144 Trend Shift Scalping-strategi

Glidende gennemsnit er sandsynligvis en af de mest populære indikatorer blandt handlende. Næsten alle handlende bruger en form for glidende gennemsnit som en del af deres strategi. Der er dog mange forskellige tilgange til at bruge glidende gennemsnit, og endnu flere glidende gennemsnitsparametre, der bruges som variationer af forskellige strategier.

Glidende gennemsnitlige crossover-strategier

Sandsynligvis en af de mest populære anvendelser af det glidende gennemsnit som en entry and exit-strategi er den glidende gennemsnitlige crossover. Dette er dybest set en handelsstrategi, der laver ind- og udgange baseret på krydsningen af to glidende gennemsnit.

Selvom der er mange crossover-strategier, der ikke virker, er der også andre, der virker. For at løse dette og forbedre vores handelsstatistik, lad os prøve at forstå, hvad ideen bag strategien egentlig er, så vi kan nærme os crossover-strategier på den rigtige måde.

Konceptet bag crossover-strategier er ideen om, at vi kunne vurdere skift i trendbias baseret på glidende gennemsnit. Mange handlende identificerer trendretninger baseret på, hvor prisen er i forhold til deres primære glidende gennemsnit. Lad os for eksempel sige, at en erhvervsdrivende bruger 200 Exponential Moving Average (EMA) til at identificere den langsigtede trendbias. Den erhvervsdrivende ville normalt teoretisere, at hvis prisen er over 200 EMA, så siges den langsigtede tendens at være bullish. Hvis prisen på den anden side er under 200 EMA, så siges markedet at have en bearish bias på lang sigt. Hvad crossover glidende gennemsnitsstrategi gør, er, at den tillader en bekræftelse af skiftet af trendbias ved at vente på et hurtigere glidende, kortere periode glidende gennemsnit for at krydse det primære glidende gennemsnit.

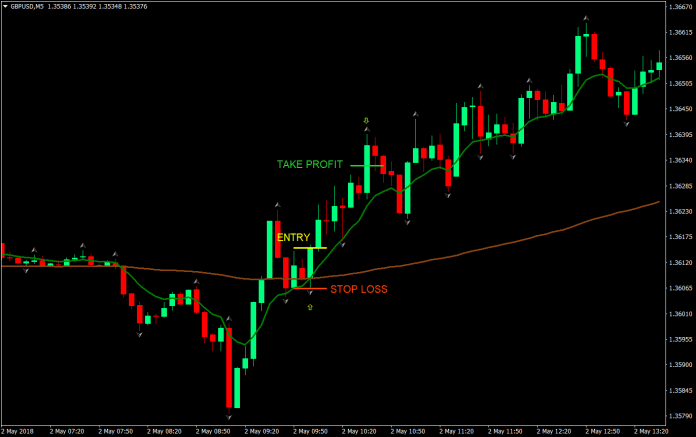

Så hvorfor er en crossover nødvendig, hvis placeringen af prisen er hovedgrundlaget for en trend? Fordi en anden modsigende måde at bruge det glidende gennemsnit på er som en dynamisk støtte eller modstand. Nogle gange kan prisen bare røre ved, gennembore eller bryde et glidende gennemsnit for et par stearinlys, før den hopper af. Ligesom dette preller af 200 EMA på diagrammet nedenfor.

Hvis du handlede med krydsninger af pris og glidende gennemsnit alene, ville du tabe på disse scenarier. Ved at bruge et andet glidende gennemsnit med kortere perioder, mindsker vi at være involveret i markedet i disse scenarier.

Men på grund af den langsommere reaktion ved at vente på den glidende gennemsnitlige crossover i stedet for at vente på prisen alene, har glidende gennemsnits crossover-strategier en tendens til at være lidt for sent på ind- og udgangen. Det er fint at komme for sent i den ene ende, men at være forsinket i begge er måske ikke godt for din konto.

Strategikoncept

Denne strategi forsøger at udnytte styrken af glidende gennemsnits-crossover-strategier, som er bekræftelsen af et skift i trendretningsbias, mens den forsøger at eliminere forsinkelsen i den ene ende af handlen, som er exit. I det væsentlige accepterer vi forsinkelsen på indgangen for at få bekræftelsen af et trendbiasskifte, men vi forsøger at eliminere forsinkelsen på udgangen ved ikke at vente på endnu en crossover.

For at gøre dette vil vi bruge et af de mest populære langsigtede glidende gennemsnit, 144 Linear Weighted Moving Average (LWMA). Jeg er ikke sikker på, hvorfor dette er populært, men det er sandsynligvis fordi denne indstilling for glidende gennemsnit ser ud til at virke.

For vores glidende gennemsnit for kortere perioder vil vi derefter bruge 5-periods Smoothed Moving Average (SMA). Dette er et meget hurtigt bevægende gennemsnit, så vi forventer mindre forsinkelser på vores tilmeldinger. Der vil dog stadig være nogle bevægelser, der ville skabe stærk momentum i blot ét stearinlys, hvilket får prisen til at være for langt væk fra 144 LWMA. Så meget som muligt bør vi forsøge at undgå disse poster, da der kan være mindre plads til, at prisen kan bevæge sig i vores retning.

Tidsramme: 5-minutters diagram

Valutapar: GBP/USD, EUR/USD

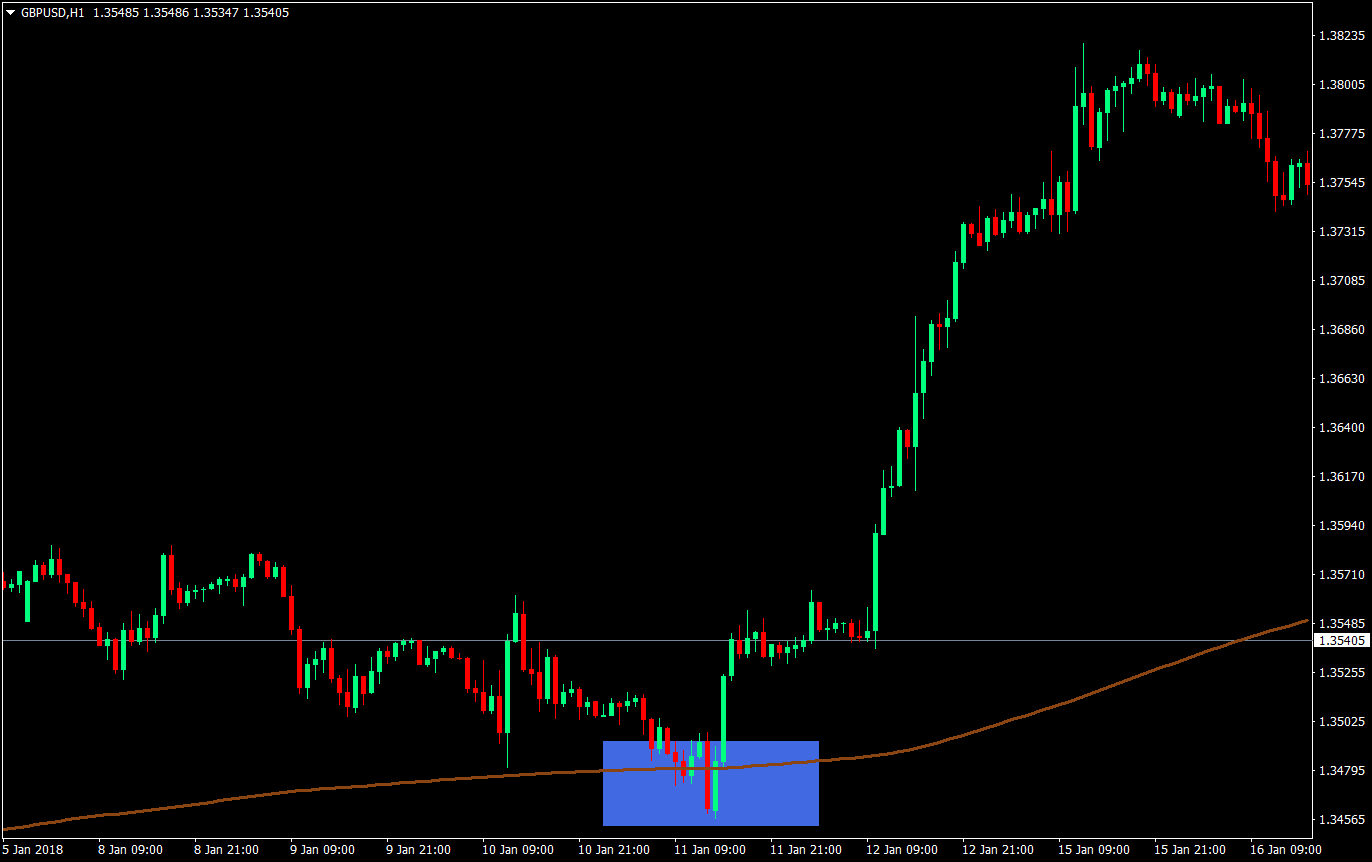

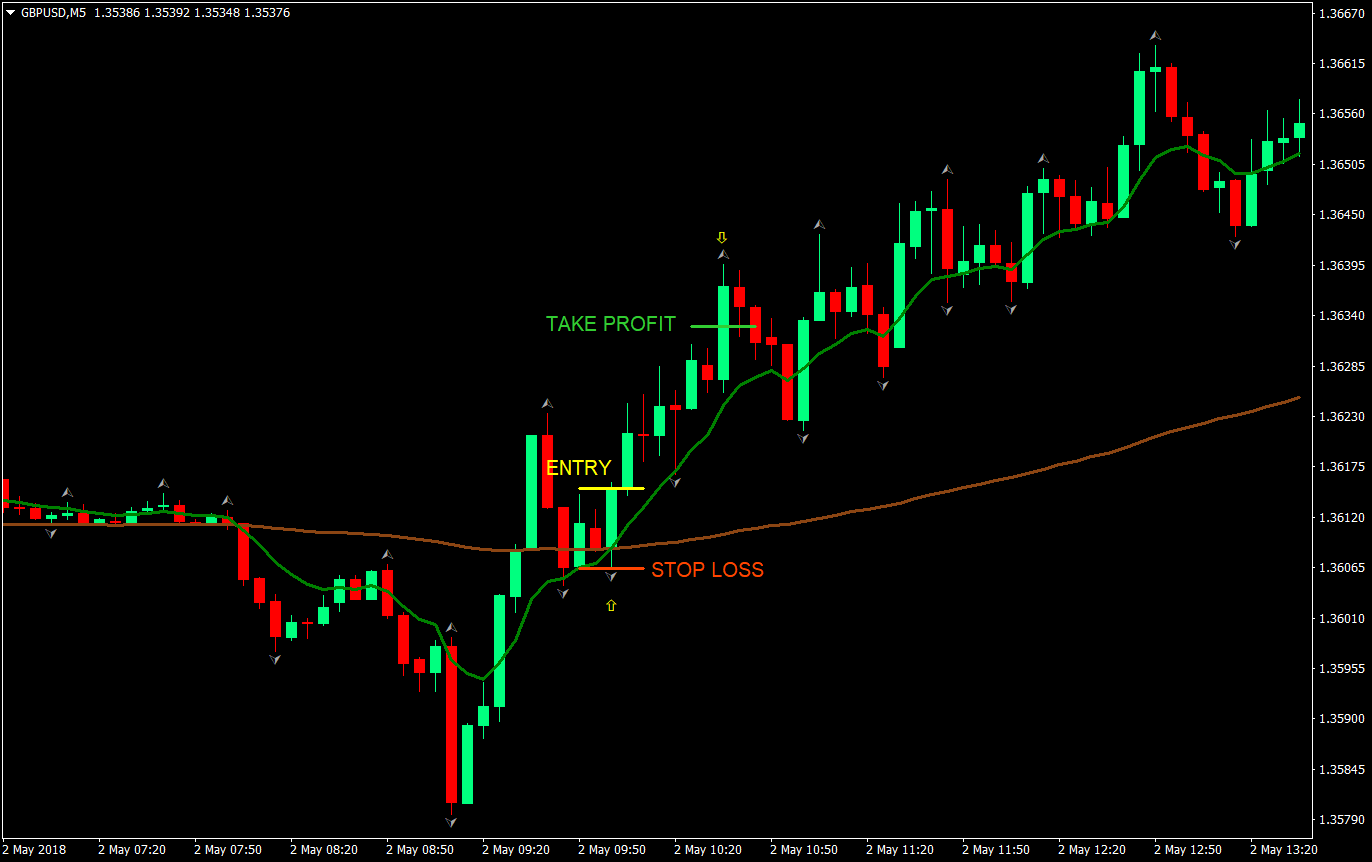

Køb Trade Setup

Indgang

- 5 SMA (grøn) skal krydse over 144 LWMA (brun)

- Prisen bør ikke være mere end 10 pips væk fra 144 LWMA

Stop Loss

- Indstil stoptabet ved fraktalen under indgangen

Tag Profit

- Sæt take-profitten til 2x risikoen på stop loss

På denne særlige handelsprøve nåede prisen nemt op på gevinsten ved den første prisfremstød. Det fortsatte endda yderligere for højere mulige gevinster. Nu kunne vi være lidt kreative og presse mere overskud ind, men da dette er en skalperingsstrategi, vil vi nøjes med 2:1 belønning-risiko-forholdet på stop-losset. Dette vil give os mulighed for at være en smule mere konsekvente med vores overskud i stedet for at vente på, at markedet vender tilbage, hvilket nogle gange kan være negativt.

Også, hvis du er en handlende med prishandling eller lysestagemønster, blev tre på hinanden følgende røde stearinlys efter gevinsten ramt, plus det lange røde lys efter det. På det tidspunkt ville vi ikke rigtig vide, om markedet ville vende om eller fortsætte med at vokse til vores fordel.

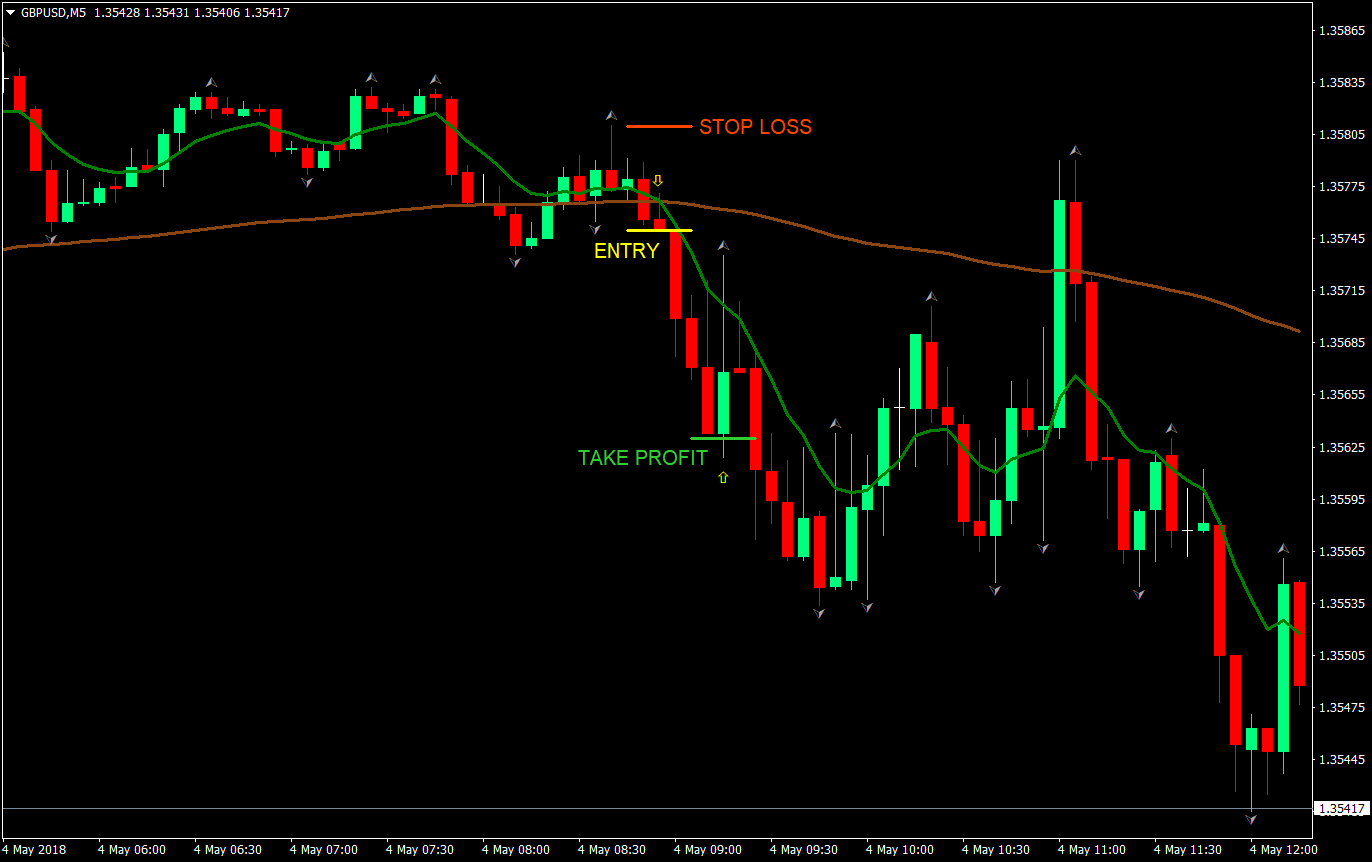

Sælg handelsopsætning

Indgang

- 5 SMA (grøn) skal krydse under 144 LWMA (brun)

- Prisen bør ikke være mere end 10 pips væk fra 144 LWMA

Stop Loss

- Indstil stoptabet ved fraktalen over indgangen

Tag Profit

Sæt take-profitten til 2x risikoen på stop loss

Igen vil du se på denne prøve, at prisen kunne være fortsat længere for større gevinster. Men igen, der var flere skræmmende øjeblikke efter, at vores profit blev ramt. På stearinlyset, hvor vores take profit blev ramt, opstod der en pludselig opadgående spids, som blev slået tilbage af bjørnene. Også på den efterfølgende sekvens af stearinlys var der et punkt, hvor prisen trængte tilbage over 144 LWMA, før den hoppede af. Selvom vi kunne have fået større gevinster i lommen, kan det stadig betale sig at tage din fortjeneste med det samme som en scalper.

Konklusion

Denne strategi er en sund crossover-strategi, som mindsker sandsynligheden for at afslutte til en dårligere pris. Dette er på grund af vores filter, som ikke tillader handler, der er gået i gang, før vi kom ind på markedet, og på grund af den konservative tilgang ved at forlade handlen med et fast belønnings-risikoforhold på 2:1. Dette skulle give denne strategi et højere gevinstforhold.

Men hvad den giver afkald på er evnen til at presse overskud fra begyndelsen af trenden, indtil den slutter. Hvis dette var tilfældet, kunne vi sandsynligvis have et højere belønnings-risikoforhold, men et lavere gevinstforhold.

Du kan også være lidt kreativ på dette og forlade delstillinger, mens du går i profit. Men dette ville også ødelægge forholdet mellem belønning og risiko, da nogle af positionerne ville tjene mere end de andre.

En anden vigtig ting at gøre er at følge stoptabet. Dette ville yderligere forbedre forholdet mellem belønning og risiko. Men følg det for stramt, og det kan skade dit forhold mellem gevinst og tab.

Lær det, tweak det, test det, og gør det til dit eget.

Anbefalet MT4 Broker

- Gratis $ 50 For at begynde at handle med det samme! (Udtrækbar fortjeneste)

- Indbetalingsbonus op til $5,000

- Ubegrænset loyalitetsprogram

- Prisvindende Forex Broker

- Yderligere eksklusive bonusser Gennem året

Klik her nedenfor for at downloade: