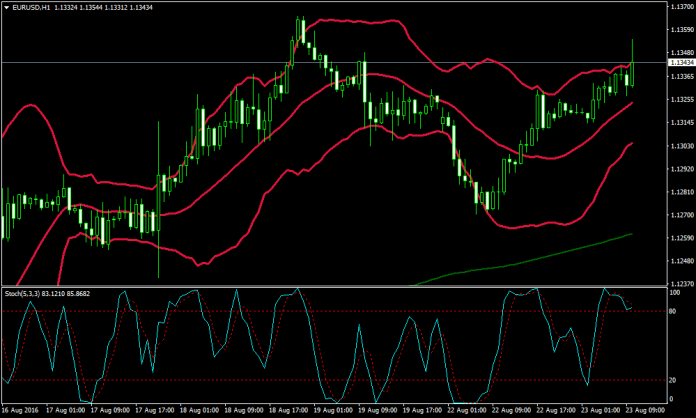

Overbought and Oversold Forex Bollinger Band Strategy

Bollinger Band is used to measure oversold and overbought. This is a trading term. Upper band shows over bought and lower band is oversold. This is applicable to any currency pairs and works on a 15 minute or higher timeframe.

Forex Indicators:

- Bollinger Bands (20 periods,2 Standar deviation);

- 34 Moving average smoothed ;

- Stochastic indicator (5,3,3).

Rules for Long:

- Buy when the price is oversold.

- Stochastic indicator also in oversold and must cross upward but also above the 34 period moving average smoothed.

Rules for Short:

- Short when the price is overbought.

- Stochastic indicator also in overbought and must cross downward but also below the 34 period moving average smoothed.

Exit when the position trades back middle band, at the predetermined profit target.

You can also exit when the price close a bar below/above the moving average.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: