Inside Bar Pattern Introduction:

[toc]Before progressing to the main methods, you have to understand the basics of inside bar. This is a price action strategy.

What is inside bar pattern?

-

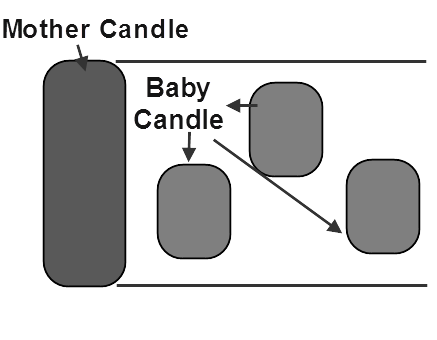

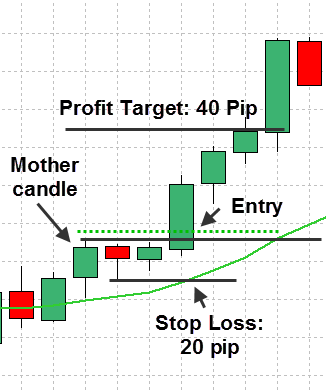

Basically, it is a pattern which consists of Mother candle and baby candles.

-

The baby candle highs must not higher than the mother candle and lows must not lower than the mother’s candle. The baby candle can be one or many.

The uses of inside bar pattern:

-

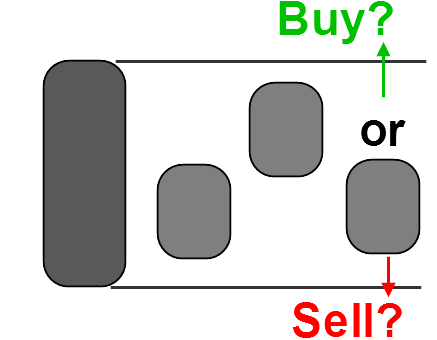

The pattern indicates a indecision of the market

-

If the mother’s candle highs or lows break, then a significant movement of the price may occur.

In this post, I’m going to teach you the 2 steps before entering an entry.

Step 1, we’re going to find the trend of the market; the purpose is to filter the bad trade, only trade with the direction of trend to be safe.

Step 2, we’re going to use inside bar pattern as a trading signal.

Next section, I’m going to touch the details of each step.

The Inside Bar Pattern Method:

Step 1: Identify Trend

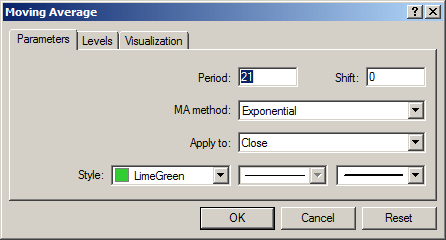

Open your chart and set a moving averages indicator to exponential and set it to 21.

The process to determine the trend is easy.

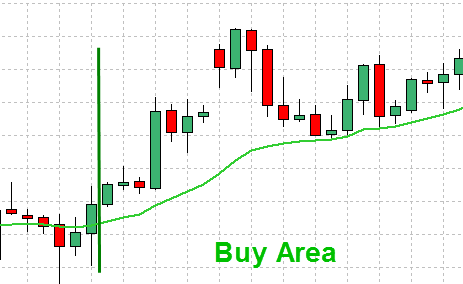

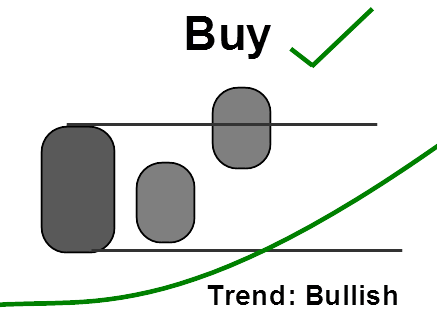

For buy/bullish trend: The EMA 21 must be below the price.

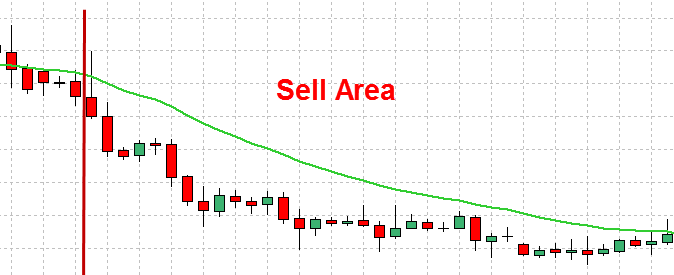

For bearish/sell trend: The EMA 21 must be above the price.

For bearish/sell trend: The EMA 21 must be above the price.

Once finished the first step, proceed to the second step.

Once finished the first step, proceed to the second step.

Step 2: Inside Bar Breakout

The reason for identifying the trend is to filter the bad trade.

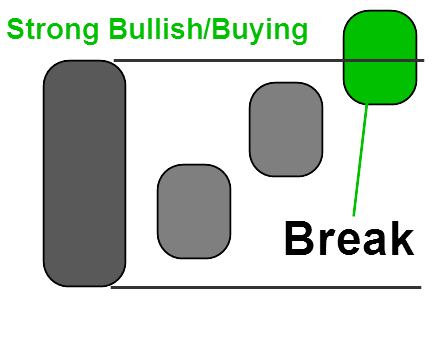

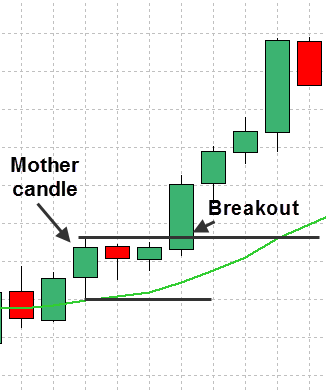

For example, if the inside bar breakout is up (the baby candle break the mother’s candle high), then trade only if the trend is bullish/up.

If the trend is bearish/sell, ignore the inside bar breakout signal (due to against the trend).

For buy/bullish trade:

-

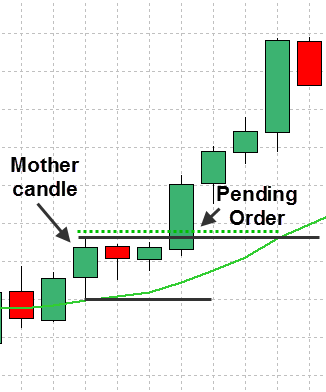

Trend is bullish/buying trend

-

The baby candle must break the mother’s candle highs.

***Tip: You can set pending order buy above the mother’s candle high instead of waiting it to break.

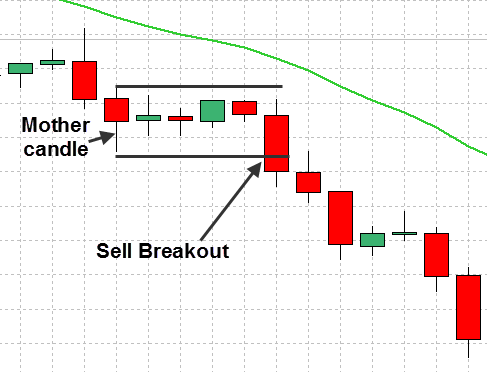

For sell/bearish trade:

-

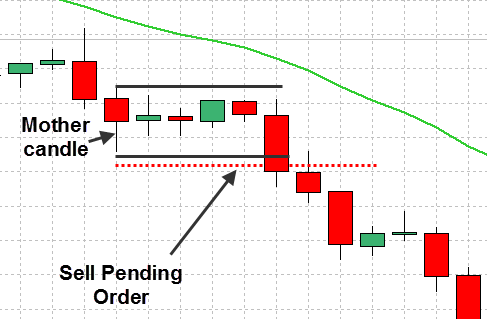

Trend is bearish/selling trend

-

The baby candle must break the mother’s candle lows

***Tip: You can set pending order sell below the mother’s candle lows instead of waiting it to break.

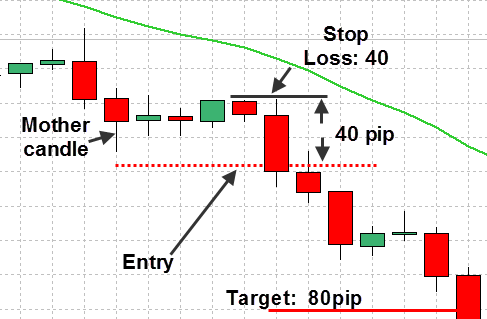

Stop loss and Profit Target

Stop loss and Profit Target

For buy: Set the stop loss below the previous baby candle lows. Profit target: use the risk:reward tactic. If the risk:reward is 1:2, then multiply the stop loss range pip by two.

In this example scenario, the stop loss is 40 pip. Since I want to use the risk:reward of 1:2, then my profit target is 80 pip.

For sell: Set the stop loss above the previous baby candle highs. Profit target: use the risk:reward tactic. If you choose risk:reward is 1:2, then multiply the stop loss range pip by two.

Risk Reward: 1:2, 40 pip x 2= 80 pip profit target.

Risk Reward: 1:2, 40 pip x 2= 80 pip profit target.

***I have found that using the risk:reward system helps you to maximize your profit while minimizing your loss.

The Inside Bar Pattern Method In A Nutshell:

So, here is a basic outline of what you’ll be doing with this method:

-

Identify trend by using moving average indicator

-

Inside Bar breakout – must follow the trend direction. Use a pending order instead of waiting the breakout. Set stoploss and profit target. Use the risk reward system.

I hope you enjoyed reading this short, simple, post on an easy way to dominate inside bar pattern. Do share and comment below if you find this useful.

Best regards,

Tim Morris

admin @ ForexMT4Indicators.com

Recommended Forex Trading Broker

- Free $30 To Start Trading Instantly

- No Deposit Required

- Automatically Credited To Your Account

- No Hidden Terms

Recommended Price Action Courses

Advance Forex Candlestick Patterns

&

Advance Forex Price Action Trading

For bearish/sell trend: The EMA 21 must be above the price.

For bearish/sell trend: The EMA 21 must be above the price. Once finished the first step, proceed to the second step.

Once finished the first step, proceed to the second step.

Stop loss and Profit Target

Stop loss and Profit Target

Hi Tim, excellent sharing 🙂

Thanks! I’m glad that you like it. I will do my best to share more forex trading tips and strategies 🙂

good one explanation