Ichimoku Cloud Forex Trading Strategi

Mange trendhandlere ved bare ikke, hvornår de skal handle med en trend efter strategi, og hvornår de ikke skal. De fortsætter med at bruge en god, rentabel strategi på den forkerte markedstilstand og ender med at tabe penge. Men de fleste trendhandelsstrategier har bare ikke en mekanisme til at fortælle dig, hvornår du ikke skal handle. Hvad hvis der er en indikator, der fungerer godt med trendende markedsforhold og har alle disse filtre. Det kunne fortælle dig trendretning, indgangssignal og et filter til ikke at handle, hvis markedet ikke trender stærkt nok.

Ichimoku Kinko Hyo – Alt-i-én-handelsindikatoren

Da jeg først stødte på denne indikator, må jeg indrømme, at jeg ikke gav det et skud. Den havde for mange linjer, der forekom for travle for mig. Jeg vidste ikke, at det kunne have tjent penge til mig. Det er sandsynligvis en af de få selvstændige indikatorer, der kunne være rentable uden at bruge andre indikatorer som filter.

Så hvordan virker det.

Ichimoku Kinko Hyo-indikatoren er sammensat af flere komponenter, Cloud (Kumo), Base Line (Kijun-sen), Conversion Line (Tenkan-sen) og Lagging Span (Chikou Span). Det lyder måske meget, og det er det, men det hele er relevant. Disse er grundlæggende variationer af glidende gennemsnit. Nogle er gennemsnit af midtpunkter, nogle er forskudt, nogle er afledte af de andre linjer.

Først skyen. Skyen er sammensat af to linjer, Leading Span A (Senkou Span A) og Leading Span B (Senkou Span B). Denne funktion af indikatoren dikterer trendretningen eller hovedtrendretningsfilteret. Der er to måder at identificere trendretning ved hjælp af skyen. Trendretningen kunne identificeres ved at bruge placeringen af prisen i forhold til skyen. Hvis prisen er over skyen, vil vi kun lede efter købshandler, hvis den er under skyen, vil vi lede efter salgshandler. En anden måde at se det på er krydsningen af det førende spændvidde A og det førende spændvidde B. Hvis det førende spændvidde A er over det førende spændvidde B, så siges markedet at være bullish, hvis det er omvendt, så siges markedet. at være bearish.

Så har vi Base Line og Conversion Line. Disse to linjer arbejder sammen med hinanden. Disse linjer er signalet for indtastninger. Det fungerer ligesom en almindelig crossover-strategi. Basislinjen er den langsommere linje, mens konverteringslinjen er den hurtigere linje. Hvis konverteringslinjen krydser over basislinjen, har vi et signal om at købe. Hvis det krydser under basislinjen, så er det et signal om at sælge.

Til sidst har vi forsinkelsesspændet. Jeg tror, det er den vigtigste linje, som de fleste trendhandelsstrategier mangler. Det skyldes, at Lagging Span dybest set er et filter, der skal fortælle os, om markedets trend er ved at ende. Det gør det ved at flytte plottet af den aktuelle prishandling med flere stearinlys. Ideen bag dette er, at hvis det laggende spænd begynder at krydse prisen, så er markedets trendmiljø måske allerede ved at blive svækket, fordi prisen allerede er ved at indhente det. Det fungerer som et filter før indgangen, men det kan også fungere som en tidlig udgang.

Indikator: Ichimoku Kinko Hyo

Tidsramme: enhver

Valutapar: enhver

Handelssession: Tokyo, London og New York

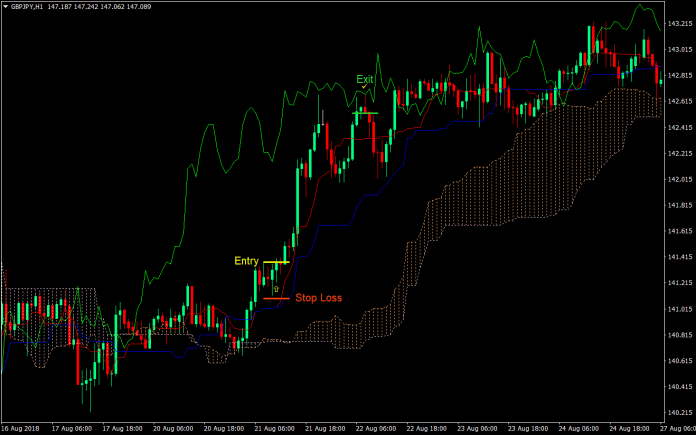

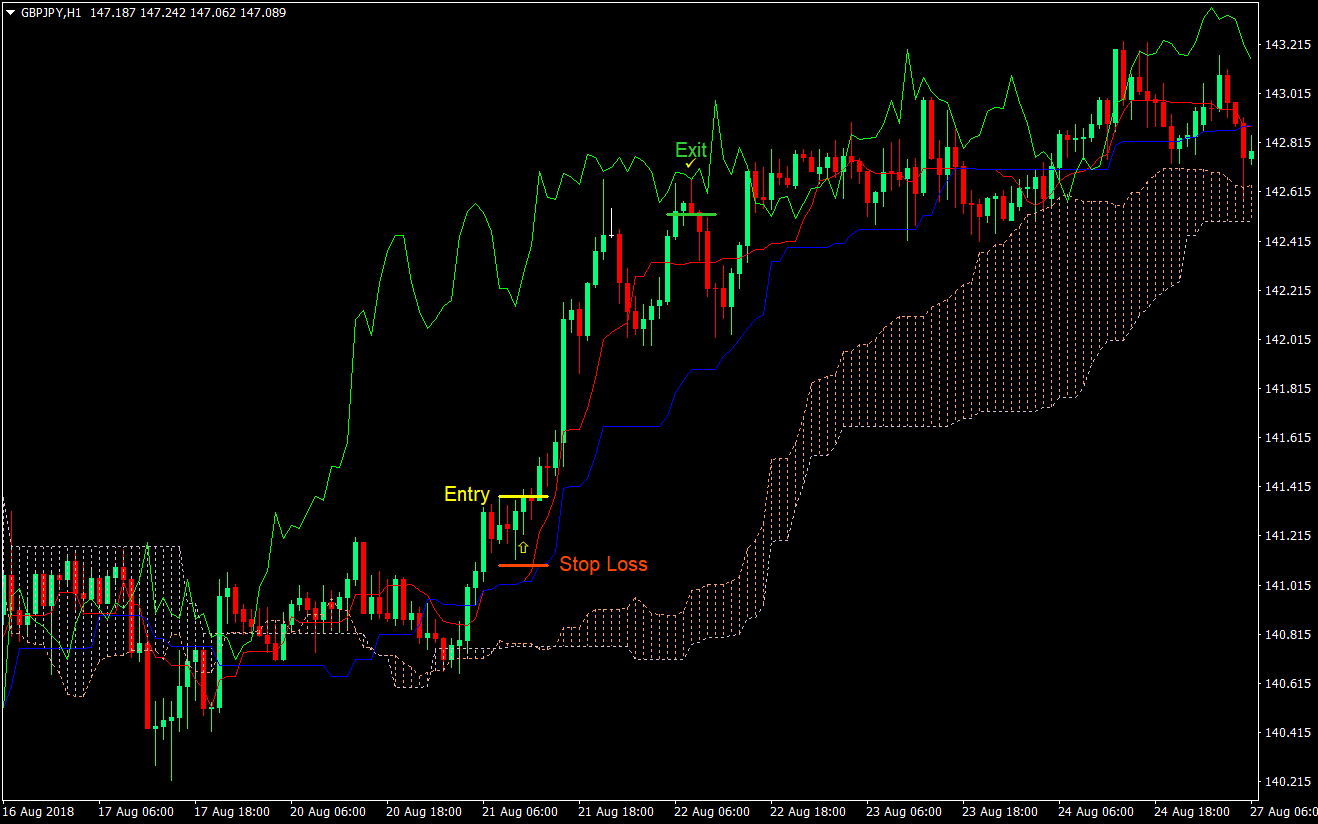

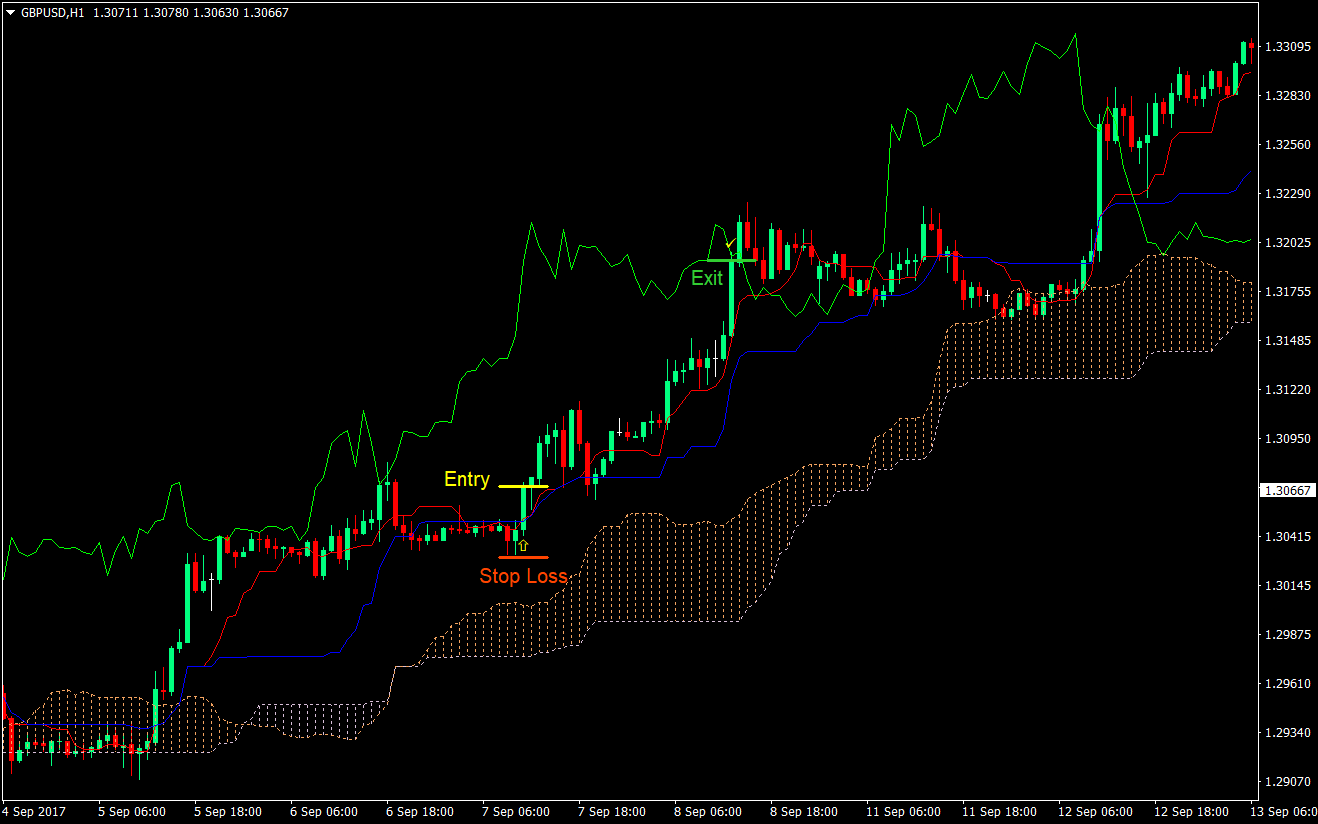

Køb (lang) handelsopsætning

Indgang

- Linjerne skulle alle vifte ud med skyen i bunden, basislinje og konverteringslinje i midten og lagging span i toppen

- Prisen bør ikke røre forsinkelsesspændet

- Vent på, at prisen kommer tilbage i nærheden af skyen

- Indtast en købsmarkedsordre, så snart konverteringslinjen krydser over basislinjen

Stop Loss

- Indstil stoptabet ved svinget lavt under indgangslyset

Udgang

- Luk handlen, så snart prisen begynder at røre den forsinkende spændvidde

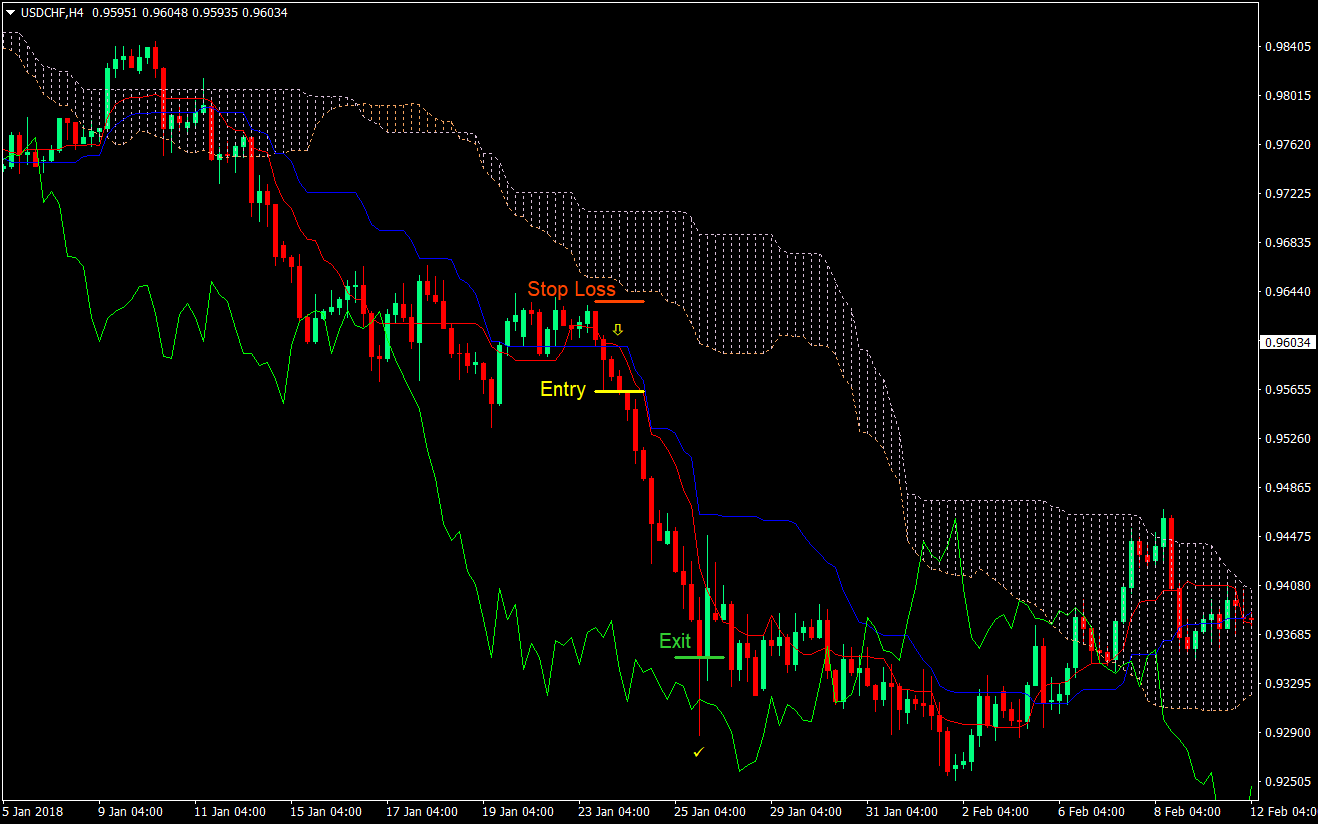

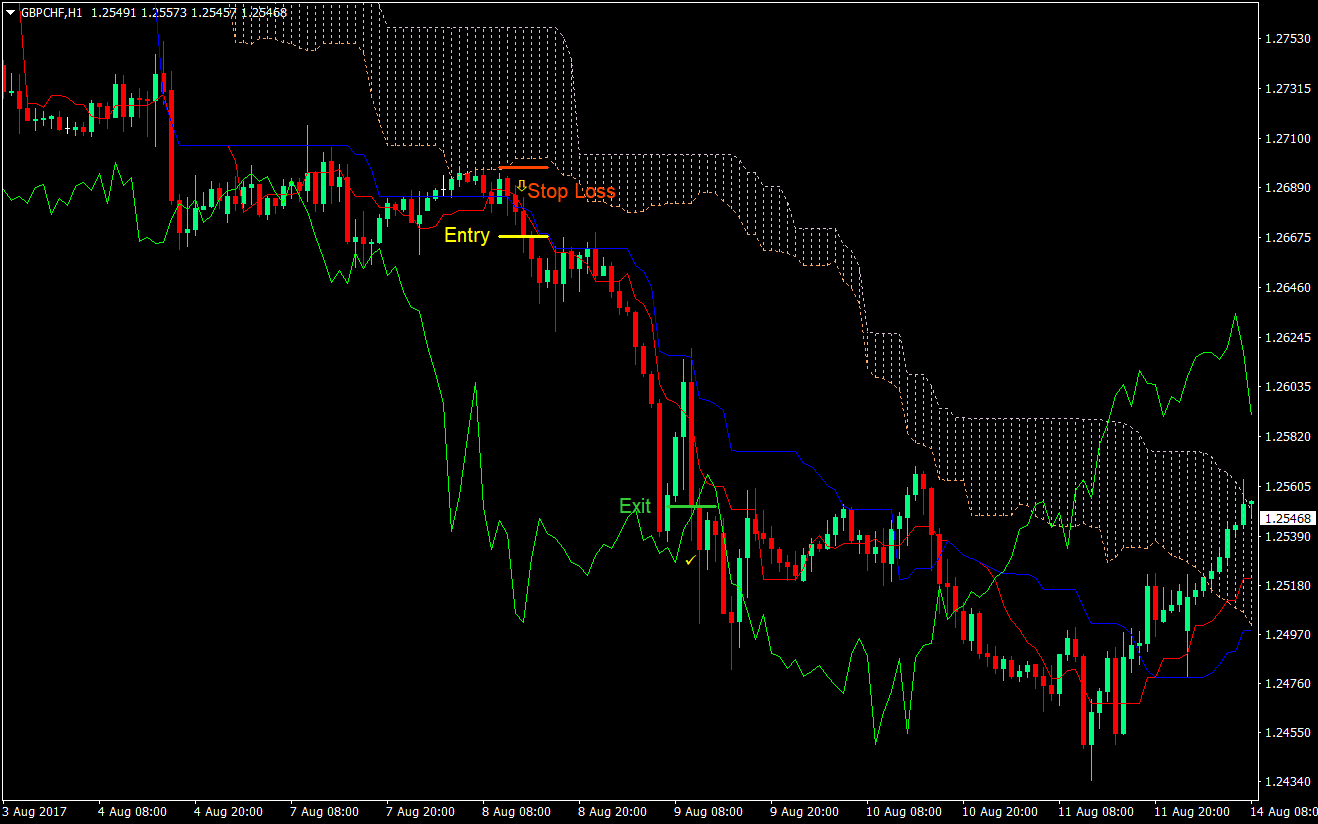

Sælg (Short) Trade Setup

Indgang

- Linjerne skulle alle blive blæst ud med skyen øverst, basislinjen og konverteringslinjen i midten og lagging-spændvidden i bunden

- Prisen bør ikke røre forsinkelsesspændet

- Vent på, at prisen kommer tilbage i nærheden af skyen

- Indtast en salgsordre, så snart konverteringslinjen krydser under basislinjen

Stop Loss

- Indstil stoptabet ved gyngen højt over indgangslyset

Udgang

- Luk handlen, så snart prisen begynder at røre den forsinkende spændvidde

Konklusion

Ichimoku Cloud har en tendens til at være lidt rodet som en indikator. Det er dog meningen med denne indikator. Hvis du ser et rodet på kryds og tværs af linjer, så snart du åbner et diagram, så forlad det. Det er ikke det diagram, du skal handle på. I et trending markedsmiljø bør diagrammet have en vis orden. Hvis du falder over den slags diagram, så vent på posten.

Anbefalet MT4 Broker

- Gratis $ 50 For at begynde at handle med det samme! (Udtrækbar fortjeneste)

- Indbetalingsbonus op til $5,000

- Ubegrænset loyalitetsprogram

- Prisvindende Forex Broker

- Yderligere eksklusive bonusser Gennem året

Klik her nedenfor for at downloade: