يكسب معظم المتداولين المال من تداول انعكاسات الاتجاه. غالبًا ما يبحث المتداولون عن الرسوم البيانية التي تظهر إشارات على أن السوق ينعكس ، إما من خلال تقاطعات المتوسط المتحرك أو أنماط حركة السعر أو المؤشرات المختلفة لانعكاس الاتجاه المحتمل قادمًا من المؤشرات الفنية. هذه طريقة منطقية للغاية لكسب المال من تداول العملات الأجنبية. تسمح انعكاسات اتجاه التداول للمتداولين بالضغط على أكبر قدر من الأرباح من اتجاه واحد عن طريق دخول السوق في بداية الاتجاه والاستمرار في التداول حتى نهاية الاتجاه.

ومع ذلك ، فإن اللحاق بانعكاسات الاتجاه عند بدايته أمر صعب للغاية. في بعض الأحيان ، يحدد المتداولون غالبًا انعكاسات الاتجاه عندما يكون الوقت قد فات بالفعل.

بالنسبة لتلك الأوقات التي نفتقد فيها بداية الاتجاه ، يمكننا الاستفادة من نوع إعداد إعادة دخول الاتجاه. على الرغم من أنها ليست نوعًا فعليًا من إستراتيجيات التداول ، إلا أنه يمكن اعتبارها نوعًا من استراتيجية تتبع الاتجاه. تفترض إعادة الدخول إلى الاتجاه أن السوق المتجه قد تم تأسيسه بالفعل ويمكن ملاحظته بوضوح على الرسم البياني للسعر. هناك نوعان من الخيارات التي يمكن للمتداولين القيام بها في هذا النوع من سيناريو السوق. أولاً ، يمكنهم انتظار انعكاس الاتجاه التالي. ومع ذلك ، ستكون هناك فرصة ضائعة حيث لا يزال من الممكن أن يتحرك السعر في اتجاه الاتجاه. الخيار الثاني هو دخول السوق في اتجاه الاتجاه في منتصف حركة الاتجاه. يكمن الخطر في أن السعر قد ينعكس بالفعل أو أننا قد نطارد السوق ويمكن أن نتداول في ذروة الاتجاه. تتطلب إعادة الدخول إلى السوق توقيتًا جيدًا لأننا نرغب في استهداف عمليات الاسترداد كعقود أسعار قبل اندفاع الزخم التالي في اتجاه الاتجاه.

قناة تجارة السلاحف

قناة تداول السلاحف عبارة عن اتجاه مخصص يتبع المؤشر الفني الذي يعتمد على الارتفاعات والانخفاضات في حركة السعر. يحاول توقع اتجاه الاتجاه بناءً على كيفية استجابة السعر لمستويات الأسعار القصوى خلال فترته المحددة مسبقًا.

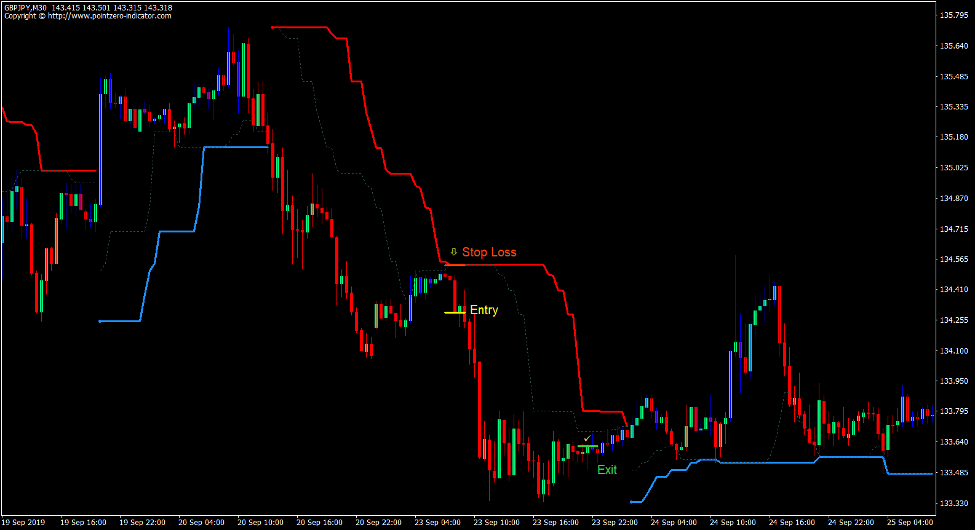

يرسم هذا المؤشر خطًا متينًا يشير إلى اتجاه الاتجاه ، يسمى فترة التجارة. يشير خط فترة التجارة إلى اتجاه الاتجاه بناءً على لونه وموقعه بالنسبة لحركة السعر. يشير الخط الأزرق أسفل حركة السعر إلى ميل في الاتجاه الصعودي. يشير الخط الأحمر فوق حركة السعر إلى ميل في الاتجاه الهبوطي.

كما يرسم خطًا آخر وهو خط منقط يسمى فترة التوقف. يعتمد هذا الخط على فترة أقصر ويستخدم بشكل أساسي كأداة لإيقاف الخسارة للصفقات التي يتم إجراؤها في الاتجاه المشار إليه في سطر فترة التداول.

قضبان تنشيط عالية منخفضة من جان

أشرطة Gann High Low Activator Bars هي مؤشر زخم يركز على انعكاسات الزخم على المدى القصير.

يشير إلى اتجاه الزخم من خلال تراكب الأعمدة على شمعة السعر. هذه الأشرطة تغير لونها حسب اتجاه الزخم. تشير الأعمدة الزرقاء إلى زخم صعودي ، بينما تشير الأعمدة الحمراء إلى زخم هبوطي.

يمكن للتجار استخدام هذا المؤشر كإشارة دخول بناءً على تحولات الزخم. إنها إشارة دخول قوية عندما يتم أخذها في اتجاه اتجاه أكبر.

استراتيجية تداول

استراتيجية تداول العملات الأجنبية ذات الاتجاه العالي والسلطة هي استراتيجية تتبع اتجاه بسيط أو استراتيجية لإعادة دخول الاتجاه تعمل على محاذاة انعكاس الزخم الأقصر مع الاتجاه الأطول.

يعتمد اتجاه الاتجاه الرئيسي على مؤشر قناة تداول السلاحف. يجب أن تؤخذ التداولات في اتجاه الاتجاه كما هو موضح من خلال لون خط فترة التجارة.

يتم استخدام أعمدة Gann High Low Activator كإشارة دخول بناءً على تحولات الزخم على المدى القصير.

يجب علينا أولاً تحديد اتجاه السوق بناءً على مؤشر Turtle Trading Channel بالإضافة إلى خصائص حركة السعر.

بعد تحديد زوج العملات الأجنبية الاتجاه ، ننتظر بعد ذلك أن يرتد السعر أو ينكمش مؤقتًا. قد يتسبب هذا في عكس لون أشرطة تنشيط Gann High Low Activator بشكل مؤقت. يتم أخذ التداولات بمجرد عودة أشرطة Gann High Low Activator إلى اللون الذي يتوافق مع اتجاه الاتجاه الرئيسي.

المؤشرات:

- قناة تداول السلحفاة

- قضبان المنشط Gann HiLo

الأطر الزمنية المفضلة: مخططات 30 دقيقة و 1 ساعة و 4 ساعات

أزواج العملات: العملات الرئيسية والثانوية والتقاطعات

جلسات التداول: دورات طوكيو ولندن ونيويورك

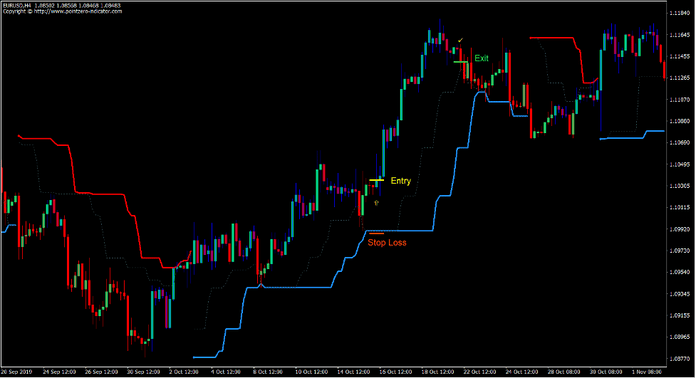

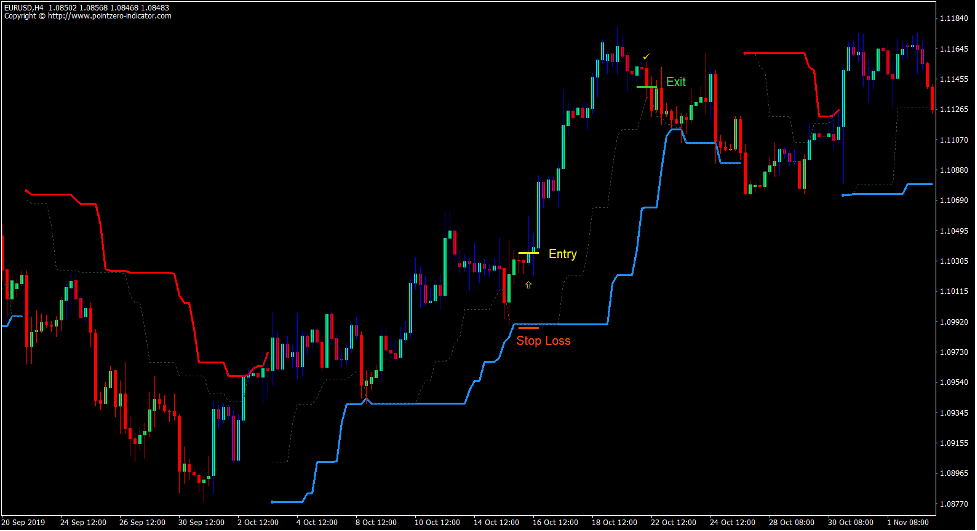

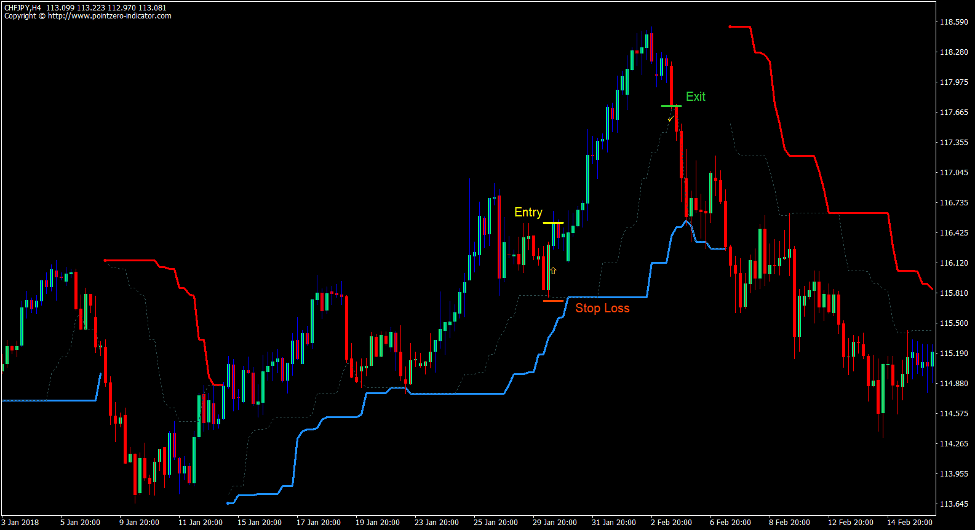

شراء إعداد التجارة

دخول

- يجب أن يكون خط فترة تداول Turtle Trading Channel أقل من حركة السعر ويجب أن يكون باللون الأزرق.

- يجب أن تقوم نقاط التأرجح في حركة السعر بتخطيط قمم التأرجح المرتفعة وقيعان التأرجح.

- يجب أن تتغير أشرطة تنشيط Gann High Low Activator إلى اللون الأحمر مؤقتًا.

- أدخل أمر شراء بمجرد عودة أشرطة Gann High Low Activator إلى اللون الأزرق.

إيقاف الخسارة

- ضع وقف الخسارة أسفل خط فترة التوقف.

خروج

- أغلق التداول بمجرد تغيير أشرطة Gann High Low Activator إلى اللون الأحمر.

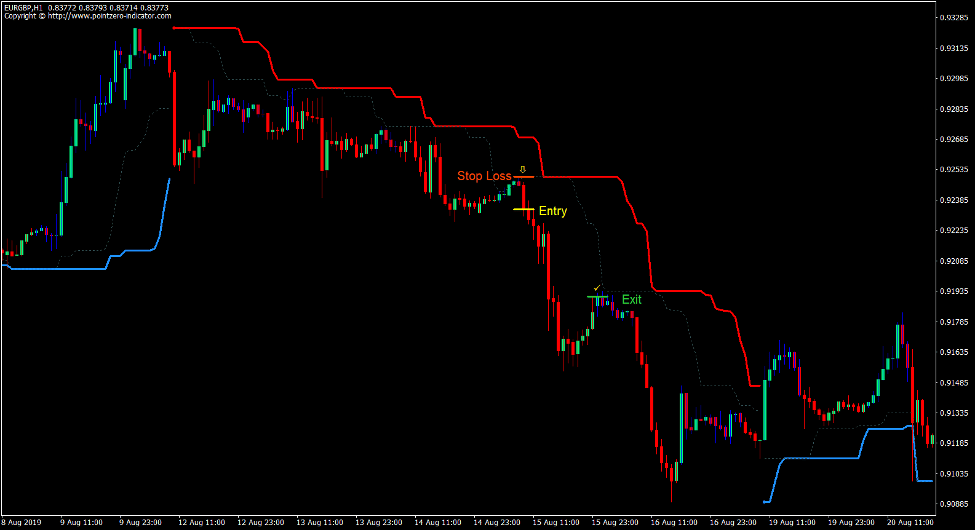

بيع إعداد التجارة

دخول

- يجب أن يكون خط فترة تداول Turtle Trading Channel أعلى من حركة السعر ويجب أن يكون باللون الأحمر.

- يجب أن تقوم نقاط التأرجح في حركة السعر بتخطيط قمم التأرجح المنخفضة وقيعان التأرجح.

- يجب أن تتغير أشرطة تنشيط Gann High Low Activator إلى اللون الأزرق مؤقتًا.

- أدخل أمر بيع بمجرد عودة أشرطة Gann High Low Activator إلى اللون الأحمر.

إيقاف الخسارة

- ضع وقف الخسارة فوق خط فترة التوقف.

خروج

- أغلق التداول بمجرد تغيير أشرطة Gann High Low Activator إلى اللون الأزرق.

وفي الختام

استراتيجية التداول هذه هي استراتيجية ممتازة لمتابعة الاتجاه أو إعادة الدخول إلى الاتجاه. يميل التداول في اتجاه الاتجاه استنادًا إلى مؤشر Turtle Trading Channel إلى أن يكون استراتيجية تداول ذات احتمالية عالية. السؤال هو أين ندخل السوق.

يمكن أن توفر قضبان Gann High Low Activator حلاً لدخول التجارة ، حيث يمكنها تحديد الانعكاسات الأقصر بناءً على الزخم.

إذا تم استخدامها في ظروف السوق المناسبة ، يمكن أن تنتج هذه الإستراتيجية إعدادات تداول عالية الجودة. ومع ذلك ، يمكن أن تنتج الإشارات أيضًا انعكاسات مبكرة إذا كان السوق متقلبًا للغاية. يجب على التجار أولاً تحديد اتجاهات السوق الواضحة لتجنب ظروف السوق المتقلبة.

وسطاء MT4 الموصى بهم

XM Broker

- مجاني $ 50 لبدء التداول على الفور! (الربح القابل للسحب)

- مكافأة الإيداع تصل إلى $5,000

- برنامج ولاء غير محدود

- وسيط فوركس حائز على جوائز

- مكافآت حصرية إضافية على مدار العام

>> سجل للحصول على حساب وسيط XM هنا <

وسيط FBS

- تداول 100 مكافأة: 100 دولار مجانًا لبدء رحلة التداول الخاصة بك!

- 100٪ مكافأة إيداع: ضاعف إيداعك حتى 10,000 دولار وتداول برأس مال معزز.

- الرافعة المالية تصل إلى 1: 3000.: تعظيم الأرباح المحتملة باستخدام أحد أعلى خيارات الرافعة المالية المتاحة.

- جائزة "أفضل وسيط لخدمة العملاء في آسيا".: التميز المعترف به في دعم العملاء والخدمة.

- الترقيات الموسمية: استمتع بمجموعة متنوعة من المكافآت الحصرية والعروض الترويجية على مدار السنة.

>> سجل للحصول على حساب وسيط FBS هنا <

انقر هنا أدناه للتنزيل: