Trendhandel er en god måde at handle på forexmarkederne. Handel med trenden betyder, at du handler med markedets generelle flow. Dette stabler i høj grad oddsene til din fordel. Dette er formentlig grunden til, at mange professionelle forhandlere foretrækker at handle med trenden.

Selvom trendhandel er en god måde at handle på forexmarkedet, er ikke alle tendenser ens. Nogle tendenser har en tendens til at være meget stærke, mens andre har et langsommere tempo. Nogle trends har lavvandede retracements, mens andre trends retracements meget dybt. Forskellige trends bør handles forskelligt.

Gann RSI Forex Trend Following Strategy er en trendfølgende strategi, der handler på stærke trends med lavvandede retracements. Det forsøger at identificere stærke tendenser og handler det i overensstemmelse hermed.

Relative Strength Index

Relative Strength Index er en momentumoscillator, der måler hastigheden af prisbevægelser.

RSI vises som en oscillator med en linje, der kan bevæge sig mellem -100 og 100.

Der er forskellige måder handlende bruger RSI på.

Trend- og momentumhandlere fortolker ofte en RSI-linje over 50 som en indikation af en optrend, mens en RSI-linje under 50 betragtes som en indikation af en nedadgående trend. Andre handlende betragter 40 som et levedygtigt støtteniveau for RSI-linjen under en optrend og 60 som et levedygtigt modstandsniveau for RSI-linjen under en nedadgående trend.

Gennemsnitlige tilbageførselshandlere fortolker på den anden side en RSI-linje over 70 som en indikation af et overkøbt marked, mens en RSI-linje under 30 fortolkes som en indikation af et oversolgt marked.

Handlende, der handler på divergenser, ser på den anden side efter uoverensstemmelser mellem peak og bund af prishandling og RSI-linjen. Enhver afvigelse mellem de to betragtes som potentielle punkter for en trendvending.

Gann HiLo Activator Bars

Gann HiLo Activator Bars er en momentumindikator, der bruges til at identificere kortsigtede tendenser.

Det indikerer den kortsigtede tendens ved at lægge tynde streger over prislysene. Disse søjler skifter farver afhængigt af trendens retning. I denne diagramopsætning indikerer blå søjler en bullish kortsigtet trend, mens røde søjler indikerer en bearish kortsigtet trend.

Gann HiLo Activator Bars er gode indgangssignalindikatorer, da det objektivt kunne pege på, hvor den kortsigtede tendens er vendt. Men selvom Gann HiLo Activator Bars er en meget præcis kortsigtet indikator, bør den stadig bruges sammen med langsigtede trendindikatorer.

Trading Strategi

Denne strategi handler på stærke trends baseret på nogle få enkle betingelser.

Trendretningen er identificeret ud fra et 50-periods Simple Moving Average (SMA). For det første identificeres trendretning baseret på placeringen af prisen i forhold til 50 SMA. Tendensen bekræftes derefter baseret på hældningen af 50 SMA. En flad 50 SMA er en indikation af en varierende eller svag tendens på markedet. Stejle skråninger med en god adskillelse mellem prishandling og 50 SMA er tegn på en stærk tendens.

Trendstyrke observeres derefter på RSI. Under en optrend bør RSI-linjen forblive over 50, hvilket indikerer, at optrenden er stærk. På den anden side, under en nedadgående trend, bør RSI-linjen holde sig under 50, hvilket indikerer en stærk nedadgående trend.

Indgangstriggeren er så baseret på Gann HiLo Activator Bars. Selv under en stærk trend ville Gann HiLo Activator Bars vende om under et retracement. Men på trods af den korte vending på Gann HiLo Activator Bars, bør betingelserne for en stærk trend baseret på 50 SMA og RSI være intakte. Hvis sådanne betingelser er opfyldt, kan den næste tilbageførsel på Gann HiLo Activator Bars tages som en indgang.

Indikatorer:

- 50 SMA

- Gann HiLo aktiveringsbjælker (standardindstillinger)

- Relative Strength Index

Foretrukne tidsrammer: 30-minutters, 1-timers og 4-timers diagrammer

Valuta Par: dur og mol par

Handelssession: Tokyo, London og New York sessioner

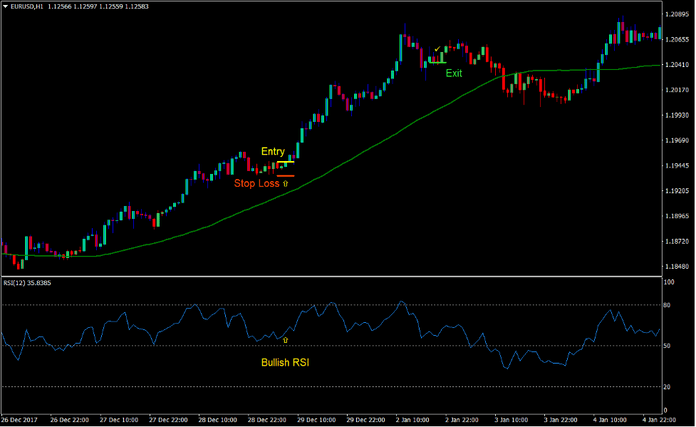

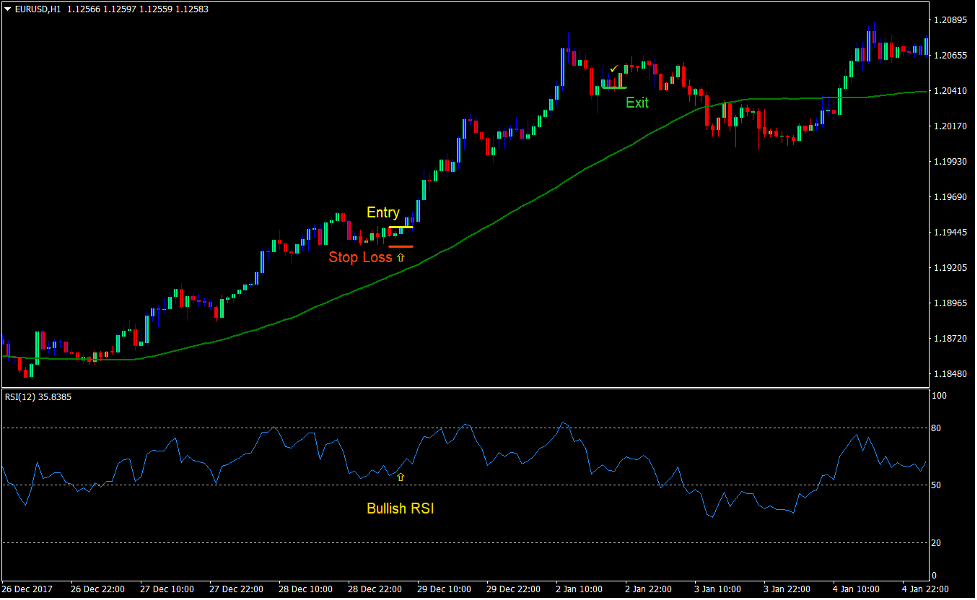

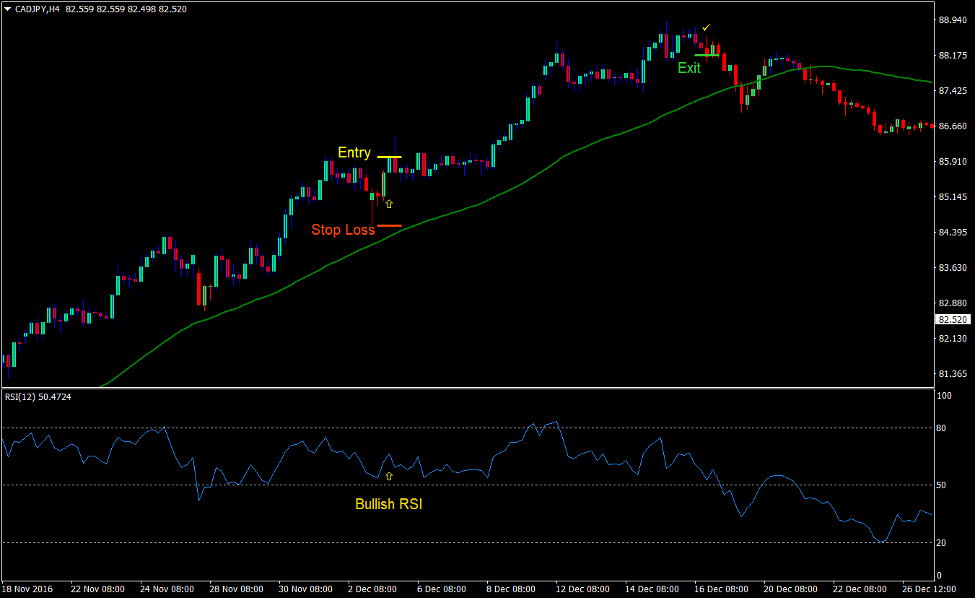

Køb Trade Setup

Indgang

- Prisen skal være over 50 SMA-linjen.

- 50 SMA-linjen skulle hælde op, hvilket indikerer en bullish trend.

- RSI-linjen bør forblive inden for intervallet 50 – 90, hvilket indikerer en stærk bullish trend.

- Prisen skulle midlertidigt ændre sig, hvilket får Gann HiLo Activator Bars til midlertidigt at skifte til rød.

- Indtast en købsordre, så snart Gann HiLo Activator Bars skifter til blå, hvilket indikerer genoptagelsen af trenden.

Stop Loss

- Indstil stop loss på fraktalen under indgangslyset.

Udgang

- Luk handlen, så snart Gann HiLo Activator Bars skifter til rød.

- Luk handlen, så snart RSI-linjen krydser under 50.

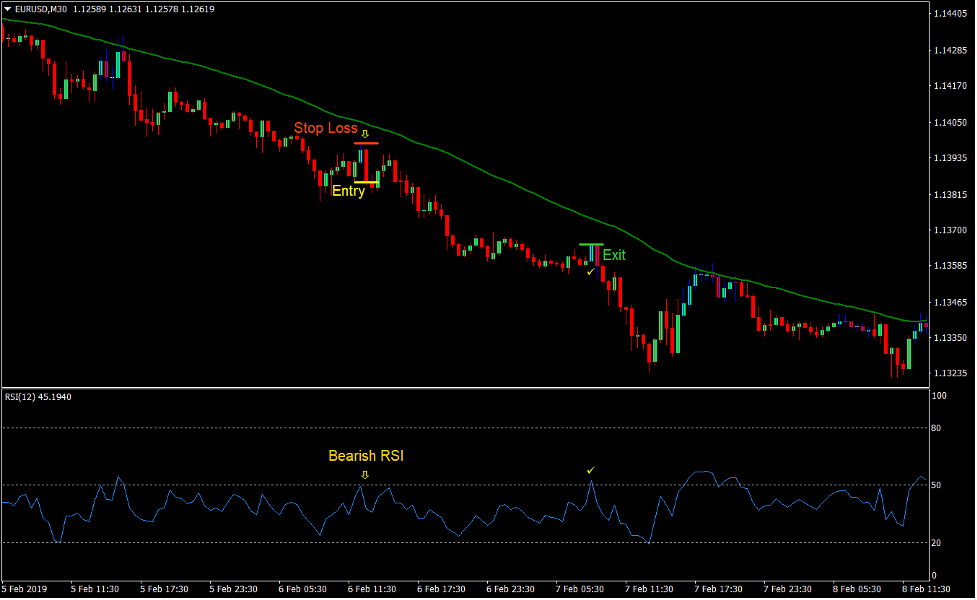

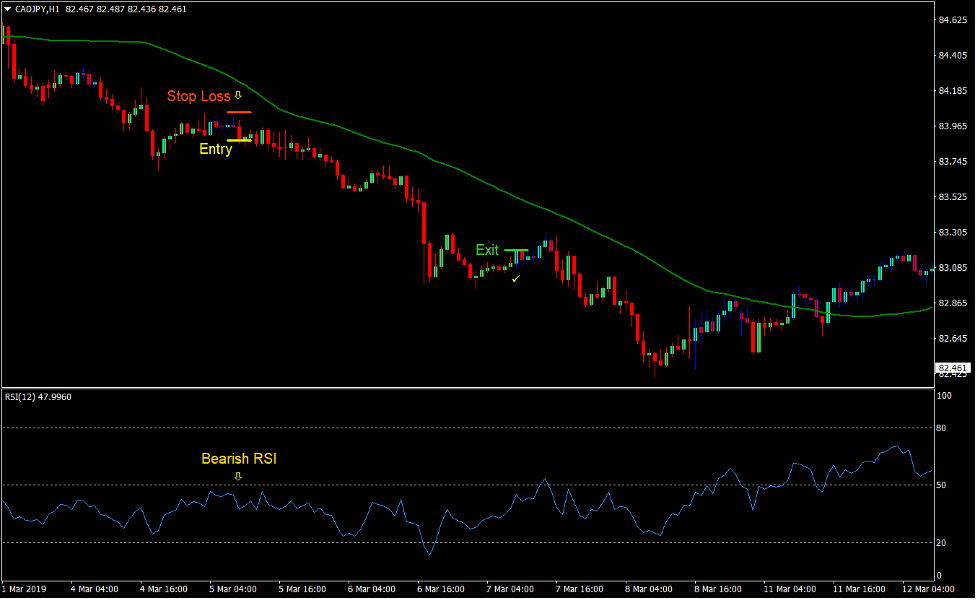

Sælg handelsopsætning

Indgang

- Prisen skal være under 50 SMA-linjen.

- 50 SMA-linjen skulle hælde ned, hvilket indikerer en bearish trend.

- RSI-linjen bør forblive inden for intervallet 10 – 50, hvilket indikerer en stærk bearish trend.

- Prisen skulle midlertidigt ændre sig, hvilket får Gann HiLo Activator Bars til midlertidigt at skifte til blå.

- Indtast en salgsordre, så snart Gann HiLo Activator Bars skifter til rødt, hvilket indikerer genoptagelsen af trenden.

Stop Loss

- Indstil stoptabet på fraktalen over indgangslyset.

Udgang

- Luk handlen, så snart Gann HiLo Activator Bars skifter til blå.

- Luk handlen, så snart RSI-linjen krydser over 50.

Konklusion

Denne handelsstrategi er en fremragende handelsstrategi, der ganske nemt kan producere store gevinster.

Handelsresultater kan variere. Nogle handler ville give små gevinster, andre ville forårsage små tab. Der er også tidspunkter, hvor prisen ville vende kraftigt, hvilket får prisen til at ramme stop loss. Ved mange lejligheder ville en handel give et rimeligt 1:1 afkast på en risiko for en handel. I nogle tilfælde kan den kortsigtede tendens dog vare lidt længere og give enorme afkast på en handel.

Teknisk set, hvis det gøres rigtigt, bør det give betydelige gevinster at tillade prisen at trende og kun lukke en handel, når trenden er afsluttet. Men denne tilgang er muligvis ikke for alle, da dette også kan forårsage lejlighedsvise nedsættelser. Nogle forhandlere foretrækker at sætte et fast profit-mål. Dette kan give gode resultater, hvis det sættes på et rimeligt niveau. Det er op til dig som erhvervsdrivende at identificere, hvilken tilgang der passer bedst til dig.

Anbefalede MT4-mæglere

XM Broker

- Gratis $ 50 For at begynde at handle med det samme! (Tilbagetrækbar fortjeneste)

- Indbetalingsbonus op til $5,000

- Ubegrænset loyalitetsprogram

- Prisvindende Forex Broker

- Yderligere eksklusive bonusser Gennem året

>> Tilmeld dig XM Broker-konto her <

FBS mægler

- Handel 100 bonus: Gratis $100 for at kickstarte din handelsrejse!

- 100% indbetalingsbonus: Fordoble dit indskud op til $10,000, og handel med øget kapital.

- Udnyttelse op til 1: 3000: Maksimering af potentielle overskud med en af de højeste gearingsmuligheder, der findes.

- Prisen 'Bedste kundeservicemægler Asia': Anerkendt ekspertise inden for kundesupport og service.

- Sæsonbestemte kampagner: Nyd en række eksklusive bonusser og kampagnetilbud hele året rundt.

>> Tilmeld dig FBS Broker-konto her <

Klik her nedenfor for at downloade: