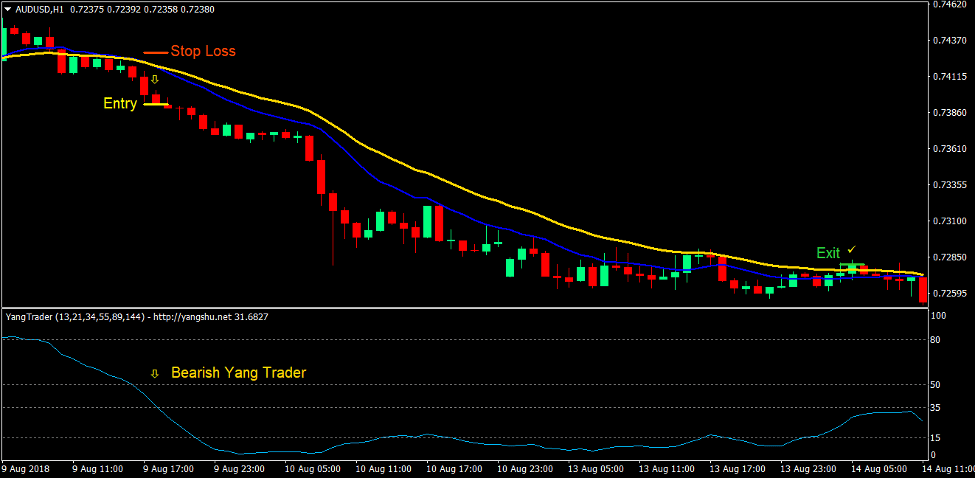

Sælg handelsopsætning

Indgang

- Yang Trader-indikatorlinjen bør krydse under 50, hvilket indikerer en bearhs-trendvending

- Den blå linje på XMA-indikatoren bør krydse under guldlinjen på 24 EMA, hvilket indikerer en bearish trendvending

- Disse bearish trendvendende signaler bør være en smule afstemt

- Indtast en salgsordre på sammenløbet af ovenstående betingelser

Stop Loss

- Indstil stoptabet på modstandsniveauet over indgangslyset

Udgang

- Luk handlen, så snart prisen lukker over guldlinjen i 24 EMA

- Luk handelen, så snart Yang Trader-linjen krydser over 50

Konklusion

Denne strategi fungerer bedst på trendende markedsforhold. Det er bedst at bruge denne type strategi på markeder, der har en stærk tendens til trend.

Denne strategi kan have nogle ulemper, når den bruges i et varierende markedsmiljø, hvilket er normalt for enhver trend efter strategitype. Det høje belønnings-risiko forhold kompenserer dog for sådanne tab. Det er ikke ualmindeligt at se handler, der kan returnere så meget som 3:1 belønning-risikoforhold ved hjælp af denne strategi.

Anbefalede MT4-mæglere

XM Broker

- Gratis $ 50 For at begynde at handle med det samme! (Tilbagetrækbar fortjeneste)

- Indbetalingsbonus op til $5,000

- Ubegrænset loyalitetsprogram

- Prisvindende Forex Broker

- Yderligere eksklusive bonusser Gennem året

>> Tilmeld dig XM Broker-konto her <

FBS mægler

- Handel 100 bonus: Gratis $100 for at kickstarte din handelsrejse!

- 100% indbetalingsbonus: Fordoble dit indskud op til $10,000, og handel med øget kapital.

- Udnyttelse op til 1: 3000: Maksimering af potentielle overskud med en af de højeste gearingsmuligheder, der findes.

- Prisen 'Bedste kundeservicemægler Asia': Anerkendt ekspertise inden for kundesupport og service.

- Sæsonbestemte kampagner: Nyd en række eksklusive bonusser og kampagnetilbud hele året rundt.

>> Tilmeld dig FBS Broker-konto her <

Klik her nedenfor for at downloade: