هناك نوعان من الاستراتيجيات التي ينجذب إليها العديد من المتداولين فيما يتعلق بكيفية تحقيق الأرباح. أولاً ، هناك متداولون ينجذبون إلى الاستراتيجيات بدقة عالية. غالبًا ما ينجذبون إلى الاستراتيجيات التي يمكن أن تنتج المزيد من المكاسب في كثير من الأحيان حتى مع انخفاض نسبة المخاطرة إلى المكافأة. هذه هي أنواع الاستراتيجيات التي يمكن أن تحقق مكاسب في أكثر من 60٪ من الوقت ، مع الحفاظ على نسبة مخاطر ومكافأة 1: 1 أو 2: 1. بعد ذلك ، هناك أيضًا متداولون يفضلون النسب العالية للمخاطرة والمكافأة على معدلات الربح العالية. يفضل هؤلاء التجار وجود صفقات ذات نسب مخاطرة ومكافأة أكبر من 4: 1 ، حتى لو كان ذلك يعني أن معدلات ربحهم ستنخفض عن 50٪.

بعد ذلك ، هناك متداولون يهدفون إلى الحصول على أفضل ما في العالمين ، ومعدل ربح مرتفع ونسبة عالية من المخاطرة إلى المكافأة. التجار الذين يمكنهم القيام بذلك جيدون حقًا في ما يفعلونه. هؤلاء هم التجار الذين يبدو أن لديهم لمسة ميداس. يمكن أن تتحول أي تجارة يقومون بها تقريبًا إلى ذهب.

استراتيجية Midas Touch لتداول العملات الأجنبية هي إستراتيجية بسيطة لكنها فعالة يمكن أن تساعد المتداولين على تحقيق أرباح ثابتة على المدى الطويل. يعتمد هذا على مزيج من معدل الربح اللائق ونسبة المخاطرة إلى المكافأة التي تكون أكثر من كافية لإرضاء معظم المتداولين.

يستخدم بعض المؤشرات التي يمكن الاعتماد عليها بشكل كبير في حد ذاتها. ومع ذلك ، عندما يتم دمج هذه المؤشرات ، فإنها تنتج إعدادات تداول ذات احتمالية عالية لتحقيق الفوز ، مع إمكانية جيدة لإنتاج عوائد عالية مع توسع السوق.

الثريا توقف v1

الثريا Stops v1 هو مؤشر لوضع وقف الخسارة والذي يمكن أن يعمل أيضًا كمؤشر لمتابعة الاتجاه أو مؤشر تصفية الاتجاه.

يعتمد هذا المؤشر على مفهوم متوسط المدى الحقيقي (ATR) وعلاقته بالاتجاه. يعتقد العديد من المتداولين أن السعر نادرًا ما يرتد بأكثر من ثلاثة أضعاف طول ATR. لهذا السبب ، فإنهم سيتتبعون مواضع وقف الخسارة بحوالي ثلاثة أضعاف طول ATR. يستخدم بعض المتداولين أيضًا مضاعف اثنين بدلاً من ثلاثة.

يستخدم مؤشر Chandelier Stops v1 نفس المفهوم. يكتشف اتجاه الاتجاه ويرسم خطًا على الجانب الآخر من الاتجاه. يعتمد هذا الخط على حساب ATR الديناميكي. عادة ما تتراجع حركة السعر حتى مع وجود اتجاه في مكانه. ومع ذلك ، فإنه نادرًا ما يتراجع ويغلق بعد الخط المرسوم. إذا اخترقت شمعة السعر الخط وأغلقت بعده ، فإن مؤشر Chandelier Stops v1 سيكتشف انعكاس الاتجاه ويحول الخط على الجانب الآخر من حركة السعر.

يشير الخط الأزرق المرسوم أسفل حركة السعر إلى اتجاه صعودي ، بينما يشير الخط الأحمر المرسوم فوق حركة السعر إلى اتجاه هبوطي. يمكن تفسير تغيير الخطوط على أنه انعكاس للاتجاه.

يمكن للمتداولين أيضًا استخدام هذا المؤشر لتصفية التداولات التي لا تتماشى مع تدفق الاتجاه. هذا يلغي اتجاه اتجاه واحد ، لذلك سيكون على المتداولين أن يقرروا فقط متى يأخذون التجارة في اتجاه الاتجاه.

Stochastic Oscillator

مؤشر الاستوكاستك Stochastic Oscillator هو تحليل فني يقيس أيضًا زخم تأرجح السعر. يشير مؤشر ستوكاستيك إلى نقطة السعر الحالي بالنسبة إلى النطاق السعري خلال فترة زمنية. هذا يعني أن المؤشر يقارن حركة السعر الحالية ببيانات الأسعار التاريخية.

يحاول هذا المؤشر التنبؤ بالحركة الدورية لحركة السعر بناءً على زخمها الحالي. يقوم بذلك عن طريق رسم خطين يتأرجحان ضمن نطاق من 0 إلى 100. يتقاطع هذان الخطان مع بعضهما البعض عندما ينعكس الزخم.

عادةً ما يكون لها علامات على المستويين 20 و 80. تشير هذه العلامات إلى النطاق الطبيعي لمذبذب الاستوكاستك. إذا انخفض عدد الخطوط إلى ما دون 20 ، فسيتم اعتبار السوق في منطقة ذروة البيع. من ناحية أخرى ، إذا اخترقت الخطوط فوق 80 ، فسيعتبر السوق في منطقة ذروة الشراء. تميل إشارات التقاطع التي تحدث في هذه المناطق إلى أن تكون موثوقة للغاية لأنها تشير إلى انعكاس الاتجاه بسبب ارتفاع سعر السوق بشكل مفرط.

استراتيجية تداول

تستخدم إستراتيجية التداول هذه مؤشر Chandelier Stops v1 كمرشح للاتجاه. تعتمد الاتجاهات ببساطة على لون الخط والموقع العام لحركة السعر فيما يتعلق بخط Chandelier Stops v1.

علاوة على ذلك ، يجب على المتداولين أيضًا تحديد اتجاه الاتجاه بشكل مرئي بناءً على قمم التأرجح والقيعان المتأرجحة لحركة السعر. هذا المفهوم بالإضافة إلى تأكيد اتجاه خط Chandelier Stops v1 ينتج عنه تحليل اتجاه موثوق للغاية.

بمجرد تحديد اتجاه الاتجاه ، يمكننا بعد ذلك انتظار ارتداد السعر مما يتسبب في انعكاس مؤشر الاستوكاستك Stochastic Oscillator مؤقتًا. كلما كان انعكاس الخطوط أعمق ، كان الارتداد أكثر موثوقية. يتم أخذ التداولات بمجرد تقاطع خطوط Stochastic Oscillator في اتجاه الاتجاه ، بينما تُظهر حركة السعر إشارات لرفض المنطقة بالقرب من خط Chandelier Stops v1.

المؤشرات:

- الثريا

- Stochastic Oscillator

الأطر الزمنية المفضلة: رسوم بيانية يومية لمدة 30 دقيقة وساعة و 1 ساعات

أزواج العملات: العملات الرئيسية والثانوية والتقاطعات

جلسات التداول: دورات طوكيو ولندن ونيويورك

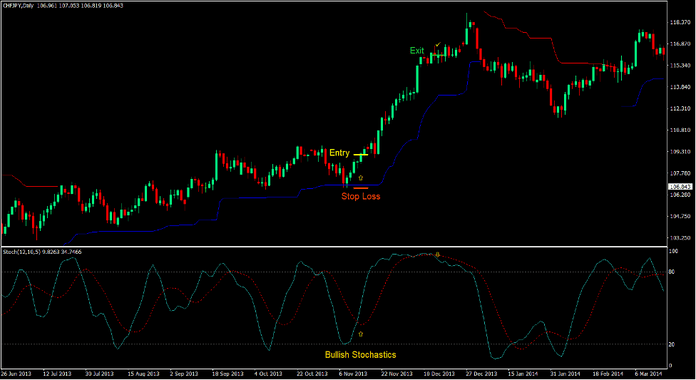

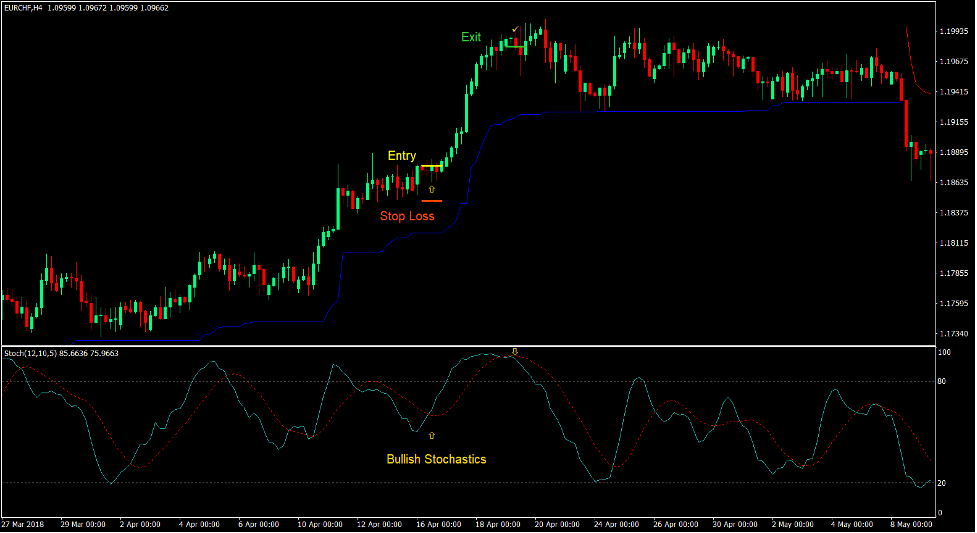

شراء إعداد التجارة

دخول

- يجب أن يكون خط وقف الثريا v1 أقل من حركة السعر ويجب أن يكون باللون الأزرق.

- يجب أن تكون حركة السعر تصنع ارتفاعات وانخفاضات أعلى.

- يجب أن يتراجع السعر باتجاه خط توقف الثريا v1.

- أدخل أمر شراء بمجرد عبور خط Stochastic Oscillator الأسرع فوق الخط الأبطأ.

إيقاف الخسارة

- قم بتعيين وقف الخسارة على مستوى الدعم أسفل شمعة الدخول.

خروج

- أغلق الصفقة بمجرد أن يعبر خط Stochastic Oscillator الأسرع أسفل الخط الأبطأ.

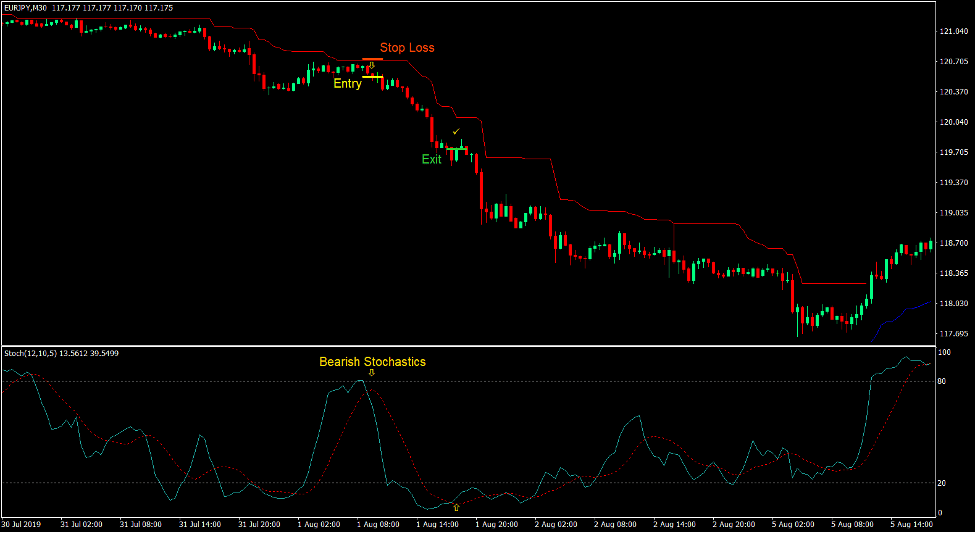

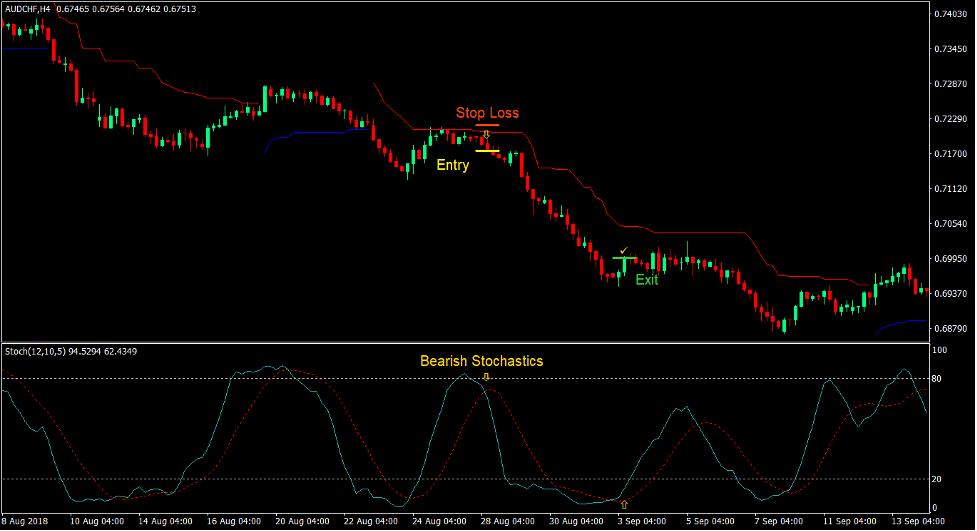

بيع إعداد التجارة

دخول

- يجب أن يكون خط وقف الثريا v1 فوق حركة السعر ويجب أن يكون باللون الأحمر.

- يجب أن تكون حركة السعر تصنع ارتفاعات وانخفاضات منخفضة.

- يجب أن يتراجع السعر باتجاه خط توقف الثريا v1.

- أدخل أمر بيع بمجرد عبور خط Stochastic Oscillator الأسرع أسفل الخط الأبطأ.

إيقاف الخسارة

- قم بتعيين وقف الخسارة على مستوى المقاومة فوق شمعة الدخول.

خروج

- أغلق الصفقة بمجرد عبور خط Stochastic Oscillator الأسرع فوق الخط الأبطأ.

وفي الختام

استراتيجية التداول هذه هي استراتيجية تتبع اتجاه العمل بناءً على الاتجاهات وعمليات الاسترداد.

تميل الاتجاهات ذات التأرجحات الواضحة لحركة السعر والتي أكدها مؤشر Chandelier Stops v1 إلى أن تكون أكثر أنواع ظروف السوق موثوقية. يمكن أن تحقق هذه الأسواق الأرباح الأكثر اتساقًا للمتداولين الذين يتبعون الاتجاه. كما أن لديها القدرة على تحقيق مكاسب ضخمة قادمة من التأرجحات القوية نحو اتجاه الاتجاه.

يمكن للمتداولين الذين يمكنهم إتقان تحديد حالة السوق الصحيحة لاستخدام هذه الإستراتيجية وقراءة تصحيحات حركة السعر والاندفاعات أن يستفيدوا من هذا النوع من الإستراتيجية.

وسطاء MT4 الموصى بهم

XM Broker

- مجاني $ 50 لبدء التداول على الفور! (الربح القابل للسحب)

- مكافأة الإيداع تصل إلى $5,000

- برنامج ولاء غير محدود

- وسيط فوركس حائز على جوائز

- مكافآت حصرية إضافية على مدار العام

>> سجل للحصول على حساب وسيط XM هنا <

وسيط FBS

- تداول 100 مكافأة: 100 دولار مجانًا لبدء رحلة التداول الخاصة بك!

- 100٪ مكافأة إيداع: ضاعف إيداعك حتى 10,000 دولار وتداول برأس مال معزز.

- الرافعة المالية تصل إلى 1: 3000.: تعظيم الأرباح المحتملة باستخدام أحد أعلى خيارات الرافعة المالية المتاحة.

- جائزة "أفضل وسيط لخدمة العملاء في آسيا".: التميز المعترف به في دعم العملاء والخدمة.

- الترقيات الموسمية: استمتع بمجموعة متنوعة من المكافآت الحصرية والعروض الترويجية على مدار السنة.

>> سجل للحصول على حساب وسيط FBS هنا <

انقر هنا أدناه للتنزيل: