In order to be profitable in trading, traders must get two things right – trade direction and timing.

“Which way will price go?” This is the question that trade direction answers. This one should be pretty easy, because this question is answerable by either up or down. Blindly picking one of these should give you 50-50 chance. Adding technical analysis to the mix should give you an edge over the 50-50 chance.

The next question is much trickier. “When will price move to the direction you picked?” This is the question that timing answers. This one is much more difficult because unlike the previous question where traders have a 50-50 chance, this one has unlimited possibilities. Price could move in the direction of your trade in the next minute, the next couple of hours, within a few days, or even within the year.

One online forex broker company recently made a study regarding traders and the trades they have taken. They found out that most traders get trade direction right. The problem is that traders often get shaken off the trade at a losing position prior to price going in the direction of their trade.

Timing the market is difficult. However, if traders get trade direction right and have a decent approximation of when the market would head your direction based on a solid technical analysis strategy, traders should be profitable.

Average Directional Breakout is a forex trading strategy that provides trade entry signals based a high probability indication of trend direction changes which are usually after a breakout indicating a trend reversal.

ADX-MA-BO Indicator

ADX-MA-BO stands for Average Directional Movement Index (ADX), Moving Average (MA) and Breakout (BO). This custom indicator is trend following indicator based on the confluence of two indicators which could also indicate a breakout.

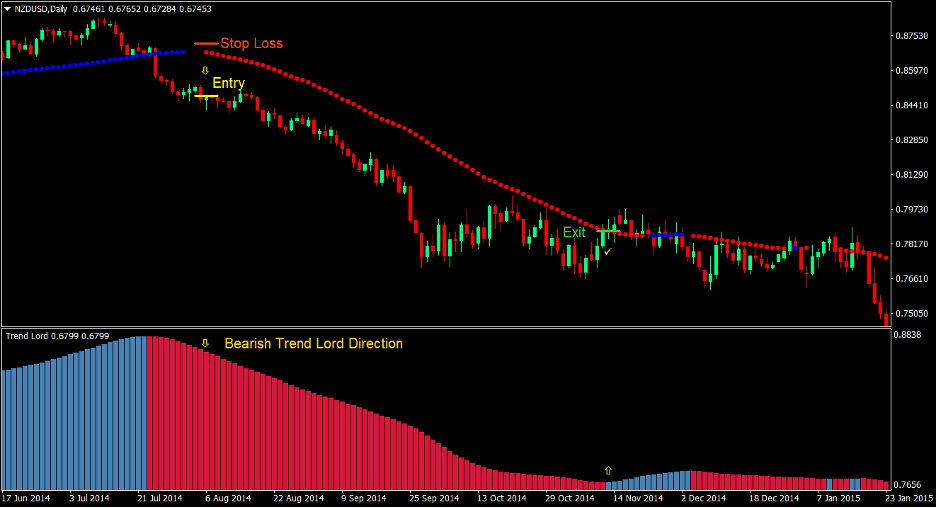

The ADX-MA-BO indicator indicates trend direction by overlaying dots on the price chart. These dots are colored depending on the direction of the trend. Blue dots indicate a bullish trend while red dots indicate a bearish trend. Traders consider the changing of the color of the dots as trend reversal signals.

Trend Lord Indicator

The Trend Lord indicator is a custom trend following indicator which aids traders in identifying trend direction. It draws histogram bars on a separate window, which is also based on a modified moving average formula. The bars are also colored based on the whether the bar represents a higher figure compared to the previous bar or not. The bars are colored steel blue whenever the bars are sloping up and crimson whenever the bars are sloping down. Steel blue bars indicate a bullish trend while crimson bars indicate a bearish trend.

Trading Strategy

This trading strategy is based on the confluence of the ADX-MA-BO indicator and the Trend Lord indicator. These two trend following indicators are complementary indicator which tend to do well in identifying medium term trend reversals.

The Trend Lord indicator usually responds to trend changes compared to the ADX-MA-BO indicator. As such, it also tends to change colors prior to the ADX-MA-BO. The ADX-MA-BO somehow acts as a confirmation of the trend reversal signals of the Trend Lord indicator.

Trend reversal signals based on the confluence of the two indicators have a high tendency of resulting in a trend.

Indicators:

- ADX_MA_BO

- MA Period: 40

- TrendLord

- Period: 74

Preferred Timeframes: 1-hour, 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York

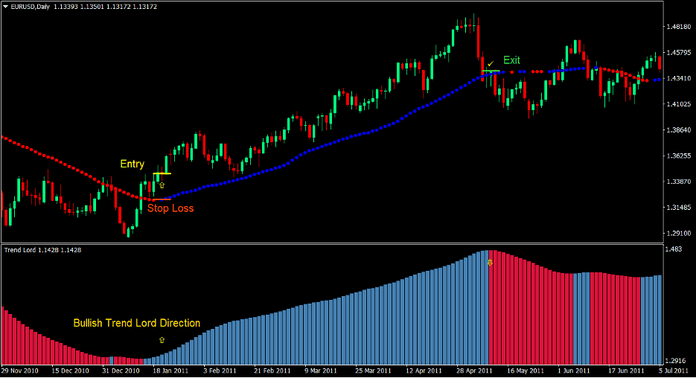

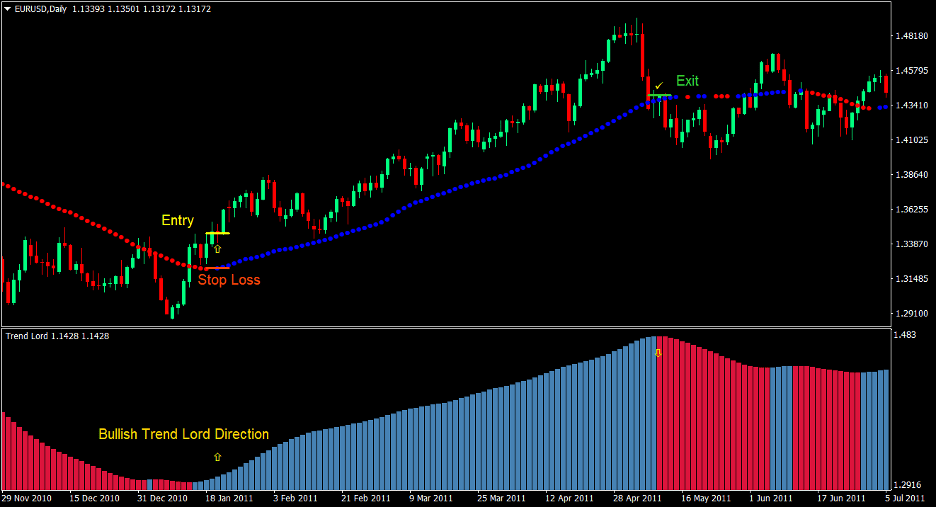

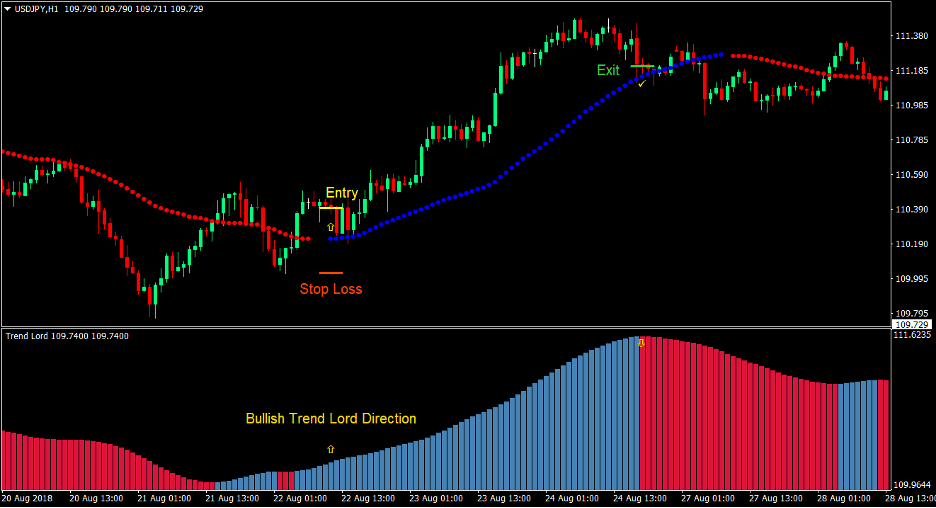

Buy Trade Setup

Entry

- Price should cross and close above the ADX-MA-BO dots

- The Trend Lord indicator bars should change color to steel blue indicating a bullish trend reversal

- The ADX-MA-BO dots should change to color blue indicating a bullish trend reversal

- The two bullish trend reversal signals should be somewhat aligned

- Enter a buy order on the confluence of the conditions above

Stop Loss

- Set the stop loss at support level below the entry candle

Exit

- Close the trade as soon as the Trend Lord indicator changes to color crimson

- Close the trade as soon as the ADX-MA-BO indicator changes to red

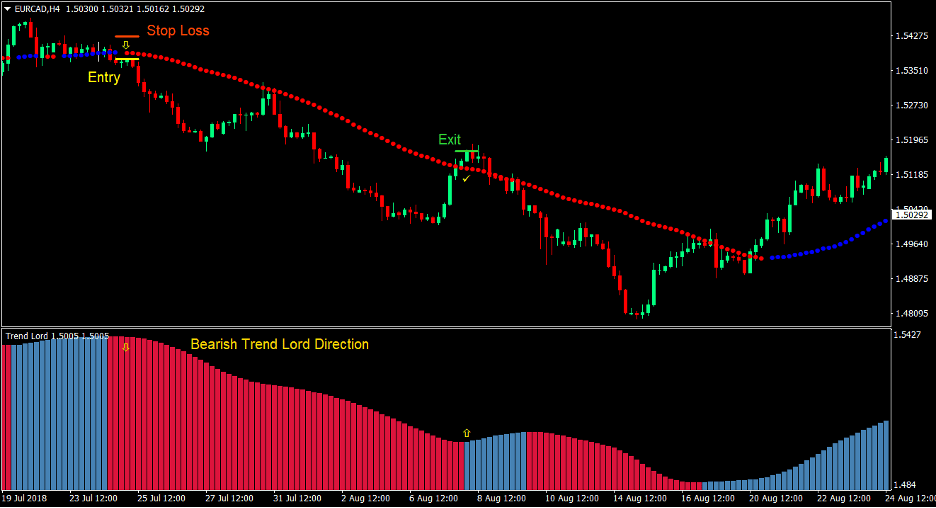

Sell Trade Setup

Entry

- Price should cross and close below the ADX-MA-BO dots

- The Trend Lord indicator bars should change color to crimson indicating a bearish trend reversal

- The ADX-MA-BO dots should change to color red indicating a bearish trend reversal

- The two bearish trend reversal signals should be somewhat aligned

- Enter a sell order on the confluence of the conditions above

Stop Loss

- Set the stop loss at resistance level above the entry candle

Exit

- Close the trade as soon as the Trend Lord indicator changes to color steel blue

- Close the trade as soon as the ADX-MA-BO indicator changes to blue

Conclusion

This trading strategy is a working trend following strategy based on trend reversal breakouts indicated by the ADX-MA-BO indicator in confluence with the Trend Lord indicator.

The ADX-MA-BO indicator in itself is already a decent indicator able to produce quality trend reversal signals. This is because this indicator is already based on a confluence of two widely used indicators, which are the ADX and the moving averages.

Adding the Trend Lord indicator to the strategy as a confirmation even improves the trade signals. The Trend Lord indicator works well indicating the mid-term trend as it is a fairly smooth indication of the trend. It has lesser false signals than most indicators yet still manages to minimize lag.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: