Crossover-strategier er sandsynligvis en af de mere populære typer handelsstrategier blandt nybegyndere. Dette skyldes sandsynligvis dens brugervenlighed. Du handler simpelthen, når glidende gennemsnit ville krydse hinanden. Men mange nye handlende, der først prøver crossover-strategier, har ofte urealistiske forventninger til handel. Dette skyldes sandsynligvis noget af hypen omkring nogle crossover-strategier. Du vil ofte høre påstande om 90 %- eller 99 %-gevinst ved brug af en bestemt strategi. Det meste af det er ikke sandt, især når det anvendes til crossover-strategier. Dette skyldes, at crossover-strategier er trendfølgende eller trendvendende strategier. De fleste trendvendingsstrategier bygger på høje belønnings-risikoforhold i stedet for høje gevinstrater. Så i stedet for at lede efter strategier, der er rigtige 99% af tiden, skal du kigge efter strategier, der vil tillade dig at vinde mere end to gange i forhold til, hvad du har risikeret på stop-losset.

Elliott Wave Cross Forex Trading Strategy er en af de trendfølgende eller trendvendende strategier, der giver handlende mulighed for at tjene penge på store bevægelser, mens de stadig har en anstændig gevinstrate.

Alligator indikator

Alligator-indikatoren er en brugerdefineret indikator, som bruges til crossover-strategier. Den er sammensat af de tre glidende gennemsnit, som udvikleren kalder Jaws, Teeth og Lips. Kæberne repræsenterer det langsigtede glidende gennemsnit, tænderne repræsenterer det mellemliggende glidende gennemsnit, mens læberne repræsenterer det kortsigtede glidende gennemsnit. Disse glidende gennemsnit kan indstilles til forskellige perioder og kan flyttes frem eller tilbage. Dette giver handlende mulighed for at tilpasse deres crossover-handelsstrategier afhængigt af, hvad der virker for dem.

EMA 5 10 34 Crossover-indikator

EMA 5 10 34 Crossover-indikatoren er en anden brugerdefineret indikator, der er udviklet specifikt til crossover-strategier. Som navnet antyder, gør dens standardparametre brug af Exponential Moving Averages (EMA) med det kortsigtede glidende gennemsnit på 5, midtvejs glidende gennemsnit på 10 og langsigtet glidende gennemsnit på 34. Denne standardopsætning kan dog være tilpasset. Tidsperioderne for hvert glidende gennemsnit kan ændres såvel som den anvendte type glidende gennemsnit. Denne indikator udskriver derefter pile, der angiver en ændring i trendretning baseret på krydsningen af de glidende gennemsnit.

Elliott Wave Oscillator

Elliott Wave Oscillator er en simpel oscillerende indikator, som også er baseret på krydsninger af glidende gennemsnit. Faktisk er det en grundlæggende vurdering af forskellen mellem glidende gennemsnit. Det beregnes ved at trække værdien af det kortsigtede glidende gennemsnit fra det langsigtede glidende gennemsnit. Den resulterende forskel vil derefter blive plottet som histogrambjælker på sit eget vindue. Den udskriver derefter positive histogrammer, når den registrerer en bullish tendens, og negative histogrammer, hvis den registrerer en bearish tendens.

Trading Strategi

Elliott Wave Cross Forex Trading Strategi er baseret på sammenløbet af ovenstående indikatorer, som i det væsentlige er crossover-indikatorer.

EMA 5 10 34-indikatoren og Elliott Wave Oscillator ville tjene som det langsigtede trendfilter. Disse indikatorer vil normalt ændre retning næsten på samme tid. En pil, der angiver en retningsændring, vil normalt fremkomme, når Elliott Wave Oscillatoren også krydser dens midterlinje.

Alligator-indikatoren vil så repræsentere det faktiske indgangssignal. En handelsopsætning genereres, når det kortsigtede glidende gennemsnit krydser mellem- og langsigtet glidende gennemsnit. Disse crossovers bør dog stemme overens med EMA 5 10 34 Crossover-indikatoren og Elliott Wave Oscillator.

Indikatorer:

- EMA 5 10 34 CrossoverI

- Alligator

- Kæbeperiode: 28

- Kæbeskift: 8

- Tandperiode: 12

- Tandskift: 5

- Læberperiode: 7

- Læbeskift: 3

- Elliott Wave Oscillator 34

Tidsramme: 1-timers, 4-timers og daglige diagrammer

Valutakryds: dur og mol par

Handelssession: Tokyo, London og New York Sessions

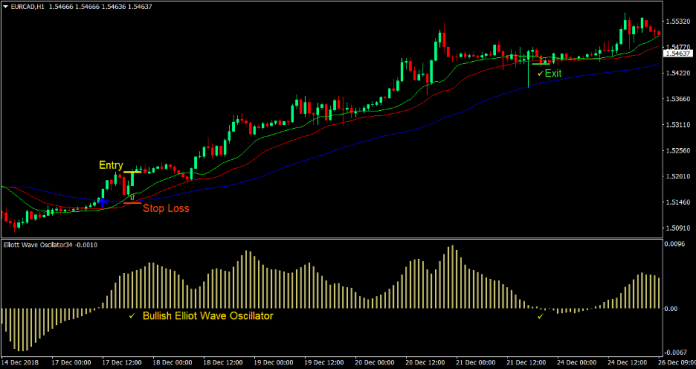

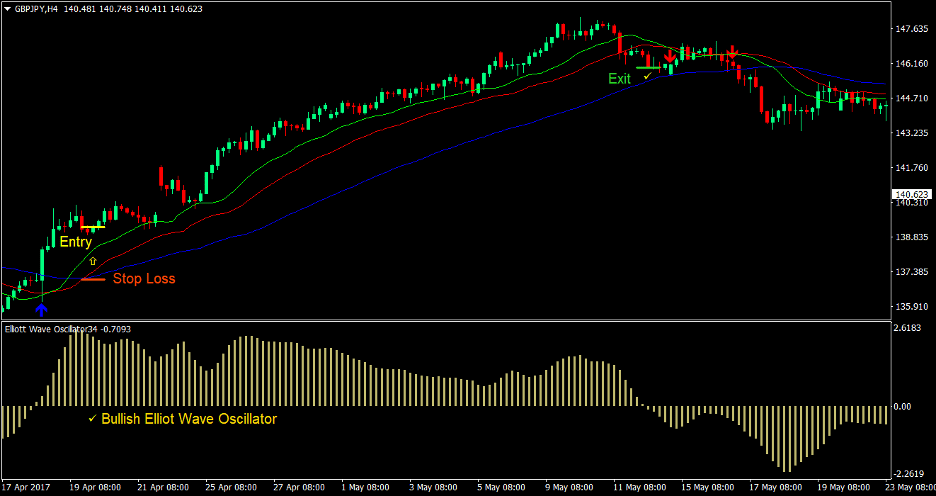

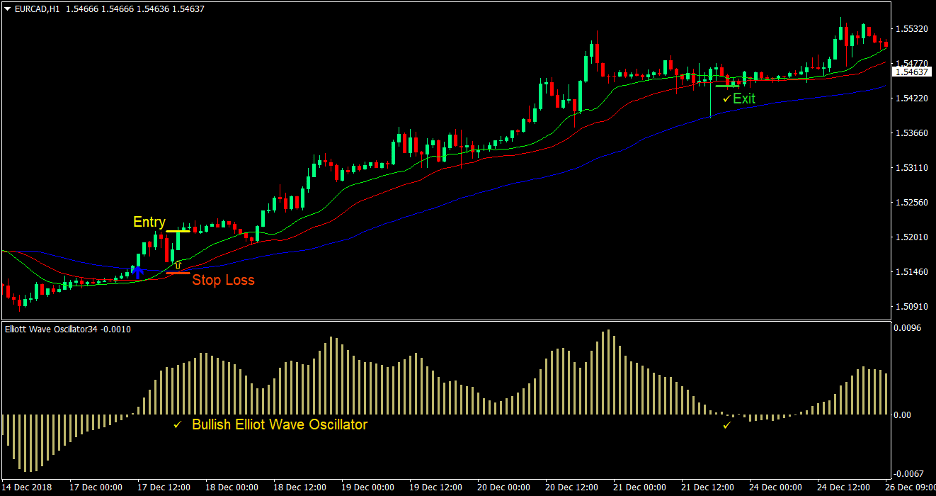

Køb Trade Setup

Indgang

- En blå pil, der peger opad, skal udskrives på diagrammet, hvilket indikerer en bullish trendvending

- Elliott Wave Oscillator skulle udskrive positive histogrammer, der indikerer en bullish tendens

- Indtast en købsordre, så snart limelinjen krydser over de røde og blå linjer, hvilket indikerer en bullish trendvending

Stop Loss

- Indstil stoptabet under de glidende gennemsnit

Udgang

- Luk handelen, så snart Elliott Wave Oscillator begynder at udskrive negative histogrammer

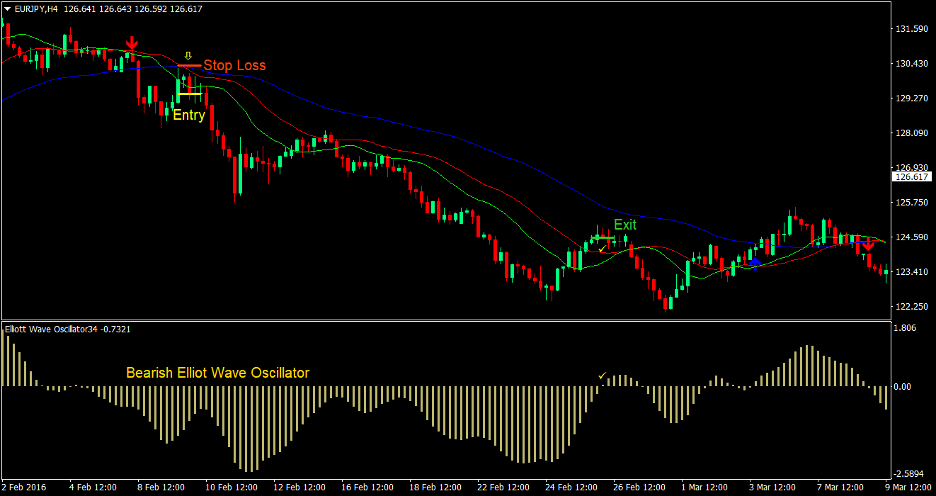

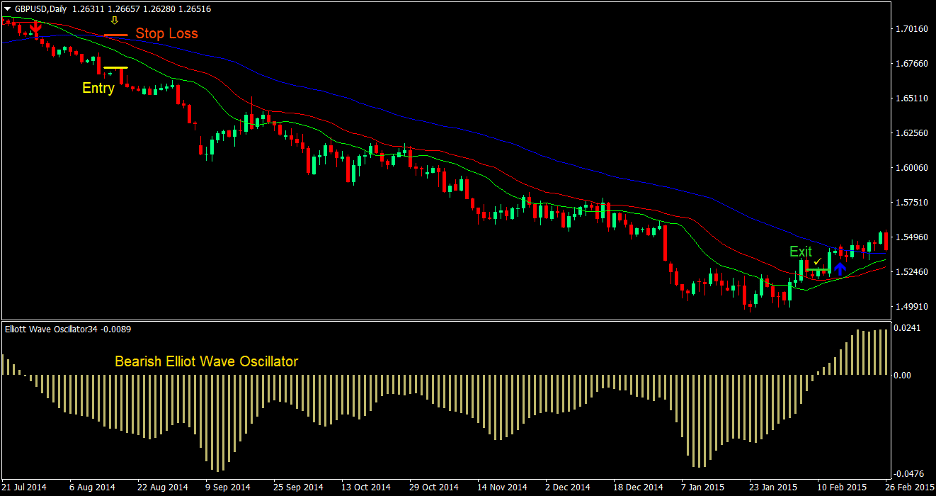

Sælg handelsopsætning

Indgang

- En rød pil, der peger nedad, skal udskrives på diagrammet, hvilket indikerer en bearish trendvending

- Elliott Wave Oscillator skulle udskrive negative histogrammer, der indikerer en bearish tendens

- Indtast en salgsordre, så snart limelinjen krydser under de røde og blå linjer, hvilket indikerer en bearish trendvending

Stop Loss

- Indstil stoptabet over de glidende gennemsnit

Udgang

- Luk handlen, så snart Elliott Wave Oscillator begynder at udskrive positive histogrammer

Konklusion

Elliott Wave Cross Forex Trading Strategi er dybest set et sammenløb af handelssignaler baseret på glidende gennemsnitlige crossover-strategier. Dette giver handlende mulighed for at bortfiltrere trendvendinger, der er af lav sandsynlighed, og giver handlende mulighed for at tage handler med stor sandsynlighed for at resultere i en stærk trend.

Disse handelsstrategier er mere afhængige af handler med højt afkast end et ekstremt højt gevinstforhold. Det giver handlende mulighed for at fange handler, der ville resultere i belønnings-risikoforhold på 3:1 til 6:1, nogle gange endda højere. Dets gevinstforhold er dog stadig respektabelt på grund af det faktum, at det får handlende til at tage handler, der kun er af høj kvalitet.

Anbefalede MT4-mæglere

XM Broker

- Gratis $ 50 For at begynde at handle med det samme! (Tilbagetrækbar fortjeneste)

- Indbetalingsbonus op til $5,000

- Ubegrænset loyalitetsprogram

- Prisvindende Forex Broker

- Yderligere eksklusive bonusser Gennem året

>> Tilmeld dig XM Broker-konto her <

FBS mægler

- Handel 100 bonus: Gratis $100 for at kickstarte din handelsrejse!

- 100% indbetalingsbonus: Fordoble dit indskud op til $10,000, og handel med øget kapital.

- Udnyttelse op til 1: 3000: Maksimering af potentielle overskud med en af de højeste gearingsmuligheder, der findes.

- Prisen 'Bedste kundeservicemægler Asia': Anerkendt ekspertise inden for kundesupport og service.

- Sæsonbestemte kampagner: Nyd en række eksklusive bonusser og kampagnetilbud hele året rundt.

>> Tilmeld dig FBS Broker-konto her <

Klik her nedenfor for at downloade: