التداول في الأسواق يدور حول المشاعر. يتعلق الأمر بالطبيعة البشرية وسيكولوجية الجمهور. سواء كان ذلك تداول الأسهم أو الذهب أو النفط أو السلع أو العملات المشفرة أو الفوركس. سيكون هناك دائما من هو متفائل بشأن سلعة معينة ومن هو متشائم بشأنها. ويطلق عليهم الثيران والدببة. من يثبت أنه أقوى في فترة معينة سيفوز. كمتداولين، ليس من واجبنا تخمين الاتجاه الذي يتجه إليه السوق. مهمتنا هي التعرف على السوق. من هو الأقوى حاليا؟ هل هم الثيران أم الدببة؟

استراتيجية Bulls Bears Stop لتداول العملات الأجنبية هي إستراتيجية تداول تتمحور حول فكرة تحديد معنويات السوق. تهدف هذه الإستراتيجية إلى الاستفادة من سوق الفوركس من خلال قياس قوة المضاربين على الصعود والمضاربين على الانخفاض بشكل موضوعي. وهذا يعطينا إشارة إلى الاتجاه الذي يجب أن نتخذه لتحقيق الربح المستمر من سوق الفوركس. وطالما لدينا فكرة عن الاتجاه الذي يريد السوق أن يسلكه، فإن المعركة قد انتهت.

مؤشرات القوة للثيران والدببة

مؤشرات الثيران والدببة هي مؤشرات تحاول قياس قوة الثيران والدببة في السوق. ومن خلال القيام بذلك، يمكننا أن نشعر بالاتجاه الذي يتجه إليه السوق بناءً على نقاط القوة الخاصة بكل منهما.

مؤشر الثيران والدببة عبارة عن مؤشرات متذبذبة بسيطة تقيس المسافة بين الارتفاع والانخفاض وتقارنها بالمتوسط المتحرك الأسي (EMA). تشير الحركة الصعودية والدببة الإيجابية إلى أن كلا من الارتفاعات والانخفاضات في السعر ترتفع مقارنة بمتوسط السعر. وهذا يعني أن معنويات السوق صعودية. من ناحية أخرى، إذا كان مؤشر الثيران والدببة سلبيًا، فهذا يعني أن الارتفاعات والانخفاضات في حركة السعر آخذة في الانخفاض مقارنة بمتوسط السعر، مما يعني أن السوق هبوطي.

توقف الثريا أو خروج الثريا

مؤشر توقف الثريا، المعروف أيضًا باسم مخارج الثريا، هو مؤشر توقف متحرك يساعد المتداولين في تحديد الموضع المثالي لإيقاف الخسائر. إنه يشبه إلى حد كبير مؤشر الإيقاف المكافئ والعكس (PSAR) ولكنه نسخة أبسط منه.

يقيس مؤشر توقف الثريا نقاط وقف الخسارة بناءً على القيمة القصوى للارتفاع والانخفاض. تستخدم الإصدارات الأخرى الحد الأقصى لقيمة الإغلاق. ثم يقوم بوضع حاجز بين القيمة القصوى عن طريق حساب متوسط المدى الحقيقي (ATR) لفترة معينة وإضافته فوق الحد الأقصى أو طرحه من الحد الأقصى المنخفض. يتيح ذلك للمتداولين تحديد المسافة الآمنة التي يمكنهم من خلالها تتبع وقف الخسارة. والحجة هي أنه إذا انعكس السعر بمضاعفات ATR، فمن المفترض أن يكون الاتجاه قد انعكس بالفعل.

استراتيجية تداول

استراتيجية التداول هذه هي استراتيجية تعتمد على قوة معنويات السوق وتحاول تحديد الاتجاه بناءً على قوة الحركة الصعودية والدببة. ويتم ذلك عن طريق استخدام مؤشرات قوة الثيران والدببة.

يتم إجراء الصفقات بناءً على اتجاه مؤشرات الثيران والدببة. إذا كانت مؤشرات الثيران والدببة إيجابية، فمن الممكن أن يتم تفعيل صفقة شراء. من ناحية أخرى، إذا كانت هذه المؤشرات سلبية، فمن الممكن أن يتم تفعيل تجارة بيع.

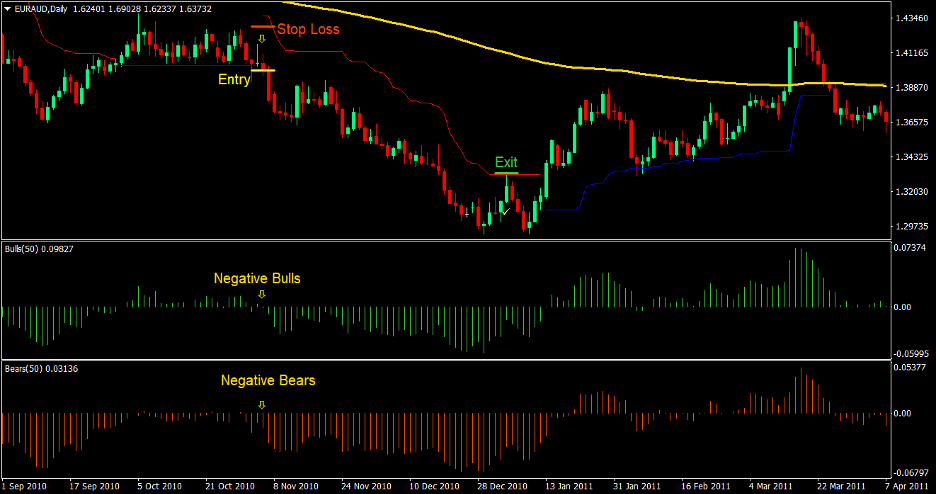

سيتم استخدام مؤشر توقف الثريا، وهو مؤشر توقف متحرك، كمؤشر لاتجاه الاتجاه. هذا الإصدار المعين من توقفات الثريا يرسم فقط الخط المعاكس لاتجاه الاتجاه. كلما كان الاتجاه صعوديًا، فإن المؤشر سيرسم الخط السفلي فقط. عندما يكون الاتجاه هبوطيًا، فإنه سيرسم الخط العلوي فقط. يخبرنا هذا بسهولة بالاتجاه الذي يعتمد عليه المؤشر.

أخيرًا، على الرغم من أن إشارات الدخول المذكورة أعلاه ذات جودة عالية، إلا أننا سنستمر في تصفية التداولات التي تتعارض مع اتجاه الاتجاه طويل المدى. للقيام بذلك، سوف نستخدم المتوسط المتحرك الأسي لمدة 200 فترة (EMA). هذا المتوسط المتحرك هو مؤشر اتجاه طويل المدى يستخدم على نطاق واسع. لا ينبغي إجراء الصفقات إلا إذا كانت المؤشرات الثلاثة الأخرى متوافقة مع المتوسط المتحرك الأسي 200.

المؤشرات:

- 200 إما (ذهب)

- الثريا توقف-v1

- مدة العرض: 28

- فترة ATR: 18

- كيلو فولت: 3.5

- الثيران

- الفترة: 50

- تتحمل

- الفترة: 50

الإطار الزمني: 4 ساعة ومخططات يومية

أزواج العملات: أزواج كبيرة وثانوية

جلسة التداول: طوكيو ولندن ونيويورك

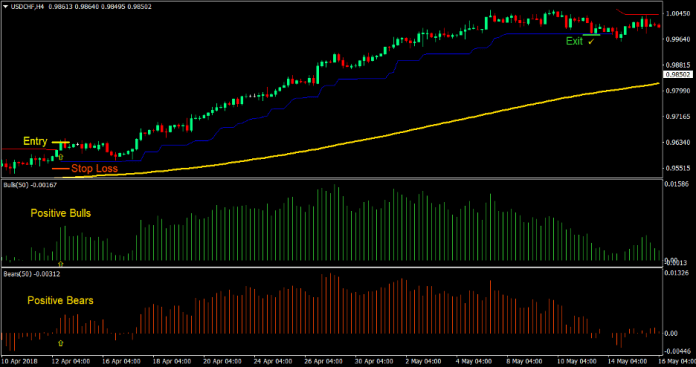

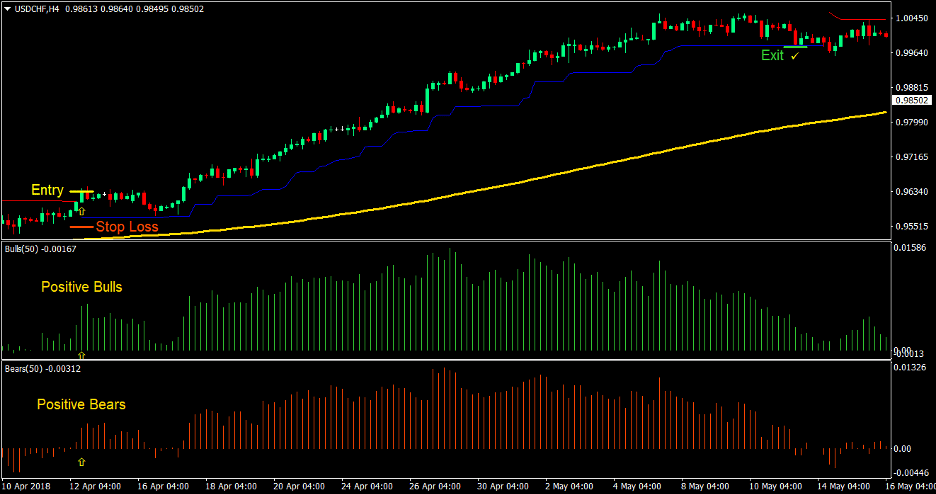

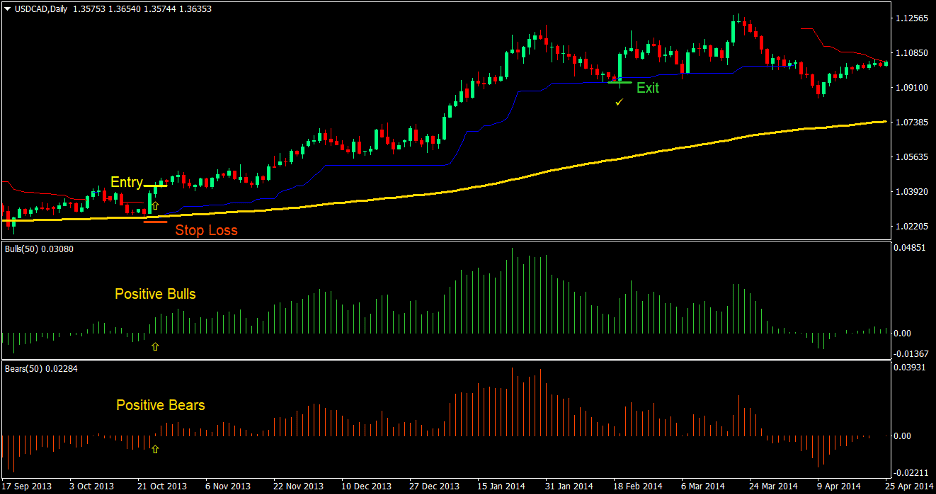

شراء إعداد التجارة

دخول

- يجب أن يكون السعر فوق 200 EMA مما يشير إلى اتجاه صعودي طويل المدى

- يجب أن تكون مؤشرات القوة للثيران والدببة إيجابية مما يشير إلى معنويات السوق الصعودية

- يجب أن يطبع مؤشر توقف الثريا خطًا أزرقًا أسفل حركة السعر مما يشير إلى الاتجاه الصعودي

- أدخل أمر شراء عند التقاء ظروف السوق المذكورة أعلاه

إيقاف الخسارة

- قم بتعيين وقف الخسارة عند مستوى الدعم أسفل شمعة الدخول

خروج

- قم بتحريك وقف الخسارة أسفل خط توقفات الثريا الأزرق حتى يتم إيقاف الربح

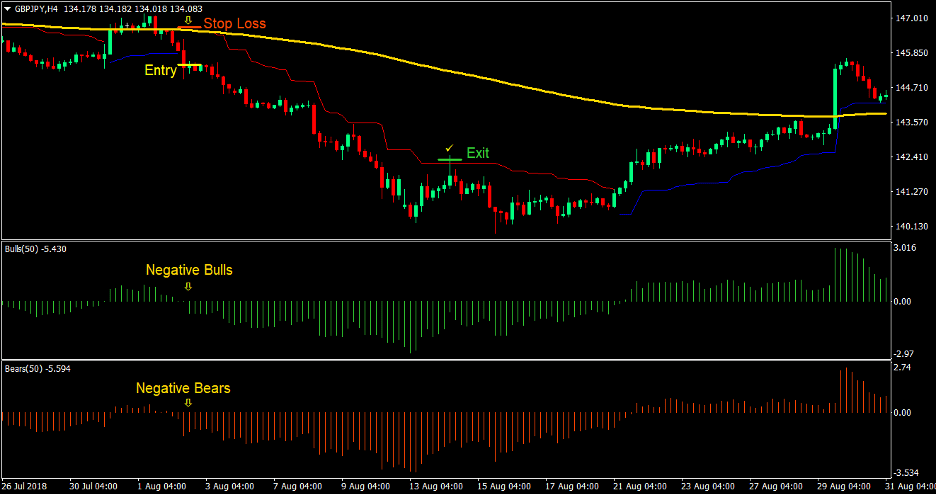

بيع إعداد التجارة

دخول

- يجب أن يكون السعر أقل من 200 EMA مما يشير إلى اتجاه هبوطي طويل المدى

- يجب أن تكون مؤشرات قوة الثيران والدببة سلبية مما يشير إلى معنويات السوق الهبوطية

- يجب أن يطبع مؤشر توقف الثريا خطًا أحمر فوق حركة السعر مما يشير إلى الاتجاه الهبوطي

- أدخل أمر بيع عند التقاء ظروف السوق المذكورة أعلاه

إيقاف الخسارة

- قم بتعيين وقف الخسارة عند مستوى المقاومة أعلى شمعة الدخول

خروج

- قم بتحريك وقف الخسارة فوق خط Chandelier Stops الأحمر حتى يتم إيقاف الربح

وفي الختام

استراتيجية التداول هذه هي استراتيجية تداول مربحة بشكل لائق. يتمتع بمعدل فوز جيد إلى حد ما نظرًا لحقيقة أن الاتجاه يعتمد على معنويات السوق ويتم تصفية التداولات لتتماشى مع الاتجاه طويل المدى. ومن خلال القيام بذلك، فإننا نقوم بتداولات من المرجح أن تتجه في اتجاه تجارتنا نظرًا لوجود دعم ومقاومة ديناميكية أقل يجب على التداولات التغلب عليها. تتمتع إستراتيجية التداول هذه أيضًا بنسبة عادلة من المكافآت إلى المخاطر والتي يمكن أن ترتفع من 2:1 إلى 4:1 اعتمادًا على حالة السوق.

وسطاء MT4 الموصى بهم

XM Broker

- مجاني $ 50 لبدء التداول على الفور! (الربح القابل للسحب)

- مكافأة الإيداع تصل إلى $5,000

- برنامج ولاء غير محدود

- وسيط فوركس حائز على جوائز

- مكافآت حصرية إضافية على مدار العام

>> سجل للحصول على حساب وسيط XM هنا <

وسيط FBS

- تداول 100 مكافأة: 100 دولار مجانًا لبدء رحلة التداول الخاصة بك!

- 100٪ مكافأة إيداع: ضاعف إيداعك حتى 10,000 دولار وتداول برأس مال معزز.

- الرافعة المالية تصل إلى 1: 3000.: تعظيم الأرباح المحتملة باستخدام أحد أعلى خيارات الرافعة المالية المتاحة.

- جائزة "أفضل وسيط لخدمة العملاء في آسيا".: التميز المعترف به في دعم العملاء والخدمة.

- الترقيات الموسمية: استمتع بمجموعة متنوعة من المكافآت الحصرية والعروض الترويجية على مدار السنة.

>> سجل للحصول على حساب وسيط FBS هنا <

انقر هنا أدناه للتنزيل: