De fleste handlende ville elske at fange handler lige i begyndelsen af trenden og afslutte i slutningen af den samme trend. Dette giver handlende mulighed for at presse så meget overskud ud af en trend som muligt. De fleste handlende kan dog kun drømme om at få sådanne handler. Mange handlende ville handle med en trendvendende strategi hele tiden uden hensyntagen til den type markedstilstand, de er i, eller om signalet har en stærk sandsynlighed eller ej. Handlende, der formår at mestre trendvendingsstrategier, har potentialet til at tjene så meget overskud fra forexmarkedet.

En af måderne, hvorpå handlende øger deres chancer for at få den rigtige trendvendende handel, er ved at lede efter divergenser. Markedsudsving har forskellige styrker og momentum. Dette får prisudsving til enten at være dybe eller overfladiske, høje eller lave. Disse prisudsving har sine tilsvarende toppe og lavpunkter, når en oscillerende teknisk indikator bruges på et prisdiagram.

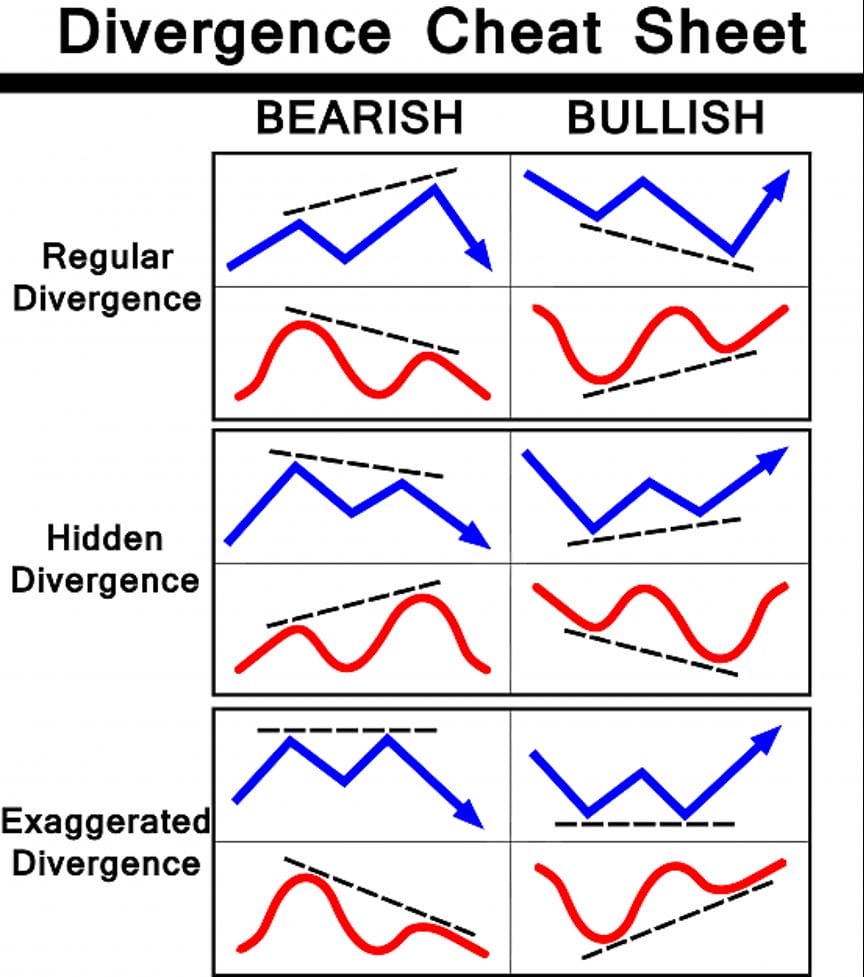

Divergens er den tilstand, hvor højden eller dybden af et prisudsving varierer i intensitet sammenlignet med en tilsvarende oscillator.

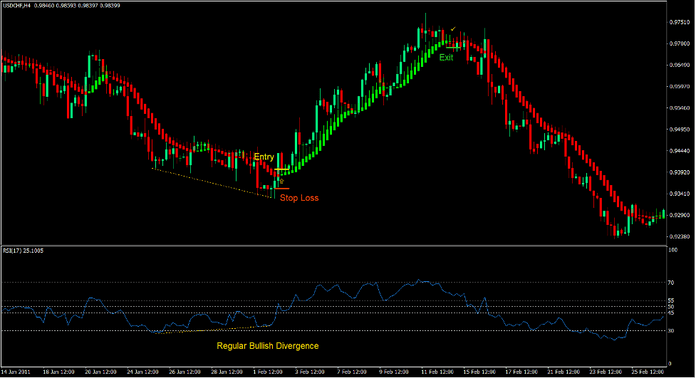

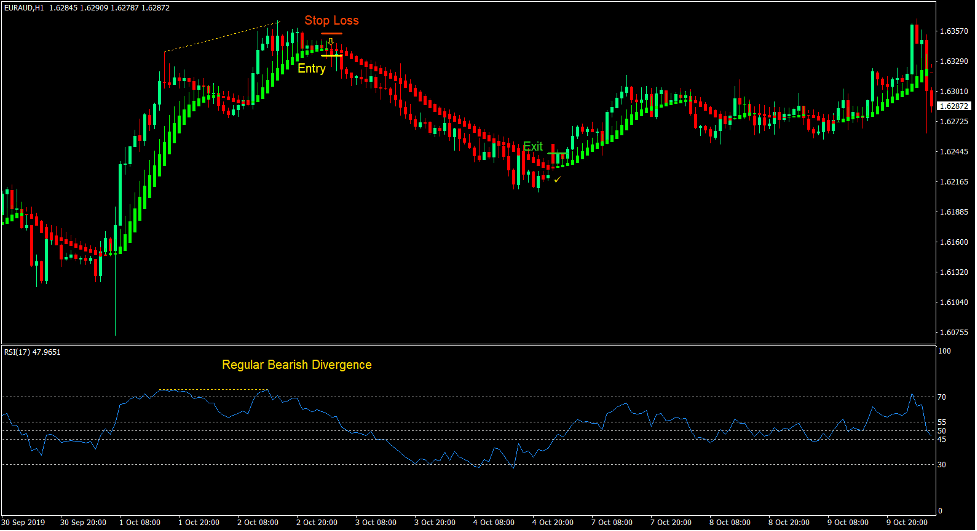

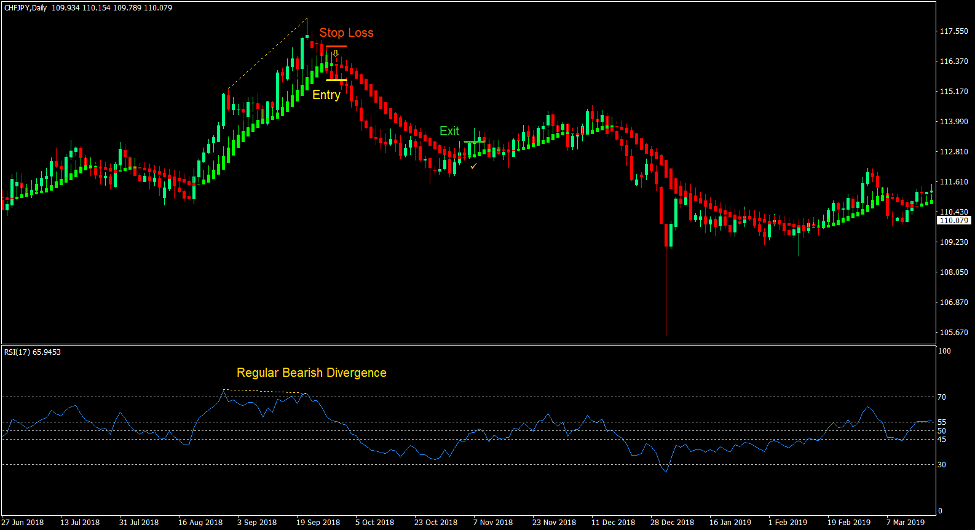

For eksempel kan et prissving registrere et sving højt, som er højere end det foregående sving, mens dets tilsvarende oscillator registrerer et top, der er lavere end det foregående top. Dette mønster kaldes en regulær bearish divergens. Dette kan betyde, at swing high produceret af prishandling er for høj, og prisen kan begynde at vende ned når som helst snart. Dette er blot et af divergensmønstrene. Nedenfor er et diagram, der viser de forskellige divergensmønstre.

Heiken Ashi Divergence Forex Trading Strategy er en trendvendende strategi, der er baseret på begrebet divergenser. Den gør brug af en Heiken Ashi Smoothed-indikator til at identificere væsentlige svingpunkter og give pålidelige trendvendingssignaler.

Heiken Ashi glattet indikator

Heiken Ashi Smoothed-indikatoren er en trendfølgeindikator, som er baseret på Heiken Ashi-lysestagerne og det eksponentielle bevægelige gennemsnit (EMA).

Heiken Ashi betyder bogstaveligt talt "gennemsnitlige barer" på japansk. Heiken Ashi Lysestager er præcis det. Det giver et gennemsnit af åbningen og lukningen af hvert lys, hvilket skaber lysestager, der kun skifter farver, når den kortsigtede trend eller momentum er vendt.

Heiken Ashi Smoothed-indikatoren producerer også søjler, der udlignes i gennemsnit. Men i stedet for at producere søjler, der ligner lysestager, producerer den søjler, der ligner glidende gennemsnit mere tæt.

Heiken Ashi Smoothed-indikatoren er en pålidelig trendfølgeindikator, som plotter søjler på prisdiagrammet. Disse søjler følger prishandlingen ganske tæt. Dens barer skifter også farve afhængigt af trendens retning. Lime søjler indikerer en bullish trend, mens røde søjler indikerer en bearish trend. Trendvendingssignaler genereres, hver gang søjlerne skifter farve.

Relative Strength Index

Relative Strength Index (RSI) er en momentumindikator, som er baseret på omfanget af de seneste historiske prisændringer.

Den angiver trendretning ved at plotte en oscillerende linje på et separat vindue, som er baseret på de seneste historiske prisændringer på prisdiagrammet. Dette skaber en oscillator, der efterligner prishandlingens bevægelse.

RSI-linjen svinger inden for intervallet 0 til 100. Den har også markører på niveau 30 og 70. Disse niveauer er tærskler, hvor hvis RSI-linjen falder til under 30, kan markedet betragtes som oversolgt, og hvis RSI-linjen er over 70 , så kan markedet betragtes som overkøbt. Imidlertid kan momentumhandlere fortolke det på den modsatte måde. Et RSI-linjebrud over 70 kan også indikere et bullish momentum, mens en RSI-linje, der falder under 30, kan indikere et bearish momentum. Dette vil afhænge af, hvordan prishandlingen opfører sig, når RSI-linjen når disse niveauer.

Det har også typisk markører på niveau 50. Dette niveau er den generelle indikation af en bullish eller bearish bias. RSI-linjer over 50 indikerer en bullish bias, mens RSI-linjer under 50 indikerer en bearish bias. Mange handlende tilføjer også niveau 45 og 55 for at bekræfte trendretningen. Linjer, der krydser over 55, indikerer en bullish trend med støtte på 45. På den anden side indikerer linjer, der falder under 45, en bearish trend med modstand på 55.

Trading Strategi

Denne strategi bruger Heiken Ashi Smoothed-indikatoren til at give handlende mulighed for nemt at identificere swing-høje og swing-lave. Disse er baseret på op- og nedture, der ville få Heiken Ashi Smoothed-indikatoren til midlertidigt at vende retninger.

Så snart vi identificerer op- og lavpunkterne, sammenligner vi disse svingpunkter med toppe og lavpunkter på RSI. Handler tages i betragtning, når der er en gyldig divergens. Handelssignaler genereres, så snart Heiken Ashi Smoothed-indikatoren skifter farve, hvilket indikerer ændringen i trendretningen.

Indikatorer:

- Heiken_Ashi_Smoothed

- Relative Strength Index

Foretrukne tidsrammer: 1-timers, 4-timers og daglige diagrammer

Valuta Par: FX majors, mindreårige og krydsninger

Handelssessioner: Tokyo, London og New York sessioner

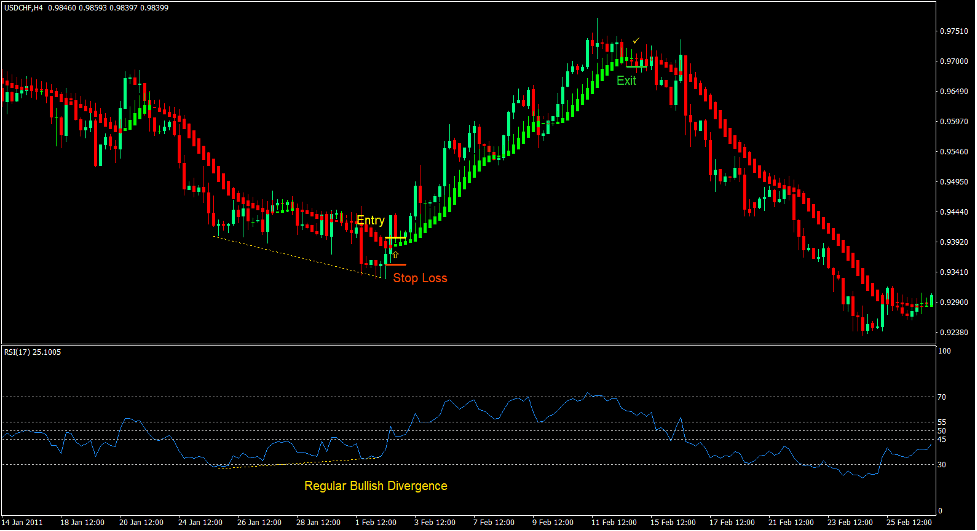

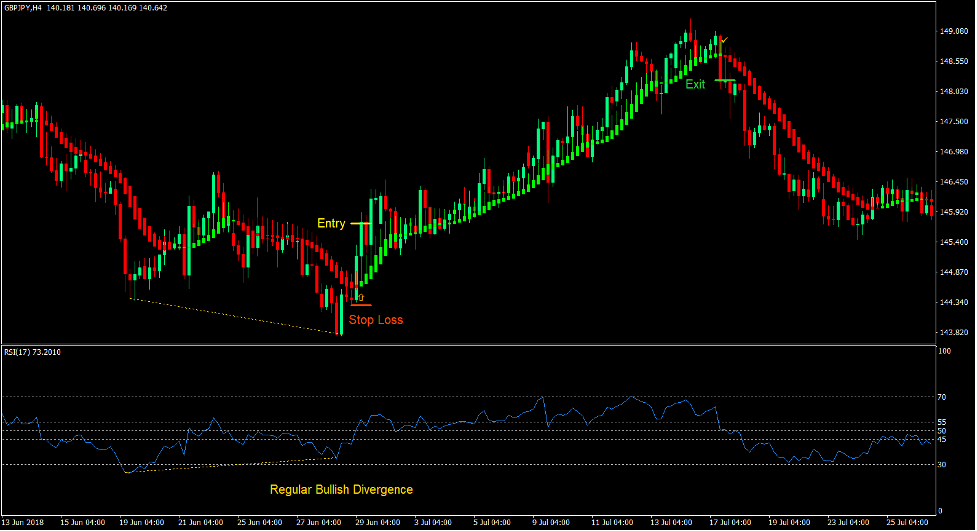

Køb Trade Setup

Indgang

- En gyldig bullish divergens bør være til stede baseret på svingende lavpunkter i prishandling og lavpunkterne på RSI-linjen.

- Indtast en købsordre, så snart Heiken Ashi Smoothed-baren skifter til lime.

Stop Loss

- Indstil stop losset under Heiken Ashi Smoothed-stængerne.

Udgang

- Luk handelen, så snart Heiken Ashi Smoothed-bjælkerne skifter til røde.

Sælg handelsopsætning

Indgang

- En gyldig bearish divergens bør være til stede baseret på svingende højder af prishandling og toppene af RSI-linjen.

- Indtast en salgsordre, så snart Heiken Ashi Smoothed-bjælken skifter til rød.

Stop Loss

- Indstil stop losset over Heiken Ashi Smoothed-stængerne.

Udgang

- Luk handelen, så snart Heiken Ashi Smoothed-stængerne skifter til lime.

Konklusion

Handel på divergenser er en fungerende handelsstrategi. Der er mange forhandlere, der udelukkende handler på prishandling og divergenser baseret på RSI-linjen.

Det er muligt at drage fordel af valutamarkedet ved at bruge divergenser med RSI-linjen alene. De fleste nye forhandlere ville dog finde det vanskeligt at identificere gyldige swing-høje og swing-lave.

Tilføjelsen af Heiken Ashi Smoothed-indikatoren forenkler processen med at identificere disse svingpunkter visuelt. Ud over dette ville Heiken Ashi Smoothed-indikatoren også tjene som et trendvendingssignal, som handlende kunne bruge til at komme ind på markedet.

Anbefalede MT4-mæglere

XM Broker

- Gratis $ 50 For at begynde at handle med det samme! (Tilbagetrækbar fortjeneste)

- Indbetalingsbonus op til $5,000

- Ubegrænset loyalitetsprogram

- Prisvindende Forex Broker

- Yderligere eksklusive bonusser Gennem året

>> Tilmeld dig XM Broker-konto her <

FBS mægler

- Handel 100 bonus: Gratis $100 for at kickstarte din handelsrejse!

- 100% indbetalingsbonus: Fordoble dit indskud op til $10,000, og handel med øget kapital.

- Udnyttelse op til 1: 3000: Maksimering af potentielle overskud med en af de højeste gearingsmuligheder, der findes.

- Prisen 'Bedste kundeservicemægler Asia': Anerkendt ekspertise inden for kundesupport og service.

- Sæsonbestemte kampagner: Nyd en række eksklusive bonusser og kampagnetilbud hele året rundt.

>> Tilmeld dig FBS Broker-konto her <

Klik her nedenfor for at downloade: