Trend Following Hammer Forex Strategy

The hammer candlestick pattern is probably one of the most popular bullish trend reversal pattern, and that is for a reason. Just as the name denotes, it is also very powerful. So powerful, it could be used as a main pattern for a trading strategy.

So, what is a hammer pattern. A hammer pattern is a candlestick pattern that has its body near the top of the candle’s range and a long wick at the bottom. This usually occurs when during a trading period price drops significantly forming the extreme low of the candle before coming back up and creating a range near the top of the candle before it closes. This type of candles denotes a market psychology wherein market participants are rejecting the lower end of the price range. This market behavior makes this pattern an effective bullish reversal pattern.

Although price could close below the opening price, a hammer candle would be considered more powerful if price closed above the opening price. This is because the candle would signify that the bulls have overcome the bears on the close of the candle.

Also, the location of the hammer candle affects the candles significance. Since this is a bullish reversal trend, the hammer pattern should be found as part of the last price action forming a low. This would signify that the price action that is either a part of bearish trend or a mere price retracement, is about to end its thrust.

Although the hammer candle is a reliable pattern, not all hammer patterns turn out to be profitable. To properly trade the hammer pattern, it should be assessed in context with the chart. Is it a bullish trend making a retracement? Is it a bearish trend that may start to reverse or range? Is the size of the hammer candle significant enough to make an impact on the chart?

100 Exponential Moving Average (EMA) as a Trend Indicator

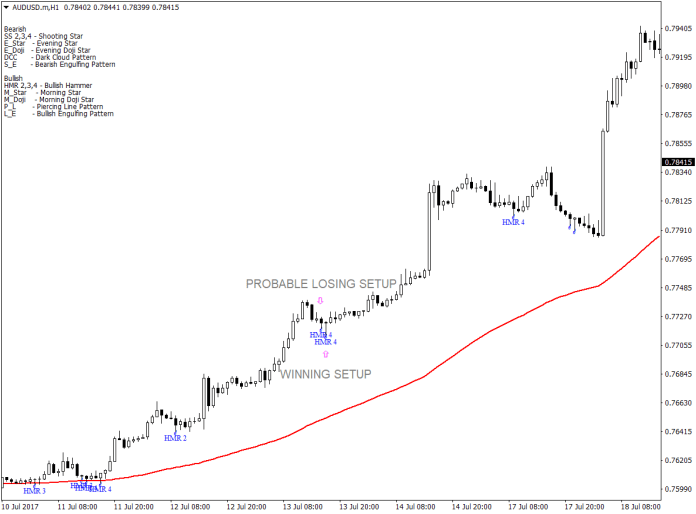

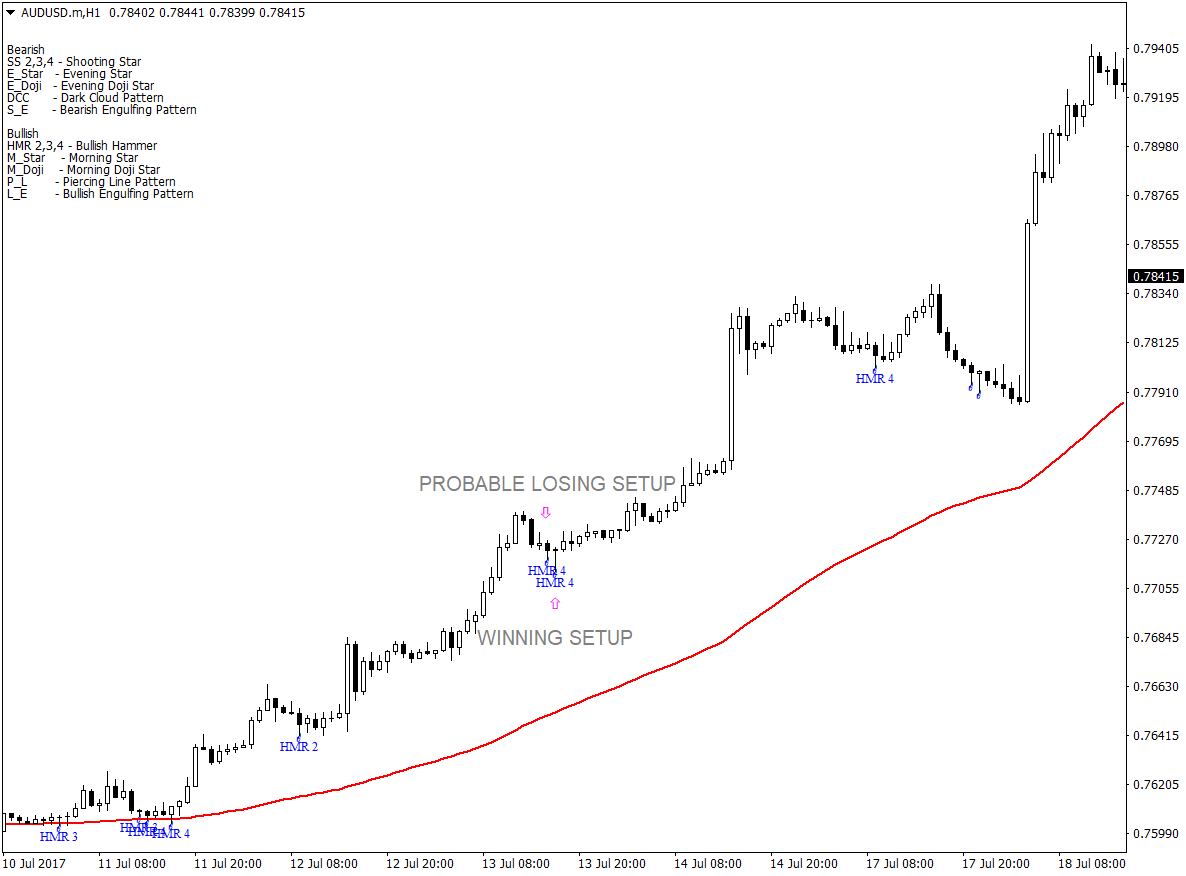

One of the context that we should take into consideration is the direction of the trend. Even though the hammer could work as an indication of a major trend reversal on a downtrend, the hammer pattern has a higher probability of success if used in the context of an uptrend having minor retracements. This is because the trade setup wouldn’t be going against the trade, but instead with it.

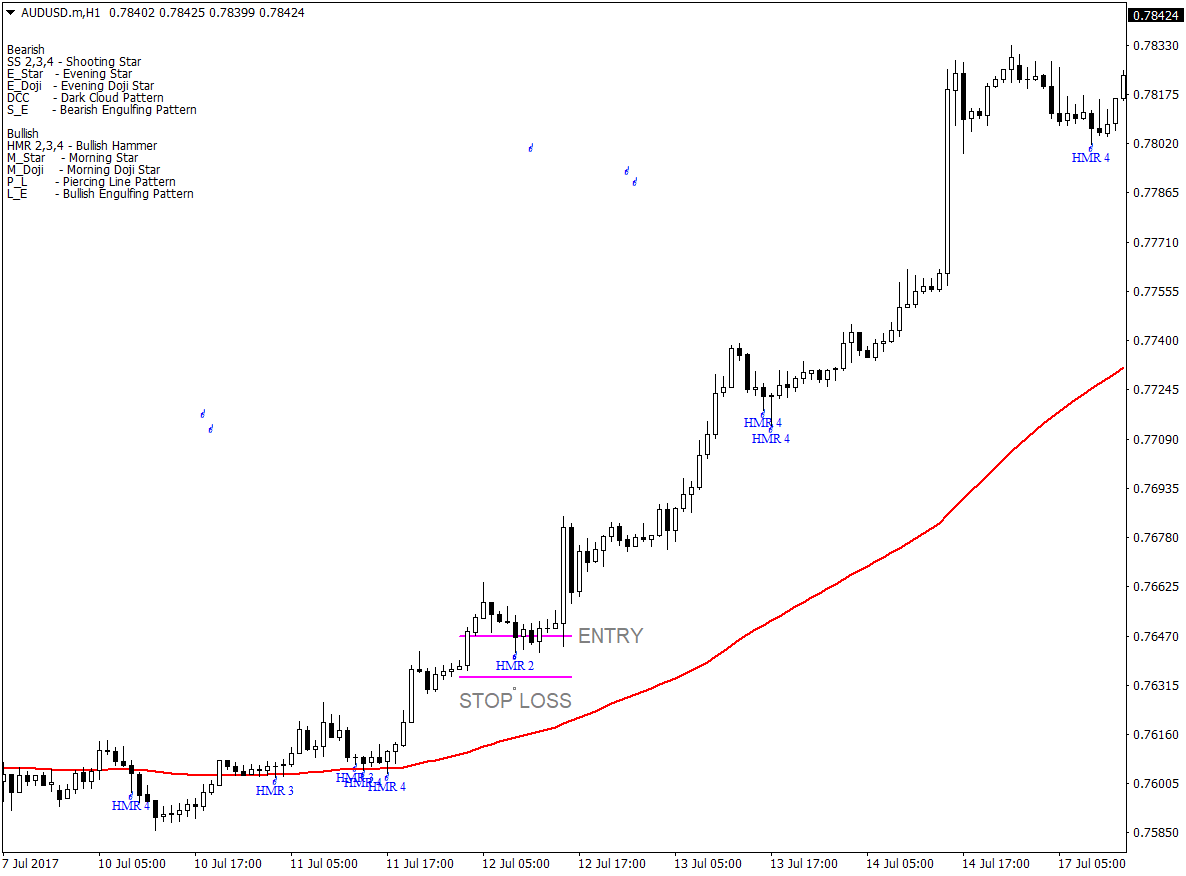

To determine the direction of the trend, we will be using the 100 EMA. The 100 EMA determines the mid-term trend by determining the location of price in relation to it. If price is above the 100 EMA, it is a bullish market. If price is below it, then it is a bearish market. Also, the slope of the 100 EMA gives out an indication whether the trend is going up or down.

Hammer Pattern Trade Setup

The setup that we would be looking for is a hammer pattern in an uptrend market, formed during a slight retracement of price. This is because these slight retracements are necessary prior to a continued price rally.

To identify the hammer candle, we will be using an indicator. This indicator would label a valid hammer pattern as HMR.

The entry rules will be as follows:

- Price should be above the 100 EMA

- The 100 EMA should be sloping upwards

- The right edge of the 100 EMA should not be curling downwards

As for the stop-loss, it would be just a few pips below the entry candle.

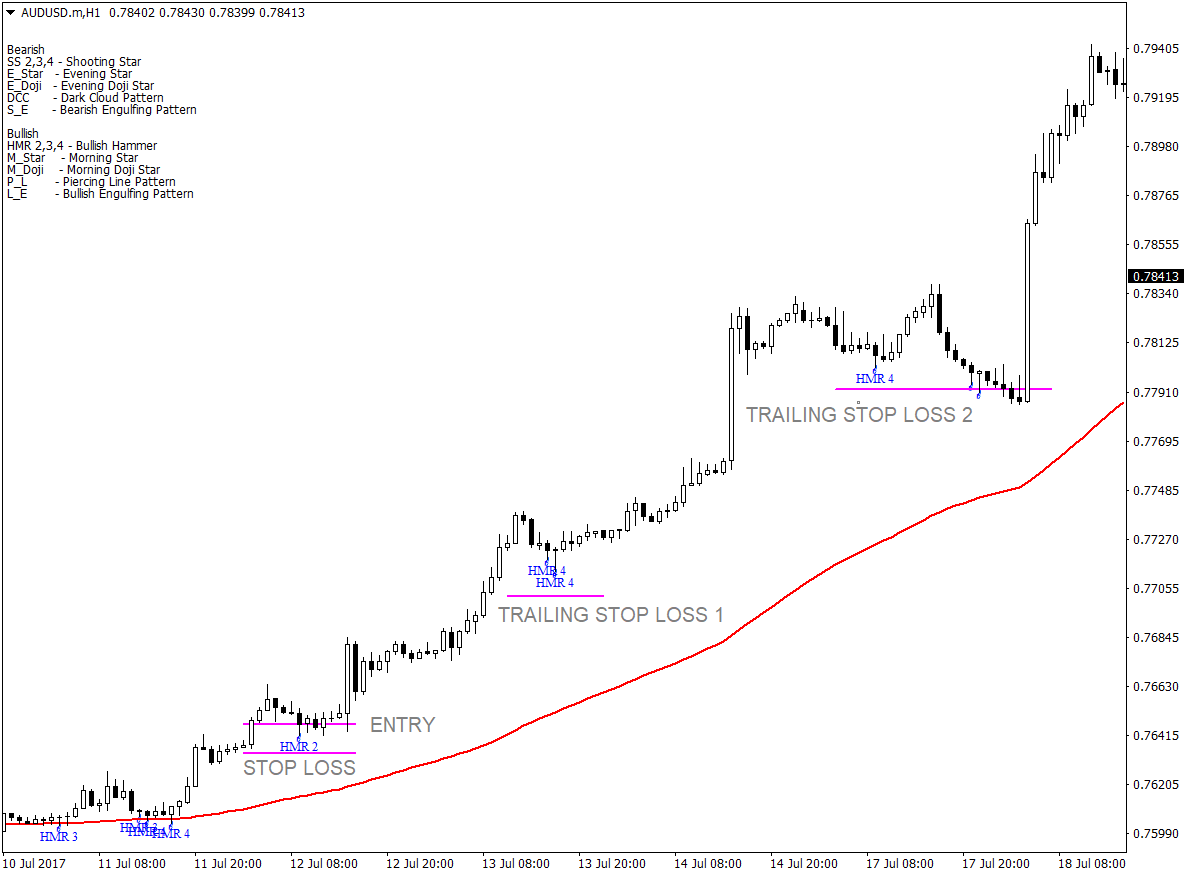

Trailing Stop-Loss as an Exit Strategy

For us to be able to maximize the profit potential of this trend following strategy, we will be using a trailing stop-loss. This would allow us to ride the trend until price stops us out.

The trailing stop-losses will be placed below the higher-lows formed as price makes some minor retracements.

Based on this chart, the trade would have gained 145 pips while risking only 12 pips on the stop-loss. That would have been a 12:1 risk-reward ratio.

The Losing Setups

However, not all hammer pattern setups would yield a profit. There are setups that even though they’ve ticked all the rules, would still result to a loss. Below is an example of one.

One of the setups that would have passed the rules could have been stopped out before continuing its rally. However, the same candle that might have stopped out the trade is still a hammer setup that would have allowed us to enter back in the market, which continued for a good profit.

Conclusions

The hammer pattern is an effective reversal pattern. But it is more effective if used together with the trend. And though it is not perfect, but because of its high risk-reward ratio, whatever losses that the loosing trades would incur would have been wiped out by the profits earned on the winning trades. If you are looking for a trend following strategy that yields a high return on its winning trades, this strategy could work for you.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: