Triple Threat Day Trade Forex Trading Strategy

One of the best things about day trading is that it could be simple and mechanical. This is because unlike swing or position trading, the length of time that a trader should hold a position is much smaller. This means that there are much lesser variables and unknowns that could happen in that shorter period of time. On the other hand, swing trading and position trading takes a lot longer to hold a trade. This means that a technically sound and fundamentally correct trading decision which would have been in profit could be adversely affected by a dissenting news release. It is much easier to predict what would happen a few minutes forward than a few days or weeks ahead. This allows day trading to be purely technical and mechanical, although this is not the only way to day trade.

Given that day trading allows for mechanical and algorithmic trading, we will explore a simple strategy that would allow us to trade this way.

Another thing that I would like to emphasize is trading with the trend. This is because trading with the trend, as opposed to trading against it increases the probability of a successful trade. This is because momentum and current market sentiment is on your side. Also, a big chunk of the market are bandwagoners. They would trade the direction which they see is the current trend direction on the chart. It would be wise to trade with the bigger chunk of the market instead of against them.

So, onto our strategy.

The Setup: Triple Threat Day Trade Strategy

This strategy is based purely on three Exponential Moving Averages (EMA), which are as follows:

- 15 EMA (gold)

- 30 EMA (green)

- 60 EMA (brown)

These three EMAs will be our basis in determining if the market is trending, the trend direction and the entry trigger.

To determine if the market is trending and trend direction, we will be needing the 30 & 60 EMA. To determine a bullish trending market, we will be looking for the 30 EMA to above the 60 EMA. On the other hand, on bearish market, it will the 60 EMA above the 30 EMA.

Then, to determine our entry trigger, we will be using the 15 EMA, 30 EMA, and price itself. In a bullish market, what we will be looking for is for price to crossover from in between the 15 & 30 EMA to outside and above the 15 EMA. In a bearish market, we will be looking for price to cross below the 15 EMA.

As an additional filter, we will need to determine if there is not reversal pressure on our trade. To determine this, we will be using the 30 EMA. Price should never close beyond the 30 EMA against our determined trend direction.

Timeframe: 5-minute chart

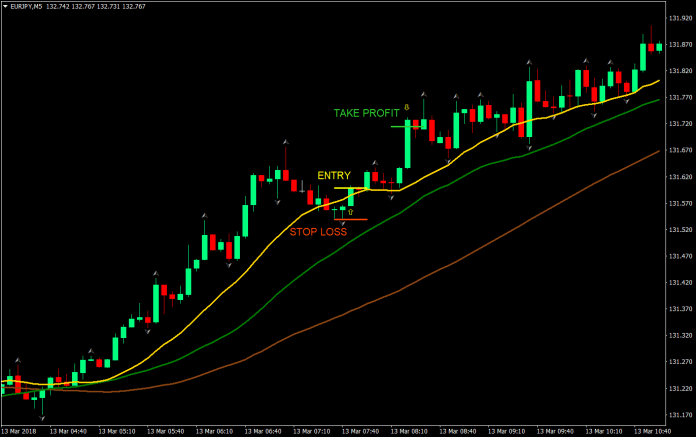

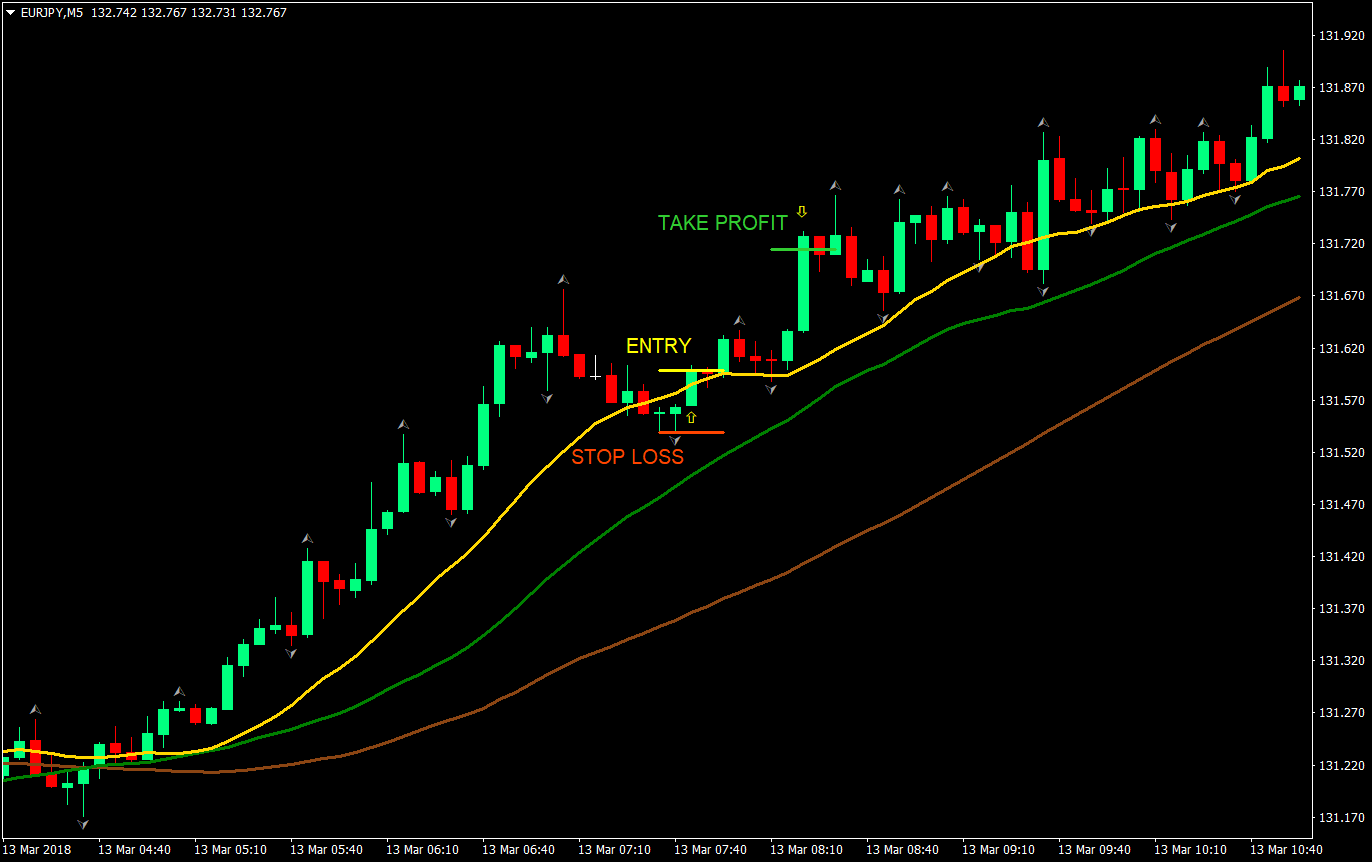

Buy Entry:

- 30 EMA should be above the 60 EMA

- Price should never close below the 30 EMA

- Price should cross from between the 15 & 30 EMA to close above the 15 EMA

- Enter a buy market order at the close of the candle

Stop Loss: Set the stop loss at the fractal below the entry

Take Profit: Set the take profit at 2x the risk on the stop loss

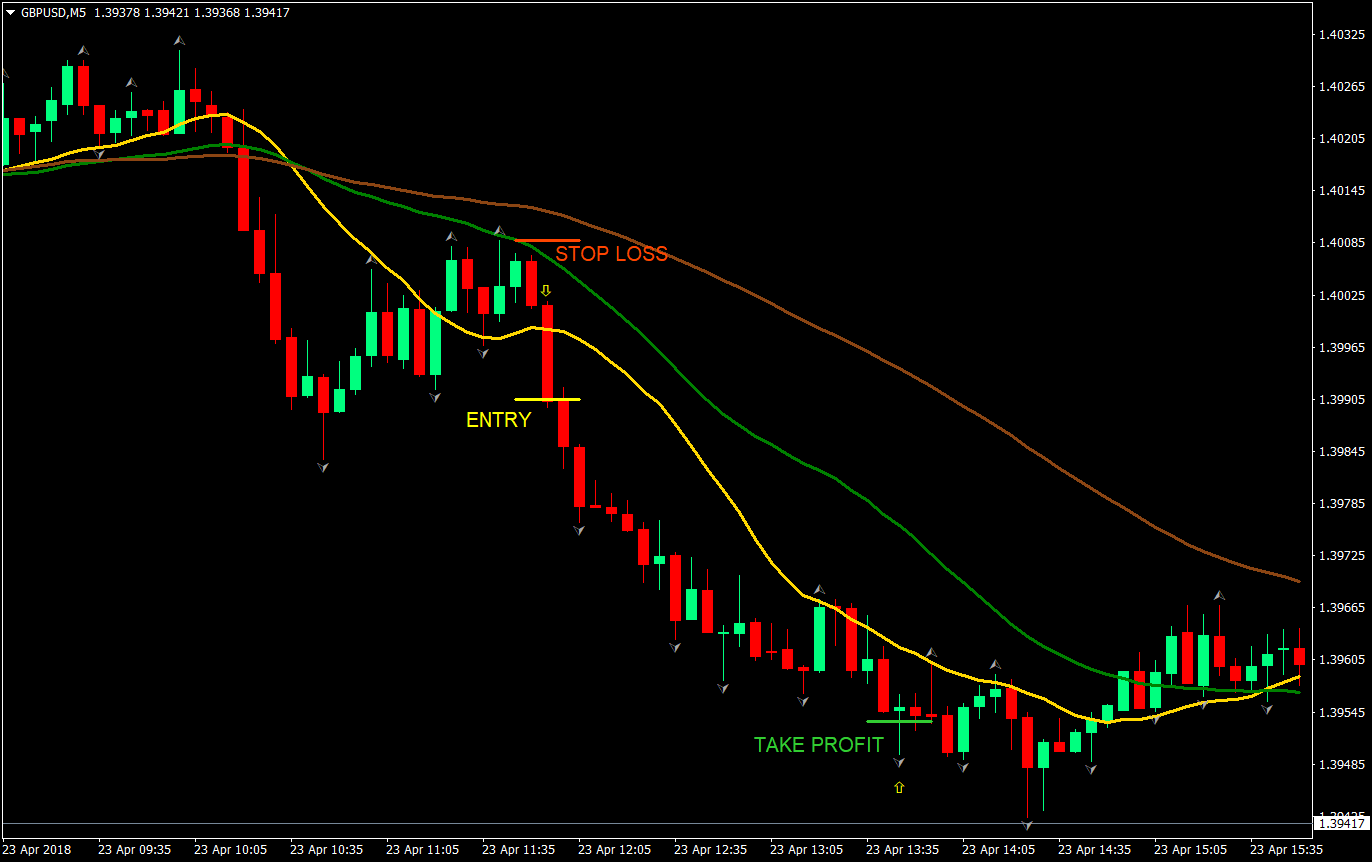

Sell Entry:

- 30 EMA should be below the 60 EMA

- Price should never close above the 30 EMA

- Price should cross from between the 15 & 30 EMA to close below the 15 EMA

- Enter a sell market order at the close of the candle

Stop Loss: Set the stop loss at the fractal above the entry

Take Profit: Set the take profit at 2x the risk on the stop loss

Conclusion

This simple day trading strategy is an actual working strategy that many day traders use. The only difference is that the settings on the moving averages differ according to the preference of traders.

With this, you could tweak the settings of the moving averages according to your liking. Setting the fast EMA (gold) tighter would mean trading on a stronger momentum, but at the same time, risk entering on the peak or trough. The middle line (green) represents our filter line. Setting it faster would make it hug price a bit more, invalidating some potential trades, yet ensuring a high momentum trade. The slow EMA (brown) represents our main trend. Setting it faster allows for faster reaction time and more trades, but you also run the risk of trading on a trend that is not yet that established.

Another aspect that you could tweak is on the type of moving average. You may use simple, linear, weighted, or whatever moving average you think works best. I just happen to prefer the exponential moving average. Each to his own.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: