Mange handlende prædiker imod at forsøge at fange toppe og lavpunkter. På en måde har de en pointe. Det er svært at fange toppe og lavninger. Det er lige så svært at forudsige, hvor prisen vil stoppe og vende, ligesom det er svært at fange en faldende kniv. På en måde er det, hvad mange handlende, der ikke har en systematisk metode til at identificere potentielle reverseringspunkter, gør.

Men hvis du kommer til at tænke over det, handler forex trading også om at købe valutapar, når priserne er lave, og sælge, når priserne er på et højt niveau. Køb lavt, sælg højt. Dette er mantraet for en erhvervsdrivende. At fange trug og toppe er en vital del af det.

Så hvordan møder vi disse to begreber i midten? En ting, som handlende gør, er, at de handler, så snart markedet viser tegn på, at det er ved at vende.

Høj lav divergens Forex Trading Strategi bruger divergenser for at finde sådanne tegn, hvilket fører til handelsmuligheder.

Afvigelser er dybest set et punkt i et prisdiagram, når dybden eller højden af en top eller lavpunkt af prishandling vil variere fra højden eller dybden af en top eller lavpunkt i en oscillator. Disse forhold indikerer, at der er spændinger i markedet. Enten viser prishandlingen, at markedet er på vej til en skarp vending, og indikatoren har ikke fulgt med endnu, eller også har oscillatoren opdaget, at prisen skulle vende dybt, og prishandlingen har ikke udført en sådan vending endnu. Uanset hvad, ville man give ud, og det er en mulighed.

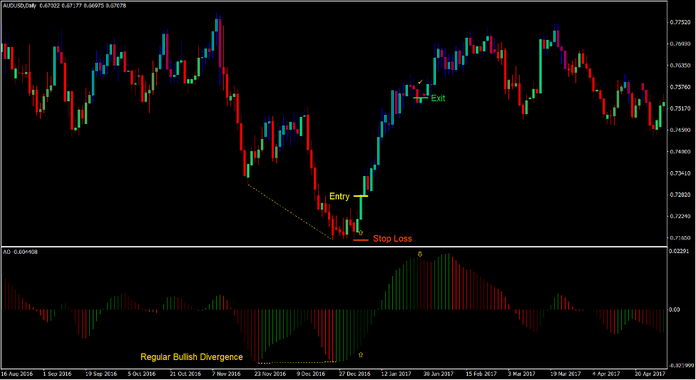

Nedenfor er et diagram over, hvordan forskellige divergenser ser ud.

Awesome Oscillator

Awesome Oscillator (AO) er en trendfølgende teknisk indikator, som er baseret på crossover af modificerede glidende gennemsnit.

AO beregnes baseret på forskellen mellem et 5-periods Simple Moving Average (SMA) og et 34-periods Simple Moving Average (SMA). I stedet for at bruge den almindelige lukning af hver periode, bruger AO dog medianen for hver periode som grundlag for beregning af SMA'erne.

Forskellen plottes derefter som en histogrambjælke på oscillatorvinduet. AO angiver trendretning baseret på om søjlen er positiv eller negativ og trendstyrke baseret på søjlernes farve.

Positive grønne søjler indikerer en styrkende bullish trend, mens positive røde søjler indikerer en aftagende bullish trend. På den anden side indikerer negative røde søjler en styrkende bearish trend, mens negative grønne søjler indikerer en aftagende bearish trend.

Skiftet af søjlerne fra positiv til negativ indikerer en trendvending, mens ændringen af søjlernes farver kunne indikere starten på en svækkelsestendens, der fører til en trendvending.

Gann Hi Lo Activator Bars

Gann Hi Lo Activator Bars er en momentum og trendfølgende indikator, som er baseret på kortsigtet.

Denne indikator er en simpel indikator, der angiver den kortsigtede tendens ved at overlejre søjler på prislysene. Disse søjler skifter farve afhængigt af retningen af den kortsigtede trend eller momentum. Blå søjler indikerer et bullish momentum, mens røde søjler indikerer et bearish momentum.

Gann Hi Lo Activator Bars er meget nyttige til at forudse kortsigtede trendvendinger og vælge nøjagtige indgangspunkter. Den kan enten bruges som en indledende indikation af en sandsynlig trendvending eller en faktisk indgangsudløser for en trendvendende opsætning.

Trading Strategi

Denne handelsstrategi handler på divergenser mellem Awesome Oscillator og prishandling, samtidig med at den bekræfter den kortsigtede trend eller momentum ved hjælp af Gann Hi Lo Activator Bars.

For det første skal vi identificere divergenser baseret på toppene og lavpunkterne for både prishandling og Awesome Oscillator. Derefter venter vi på, at farven på Awesome Oscillator-bjælkerne ændrer sig, hvilket indikerer svækkelsen af den aktuelle trendretning.

Derefter venter vi på Gann Hi Lo Activator Bars på, at farven på søjlerne ændrer sig, hvilket indikerer retningen af trendvendingen.

Så snart vi finder sammenfald mellem disse forhold, kunne vi så tage en trendvendende handelsopsætning.

Indikatorer:

- Gann HiLo aktivator barer

- Awesome

Foretrukne tidsrammer: 30-minutters, 1-timers, 4-timers og daglige diagrammer

Valuta Par: FX majors, mindreårige og krydsninger

Handelssessioner: Tokyo, London og New York sessioner

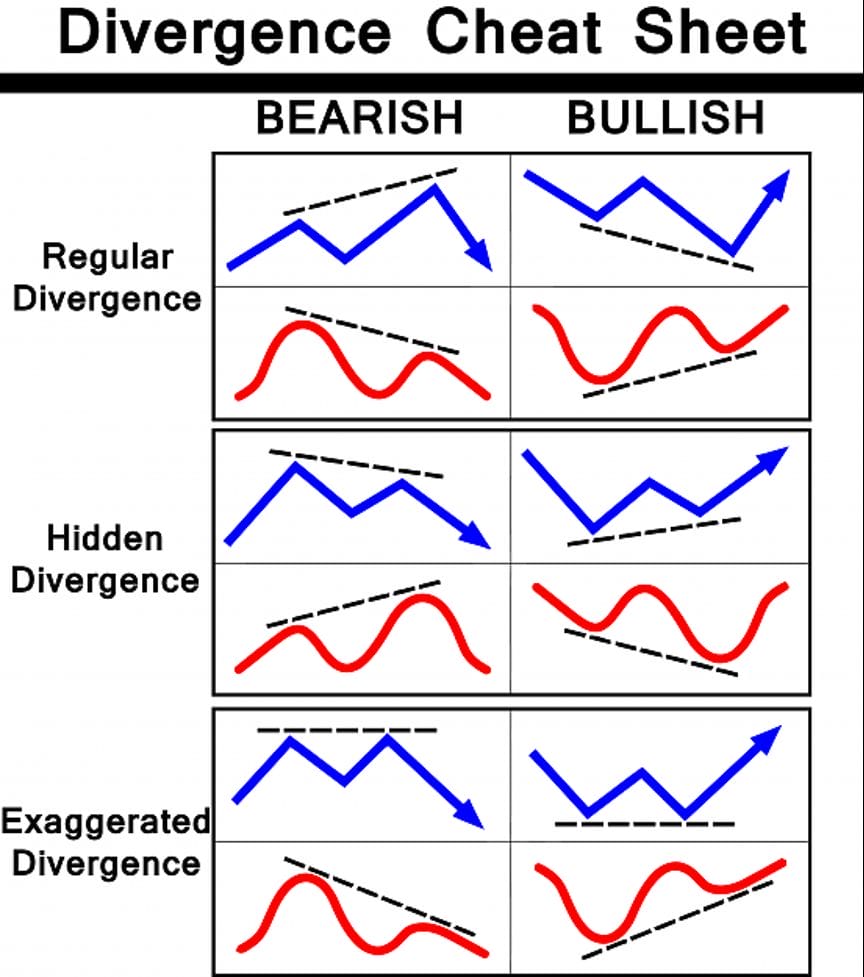

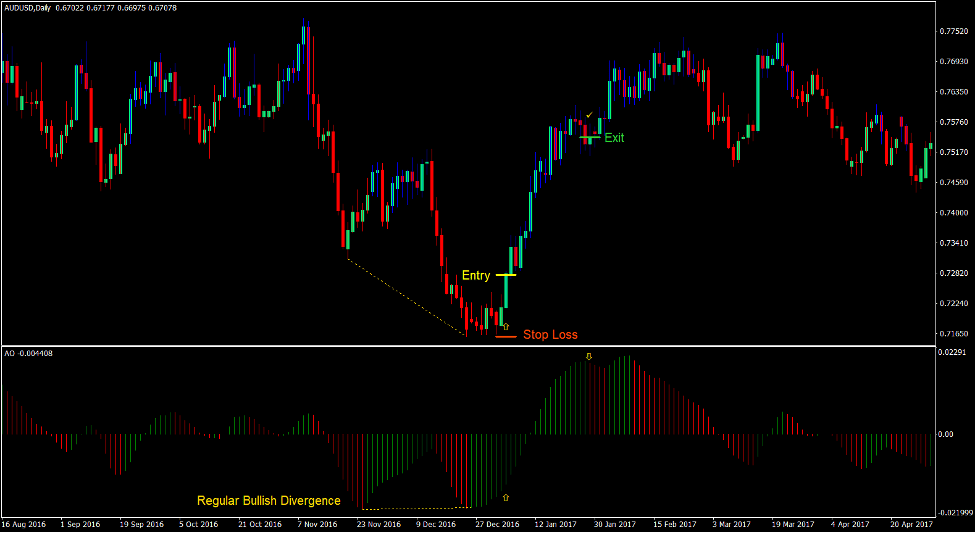

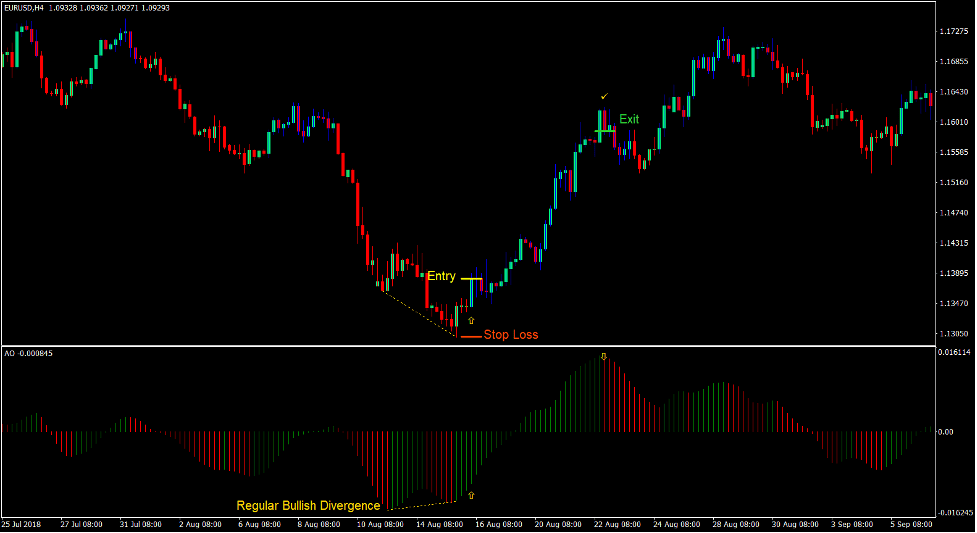

Køb Trade Setup

Indgang

- En bullish skjult eller regelmæssig divergens skal kunne observeres baseret på prishandling og Awesome Oscillator.

- Awesome Oscillator-bjælkerne skulle skifte til grønne.

- Gann Hi Lo Activator Bars skulle skifte til blå.

- Indtast en købsordre på bekræftelsen af disse betingelser.

Stop Loss

- Indstil stop loss på fraktalen under indgangslyset.

Udgang

- Luk handlen, så snart AO skifter til rød.

- Luk handlen, så snart Gann Hi Lo-aktivatorbjælkerne skifter til røde.

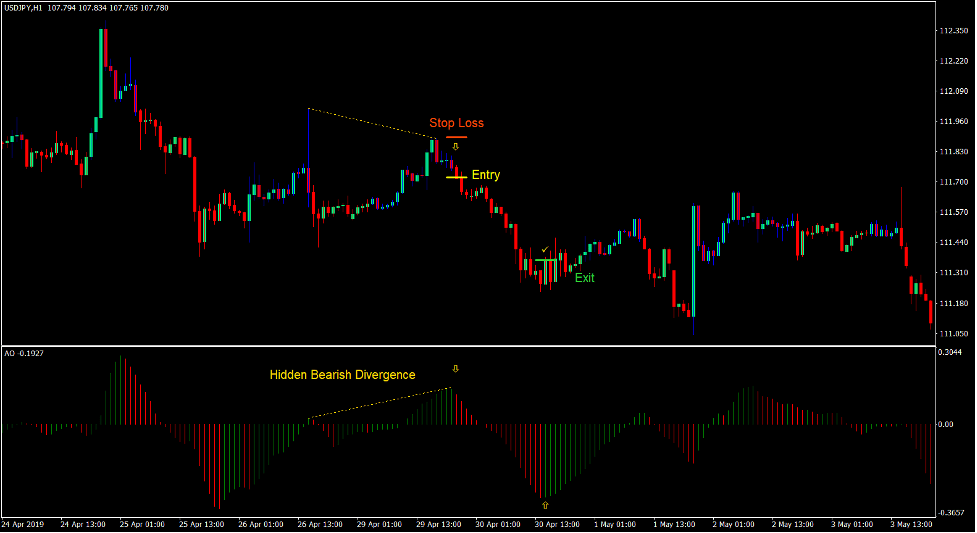

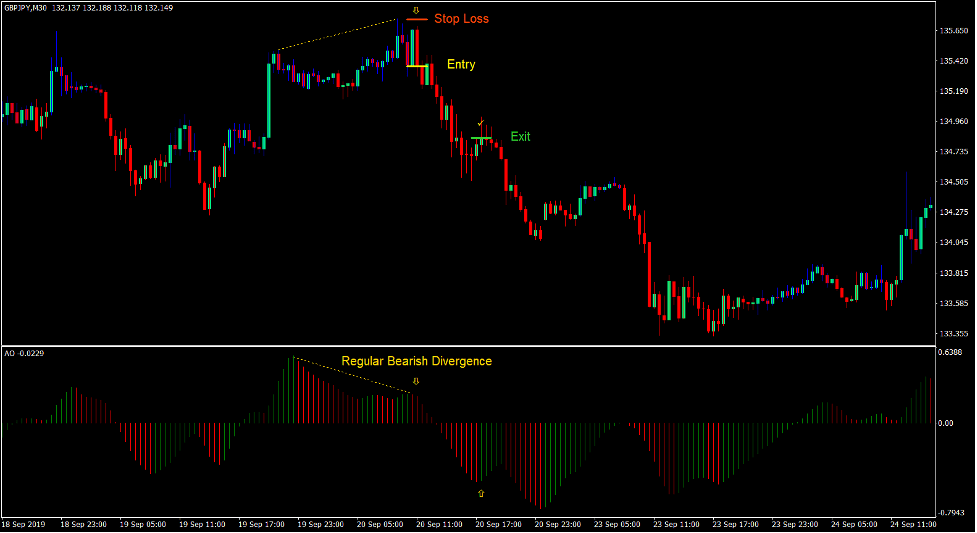

Sælg handelsopsætning

Indgang

- En bearish skjult eller regelmæssig divergens skal kunne observeres baseret på prishandling og Awesome Oscillator.

- Awesome Oscillator-bjælkerne skulle skifte til røde.

- Gann Hi Lo Activator-bjælkerne skulle skifte til røde.

- Indtast en salgsordre ved bekræftelsen af disse betingelser.

Stop Loss

- Indstil stoptabet på fraktalen over indgangslyset.

Udgang

- Luk handlen, så snart AO skifter til grøn.

- Luk handlen, så snart Gann Hi Lo-aktivatorbjælkerne skifter til blå.

Konklusion

Mange profitable handlende bruger divergenser til at tjene på markedet. Dette skyldes, at divergenser normalt vil give meget rentable handler med relativt høje sandsynligheder.

Mange handlende, der sigter efter rimelige mål, kan få så høj som 60% nøjagtighed ved at bruge divergenser. I de fleste tilfælde vil divergensopsætninger i et enkelt diagram normalt give mindst én rentabel handel i hver tre muligheder. Med en korrekt risikostyring og risiko-belønningsforhold kan divergenser give opsætninger, der kan producere ensartede overskud.

Anbefalede MT4-mæglere

XM Broker

- Gratis $ 50 For at begynde at handle med det samme! (Tilbagetrækbar fortjeneste)

- Indbetalingsbonus op til $5,000

- Ubegrænset loyalitetsprogram

- Prisvindende Forex Broker

- Yderligere eksklusive bonusser Gennem året

>> Tilmeld dig XM Broker-konto her <

FBS mægler

- Handel 100 bonus: Gratis $100 for at kickstarte din handelsrejse!

- 100% indbetalingsbonus: Fordoble dit indskud op til $10,000, og handel med øget kapital.

- Udnyttelse op til 1: 3000: Maksimering af potentielle overskud med en af de højeste gearingsmuligheder, der findes.

- Prisen 'Bedste kundeservicemægler Asia': Anerkendt ekspertise inden for kundesupport og service.

- Sæsonbestemte kampagner: Nyd en række eksklusive bonusser og kampagnetilbud hele året rundt.

>> Tilmeld dig FBS Broker-konto her <

Klik her nedenfor for at downloade: