London-sessionens åbne er fuld af muligheder. Dette skyldes de iboende karakteristika ved London Open, som giver handlende mulighed for at få mest muligt for pengene. London Box Reversal-handelsstrategien er en, der giver overskud ud af valutamarkedet forårsaget af tilbageførsler under London-åbningen.

Før åbningen i London, etablerer eller sætter Tokyo-markedet normalt tonen for den kommende handelsdag. Det kan enten være en retningsbestemt bevægelse, der resulterer i et trendmarked, et fladt og roligt marked, der danner en rækkevidde, eller en fortsættelse af den foregående handelsdags retning.

Det meste af tiden ville handlende fra London også tage signaler fra handlende i Tokyo om, hvor de føler, at flytningen i løbet af dagen ville være. London Open er dog et andet udyr i sig selv. På grund af dets store størrelse, handelsvolumen og volatilitet kan markedet også lave en drastisk vending under London-åbningen. Der er mange tilfælde, hvor den tendens, der blev etableret under Tokyo-sessionen, ignoreres fuldstændigt under London-åbningen og vender øjeblikkeligt. Der er dog spor, der kunne give os en idé, hvis markedet kunne vende.

Som tidligere nævnt vil Tokyo-sessionen normalt etablere et interval, hvor markedet bevæger sig under den session. Dette er præget af intradag høj og lav under Tokyo-sessionen. Når prisen når disse områder, kan prisen reagere på et par måder. Det kan enten bryde ud eller hoppe af, da disse lav- og højdepunkter i løbet af dagen er naturlige understøtninger og modstande. Denne strategi tjener penge på tidspunkter, hvor markedet ville hoppe af fra disse støtter og modstande.

Forex Breakout Box

Forex Breakout Box er en skræddersyet indikator lavet specielt til London Opens potentiale til at bryde ud af eller hoppe af fra Tokyo-sessionens rækkevidde.

Det markerer det højeste høje og laveste lavpunkt under Tokyo-sessionen. Disse punkter markerer yderpunkterne i Tokyo-sessionens rækkevidde. Indikatoren, der tegner en karmosinrød boks, der markerer Tokyo-sessionens rækkevidde. Det udvider derefter dette område ved at oprette yderligere to kasser til at identificere London-sessionen, en blå og en anden orange.

Handelsstrategikoncept

Denne brugerdefinerede indikator er nyttig i de fleste tilfælde for GBP- og EUR-par. Det kan enten bruges til udbrud og vendinger. For denne strategi ville vi fokusere mest på tilbageførsler.

Ofte, da markedet danner en række under Tokyo-sessionen, ville markedet nogle gange have svært ved at bryde ud af Tokyo-sortimentet. Det ville ofte have et eller to besøg på området af højen. Så, efterhånden som London-markedet åbner, bliver markedets retning klar. Du vil ofte se markedet vende næsten øjeblikkeligt, når London-sessionen åbner. Til denne strategi vil vi dog gøre brug af et vindue på to timer. Det betyder, at vendingsopsætningen bør tage form inden for det tidsrum, der går fra London-åbningen.

Vendningsmønsteret er dybest set en pin bar, som viser en afvisning af toppen eller bunden af boksen, relativt tæt på starten af sessionen. Når den er zoomet ud eller placeret på en højere tidsramme, vil den også normalt danne en række vendingsmønstre, såsom dobbelte toppe og bunde eller tredobbelte toppe og bunde. Så snart vi identificerer et pin-bar-mønster inden for det tildelte vindue, tager vi handlen som en vending og sigter mod den anden ende af intervallet.

Indikatorer:

- forex-breakout-boks

Tidsramme: 5-min tidsramme; zoom ud til 15 minutter for at tjekke for et muligt vendemønster (valgfrit)

Valutapar: alle EUR- og GBP-par; fortrinsvis EURUSD, GBPUSD, EURJPY og GBPJPY

Handelssession: London kun åbent

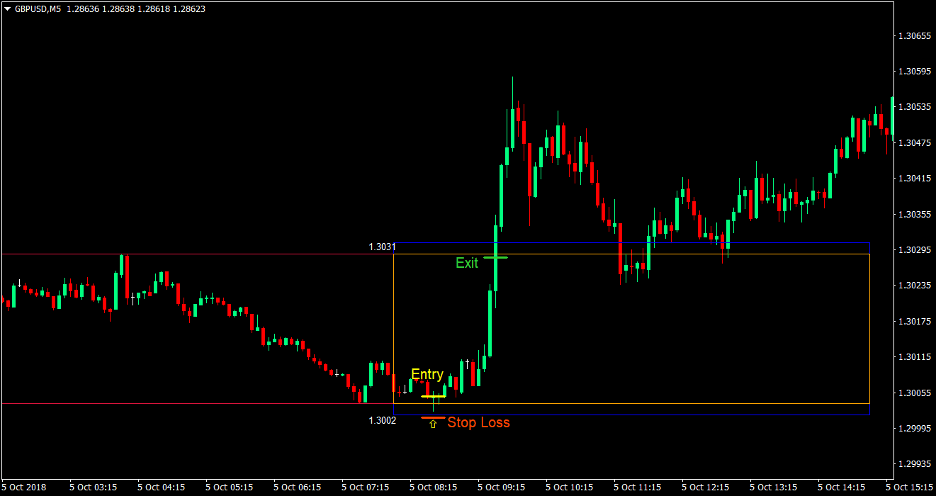

Køb (lang) handelsopsætning

Indgang

- Observer markedets adfærd i slutningen af Tokyo-sessionen, hvilket helst viser manglende evne til at bryde ud af en række

- Vent til prisen rører bunden af det orange rektangel

- Vent på, at prisen danner en bullish pin bar med halen rører ved støtteniveauet

- Afgiv en købsordre, så snart den bullish pin-bjælke dannes

Stop Loss

- Indstil stoptabet under indgangslyset og under den nederste linje i det blå rektangel

Tag Profit

- Indstil målet for at tage profit et par pips under den øverste linje af det orange rektangel

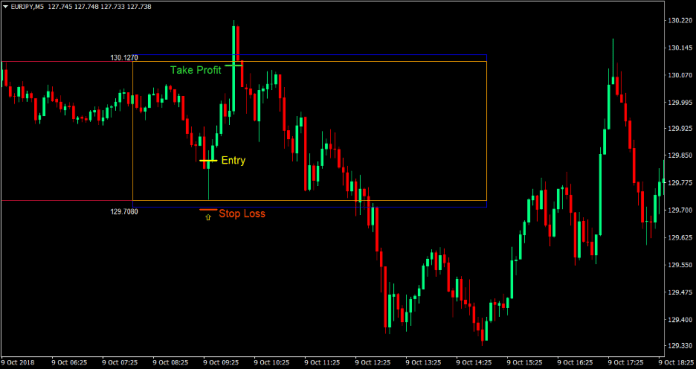

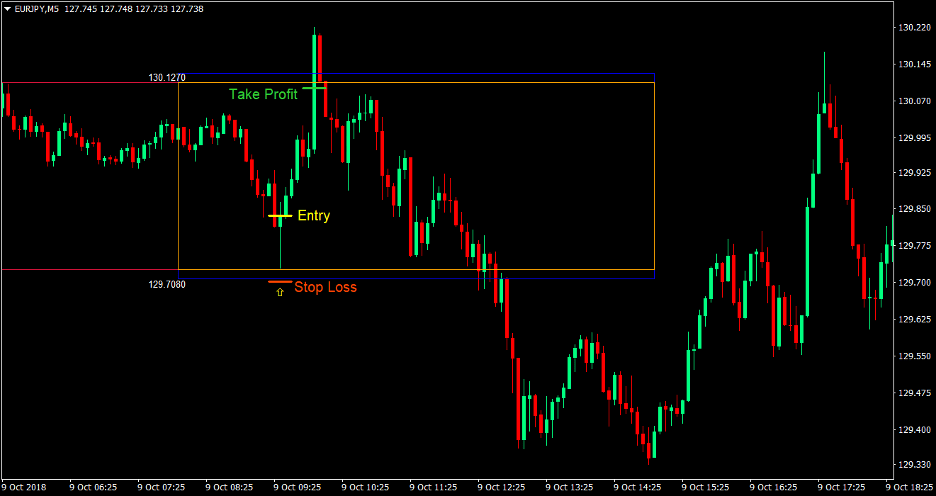

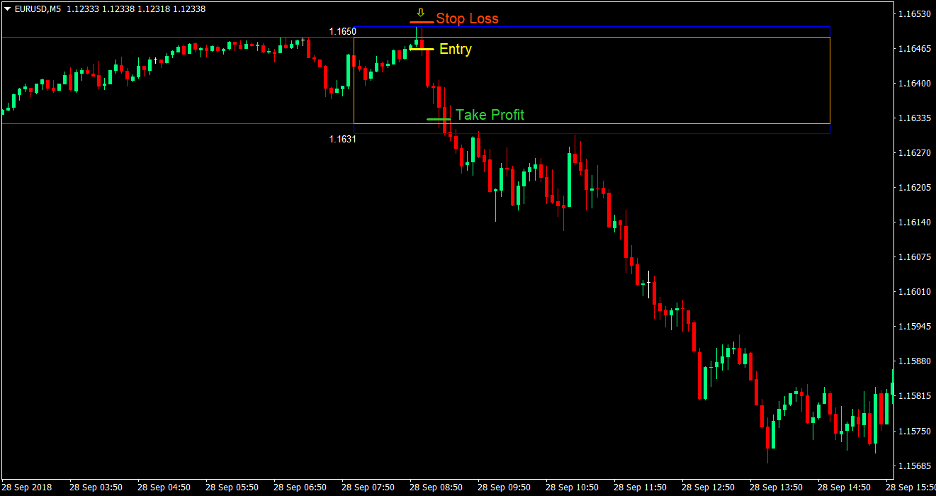

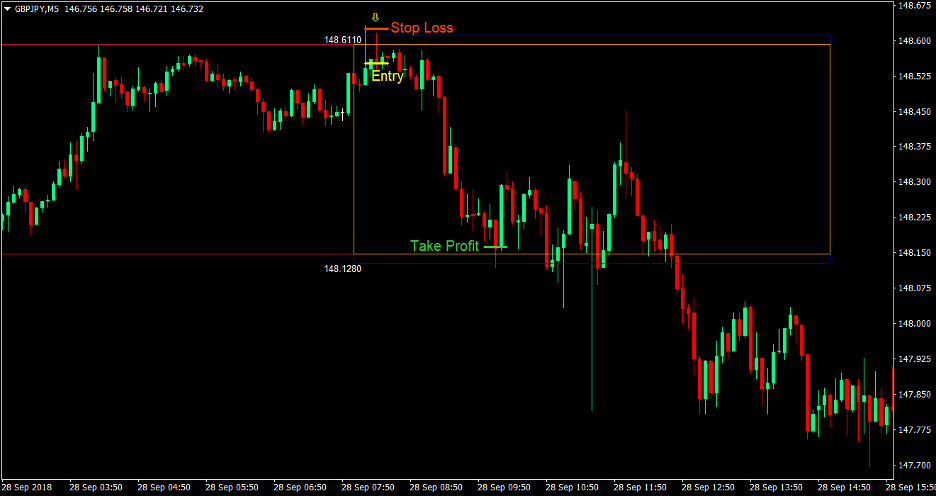

Sælg (Short) Trade Setup

Indgang

- Observer markedets adfærd i slutningen af Tokyo-sessionen, hvilket helst viser manglende evne til at bryde ud af en række

- Vent til prisen rører toppen af det orange rektangel

- Vent på, at prisen danner en bearish pin bar med halen rører ved modstandsniveauet

- Afgiv en salgsordre, så snart den bearish pin bar dannes

Stop Loss

- Indstil stoptabet over indgangslyset og over den øverste linje i det blå rektangel

Tag Profit

- Indstil målet for at tage profit et par pips over den nederste linje i det orange rektangel

Konklusion

Denne strategi er det fuldstændige modsatte af den sædvanlige London breakout-strategi. De fleste forhandlere ville bare tage udbrud fra det interval, der blev dannet under Tokyo-sessionen. Der er dog andre forhandlere, som faktisk ville handle med tilbageførslen ved at bruge den som grundlag for en intervallbundet markedsopsætning.

Nøglen til denne strategi er, at vendingen sker i begyndelsen af London-åbningen. Dette tyder på, at handlende i London er uenige i de holdninger, som handlende indtager i Tokyo. Dette vil normalt også ske, når der er en hvisken fra markedet om en fundamental nyhed, der er lækket til medierne, som finder sted på London Open. Dette ville ofte forårsage en pludselig vending af retningen, men dette bør ikke komme som et chok for erfarne handlende, fordi dette normalt går forud for, at Tokyo-markedet mangler volumen for at skubbe handlen ud af en varierende tilstand. Dette kan også føre til en vending på den højere tidsramme, hvilket kan betyde større overskud, hvis handlen holdes på selv ud over intervallet.

Anbefalede MT4-mæglere

XM Broker

- Gratis $ 50 For at begynde at handle med det samme! (Tilbagetrækbar fortjeneste)

- Indbetalingsbonus op til $5,000

- Ubegrænset loyalitetsprogram

- Prisvindende Forex Broker

- Yderligere eksklusive bonusser Gennem året

>> Tilmeld dig XM Broker-konto her <

FBS mægler

- Handel 100 bonus: Gratis $100 for at kickstarte din handelsrejse!

- 100% indbetalingsbonus: Fordoble dit indskud op til $10,000, og handel med øget kapital.

- Udnyttelse op til 1: 3000: Maksimering af potentielle overskud med en af de højeste gearingsmuligheder, der findes.

- Prisen 'Bedste kundeservicemægler Asia': Anerkendt ekspertise inden for kundesupport og service.

- Sæsonbestemte kampagner: Nyd en række eksklusive bonusser og kampagnetilbud hele året rundt.

>> Tilmeld dig FBS Broker-konto her <

Klik her nedenfor for at downloade: