There are many ways to trade and profit from the forex market. You could trade crossover strategies, trend following strategies, mean reversal, price action and more. It is up to the trader what he thinks works best for him. One of the most overlooked method of trading is trading with the use of divergences. Yet it is one of the most logical and effective ways to trade the market.

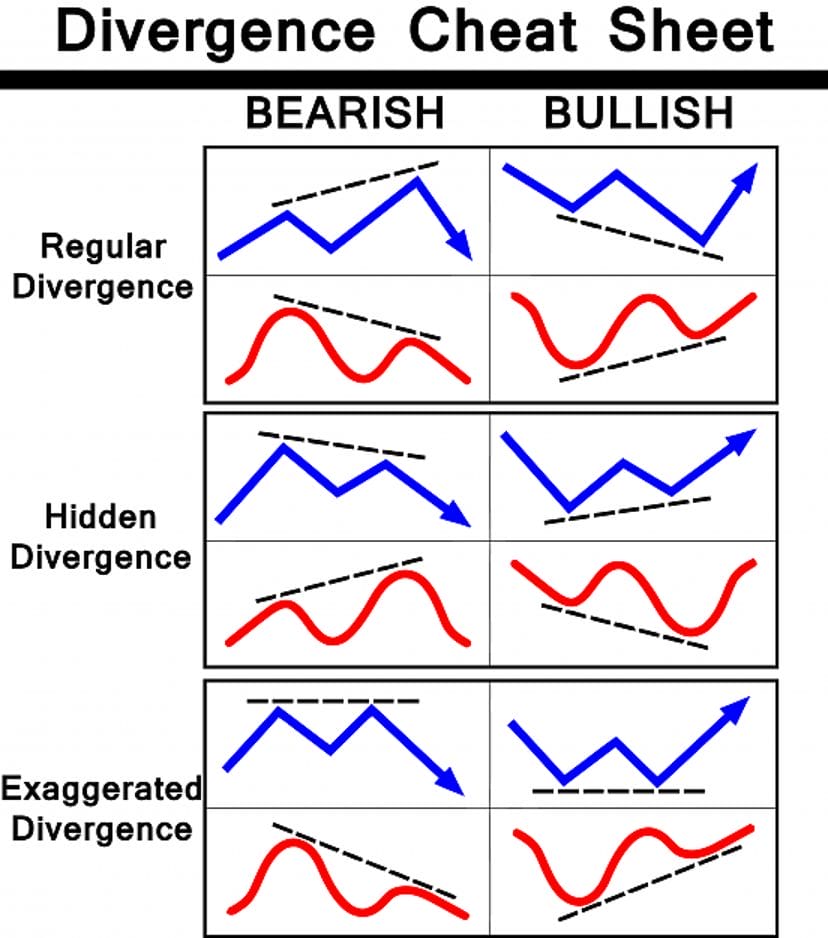

Divergences literally means separation or parting. In trading however, divergences refer to the separation of the direction of an oscillating indicator and price action. Divergences occur when the peaks and valleys, swing highs and swing lows of oscillating indicators and price action differ.

Let us say for example, price action is on an uptrend, meaning it is forming higher highs and higher lows. However, a corresponding oscillating indicator which should reflect and shadow price action is showing a different story. It printed a lower high instead. This is a divergence, a bearish divergence. This indicates a probable bearish reversal that may occur soon.

Divergences work because it indicates the slowing down of a trend or the strengthening of the retracements. It represents the tension between price action and indicators. Sooner or later one would give way resulting to a trend reversal.

Below is a chart that shows the different divergence patterns.

Gann HiLo Activator Bars

The Gann HiLo Activator Bars is a custom trend following indicator. It indicates trend direction by printing bars overlaid on the price chart’s candlesticks. The bars changes color only when the direction of the trend changes.

This indicator identifies the short-term trend direction by considering the highs and lows, as well as the close of each period. This makes it very responsive to trend changes. If you would look at it, does have a resemblance of how the Heiken Ashi candles behave.

The Fisher Indicator

The Fisher Indicator is a trend following oscillating indicator. It attempts to anticipate trend direction based on probabilities. The hypothesis behind it is that price movement does not have a symmetrical probability of moving a certain distance. Instead, it assumes that price could move in a certain direction more likely than the other based on the current trend direction. It does makes sense because if you would look at price movements, price does seem to have a higher tendency to move with the trend rather than against it.

The Fisher Indicator prints histogram bars on its own window. Positive histogram bars indicate a bullish trend, while negative histograms indicate a bearish trend. The trend changes do not occur too often. Instead, it has lesser fake trend change signals compared to other trend following indicators.

Trading Strategy

The Fisher Divergence Forex Trading Strategy is a divergence-based trading strategy. This strategy makes use of the peaks and troughs of the Fisher indicator and compares it with the swing highs and swing lows of price action. By comparing the Fisher indicator with price action, we could then spot divergences between the two. These divergences tend to indicate possible trend changes quite accurately. If paired with a confluence of trend reversals, divergences tend to have a win probability of more than 60%.

As for the trend signals used, we will be making use of the reversal signals produced by the Gann HiLo Activator Bars and the Fisher Indicator. A confluence of these two indicators would usually result to a profitable trade.

Indicators:

- Gann HiLo activator bars

- Lb:

- Fisher_m11

- Range Periods: 24

Timeframe: 1-hour, 4-hour and daily timeframes

Currency Pair: major and minor pairs

Trading Session: Tokyo, London and New York sessions

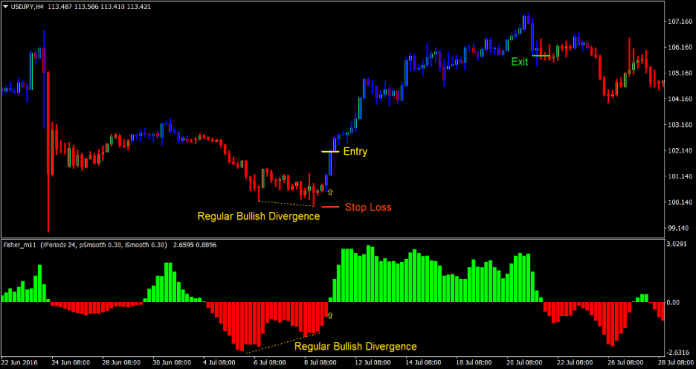

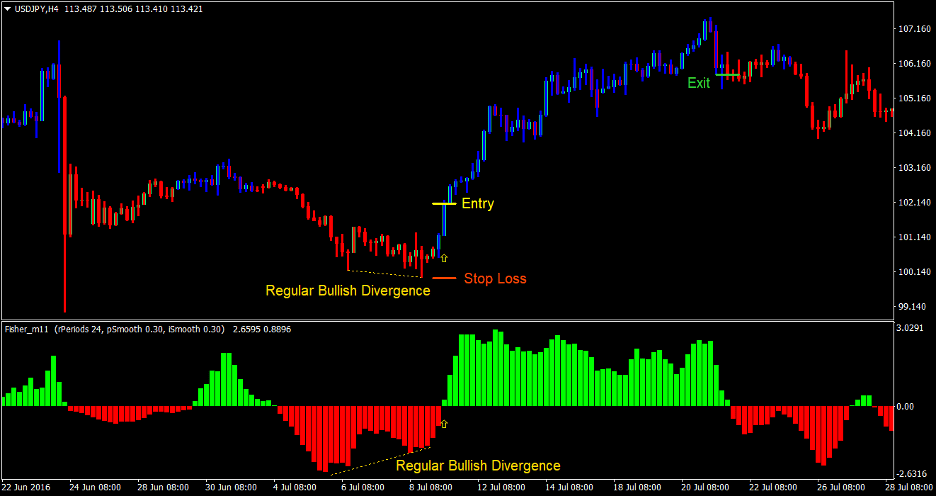

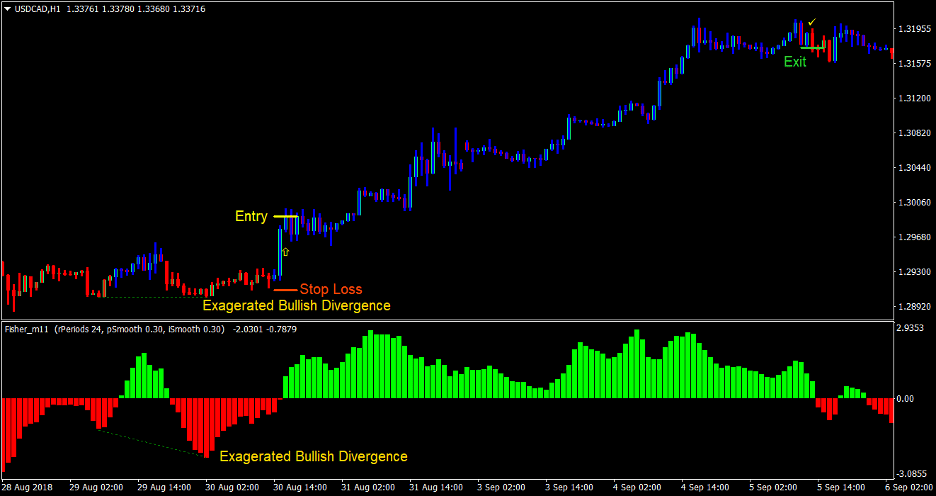

Buy Trade Setup

Entry

- Observe for discrepancies between the swing lows of price action and troughs of the Fisher indicator

- A bullish divergence should be observed between the two

- The Fisher Indicator should change to lime indicating a bullish trend reversal

- The Gann HiLo Activator Bars should change to blue indicating a bullish trend reversal

- Enter a buy order on the confluence of the above conditions

Stop Loss

- Set the stop loss at the support below the entry candle

Exit

- Close the trade as soon as the Fisher Indicator changes to red

- Close the trade as soon as the Gann HiLo Activator Bars changes to red

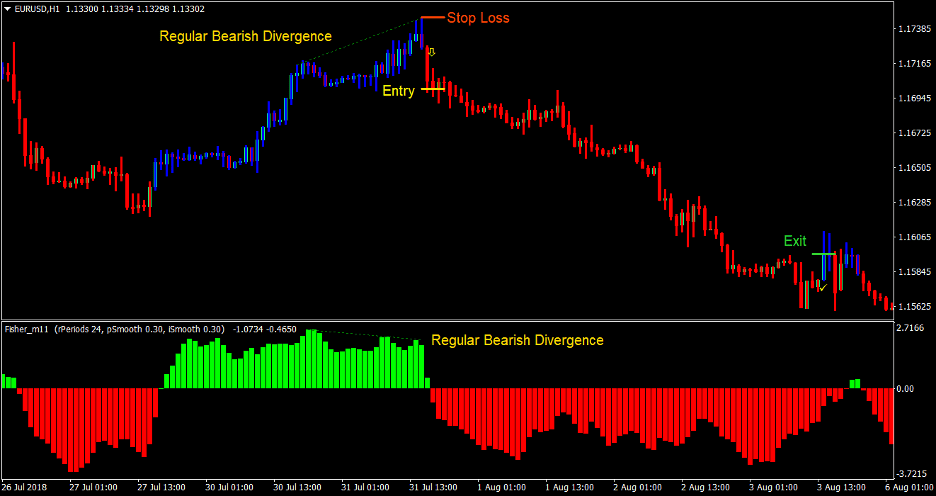

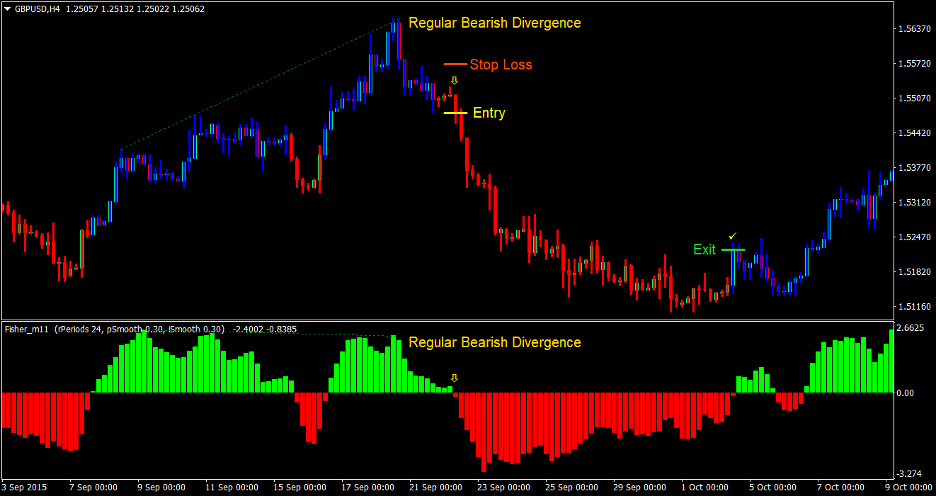

Sell Trade Setup

Entry

- Observe for discrepancies between the swing highs of price action and peaks of the Fisher indicator

- A bearish divergence should be observed between the two

- The Fisher Indicator should change to red indicating a bearish trend reversal

- The Gann HiLo Activator Bars should change to red indicating a bearish trend reversal

- Enter a sell order on the confluence of the above conditions

Stop Loss

- Set the stop loss at the resistance above the entry candle

Exit

- Close the trade as soon as the Fisher Indicator changes to lime

- Close the trade as soon as the Gann HiLo Activator Bars changes to blue

Conclusion

Although divergence trading is one of the most overlooked trading strategies, it is still one of the most effective. In fact, it is one of the staple types of strategies which I personally use.

Given that the divergences are paired with a confluence of high probability entry signals, this trading strategy should give traders an edge over other trading strategies.

The key to this strategy is the mastery of identifying the right divergences or divergences that are meaningful enough. Minor divergences should be avoided as it might not have an impact on price action. Once you get to master identifying divergences well enough, the rest should be easier. This is because entries after the identification of divergences is just a matter of waiting for the confluence and placing the stop loss at the right distance. Then, as price moves, you could then move your stop loss to breakeven to protect profits and watch price run in your favor.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: