استراتيجية تداول العملات الأجنبية باستخدام مؤشر ستوكاستيك المزدوج

معظم المتداولين هم من المتعلمين. الأشخاص الذين ينجذبون إلى التداول هم عادةً أولئك الذين يعتقدون أن بإمكانهم تعلم شيء معقد بسرعة من خلال المثابرة والمثابرة، وعادةً ما يظهرون ذلك من خلال الساعات التي لا تعد ولا تحصى التي يقضونها في التعلم عن الأسواق.

يعد التعرف على الأسواق أمرًا جيدًا، ولكنه قد يكون أيضًا فخًا للكثيرين. كيف يمكن أن يكون هذا؟ في كثير من الأحيان، عندما يدخل المتداولون الجدد إلى الأسواق، فإن شهيتهم للتعلم تدفعهم إلى دراسة الأسواق بنهم. بين الحين والآخر يتعلمون شيئًا جديدًا. خطوط الاتجاه، الدعم والمقاومة، أنماط الأسعار، هذا المؤشر، ذلك المتوسط المتحرك، وما إلى ذلك. ثم، قبل أن تعرف ذلك، تصبح مخططاتهم مزدحمة بجميع الخطوط المتعرجة التي تغطي لوحة قوس قزح بأكملها. يعتقدون أنهم قد اكتشفوا كل شيء مع كل ما تعلموه. بعد ذلك، تبدأ كل تلك الخطوط المتعرجة في توجيههم إلى عشرة اتجاهات مختلفة. إنهم إما يتجمدون ولا يتخذون أي قرار أو ينتهي بهم الأمر إلى اتخاذ قرارات غير منتظمة دون أي أساس منطقي ثابت وملموس لمثل هذه التجارة. وهذا ما يسمى الضوضاء. حتى لو أبعدت نفسك عن أي ضجيج آخر من الأخبار، فإن وجود الكثير من المعلومات على شاشتك قد يكون مصدرًا للضجيج. الآن، لا تفهموني خطأ. كل ما يهمني هو التعلم ولكن اختر بحكمة التقنيات والمؤشرات التي تدرجها في استراتيجية التداول الخاصة بك.

إحدى طرق تجنب هذا الفخ هي تبسيط المؤشرات الفنية الخاصة بك. اختر واحدة، أو اثنتين، أو ربما ثلاثة على الأكثر وقم بزيادة إمكاناتها إلى أقصى حد عندما تتقنها.

مذبذب الاستوكاستك

يعد مؤشر ستوكاستيك أحد أقدم وأبسط المؤشرات الفنية المتاحة للمتداولين، إلا أن الكثيرين تجاهلوه بسبب بساطته.

مذبذب العشوائية هو نوع من المؤشرات المتذبذبة التي تقارن سعر السوق الحالي بنطاق الأسعار التاريخية لأداة التداول. ومن خلال القيام بذلك، يميل مؤشر ستوكاستيك إلى متابعة حركة السعر عن كثب على الرسم البياني للسعر.

إحدى ميزات مؤشر الستوكاستيك هي مناطقه المفرطة في التمدد. باستخدام مذبذب العشوائية، يمكن للمتداول أن يحدد رياضيًا ما إذا كان السوق في منطقة ذروة الشراء أو ذروة البيع، مما يضغط على السعر للعكس.

ومع ذلك، يمكن أيضًا تفسير نفس مناطق ذروة الشراء أو ذروة البيع بشكل مختلف. يمكن أن تظل خطوط المذبذب في منطقة ممتدة لفترة طويلة ولا تنعكس. قد يعني هذا أن السوق بدأ في الاتجاه.

مفهوم استراتيجية التداول

لقد تحدثنا سابقًا عن كيف أن وجود عدد كبير جدًا من المؤشرات الفنية يمكن أن يسبب الكثير من الضجيج. من خلال هذه الاستراتيجية، سنقوم بتبسيط استراتيجيتنا لتشمل مؤشرات عشوائية ومتوسط متحرك واحد، وفي الوقت نفسه نعمل على تعظيم إمكانات مؤشر ستوكاستيك.

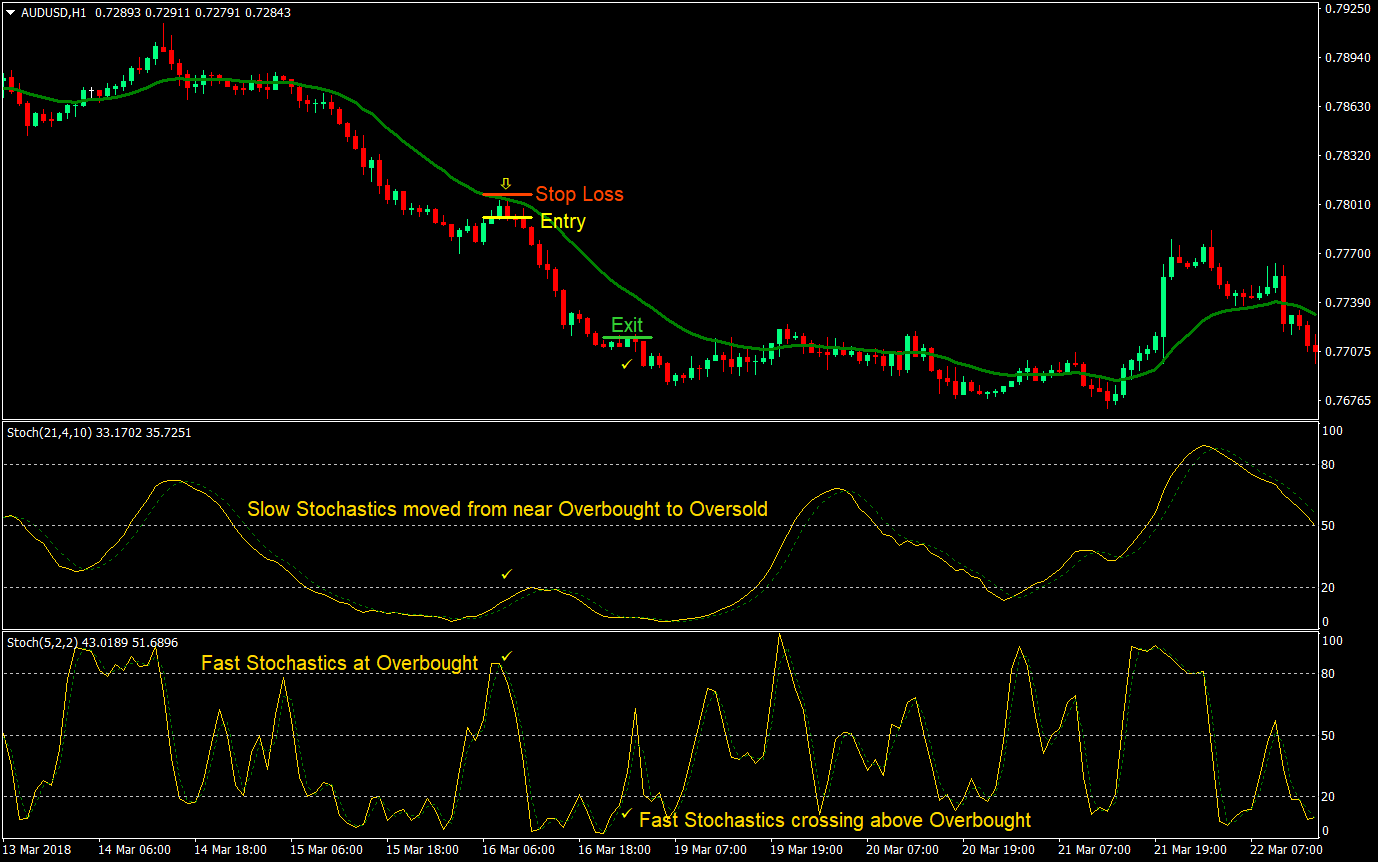

وبما أنه يمكن استخدام مؤشر الستوكاستك للإشارة إلى ما إذا كان السوق على وشك الانعكاس أو أنه بدأ في الاتجاه، فسوف نستخدم هذين المفهومين في نفس الوقت. سنقوم بذلك من خلال وجود اثنين من مؤشرات التذبذب العشوائية، أحدهما ذو إعداد سريع والآخر ذو إعداد بطيء.

سيتم استخدام مؤشر ستوكاستيك البطيء لتحديد ما إذا كانت التوقعات طويلة المدى للسوق قد بدأت في الاتجاه. إذا تحرك المذبذب من طرف إلى آخر وبدأ في البقاء في الطرف المقابل، يمكننا القول أن السوق قد انعكس وبدأ في الاتجاه. لذلك، يجب أن يعبر مؤشر ستوكاستيك البطيء من ذروة البيع إلى ذروة الشراء ويظل في منطقة ذروة الشراء لضمان إعداد تجارة الشراء. اقلبها للحصول على إعداد تجارة البيع. سيكون هذا هو اتجاه تجارتنا.

أما بالنسبة للدخول الفعلي، فسوف نستخدم مؤشر ستوكاستيك الأسرع والمتوسط المتحرك الأسي لمدة 20 فترة (EMA). ما سنبحث عنه هو أن يتراجع السعر إلى المتوسط المتحرك الأسي 20. ويجب أن يصاحب ذلك تقاطع مؤشر ستوكاستيك السريع من طرف إلى آخر، ثم يستأنف اتجاهه الأولي. في بيئة الاتجاه الصعودي، يجب أن يرتد مؤشر ستوكاستيك السريع إلى منطقة ذروة البيع حيث يتراجع السعر إلى 20 EMA. بعد ذلك، مع تقاطع مؤشر ستوكاستيك للأعلى، ندخل في صفقة شراء.

المؤشرات:

- المتوسط المتحرك الأسي لمدة 20 فترة (أخضر)

- مذبذب الاستوكاستك البطيء

- فترة K٪: 21

- فترة٪ D: 4

- التباطؤ: 10

- مؤشر ستوكاستيك السريع

- فترة K٪: 5

- فترة٪ D: 2

- التباطؤ: 2

الإطار الزمني المفضل: الرسم البياني لمدة ساعة واحدة

زوج العملات: أي

جلسة التداول: أي

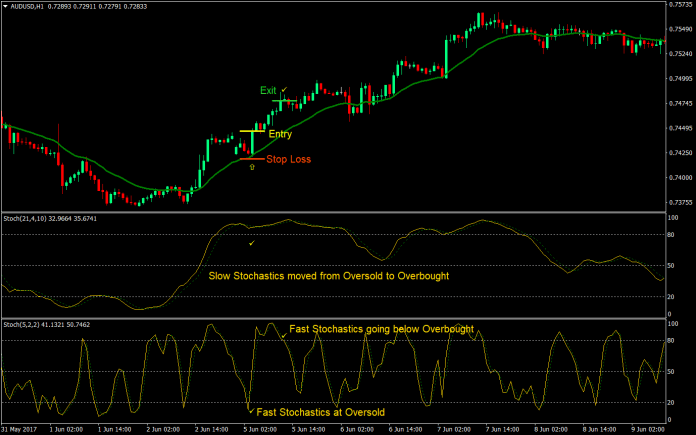

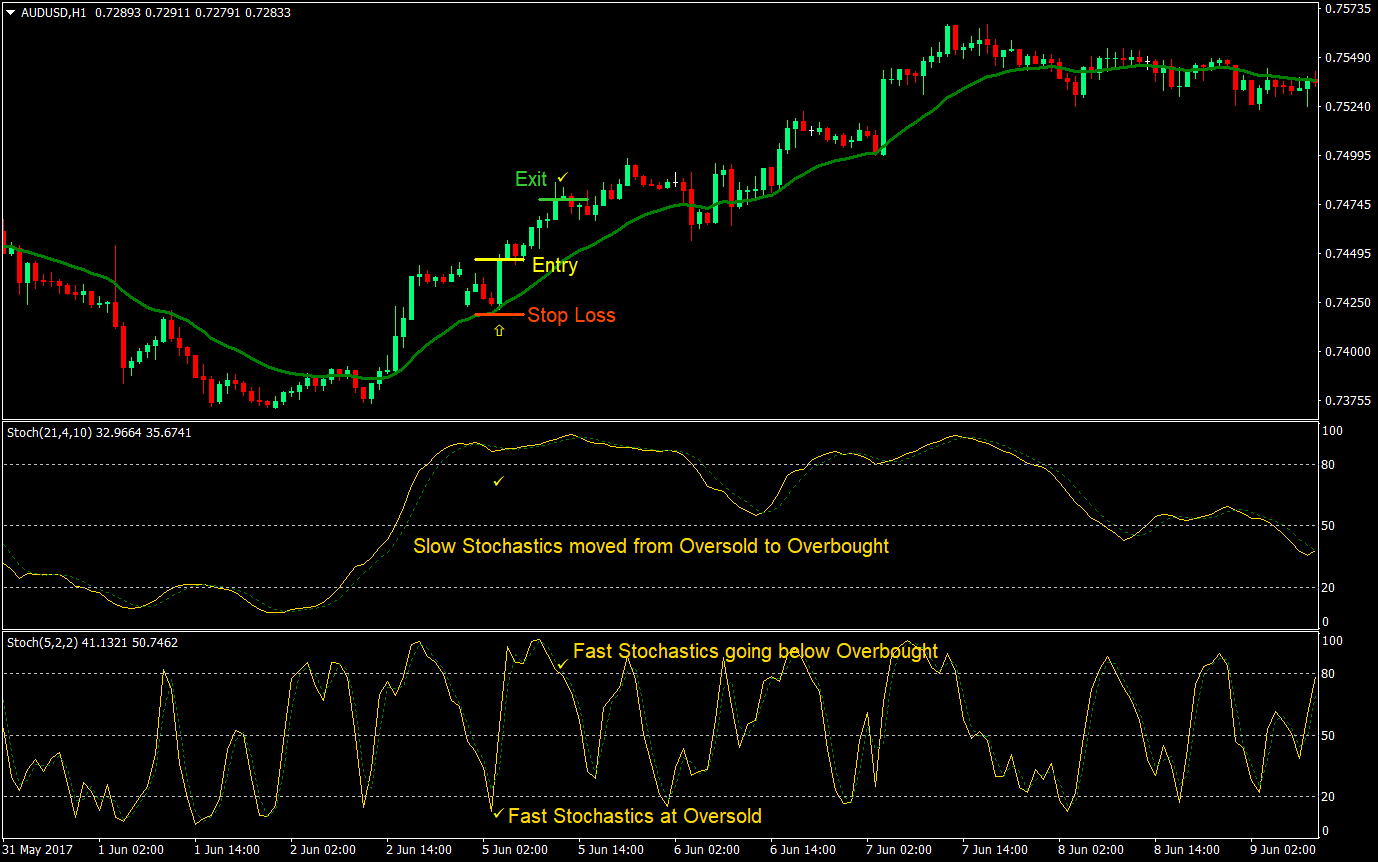

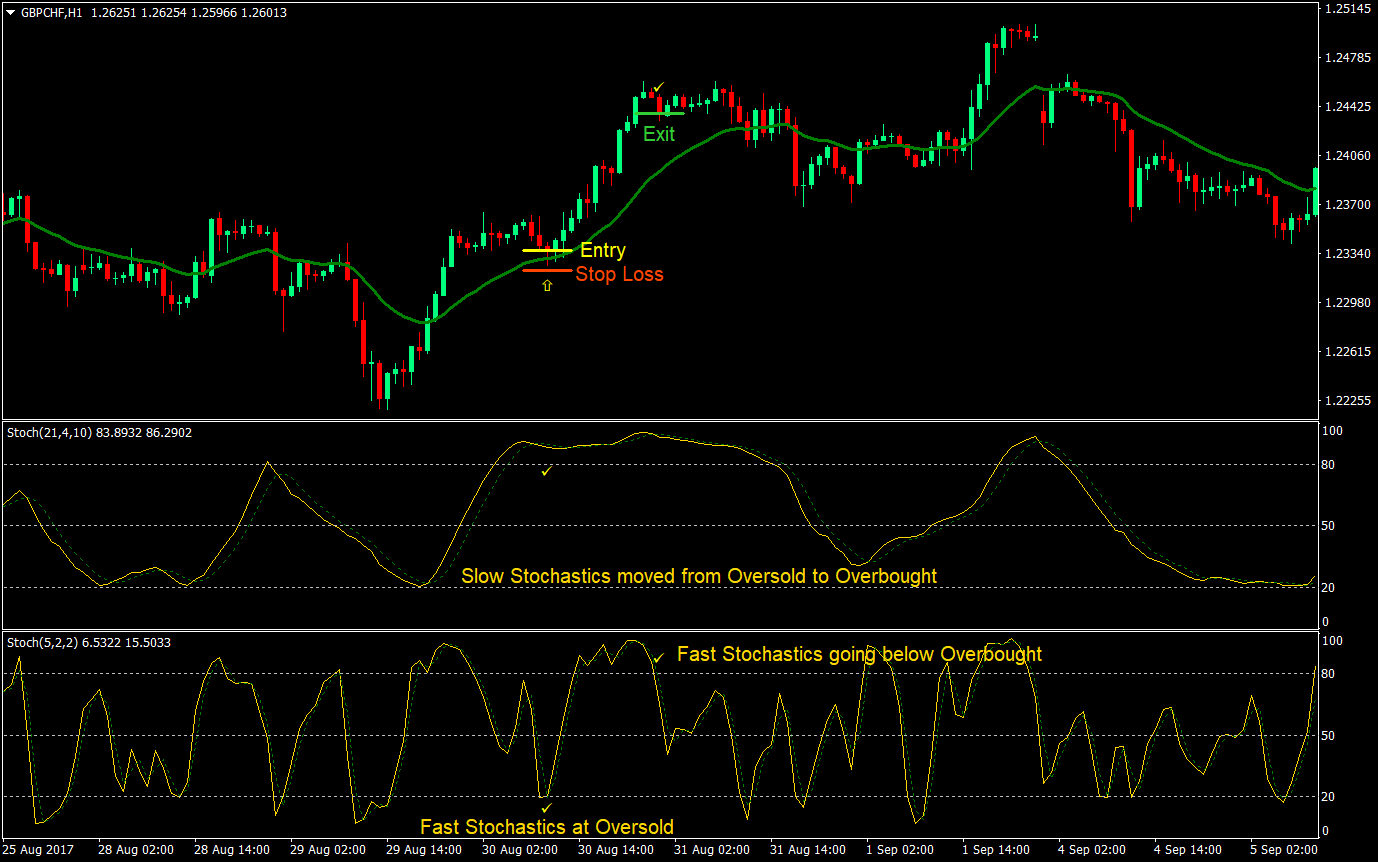

شراء (طويل) إعداد التجارة

دخول

- من المفترض أن يتحرك مؤشر ستوكاستيك البطيء من منطقة ذروة البيع إلى منطقة ذروة الشراء مما يشير إلى أن الزخم يتغير ويبدأ في الاتجاه الصعودي

- يجب أن يتراجع السعر بالقرب من المتوسط المتحرك الأسي 20

- من المفترض أن يلامس مؤشر ستوكاستيك السريع مستوى 20 أو يتجاوزه مما يشير إلى أن السوق في منطقة ذروة البيع على المدى القصير

- أدخل أمر شراء حيث يعود مؤشر الاستوكاستك السريع إلى ما فوق 20

إيقاف الخسارة

- قم بتعيين وقف الخسارة أسفل شمعة الدخول

خروج

- اسمح لمؤشر ستوكاستيك السريع بالعبور إلى منطقة ذروة الشراء ثم قم بإغلاق التداول عندما يعود إلى ما دون مستوى 80

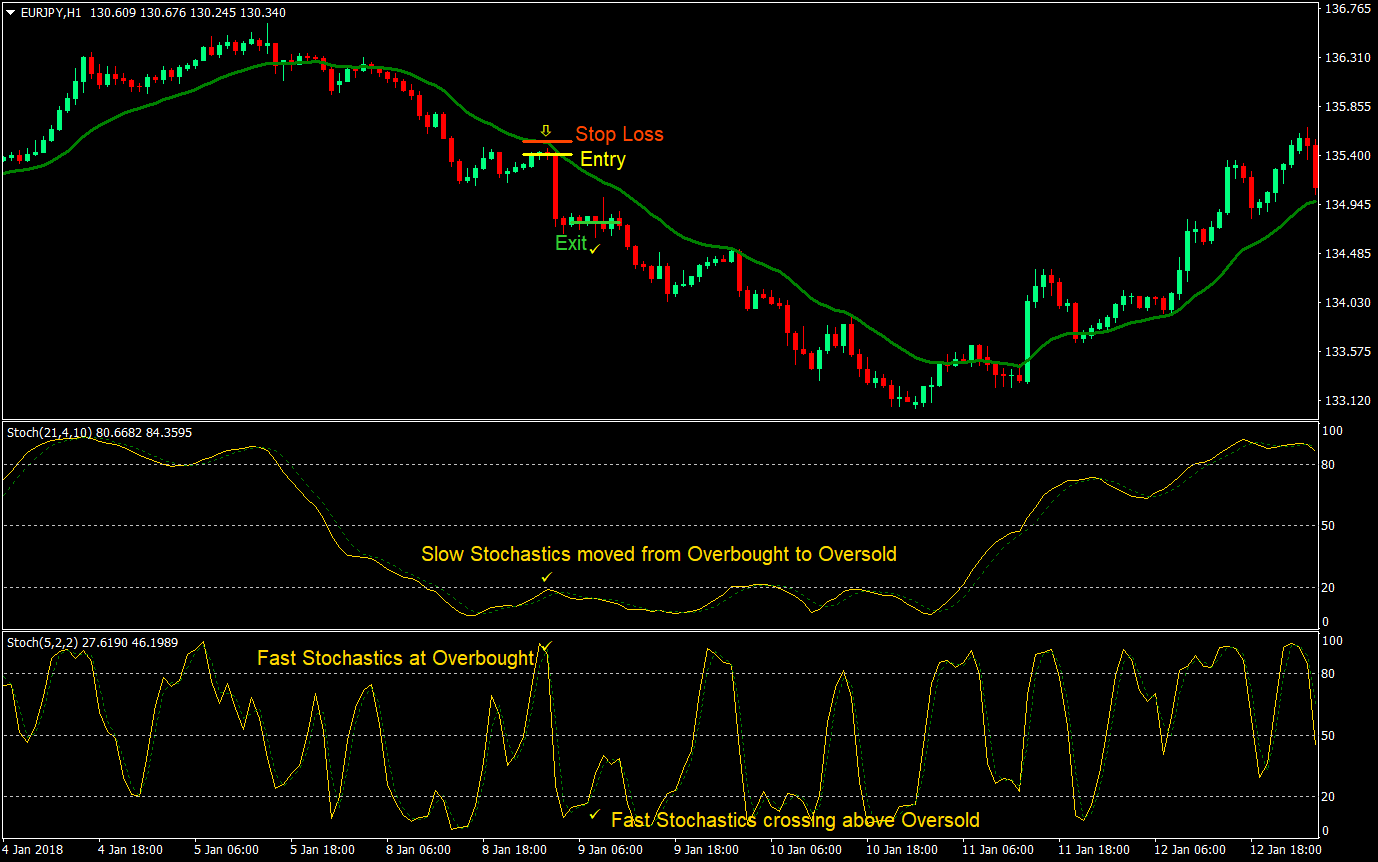

بيع (قصير) إعداد التجارة

دخول

- من المفترض أن يتحرك مؤشر ستوكاستيك البطيء من منطقة ذروة الشراء إلى منطقة ذروة البيع مما يشير إلى أن الزخم يتغير ويبدأ في الاتجاه الهبوطي

- يجب أن يتراجع السعر بالقرب من المتوسط المتحرك الأسي 20

- من المفترض أن يلامس مؤشر ستوكاستيك السريع مستوى 80 أو يتجاوزه مما يشير إلى أن السوق في منطقة ذروة الشراء على المدى القصير

- أدخل أمر بيع حيث يعود مؤشر الاستوكاستك السريع إلى ما دون مستوى 80

إيقاف الخسارة

- قم بتعيين وقف الخسارة فوق شمعة الدخول

خروج

- اسمح لمؤشر ستوكاستيك السريع بالعبور إلى منطقة ذروة البيع ثم قم بإغلاق التداول عند عبوره مرة أخرى فوق مستوى 20

وفي الختام

هذه الإستراتيجية هي نوع من الإستراتيجية التي تتبع الاتجاه والتي تأخذ الصفقات مع تراجع السعر إلى المتوسط. إن إجراء الصفقات مع تراجع السعر إلى متوسط متحرك لمدة 20 فترة هو اتجاه شائع يتبع الإستراتيجية. ومع ذلك، غالبًا ما يكون من الصعب تحديد ما إذا كان السوق يتجه أم لا. والأكثر صعوبة هو توقيت الدخول مع تراجع السعر إلى المتوسط.

باستخدام المعلمتين الخاصتين بمؤشر Stochastic Oscillator، لا نتمكن فقط من تحديد ما إذا كان السوق قد بدأ في الاتجاه، بل لدينا أيضًا احتمالية أفضل لتوقيت الدخول بشكل صحيح.

وسيط MT4 الموصى به

- مجاني $ 50 لبدء التداول على الفور! (ربح قابل للسحب)

- مكافأة الإيداع تصل إلى $5,000

- برنامج ولاء غير محدود

- وسيط فوركس حائز على جوائز

- مكافآت حصرية إضافية على مدار العام

>> طالب بمكافأتك البالغة 50 دولارًا هنا <

انقر هنا أدناه للتنزيل: