Klassisk Bear Trap Swing Forex Trading Strategi

Tidligere har jeg diskuteret, hvordan vi kan tjene penge, selv når andre handlende taber penge. Desværre er det endda på deres bekostning. Jeg taler om den klassiske bull trap-strategi, som tidligere er blevet diskuteret. Men muligheden er ikke kun begrænset til fangede tyre. Selv bjørne kunne også blive fanget.

Bullish, alt for optimistiske handlende er ikke de eneste, der kan blive fanget i en handel. Bearish-handlere er ikke immune over for fælder, især i dag og alder, og især på forexmarkedet. Det plejede at være, at markedet kun bevæger sig udelukkende med køb og salg. Dette fik for optimistiske bullish swing- og positionshandlere til at blive fanget i et marked, der er på vej ned. De ser prisen bryde ud af en modstand, de tager en position, hvorefter kursen straks går tilbage. Men fordi handel også giver mulighed for shorting på de fleste instrumenter, kan en erhvervsdrivende også være alt for optimistisk over, at prisen ville falde. De ser, at prisen går under support, de benytter lejligheden til at shorte, og derefter stiger prisen straks igen. Dette gælder især med forex. Dette skyldes, at valutamarkedet ikke kun handler om at købe og sælge, det handler i bund og grund en valuta til fordel for en anden. At købe en valuta betyder, at du sælger den anden, og omvendt. Dette gør sandsynligheden for et udbrud af en modstand og et brud under en støtte næsten symmetrisk, afhængigt af den aktuelle markedstilstand.

Bjørnefælde

En bjørnefælde er præcis det modsatte af en tyrefælde. Hvis du forstår, hvordan en tyrefælde fungerer, så vend den om, og det er præcis, hvordan en bjørnefælde ville fungere.

Dybest set er en bjørnefælde en situation, hvor bearish handlende, der troede, de så et signallys bryde under et støtteniveau, ville shorte et valutapar eller ethvert handelsinstrument i håb om, at prisen ville fortsætte med at falde. I nogle tilfælde ville det virke. Men der er også mange tilfælde, hvor prisen ville stikke under støtten, kun for at vende tilbage over den og lukke. Det ville betyde en afvisning af prisen under støtten. Det ville også danne et stearinlys med en væge under kroppen. Så, lidt senere, ville prisen hoppe af støtteniveauet og gå op igen. Nogle handlende ville have et stop loss på plads, mens andre ville holde fast i den tabende handel. Da disse forhandlere enten bliver stoppet eller presset ud af handelen, vil prisen så begynde at få et momentum i vejret, da lukning af en salgshandel reelt er en købstransaktion.

Handelsstrategikoncept

Bjørnefældestrategien er dybest set en strategi, der sigter mod at komme ind i en handel, da prisen viser tegn på at have et mislykket brud under et støtteniveau.

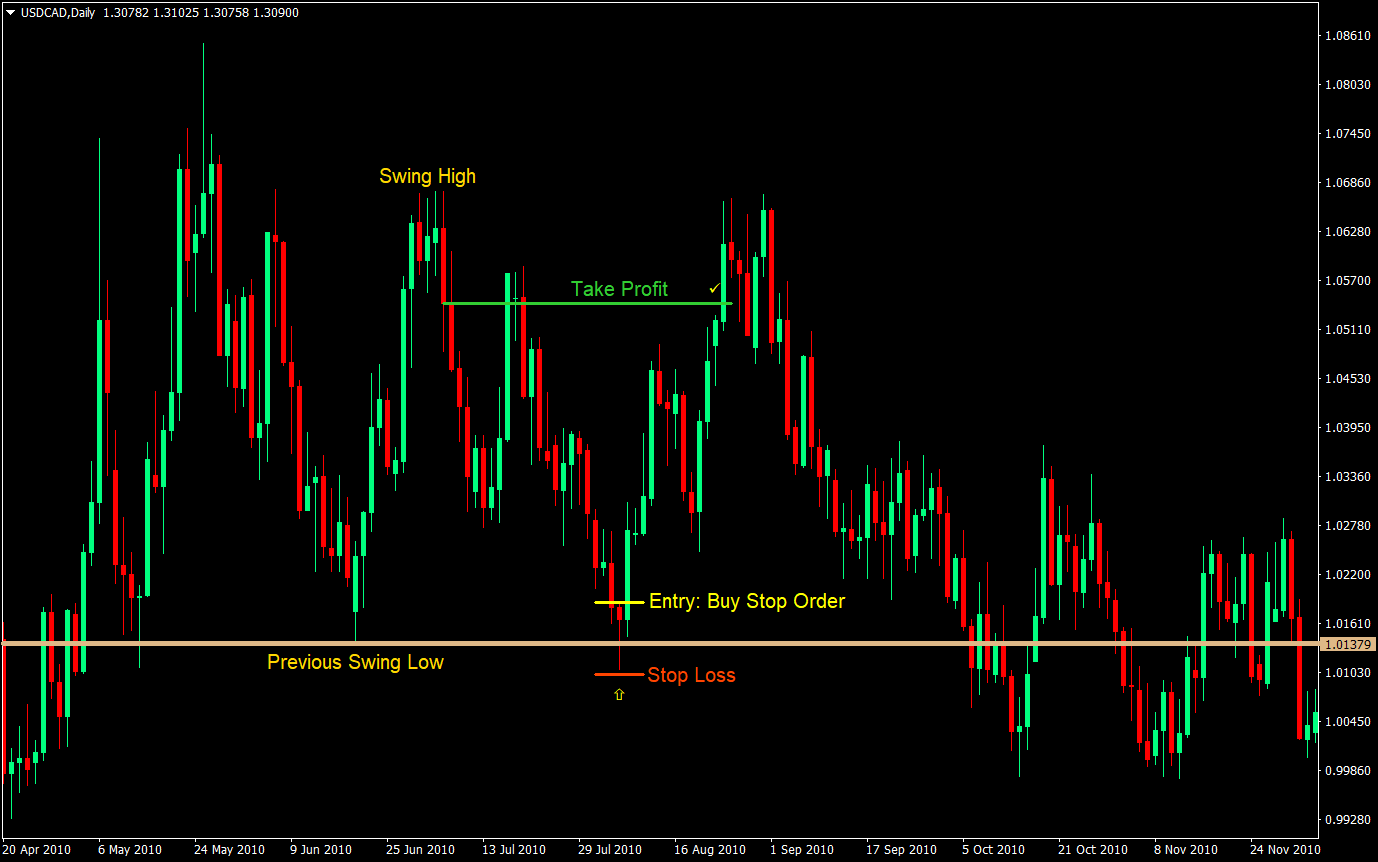

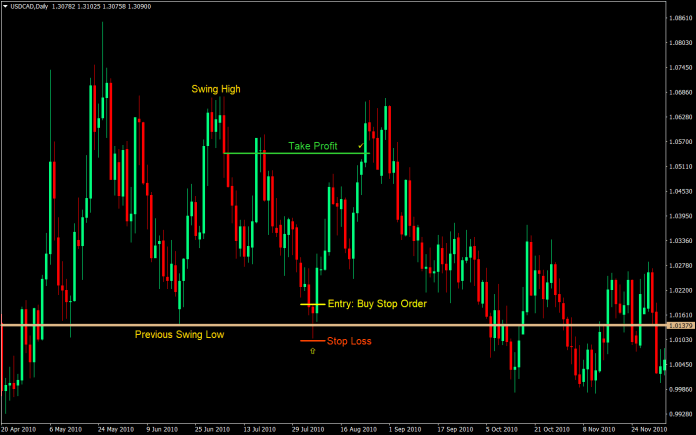

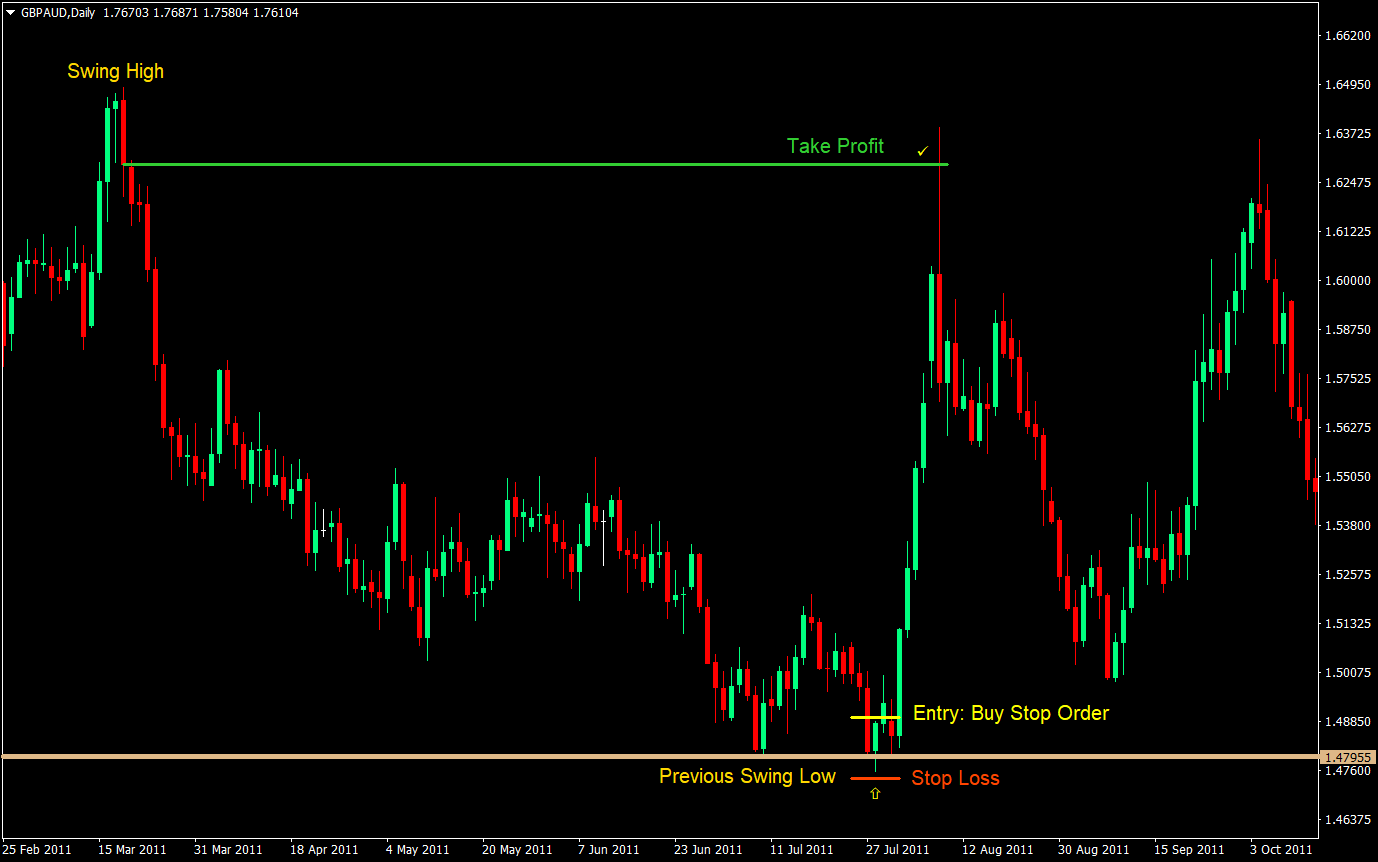

I løbet af dagen, da prisen begynder at stikke under et supportniveau, ville mange breakout-handlere bemærke dette, og mange ville springe foran og shorte parret. Så, når prisen lukker tilbage over støtteniveauet, vil der blive dannet et stearinlys med en lang væge under kroppen eller et bullish pin bar stearinlys. Dette viser tegn på prisafvisning. Dette ville være vores signal om at sætte vores købsstopordre over det stearinlys. Så, når prisen begynder at stige igen, ville mange af bjørnene blive presset ud af handelen, enten med et stop loss, der bliver ramt eller manuelt lukket en tabende handel, efterhånden som smerten ved at tabe intensiveres. Efterhånden som dette finder sted, vil prisen tage fart på vej op igen og forhåbentlig på den anden side af intervallet.

Vi vil gøre brug af længere tidsrammer, da dette giver mulighed for at fange flere bjørne. Jo flere bjørne der er fanget, jo mere potent bliver opsætningen.

Valutapar: enhver

Tidsramme: daglig tidsramme

Køb (lang) handelsopsætning

Indgang

- Identificer et vandret støtteniveau ved at bestemme svinglavere eller et faktisk vandret støtteniveau med flere berøringer

- Vent på prisen for at gense området for supportniveauet

- Vent på, at prisen stikker under støtteniveauet og lukker tilbage over støtteniveauet

- Lyset skal danne et bullish nålemønster eller en lysestage med en lang væge under lysets krop

- Indstil en købstopordre over det højeste af stearinlyset

Stop Loss

- Indstil stop losset under stearinlysets laveste

Tag Profit

- Sæt take-profitten på kroppen af det forrige sving højt

Konklusion

Dette scenarie er et almindeligt tilbagevendende scenario. Du vil ofte se dette i et af diagrammerne. Dette er almindeligt selv på andre instrumenter. Forestil dig, hvis du er en detailinvestor eller en positionshandler. Du har hørt i nyhederne, at en bestemt valuta, råvare, aktie eller obligation er faldet. Så hører du et af boblehovederne i nyhederne sige, at prisen allerede er under et vigtigt supportniveau. Så du skyndte dig at ringe til din mægler eller tage en handel med at sælge det nævnte instrument. Så springer prisen pludselig op igen. Ofte ville du høre dem tude om det, efterhånden som smerten bliver stærkere. Så kan de bare ikke tage det, de ringer enten til deres mægler eller lukker handlen. Det er de handlende eller markedsdeltagere, vi handler imod.

Denne strategi fungerer godt, da flere og flere bjørne er fanget i handelen. Så jo længere vægen er, jo bedre, jo højere tidsramme vi spiller på, jo bedre. Lange væger betyder flere transaktioner, flere bjørne fanget i fælden. Højere tidsrammer betyder mere tid til at tillade bjørne at blive fanget. Så snart de begynder at lukke deres positioner med tab, begynder vores position at tage fart.

Anbefalet MT4 Broker

- Gratis $ 50 For at begynde at handle med det samme! (Udtrækbar fortjeneste)

- Indbetalingsbonus op til $5,000

- Ubegrænset loyalitetsprogram

- Prisvindende Forex Broker

- Yderligere eksklusive bonusser Gennem året

Klik her nedenfor for at downloade:

Tilføj venligst indikatoren, du kan kun tilføje TPL

send mig venligst indikatoren classic-bear-trap-swing-forex-trading-strategy

Der er ingen mq4/ex4-fil til denne strategi. Bare upload TPL-filen, og den vil automatisk forbindes med indikatorerne i MT4.