Confirmed Crossover Forex Trading Strategy

Trading strategies need not be complicated. Even the most basic trading strategies could make money. All you need is a positive expectancy based on the mix of the strategies reward-risk ratio and its win percentage. If you’ve got this down, then you’ve won half the battle.

But how do we get to make a simple strategy to have a good reward-risk ratio and win percentage? The answer – CONFLUENCE.

Confluence is basically a combination of different rationales that could each work as a standalone, but when put together increases the odds on your favor. This could either be a confluence of a price action setup, indicator-based setup, a crossover strategy, etc. The key is to have multiple setups point the same direction at the same time. By having such agreement from multiple sources, we end up having a higher probability trade. That is how confluence works.

The 5-10 SMA Crossover Strategy

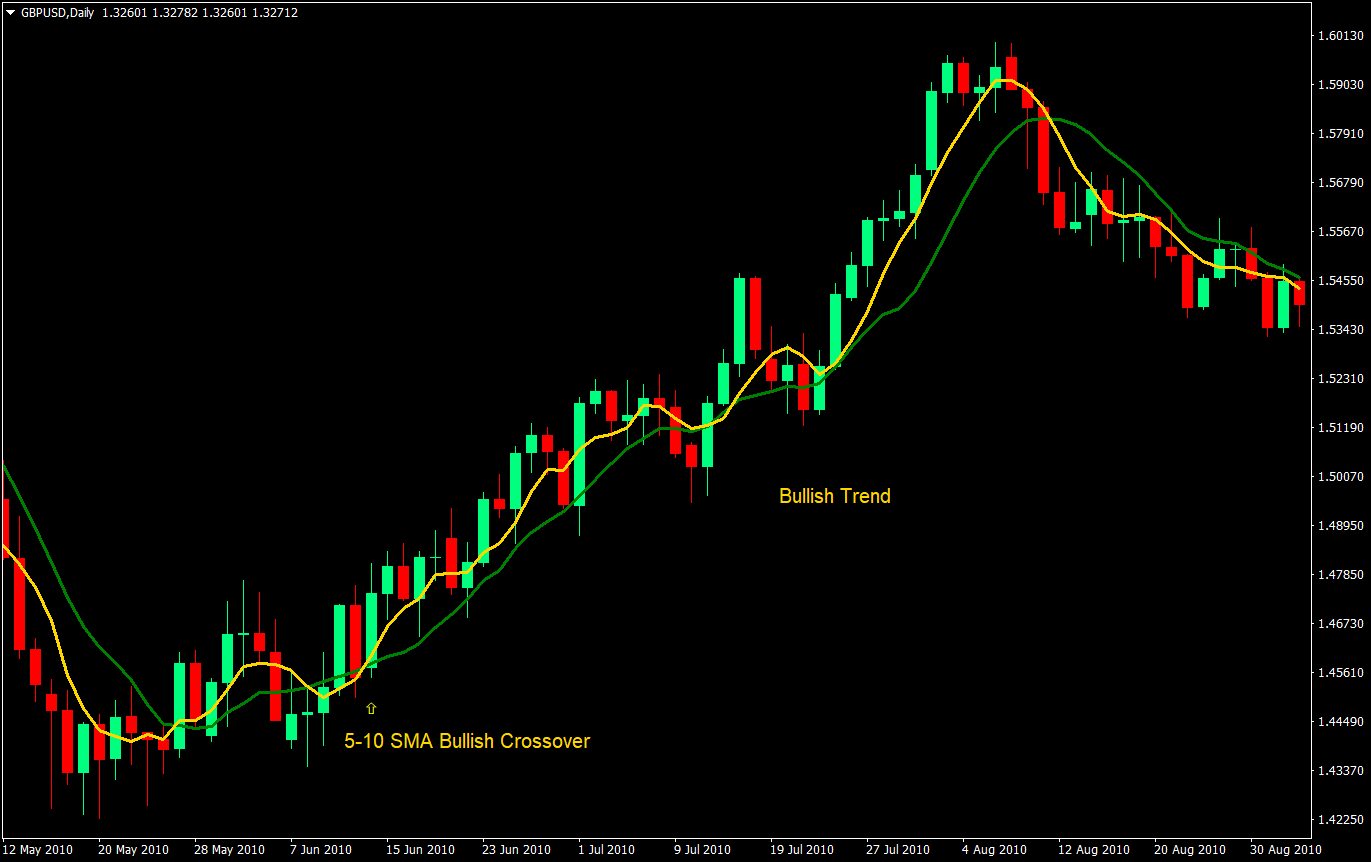

The 5-10 Simple Moving Average (SMA) crossover strategy is a very basic and popularly used trading strategy. It is a pretty fast crossover strategy that excels in catching a trend pretty early.

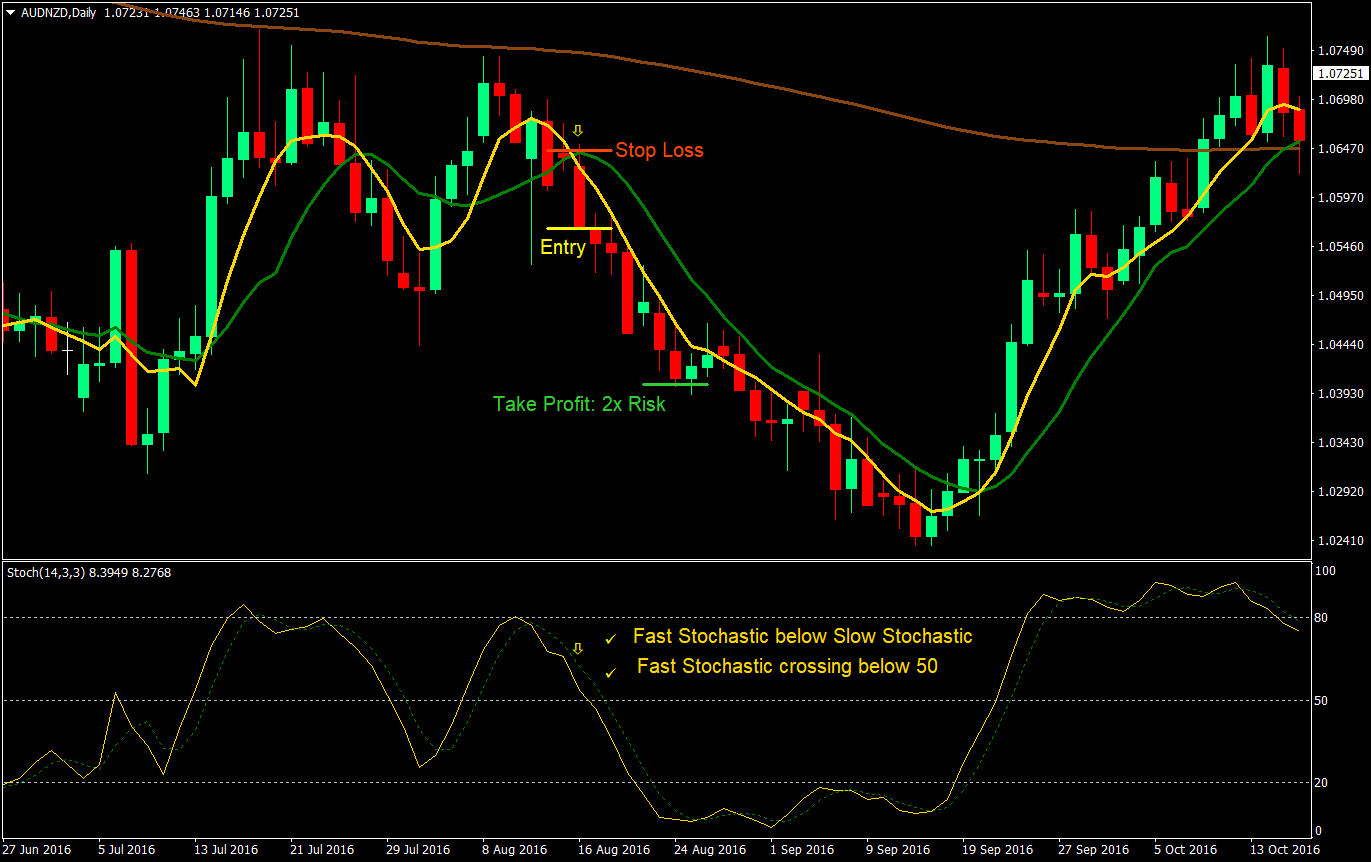

Below is an example of a 5-10 crossover trade setup.

As you could notice, the 5-10 SMA strategy is able to capture big trends from start to finish. Because the moving averages used hug closely to price, the crossovers could respond quickly to whatever price does and therefore allows us to catch a trend right from the start.

Trading Strategy Concept

Knowing that confluences stack the odds on our favor when looking for confluences, this strategy will be based on the 5-10 SMA Crossover Strategy, but with some additional confluences. What we will be looking for is a crossover that agrees with the long-term trend and a fresh thrust.

To filter signals that do not agree with the long-term trend, we will be using the 200 Exponential Moving Average (EMA). This is a commonly used moving average filter that many traders use to determine the long-term trend.

As for our short-term thrust or fresh trend, the 5-10 SMA crossover is already a signal in that regard. However, to further filter trades, we will be using the Stochastic Oscillator. This indicator has two oscillating lines, both of which are pretty responsive to price action. The crossover of these two lines could also be used as an entry signal. But we will be using it differently for this strategy. We will be using it as a confirmation of the crossover on top of the 5-10 SMA. What we will be looking for is for the stochastic oscillator lines to have already crossed over each other. If the 5-10 SMA is crossing on a bearish signal, the fast stochastic should be below the slow stochastic line. If the 5-10 SMA is making a bullish signal, then the fast stochastic should be above the slow stochastic line. Not only that, the fast stochastic should also be crossing over the midline of the Stochastic Oscillator, which is 50.

These confluences should stack up the odds on our favor.

Indicator:

- 5-period SMA (Gold)

- 10-period SMA (Green)

- 200-period EMA (Brown)

- Stochastic Oscillator

- %K period: 14

- %D period: 3

- Slowing: 3

Currency Pair: any

Timeframe: 4-hour and daily charts

Trading Session: any

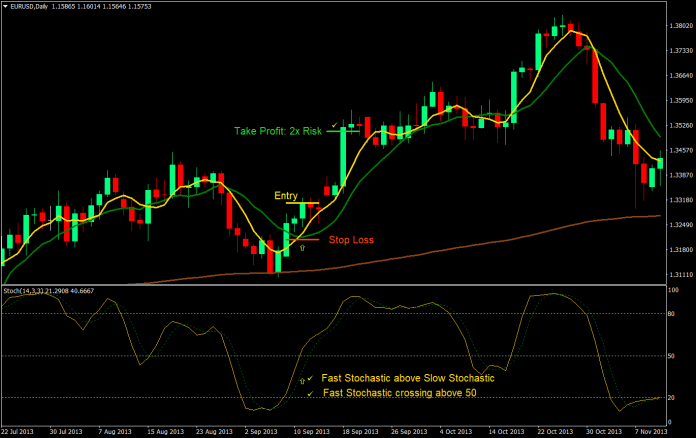

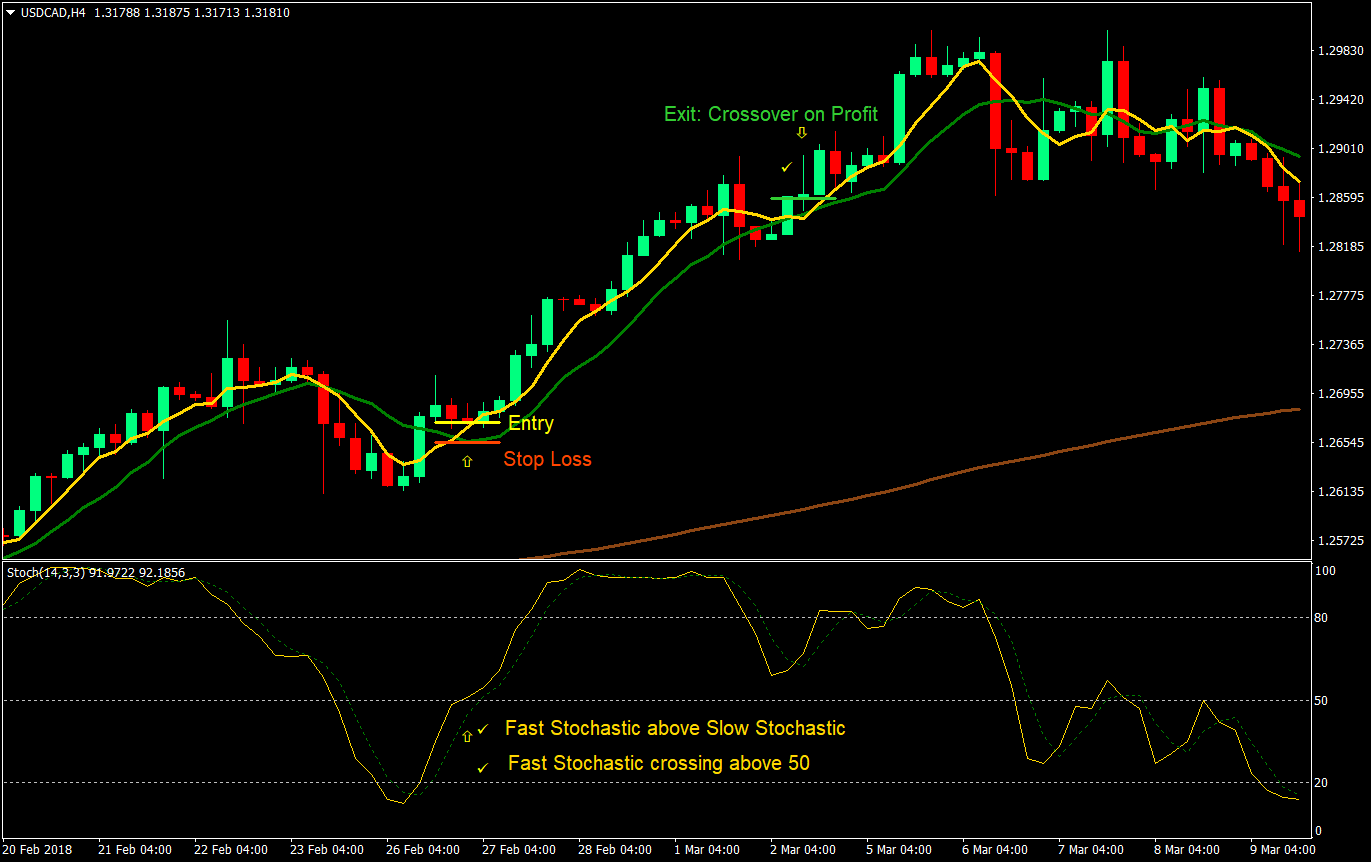

Buy (Long) Trade Setup Rules

Entry

- Price and the 5 & 10 SMAs should be above the 200 SMA

- Fast Stochastic should be above the Slow Stochastic line

- 5 SMA should cross above the 10 SMA

- Fast Stochastic should be crossing above 50

- Enter at the close of the candle corresponding the confluence of the above rules

Stop Loss

- Set the stop loss below the 10 SMA

Exit/Take Profit

- Option 1: Set the take profit at 2x the risk on the stop loss

- Option 2: Close the trade on the reverse crossover of the 5 & 10 SMA

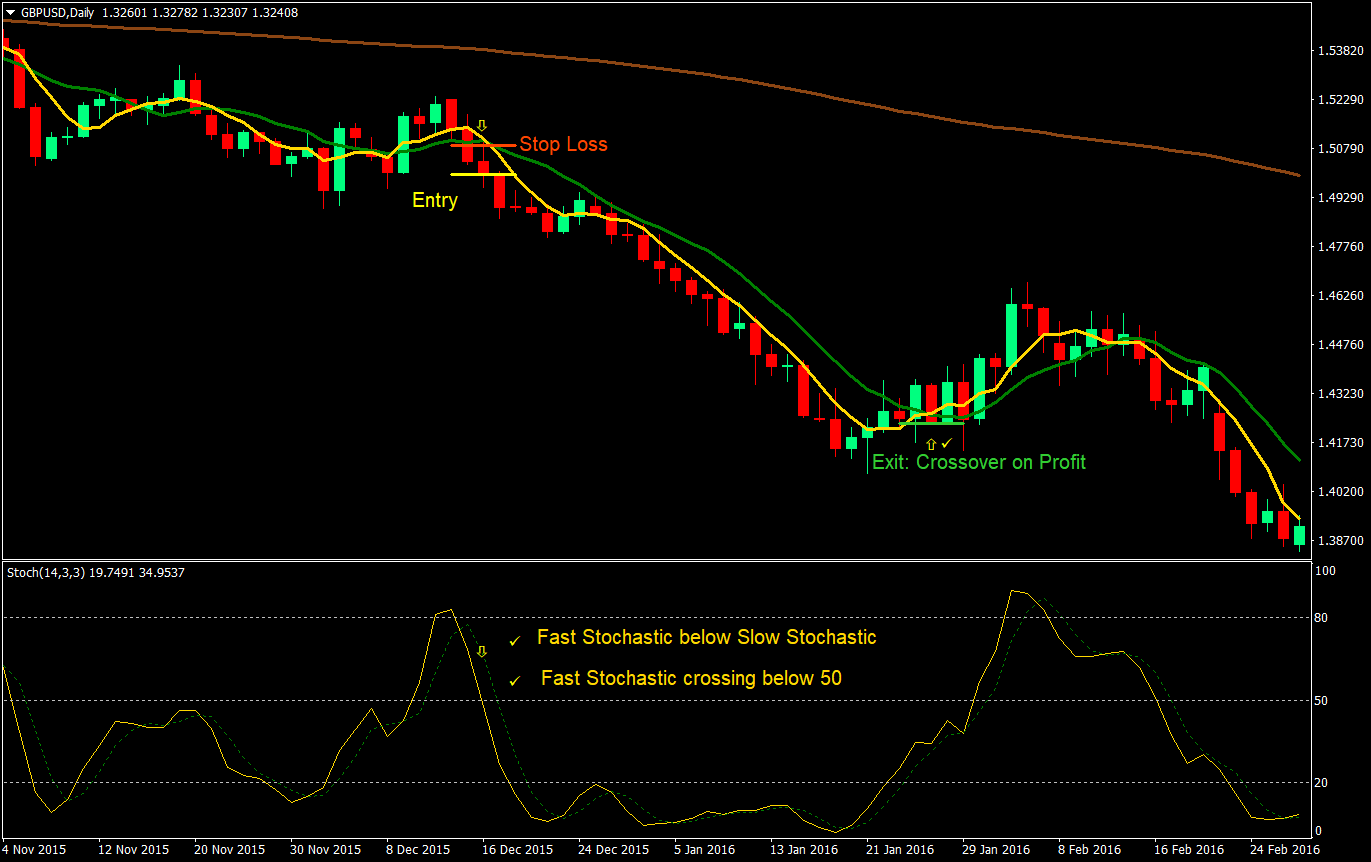

Sell (Short) Trade Setup Rules

Entry

- Price and the 5 & 10 SMAs should be below the 200 SMA

- Fast Stochastic should be below the Slow Stochastic line

- 5 SMA should cross below the 10 SMA

- Fast Stochastic should be crossing below 50

- Enter at the close of the candle corresponding the confluence of the above rules

Stop Loss

- Set the stop loss above the 10 SMA

Exit/Take Profit

- Option 1: Set the take profit at 2x the risk on the stop loss

- Option 2: Close the trade on the reverse crossover of the 5 & 10 SMA

Conclusion

This strategy is a commonly used strategy among traders. Many traders use this type of strategy as a newbie, but there are also other traders who have mastered this type of strategy who are very profitable.

Each component rules of the strategy would have a low probability if used as a standalone rule. However, combining all the rules together and having a confluence, we are able to increase the odds of a successful trade.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: