Modified News Straddle Forex Trading Strategy

Many traders have opposing opinions regarding news trading. Some traders strongly preach against it, others welcome news trades with welcome arms. Many traders avoid it like a disease, others see it as a money printing machine.

One trader friend of mine has an explicit rule never to take a trade two hours prior to a high impact news release, and never to trade the whole day during a central bank rate news day.

I also remember a trader friend of mine saying on our chatgroup that he’ll be printing money that day coz it was Non-Farm Payroll (NFP) news day. Whether he made money that day, I don’t know, but I do know he knows what he is doing coz he is quite a successful trader too.

My personal take on this, based on my own experience, news trading is hard. You could lose money in a split of a second. But as with everything that is difficult and risky, there is great reward if you get it right. I’ve personally lost money in a split of a second on some news trades and have made money 5 to 10 times my risk on some. So, a word of caution, if ever you’d like to dip your feet into news trading, do it with caution. Don’t bet the house in one trade.

Before we begin with the actual strategy, let us first discuss how institutional traders trade the news. To be quite frank about it, institutional traders have a huge edge over us retail traders when it comes to news trading. In fact, they know their positions, or might have even made their positions prior to the actual news release. First, they have research teams who do quantitative analysis to project the figures. I don’t know how they do it but probably it is based on correlated data and historical data. Then they have these very expensive terminals costing $20,000 a year, the Bloomberg terminal, which they also get information from. You could do a lot of stuff using this terminal. If you watch the Bloomberg news, you would see analysts use the terminal to show some of the data that they’ve analyzed. Then, these research teams and analysts compare notes. Yes, they actually share information with each other. That is the “whisper number”. Then finally, a day before or sometimes the morning prior to the actual news release, bank traders huddle with their seniors to discuss their position. They don’t actually make money during the news release, they just get out of their positions using the volatility during news releases.

If this is the case, could we really make money out of news releases? The short answer is yes. This is because whenever there is volatility, we traders could make money out of it.

How? Here it is.

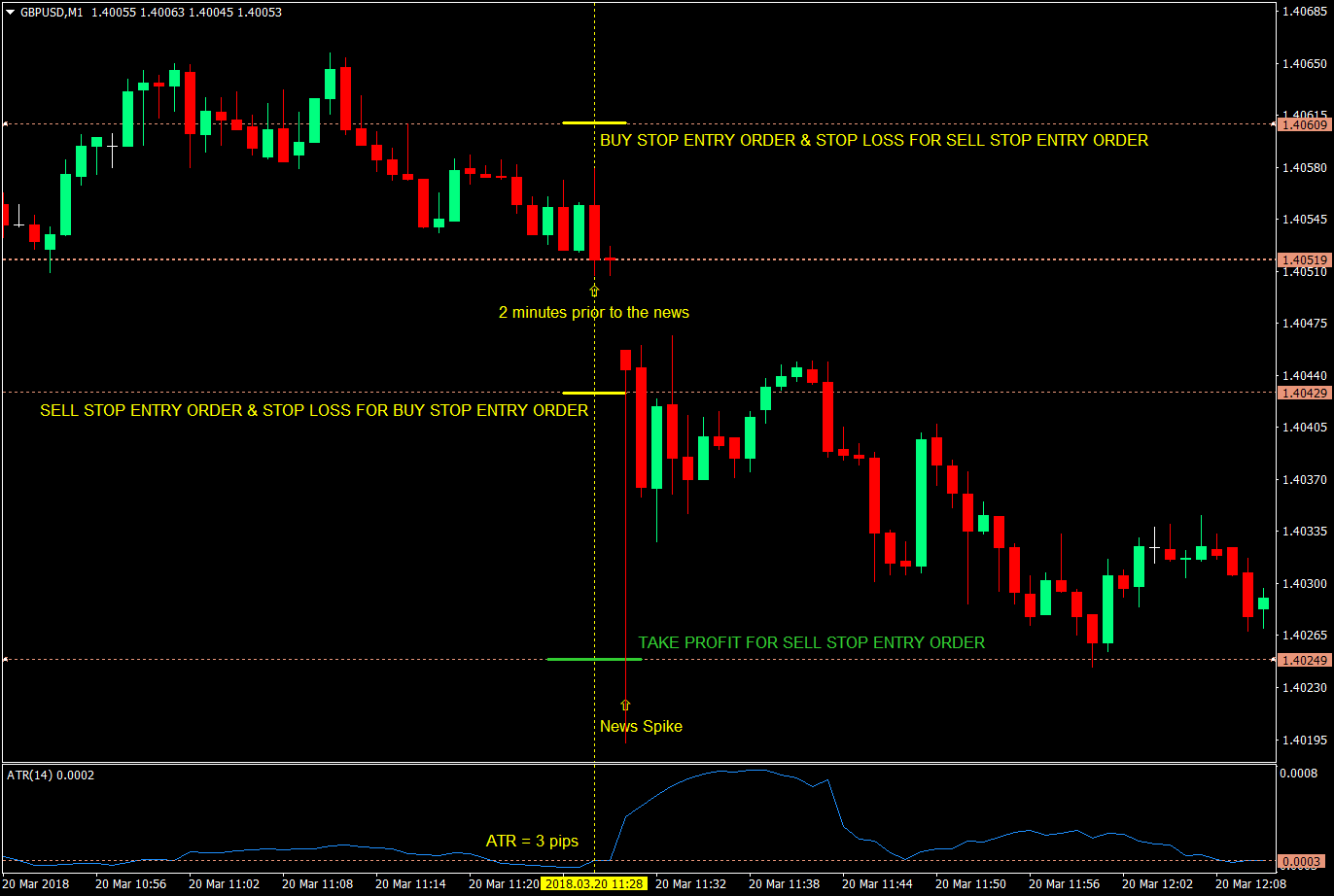

As retail traders, we don’t have what the institutional traders have, so we really don’t know which direction the spike will be. But, if the actual figures differ greatly from the forecast, we can bet that there will be a spike. So, what we will be doing is that we will be placing pending Stop Entry Orders both ways. This is called straddling the news. This is a common strategy for many news traders. They straddle the price a minute or two before the news release by let’s say 15 pips or so. However, I find this quite illogical. Why? A 15 pip move for one currency pair might be too strong for one but too weak for another. So, we will be adding something that would add a little more logic to it. We will be using Average True Range (ATR).

The Setup: Straddling the News Using ATR

Why use the ATR? By using the ATR, we get to have all currency pairs on the same level. Again, pip moves are not a one size fits all number. ATRs however average out the distance that price can travel in pips. This gives us an idea how much to straddle price by and how far our target take profit will be.

As for the timeframe, we will be using the 1-minute chart. This will allow us to put our pending orders a couple of minutes prior to the trade and actually see the range prior to the news spike.

To look for news releases, you could use www.forexfactory.com. Below is an example of what you will be seeing.

Lastly, yes you could pair a currency with any currency you want but choose a currency pair with the least spread. Usually, any currency paired with the USD has a very low spread.

Entry:

- Two minutes prior to the actual news release, place a pending Buy Stop Entry Order above the current price by a multiple of three (3) times the 1-minute ATR.

- Two minutes prior to the actual news release, place a pending Sell Stop Entry Order below the current price by a multiple of three (3) times the 1-minute ATR.

- Example: If the ATR is at 3 pips, place the pending Stop Entry Orders 9 pips above and below the current price.

Stop Loss: The stop loss will be exactly where the opposite pending Stop Entry Orders will be.

Exit/Take Profit: Set the target take profit six (6) times the ATR or twice what you are risking based on your stop loss.

Notes:

- As soon as one Stop Entry Order is hit, cancel the other.

- If no Stop Entry Order is hit on the news release, cancel both orders.

- If the Actual figure is equal to the Forecast on the Forex Factory news calendar, cancel the orders.

As you would see on the chart above, price was straddled two minutes prior to the news release. Buy Stop Entry Order nine pips above with a Stop Loss nine pips below price. And Sell Stop Entry Order nine pips below with a Stop Loss nine pips above price.

On the actual news release, the target take profit of nine pips from the Sell Stop Order was hit. That would instantly be twice what you have risked on the Stop Loss.

However, there are also some things to consider. Take note that the market dries up prior to the news release, widening the spread by so much. Slippage should also be considered as there will be many traders making a trade in a single minute.

My personal experience on slippage and the widening of spread was that I lost a trade because my Stop Loss was hit by 0.1 pips. Spread was too wide, as soon as my pending order was hit, my stop loss also got hit in a split second, before price went my way and should have hit my target take profit.

Conclusion

News trading is difficult and risky. My real honest view on news trading is that you could make money on it, but there are other ways to make money from the market with lesser risk. If you are watching another setup that is not news trading, a scalp trade for example, and a news release would be coming out, chose the scalp trade. It would yield you probably the same profit, but at a manageable volatility.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: