The Correlation Indicator is a technical analysis tool that measures the correlation between two or more currency pairs in MetaTrader 4. It is a powerful tool that can help traders identify the strength and direction of the correlation between different currency pairs, which can be useful in developing trading strategies.

Why is the Correlation Indicator important?

The Correlation Indicator is important because it can help traders identify the correlation between different currency pairs, which can be useful in developing trading strategies. By analyzing the correlation between different currency pairs, traders can identify potential trading opportunities and make informed trading decisions.

How Does the Correlation Indicator Work?

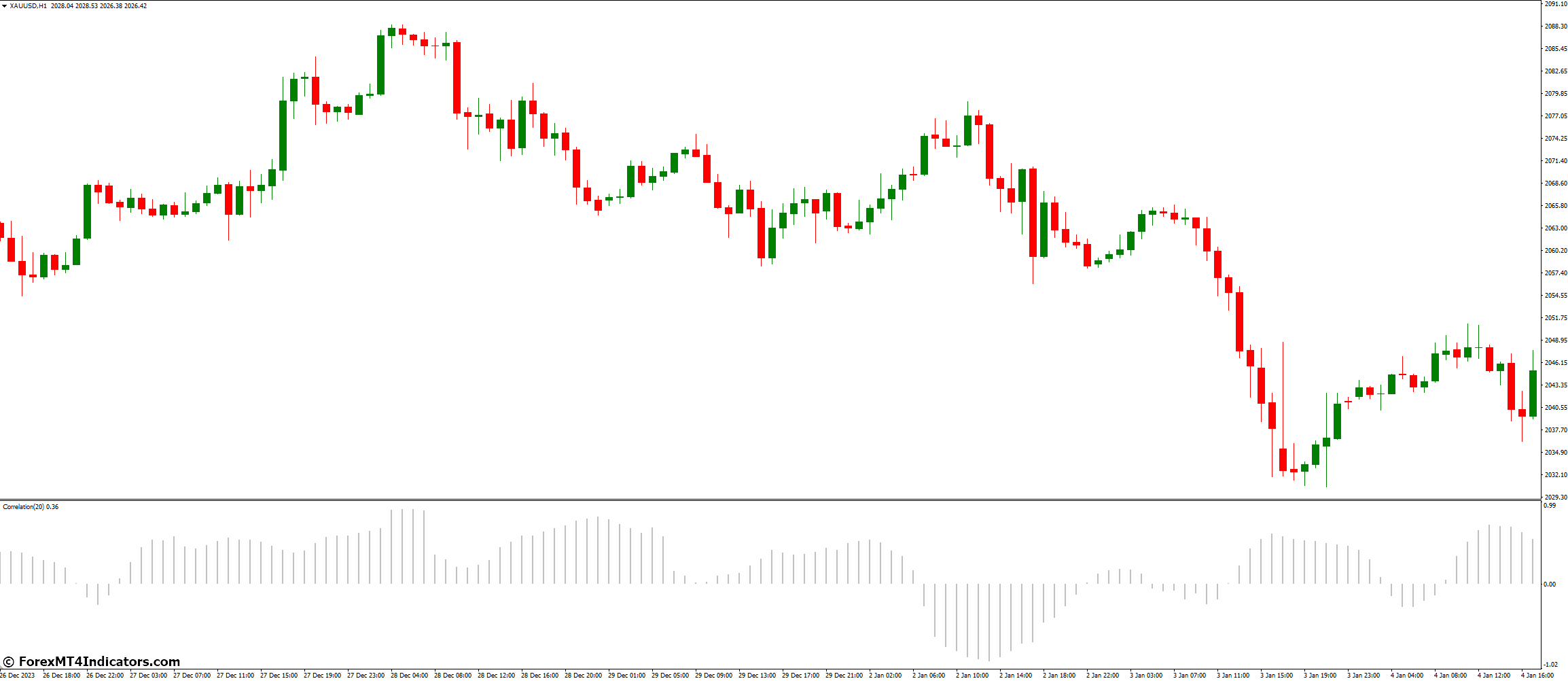

The Correlation Indicator works by measuring the correlation between two or more currency pairs in MetaTrader 4. It calculates the correlation coefficient between the currency pairs, which ranges from -1 to +1. A correlation coefficient of -1 indicates a perfect negative correlation, while a correlation coefficient of +1 indicates a perfect positive correlation. A correlation coefficient of 0 indicates no correlation between the currency pairs.

What are the benefits of using a Correlation Indicator?

The benefits of using Correlation Indicator include:

- Identifying potential trading opportunities

- Making informed trading decisions

- Developing trading strategies based on the correlation between different currency pairs

- Reducing risk by diversifying trading strategies

What are the limitations of the Correlation Indicator?

The limitations of Correlation Indicator include:

- It only measures the correlation between two or more currency pairs

- It does not provide information on the causality of the correlation

- It does not provide information on the strength of the correlation

What are the alternatives to the Correlation Indicator?

The alternatives to Correlation Indicators include:

- Regression analysis

- Co-integration analysis

- Time-series analysis

What are the Best Practices for using the Correlation Indicator?

The best practices for using Correlation Indicator include:

- Using the Correlation Indicator in conjunction with other technical analysis tools

- Analyzing the correlation between different currency pairs over different periods

- Using the Correlation Indicator to identify potential trading opportunities

What are the Common Mistakes to Avoid When Using Correlation Indicators?

The common mistakes to avoid when using Correlation Indicator include:

- Relying solely on the Correlation Indicator to make trading decisions

- Failing to analyze the correlation between different currency pairs over different periods

- Failing to use the Correlation Indicator in conjunction with other technical analysis tools

How to Interpret Correlation Indicator Results?

To interpret Correlation Indicator results, follow these guidelines:

- A correlation coefficient of -1 indicates a perfect negative correlation

- A correlation coefficient of +1 indicates a perfect positive correlation

- A correlation coefficient of 0 indicates no correlation between the currency pairs

What are the real-world Applications of the Correlation Indicator?

The real-world applications of Correlation Indicators include:

- Identifying potential trading opportunities

- Developing trading strategies based on the correlation between different currency pairs

- Reducing risk by diversifying trading strategies

Example and Case Study

How to use a Correlation Indicator for Trading?

To use a Correlation Indicator for trading, follow these steps:

- Analyze the correlation between different currency pairs using the Correlation Indicator

- Identify potential trading opportunities based on the correlation between different currency pairs

- Develop trading strategies based on the correlation between different currency pairs

Case study: Correlation Indicator in Action

John is a forex trader who uses the Correlation Indicator to analyze the correlation between different currency pairs. He notices that there is a strong positive correlation between the EUR/USD and GBP/USD currency pairs, which indicates that when the EUR/USD goes up, the GBP/USD also goes up. Based on this correlation, John decides to go long on the EUR/USD and GBP/USD currency pairs.

Example: How to use a Correlation Indicator for Trading?

To use a Correlation Indicator for trading, follow these steps:

- Analyze the correlation between different currency pairs using the Correlation Indicator

- Identify potential trading opportunities based on the correlation between different currency pairs

- Develop trading strategies based on the correlation between different currency pairs

Case study: Correlation Indicator in Action

John is a forex trader who uses the Correlation Indicator to analyze the correlation between different currency pairs. He notices that there is a strong positive correlation between the EUR/USD and GBP/USD currency pairs, which indicates that when the EUR/USD goes up, the GBP/USD also goes up. Based on this correlation, John decides to go long on the EUR/USD and GBP/USD currency pairs.

How to Trade with Correlation Indicator

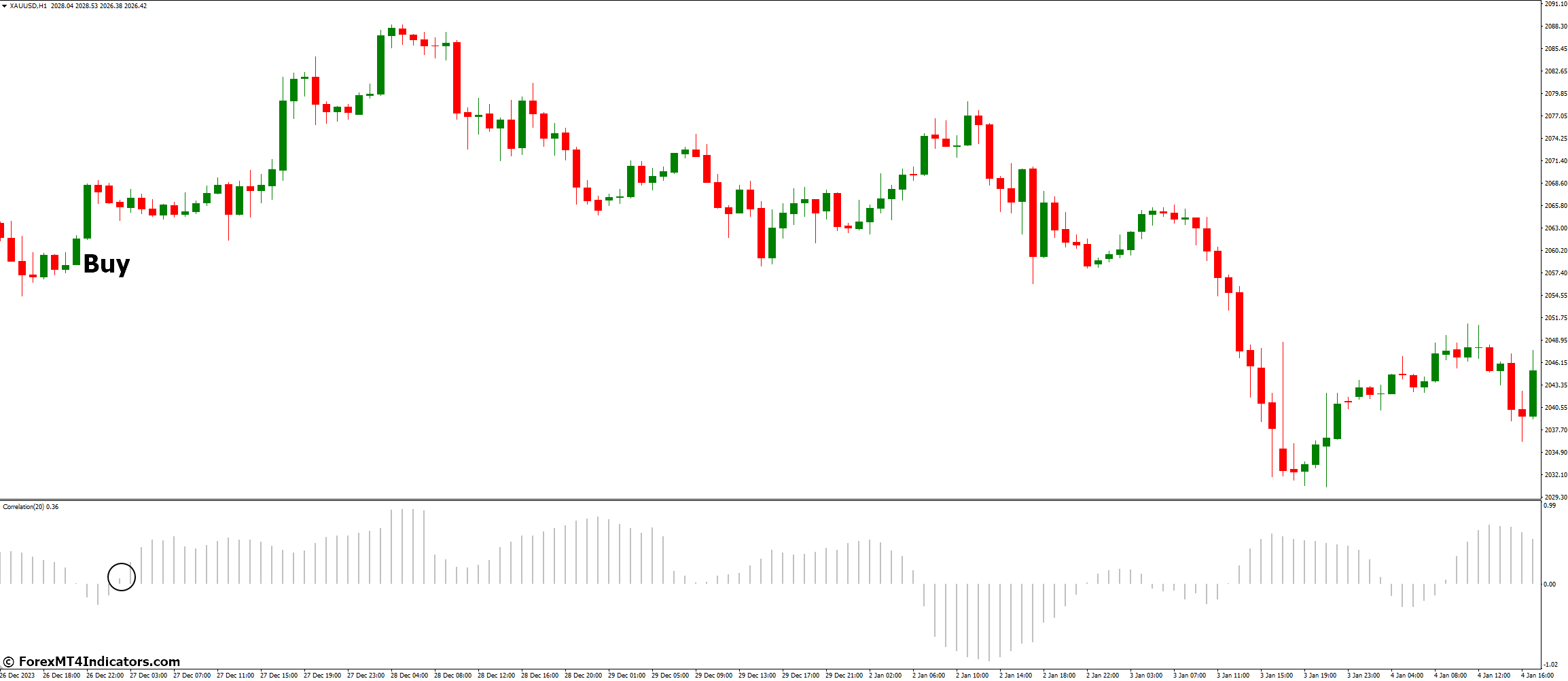

Buy Entry

- When the correlation between two currency pairs is strongly positive, consider entering a buy trade on one of the pairs.

- Confirm the buy entry with additional technical analysis or signals to ensure a comprehensive approach.

- Look for supportive candlestick patterns, trendline breaks, or other confirming indicators.

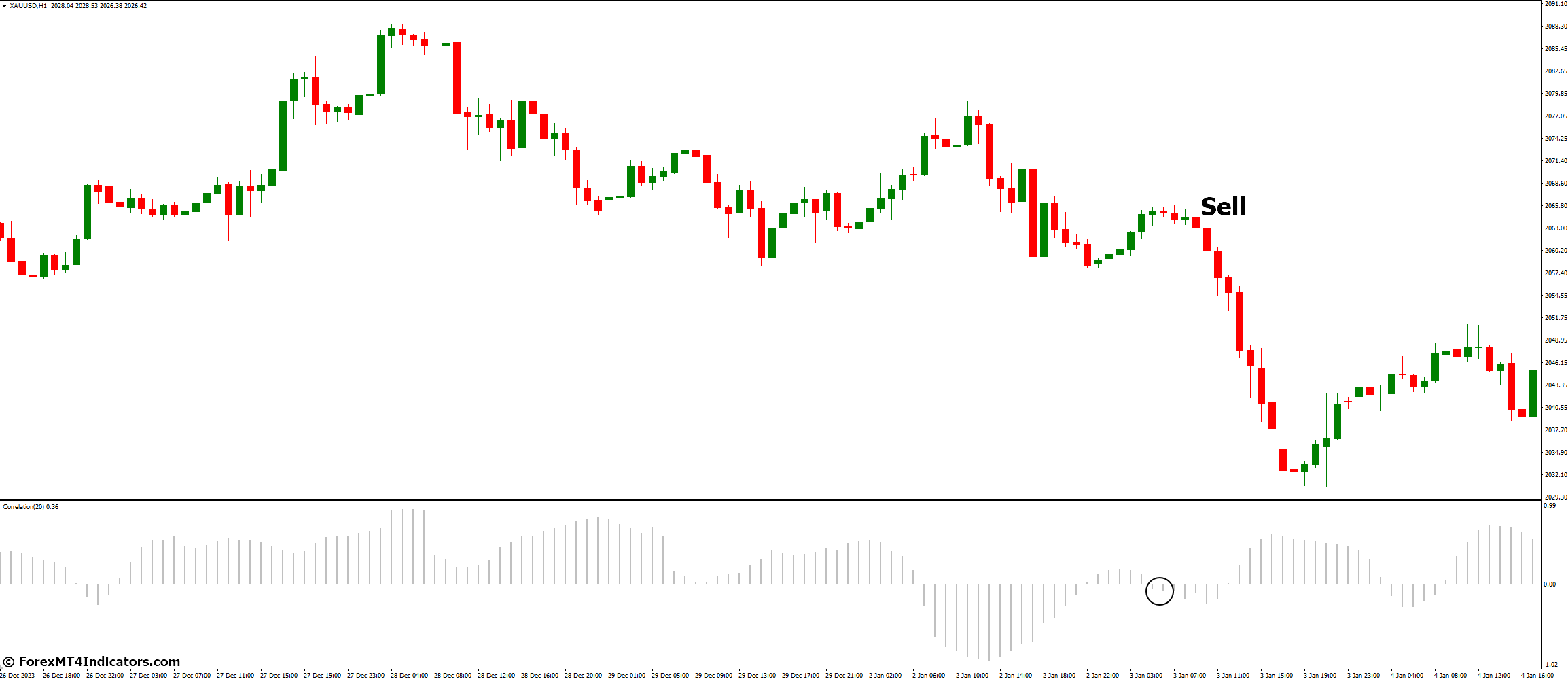

Sell Entry

- If the correlation is strongly negative between two currency pairs, consider entering a sell trade on one of the pairs.

- Confirm the sell entry with other technical analysis tools or signals to enhance the reliability of the trade.

- Look for bearish candlestick patterns, trendline breaks, or other confirming indicators.

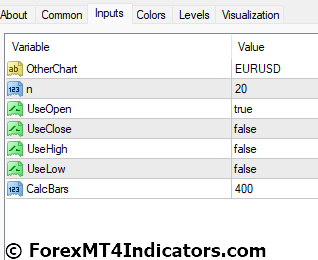

Correlation Indicator Settings

Conclusion

The Correlation Indicator for MetaTrader 4 is a powerful tool that can help traders identify the correlation between different currency pairs. By analyzing the correlation between different currency pairs, traders can identify potential trading opportunities and make informed trading decisions.

However, it is important to remember that the Correlation Indicator is just one of many technical analysis tools available to traders, and should be used in conjunction with other tools to develop effective trading strategies.

Recommended MT4/MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT4 Indicators Download)

Click here below to download: