Most traders know about momentum trading, trend reversals and trend following trading strategies. However, many traders overlook mean reversal trading. This is because mean reversal trading strategies often do not carry as much allure to it as the other types of trading strategies.

While trend following and trend reversal strategies often offer high yields for a single trade setup, mean reversal strategies bank on lower yields on each trade with a higher percentage of wins. This steady but surely approach might not be as exciting as winning the lottery approach, it is a viable way to trade the forex market and consistently profiting from it over the long run.

Mean reversal strategies often entail short-term reversals due to overbought or oversold market conditions. This is because prices which are overextended away from its mean would often revert to the average price quickly and would often overshoot it heading towards the opposite extreme.

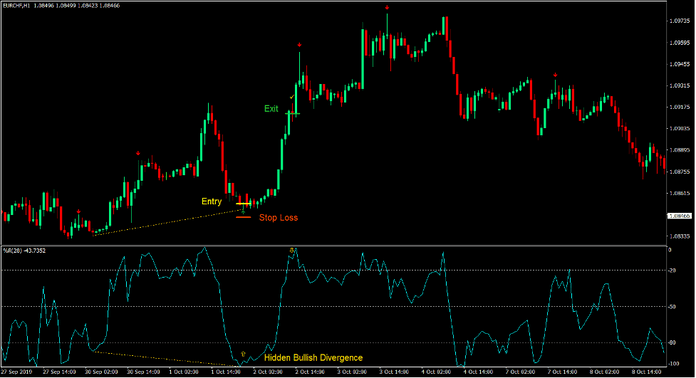

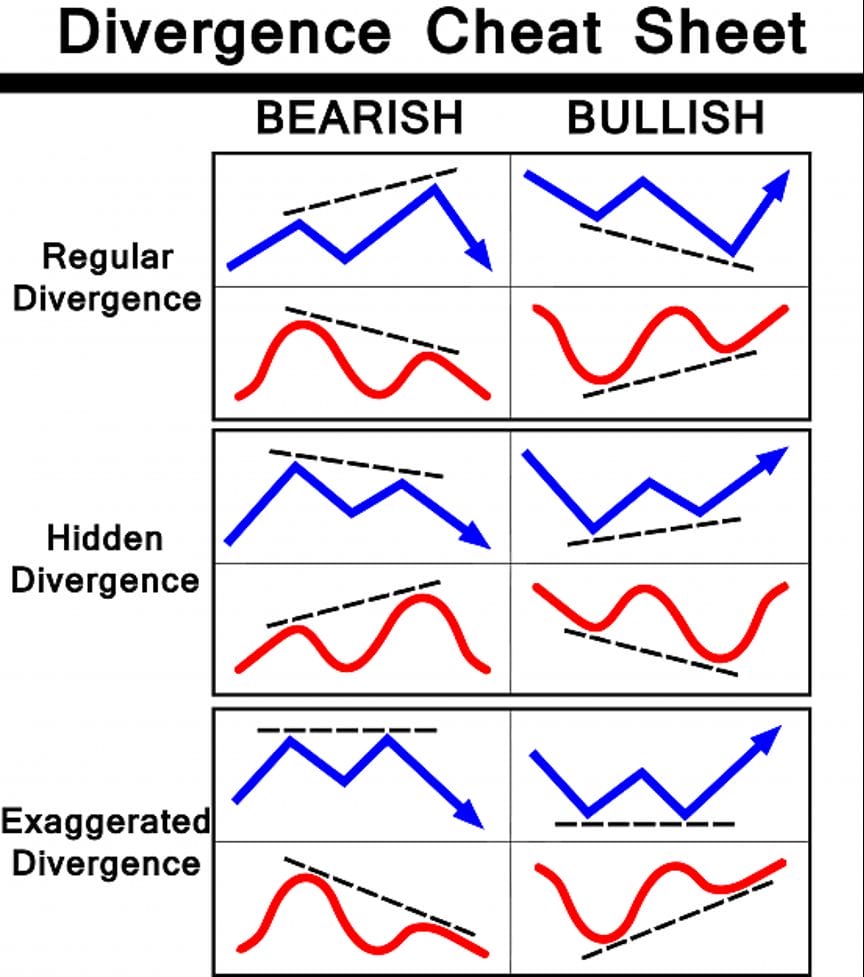

Divergence is a very powerful trading concept which allows traders to anticipate reversals with a relatively high degree of accuracy. Divergences are basically discrepancies in depth of the peaks and troughs of price action and that of its corresponding oscillator. Divergences often tend to result in reversals. Below is a chart that shows the different types of divergences.

Pin Bar Indicator

Candlestick formations and patterns are some of the most powerful signals in the market. These are recurring candlestick patterns and formations that could either indicate a trend continuation, a trend reversal or a pattern breakout.

Among the many different candlestick patterns and despite its simplicity, the pin bar pattern is probably one of the most popular. This is because pin bar patterns tend to be very effective indications of a reversal.

The Pin Bar indicator is a custom technical indicator which helps new traders objectively identify pin bar patterns. It plots an arrow pointing up whenever it detects a bullish pin bar, and an arrow pointing down whenever it detects a bearish pin bar. Traders can systematically use these signals as an entry signal or trigger.

Williams Percentage Range

Williams Percentage Range, also known as Williams %R (%R), is a momentum indicator which is based on the recent highs and lows of price movements. This technical indicator is also a part of the oscillator family of technical indicators.

The Williams %R is computed by dividing the difference of the highest high of price within a certain period and the close of price, to the difference of the highest high and the lowest low of price within the same period. The result is an oscillator line that could range from -100 to 0. The range also has markers at level -80 and -20.

This indicator is used to identify price extremes. Price is considered overbought if the line breaches above -20 and oversold if the line drops below -80. Traders can use this information to trade mean reversal trade setups coming from such price extremes.

Trading Strategy

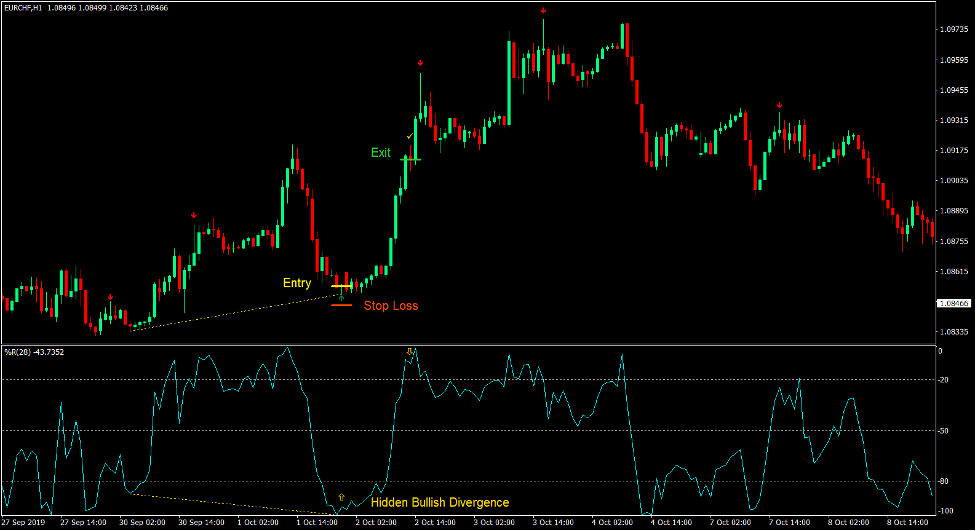

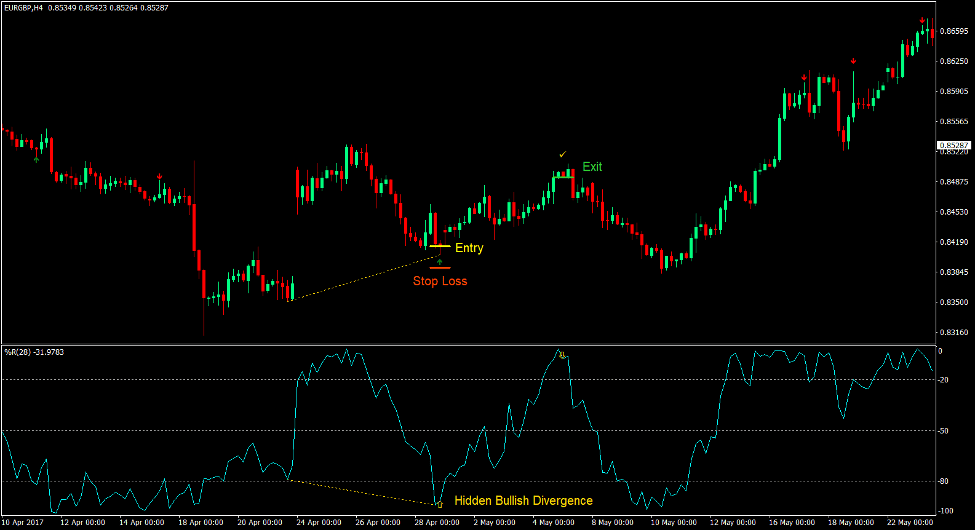

Williams Percentage Range Divergence Forex Trading Strategy is a simple mean reversal strategy which also finds confluences from divergences in order to filter out lower probability trade setups.

The Williams %R indicator is used both to identify overbought and oversold price conditions, as well as divergences. Divergences are identified based on discrepancies coming from price swings on the price chart and the peaks and troughs on the Williams %R range. However, only divergences which are also overbought or oversold are considered.

The trend reversal entry trigger is then confirmed by a pin bar candlestick pattern. The Pin Bar indicator is used to objectively confirm such patterns based on the arrow plotted on the price chart.

Indicators:

- Pinbar

- Williams’ Percentage Range

- Period: 28

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

Buy Trade Setup

Entry

- The Williams %R line should be below -80 indicating an oversold price condition.

- A bullish divergence should be observed.

- The Pin Bar indicator should plot an arrow pointing up indicating the presence of a bullish pin bar.

- Enter a buy order on the confluence of these conditions.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the Williams %R line indicates a reversal from the overbought range.

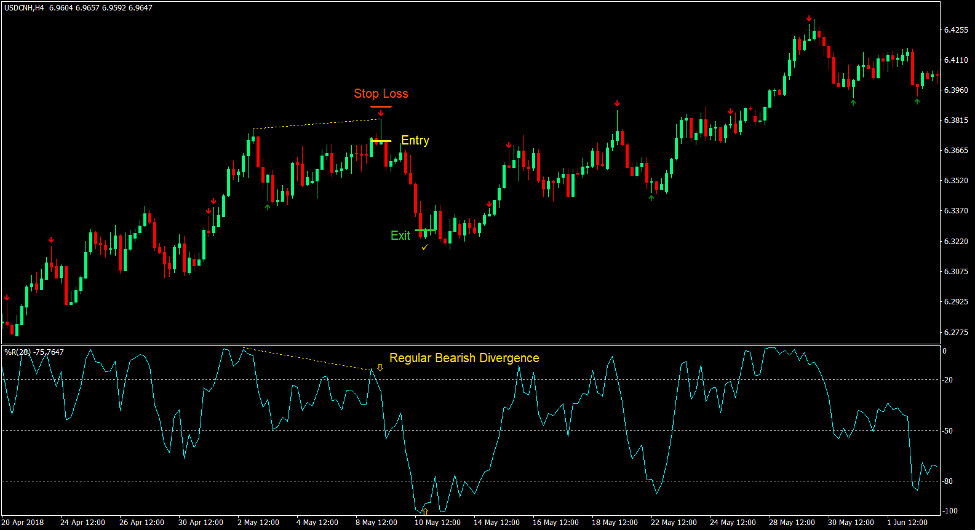

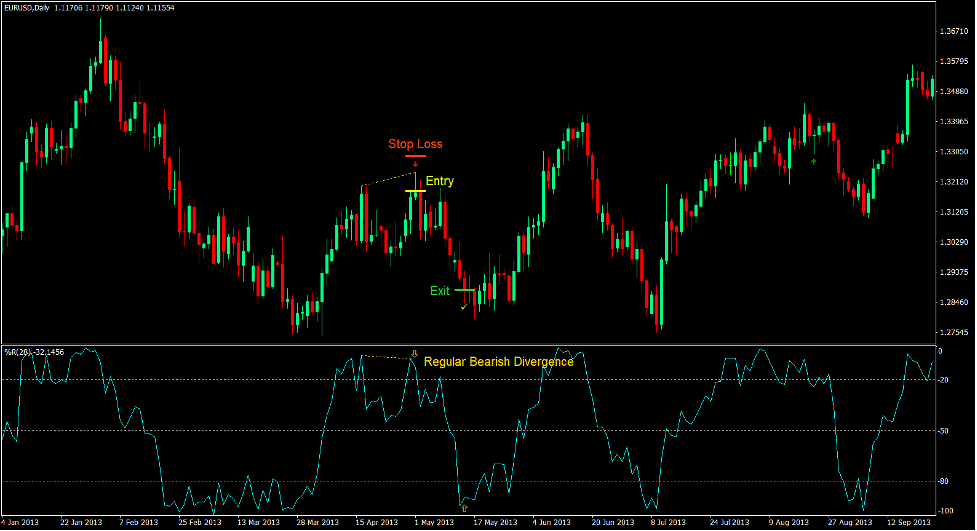

Sell Trade Setup

Entry

- The Williams %R line should be above -20 indicating an overbought price condition.

- A bearish divergence should be observed.

- The Pin Bar indicator should plot an arrow pointing down indicating the presence of a bearish pin bar.

- Enter a sell order on the confluence of these conditions.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as the Williams %R line indicates a reversal from the oversold range.

Conclusion

Divergences are reliable market scenarios that provide traders trade setups with a relatively high win probability. With the right divergence setup, traders could have an accuracy level of as high as 60% to 70%.

Trading on overbought and oversold market conditions significantly increases the likelihood of price reversing strongly due to its mean reversal properties.

Pin bar patterns also tend to be one of the most accurate reversal signals coming from a candlestick pattern.

The combination of all three conditions allow us to have a confluence of conditions that are individually reliable. This results in trade setups that have a very high win probability.

On top of this, traders can also place tighter stop losses depending on their risk appetite, since they are trading on a pin bar pattern, which if successful are usually the tip of a price swing. This allows traders to have a combination of a high win rate and a good risk-reward ratio, resulting in a winning trade setup.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: