The market is often very chaotic and unpredictable. This is especially true with the forex market. The forex market is one of the most volatile markets and could move in any direction any time. However, there are some traders who have found a way to anticipate market movements.

There are several ways on how to read and predict market movements. One of the more popular methods is by using the Elliott Wave Theory.

The Elliott Wave Theory is a technical analysis method which many traders use in order to anticipate market movements. The idea behind this method is that the market forms the same type of patterns repetitively. These patterns consist of waves wherein price would push to a certain direction for a period before it retraces and pushes back again. After several waves, price would typically reverse.

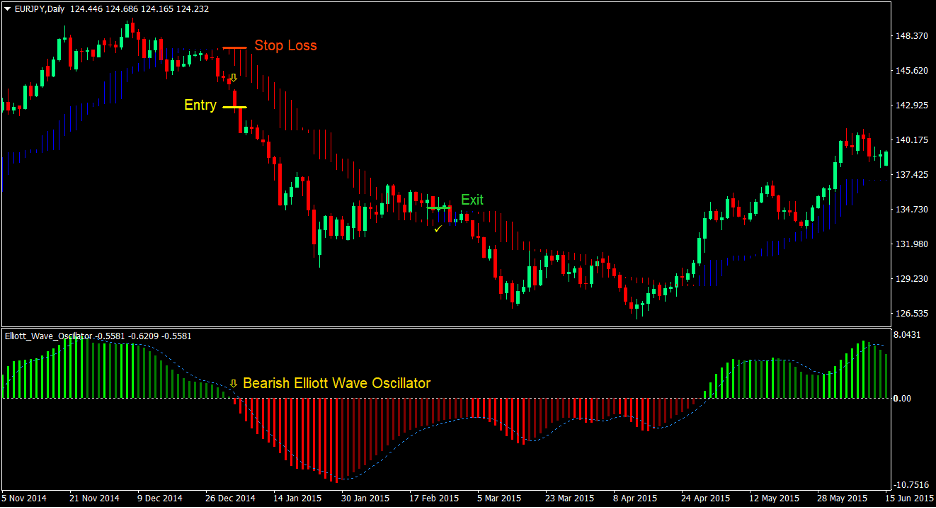

The Elliot Wave Oscillator Forex Trading Strategy helps traders identify the direction of the waves through the use on indicators. These clues regarding the direction of the wave and the possible reversal points of a trend provide traders a viable entry point. It allows traders to enter the market at the start of a new wave, which could result in a trend.

Elliott Wave Oscillator Indicator

The Elliott Wave Oscillator is a custom indicator which aids traders in identifying waves as well as the general direction of the trend.

It indicates waves and trends by showing the difference between two Simple Moving Averages (SMA). The difference is then displayed as a histogram.

Waves are based on whether the histograms are shorter or taller than the previous. Histograms that are gradually getting longer indicate that the current wave is going with the direction of the current trend, while histograms that are getting shorter indicate a retracement.

The general trend direction is also based on the histogram. Positive histograms are indicative a bullish trend direction, while negative histograms are indicative of a bearish trend direction. As such, crossovers from positive to negative or vice versa are considered as trend reversal signals.

Trend Manager Indicator

The Trend Manager indicator is a momentum-based custom indicator which aids traders in identifying trend direction.

It indicates trend direction by plotting bars on the price chart. These bars shadow price action. It expands whenever price is pushing to the direction of the trend and shortens whenever price is retracing.

It also indicates trend direction based on the color of the bars. Bullish trends have blue bars while bearish trends display red bars. Traders use the changing of the color of the bars as an entry signal based on shorter-term trend reversals.

Trading Strategy

This trading strategy provides trading signals based on the confluence of the trend reversal of the Elliott Wave Oscillator and the Trend Manager indicator.

The Elliott Wave Oscillator provide a longer-term view of the trend based on whether the histograms are positive or negative.

The Trend Manager indicator on the other hand provide a shorter-term perspective compared to the Elliott Wave Oscillator based on the changing of the color of its bars.

Whenever these two indicators provide trade signals that are closely aligned, trade signals tend to have higher accuracy and would typically follow the direction indicated by the two indicators.

Traders could then ride the new trend up until one of the indicators would indicate a possible reversal. This would typically be the changing of the Trend Manager indicator’s color.

Indicators:

- TrendManager

- TM Period: 21

- TM Shift: 4

- Elliott_Wave_Oscillator

- Slow MA: 45

Timeframe: preferably 1-hour, 4-hour and daily charts (could be done on the lower timeframes with lower accuracy)

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York

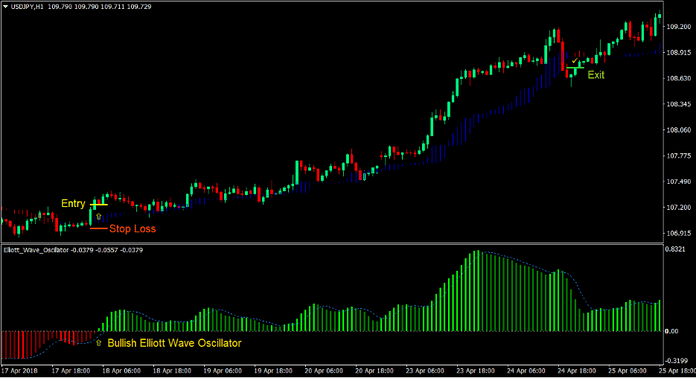

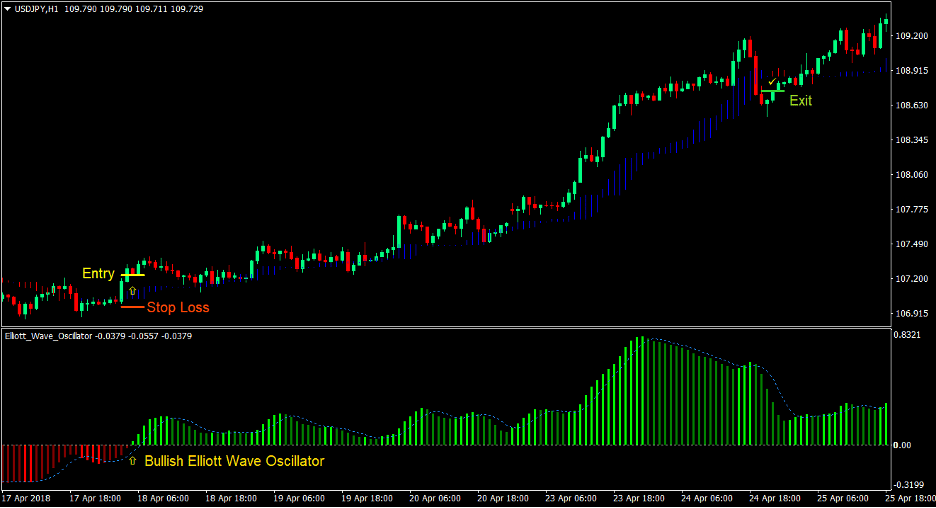

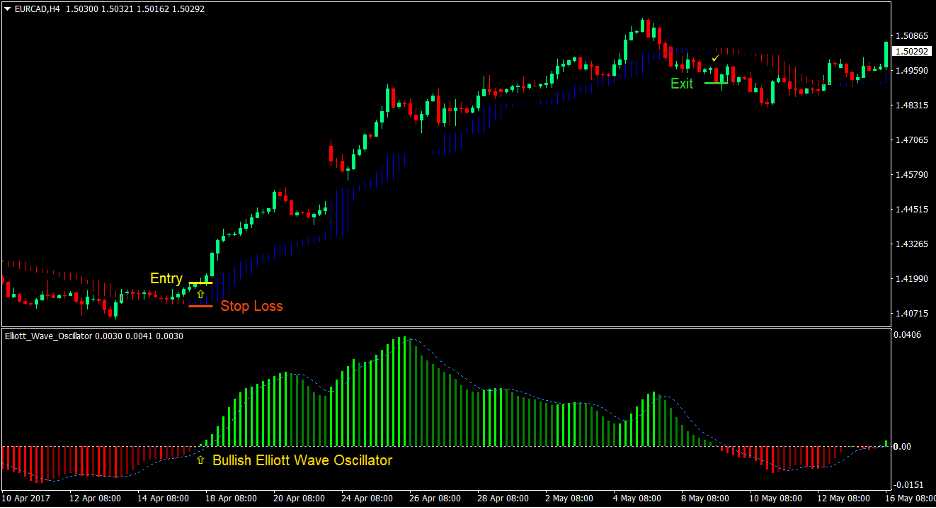

Buy Trade Setup

Entry

- Price should cross above the Trend Manager indicator

- The Trend Manager indicator should change to color blue indicating a bullish trend reversal

- The Elliott Wave Oscillator should cross above zero indicating a bullish trend reversal

- These bullish trend reversal signals should be closely aligned

- Enter a buy order on the confluence of the above conditions

Stop Loss

- Set the stop loss on the support level below the entry candle

Exit

- Close the trade as soon as the Trend Manager indicator changes to red

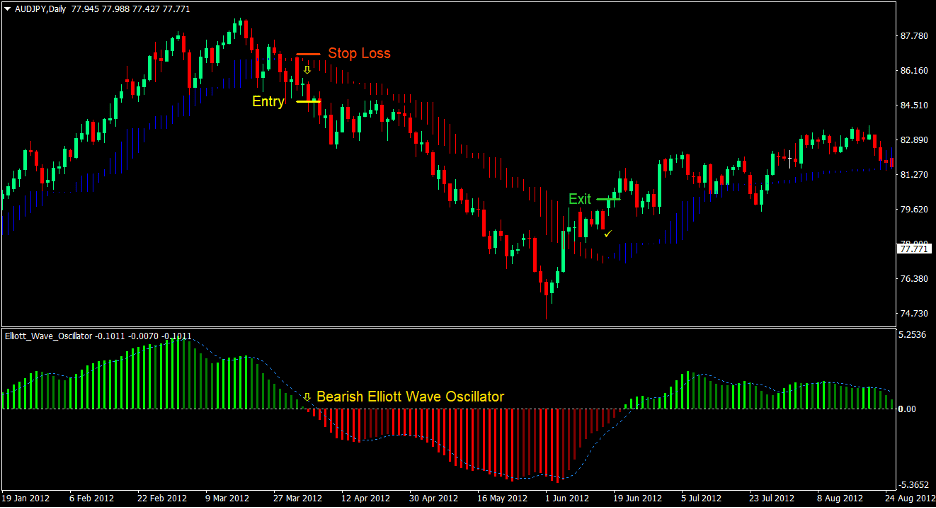

Sell Trade Setup

Entry

- Price should cross below the Trend Manager indicator

- The Trend Manager indicator should change to color red indicating a bearish trend reversal

- The Elliott Wave Oscillator should cross below zero indicating a bearish trend reversal

- These bearish trend reversal signals should be closely aligned

- Enter a sell order on the confluence of the above conditions

Stop Loss

- Set the stop loss on the resistance level above the entry candle

Exit

- Close the trade as soon as the Trend Manager indicator changes to blue

Conclusion

This trading strategy works best on a trending market environment and potential trend reversal setups. In such conditions, long-term trends could take shape allowing traders to earn as much as 5 times their risk on a single trade.

Although this strategy is based on the Elliott Wave Theory, it is not necessary that the trade should take shape on a reversal point of an Elliott Wave pattern. There will be times when the Elliott Wave Oscillator will indicate a trend reversal even without the presence of a clear Elliott Wave pattern. The key is to find confluences between the Trend Manager indicator and the Elliott Wave Oscillator.

When trading trend following strategies with an open-ended profit target, it is important to pair the strategy with a skill in trade management. Traders should trail the stop loss at a comfortable distance.

Trade wisely!!

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: