The forex market is the most liquid market that traders could participate in. Its sheer size and volume speak for itself. With this comes great opportunities. A market that has enough volume to trade, volatility that could easily cover transaction costs and trading opportunities that occur round the clock. It seems like it is an inexhaustible source of money. However, with this also comes some difficulties. The forex market is also one of the most erratic markets. Volatility could be good for some but for those who have not learned to ride the waves of the forex market, volatility could cause them to drown.

The forex market moves in cycles and trends. One moment the market is silent, then it starts trending without warning. These trending waves are often unpredictable to many. However, there are ways to correctly time these trending cycles with great accuracy. The Tenkan Trigger Cross Forex Trading Strategy allows traders to identify probable starts of these trending phases. Traders could only dream of riding these trends from start to finish, but this strategy allows traders to do so more often.

Tenkan-sen

The Tenkan-sen is a component of the Ichimoku Cloud indicator developed by Goichi Hosada, which is one of the most effective indicators available to traders. It is often used in conjunction with the Kijun-sen and is referred to as the Conversion Line.

The Tenkan-sen is basically an average of the median of a certain period. It is computed by adding the highest high and lowest low and dividing the sum by two. The result is then plotted just like a moving average line overlaid on a price chart.

If you would observe the characteristics of the Tenkan-sen, it is very jagged compared to the usual moving average and hugs price action much closer. It is also used to represent the mid-term trend whereas the Kijun-sen is used as the longer-term trend of the two.

200 EMA

Moving Averages are used in many ways by different traders. One of its primary uses is identifying the general trend direction. Traders do this by identifying the location of price in relation to a preferred moving average line. One of the most commonly used moving average is the 200-period Exponential Moving Average (EMA). This moving average line is used by many traders to determine the long-term trend direction. Many traders also use this as a trend filter and would always avoid taking trades going against the trend direction of the 200 EMA.

BTtrend Trigger Indicator

The BTtrend Trigger indicator is a custom oscillating indicator based on the Trend Trigger Factor (TTF) indicator, which also has characteristics like the Relative Strength Index (RSI).

The BTtrend Trigger indicator is an unbounded oscillating indicator. This allows the BTtrend Trigger line to move freely on its own window. Instead of having a fixed marker to identify overbought or oversold price conditions, this indicator draws another line which shifts above and below zero depending on what trend it is detecting. Crossovers beyond this line could be considered as an entry signal and could be used by different traders in a variety of ways. Mean Reversion traders could use entry signals going the direction of the midline while Momentum traders could use entry signals going away from the midline.

Trading Strategy

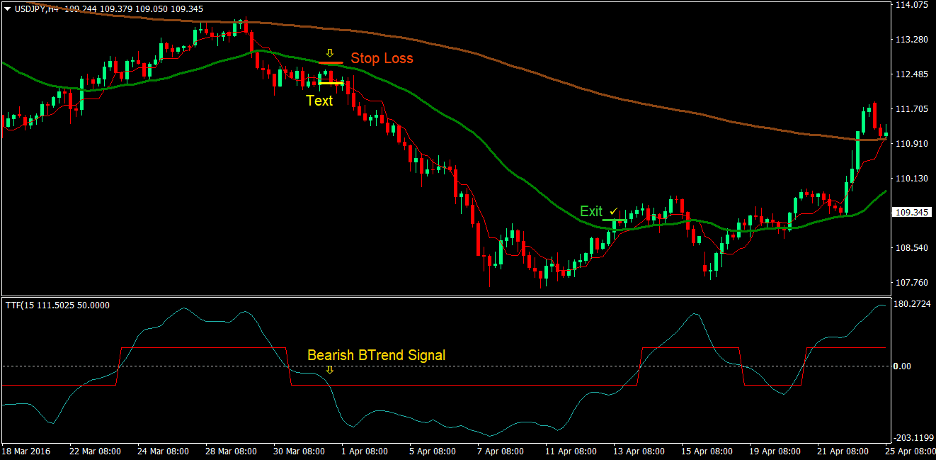

This trading strategy makes trade entries based on the crossing of the Tenkan-sen line over the 32-period Exponential Moving Average (green). The Tenkan-sen line represents the shorter-period trend while the 32 EMA represents the longer-term trend. Buy trades are taken when the Tenkan-sen line crosses above the 32 EMA, while sell trades are taken when the Tenkan-sen line crosses below the 32 EMA.

Trades are also filtered based on the long-term trend direction of the 200 EMA (brown). Only trades signals that are in agreement with the 200 EMA could be taken.

Trade signals should then be confirmed by the BTtrend Trigger indicator based on Momentum. Buy trades are taken when the BTtrend Trigger line crosses above the red line while being above the midline, while sell trades are taken when the BTtrend Trigger line crosses below the red line while being below zero.

Indicators:

- Ichimoku Kinko Hyo

- Tenkan-sen: 6

- Kijun-sen: 36

- 32 EMA (green)

- 200 EMA (brown)

- BTtrend Trigger

Timeframe: preferably 4-hour and daily charts

Currency Pairs: preferably major and minor pairs

Trading Session: Tokyo, London and New York

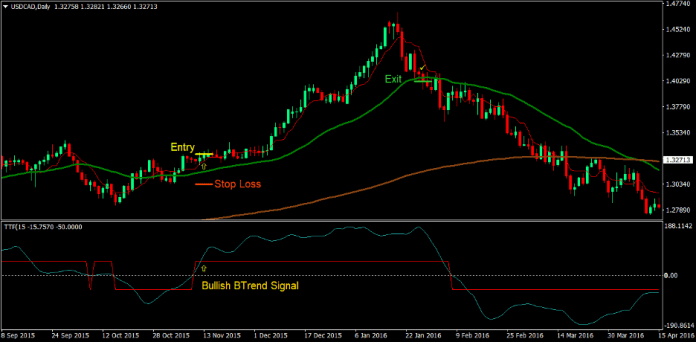

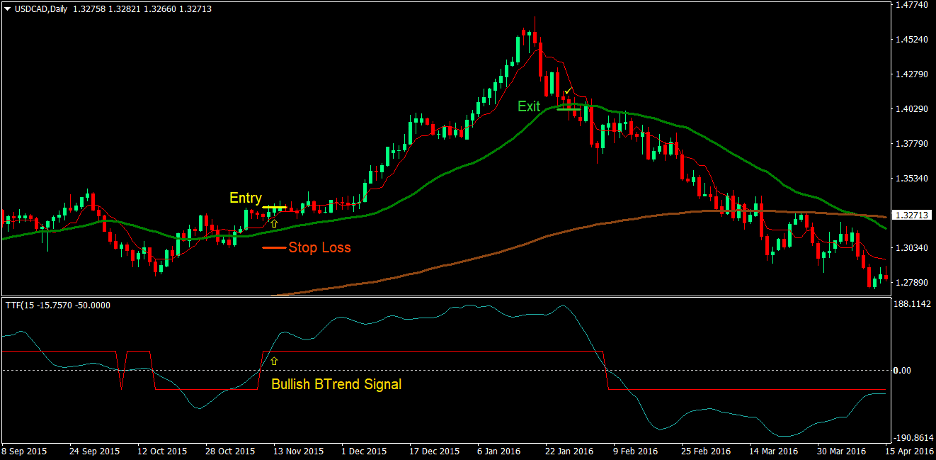

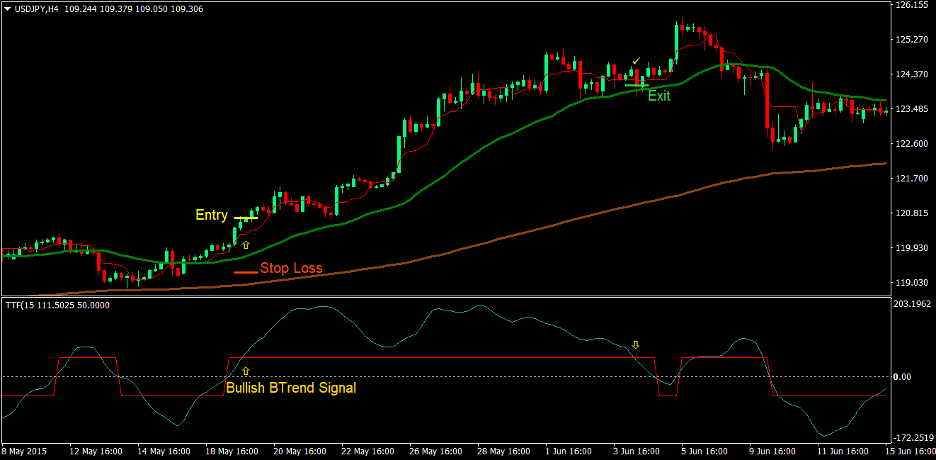

Buy Trade Setup

Entry

- Price action should stay above the 200 EMA indicating a bullish long-term trend

- The Kijun-sen line should cross above the 32 EMA indicating a bullish mid-term trend reversal

- The BTtrend Trigger line (light sea green) should cross above the red line while being above zero confirming the bullish trend reversal with momentum

- These bullish signals should be somewhat aligned

- Enter a buy order on the confluence of the above conditions

Stop Loss

- Set the stop loss on the support level below the entry candle

Exit

- Close the trade as soon as a candle closes below the 32 EMA

- Close the trade as soon as the BTtrend Trigger line crosses below the red line

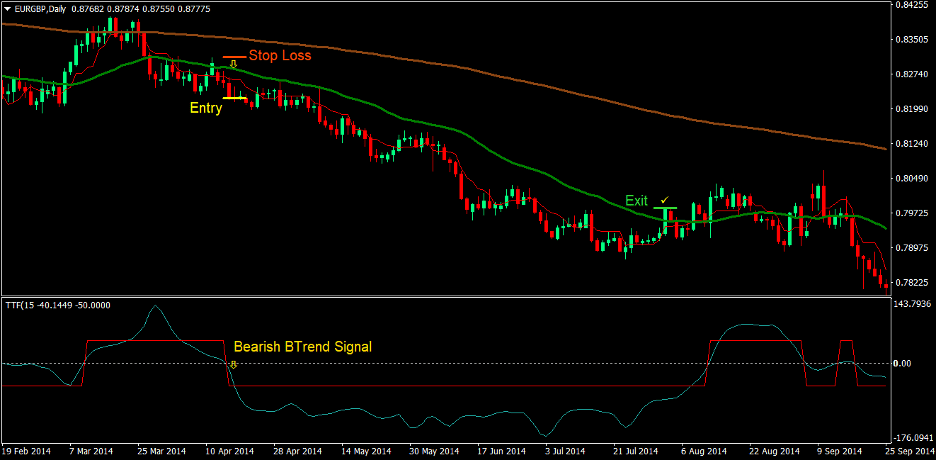

Sell Trade Setup

Entry

- Price action should stay below the 200 EMA indicating a bearish long-term trend

- The Kijun-sen line should cross below the 32 EMA indicating a bearish mid-term trend reversal

- The BTtrend Trigger line (light sea green) should cross below the red line while being below zero confirming the bearish trend reversal with momentum

- These bearish signals should be somewhat aligned

- Enter a sell order on the confluence of the above conditions

Stop Loss

- Set the stop loss on the resistance level above the entry candle

Exit

- Close the trade as soon as a candle closes above the 32 EMA

- Close the trade as soon as the BTtrend Trigger line crosses above the red line

Conclusion

This trading strategy is an excellent crossover strategy. The Tenkan-sen and Kijun-sen line crossover is a working crossover strategy. However, with this strategy we are making use of the 32 EMA instead of the Kijun-sen, which is a more widely used moving average line. It also shows trade entries which could trend quite long. Trade signals could work either way even without trend filters, however adding the 200 EMA filters out lower probability trades since we are not trading against the long-term trend. The BTtrend Trigger signal then assures us that the trade signal does have momentum behind it.

This strategy works well in a market that has a tendency to trend strongly. It also works much better when used with support and resistance breakouts, since the entry signals are typically after a retrace to the 200 EMA during a strong long-term trend.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: