Trading the forex markets is partly getting the right trade direction. The remaining part is all about timing. Getting the trade direction right is easy. Timing the trade right is the hard part. It is a combination of taking trades with momentum, while at the same time not being too late to the trend.

Trading with momentum is vital for traders. Even traders who do not trade momentum strategies should also take into consideration the momentum of the short-term direction when entering a trade.

One of the key elements that cause momentum breakouts is volume. Without volume, momentum cannot be developed. However, volume and momentum do not come too often. There are times when volume is thin, and momentum just does not develop. Traders end up taking trades with no momentum and enters the market during a choppy period.

So, when do we trade to ensure that there is momentum behind a trade. The London or European open is one of the most explosive sessions in the forex market. This is because of the nature of this session. Prior to this session is the Asian session. The Asian session is characterized by a slow and low volume trading condition. This is understandable because the Asian market trades with the lowest volume compared to other major markets. The London market on the other hand is the exact opposite. It is the biggest and most active market among all major markets. As the European and London market opens a sudden influx of volume comes in creating an explosive market condition which could easily generate breakout trade setups with strong momentum.

London Breakout Forex Trading Strategy is a momentum breakout strategy based on the relationship between the Asian and European sessions.

Sessions Indicator

The Sessions indicator is a custom indicator designed to help traders identify the current market sessions or the markets that are currently active.

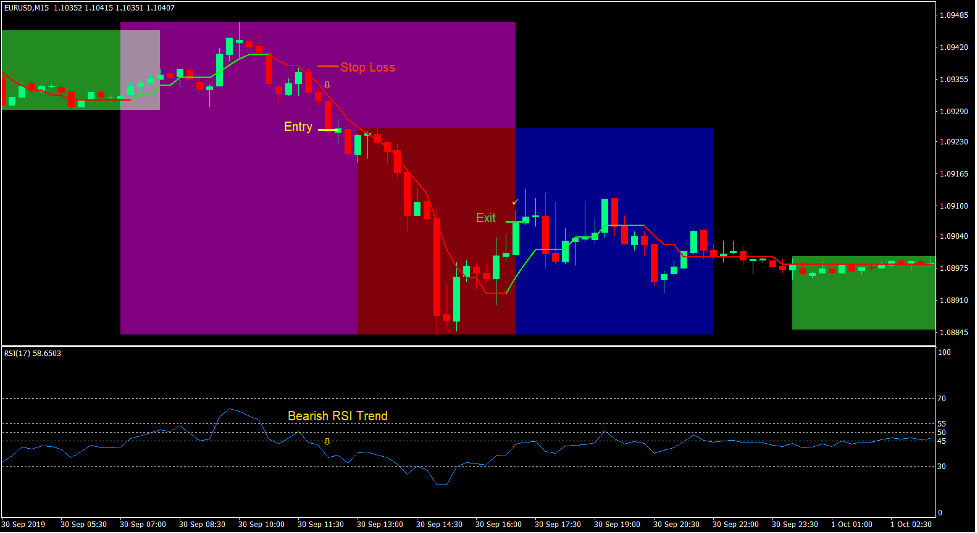

It plots a forest green box to indicate the Asian session, a purple box to indicate the London or European session, and a blue box to indicate the US session.

Traders can use this information to trade based on the timing and characteristics of the sessions that they are trading in.

Relative Strength Index

The Relative Strength Index (RSI) is a momentum oscillator which has multiple functions. It can be used to identify trend direction or bias, momentum and overbought or oversold market conditions.

The RSI plots a line that oscillates from 0 to 100. It also typically has a line at 30, 50 and 70. The 30 level indicates the threshold for oversold prices, while the 70 level indicates the threshold for overbought prices. The level 50 on the other hand generally indicates the trend direction bias.

However, some traders also use the 30 and 70 levels inversely. If the RSI line breaches above 70, a bullish momentum is considered, while if the RSI line drops below 30, then a bearish momentum is considered.

Some also add the levels 45 and 55 to identify trend. The RSI line breaching above 55 indicates a bullish trend with a support at 45. Inversely, an RSI line dropping below 45 indicates a bearish trend with a resistance at 55.

Buzzer Indicator

The Buzzer indicator is a trend following indicator which is aimed at identifying the short-term trend direction.

It indicates trend direction by plotting a line on the price chart. This line follows price action quite closely. It then detects trend direction and trend reversals based on the slope of the line. If the line slopes up, the line changes to lime indicating a bullish trend. On the other hand, if the line slopes down, the line changes to red indicating a bearish trend.

Traders can use this changing of the color of the line as a trend reversal signal, which can also be used as a trade entry trigger. Traders can also use it to confirm the direction of the trend, which should align with their trade direction.

Trading Strategy

This trading strategy trades on breakouts from the Asian session that occurs during the London or European session.

First, we should identify currency pairs with tight ranging markets during the Asian session. The indicator would automatically mark the session with a forest green box.

During the London session, which is marked by a purple box, a candle should breakout and close beyond the range of the Asian session. The breakout should be confirmed by the RSI trend and the Buzzer indicator.

On the RSI, the line should cross above 55 in a bullish breakout or below 45 during a bearish breakout.

On the Buzzer indicator, the trend direction will be based on the color of the Buzzer line.

Indicators:

- Sessions

- Buzzer

- Relative Strength Index

Preferred Time Frames: 15-minute chart only

Currency Pairs: EUR and GBP pairs only

Trading Sessions: London open only

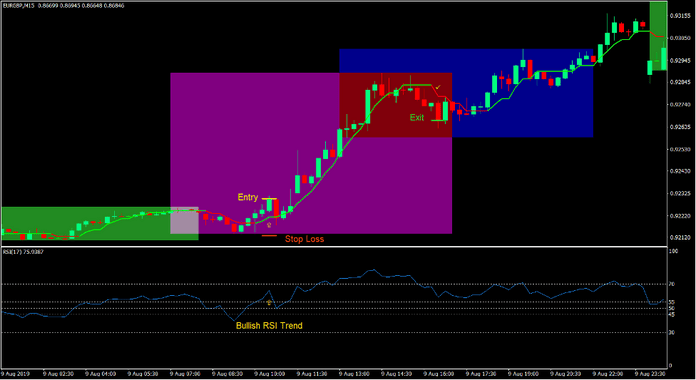

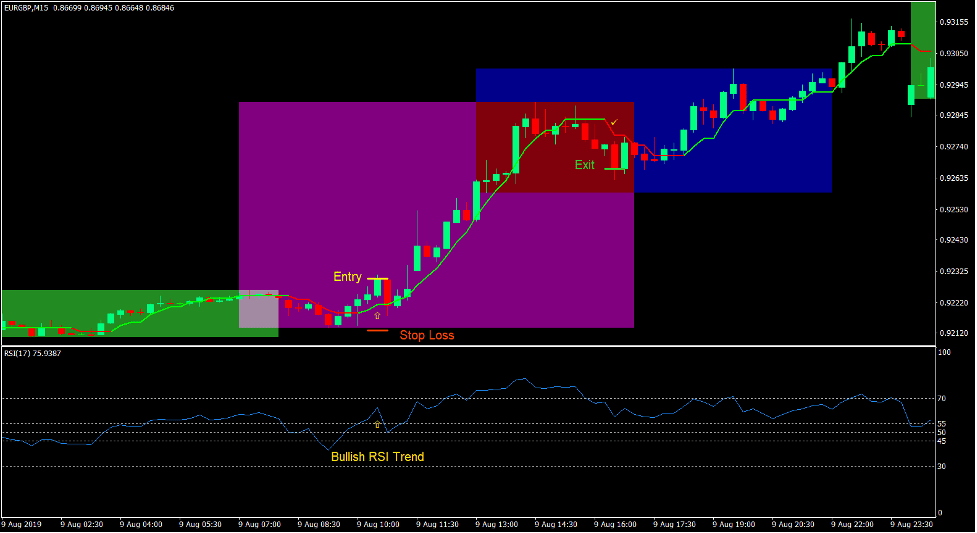

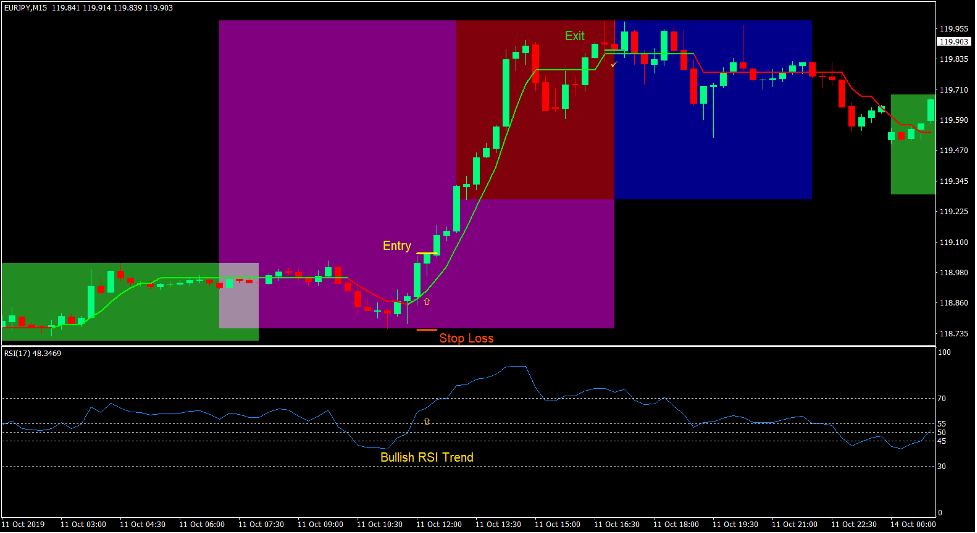

Buy Trade Setup

Entry

- Price should break and close above the Asian session range.

- The RSI line should cross above 55.

- The Buzzer line should be lime.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade if the buzzer line changes to red.

- Close the trade on the close of the London session.

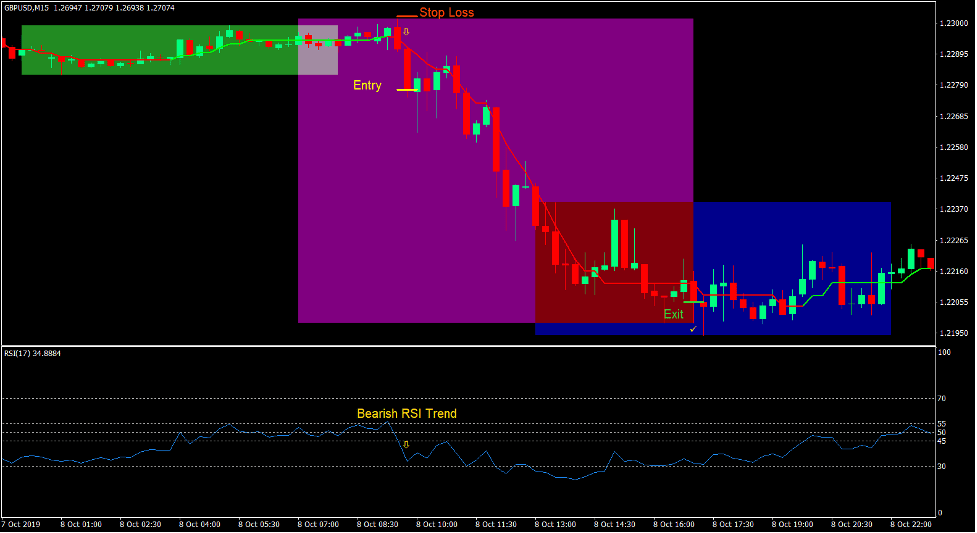

Sell Trade Setup

Entry

- Price should break and close below the Asian session range.

- The RSI line should cross below 45.

- The Buzzer line should be red.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade if the buzzer line changes to lime.

- Close the trade on the close of the London session.

Conclusion

This trading strategy works very well during seasons wherein the GBP and EUR pairs move explosively. Fundamental news releases such as ECB rate changes, Brexit deals, or other high impact news can trigger markets to generate such explosive momentum breakouts. This strategy could be used during such momentum breakout conditions.

Traders can easily grow their accounts using this strategy if they could ride the right momentum breakout trades.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: